During the week of April 14, the rumor around the Texas Capitol went something like this: If your bill does not advance out of committee within the next five days, chances are it will die there. However, the rumor extended into the following week, and committee hearings proceeded with hundreds of witnesses making their way to Austin to make one last push for or against proposed legislation.

As of noon on April 30, 4,762 bills had been introduced in the House of Representatives, and seven bills had passed. Twenty-two bills had passed in the Senate, after 2,556 had been filed. This makes for a grand total of:

7,318 House and Senate bills filed;

29 passed; and

4 weeks to go in the Regular Session.

With sine die looming, the Texas House of Representatives Land and Resource Management Committee chaired by Rep. Tom Craddick elected to consider all of the bills regarding eminent domain in one hearing. The committee convened on April 25 and asked anyone who was testifying to provide comments on any or all of the bills.

“For those keeping score at home, the committee hearing ran for a total seven hours and six minutes,” shared Michael Lozano, director of government affairs for the Permian Basin Petroleum Association (PBPA). The committee met for two hours before the House of Representatives was called to order and then for five additional hours after the House gaveled out around 8 p.m., meaning the committee adjourned at 1:23 a.m. on Friday, April 26.

The witness list including those testifying “for,” “against,” or “on” ran almost five full pages in length.

Marathon Meeting

The following 13 bills were laid out and eventually left pending in committee: H.B. 4749, H.B. 4708, H.B. 991, S.B. 421, H.B. 1157, S.B. 555, H.B. 1253, H.B. 1919, H.B. 1987, H.B. 2831, H.B. 3327, S.B. 553, and S.B. 552.

PBPA staff and several members of the Association attended the hearing and testified regarding the proposed legislation, Lozano reported.

“While there could be conceptual agreement on the issues of an initial offer, public meetings, and easement terms, when it comes to the details, it appears stakeholders will have to continue to negotiate with each other (on eminent domain) as no action was taken on the legislation in committee,” Lozano said. Craddick pushed several of the proponents of the proposed legislation to agree to a 10-year moratorium on eminent domain bills if an agreement between those engaging in the process could be reached.

“By the end of the committee hearing, no such agreement was in hand,” Lozano stated.

Legislation Spotlight

Eminent Domain

The PBPA has been carefully watching the varied bills that have the potential to affect infrastructure, which is critical to oil and gas operations. Take, for example, H.B. 991 filed by Rep. D. Wayne Burns and S.B. 421 authored by Sen. Lois Kolkhorst.

The author/sponsors’ “statement of intent” details three components “designed to provide additional protections and transparency for landowners who are forced to undergo the condemnation process.” The legislation is largely limited to private condemnors.

The bill would require private condemnors to use standardized easement forms that contain minimum protections for landowners related to issues that they may not otherwise know to discuss. S.B. 740 from the 85th Regular Session contained similar language.

The bill also would require a private condemnor who wishes to acquire for the same public use one or more tracts of real property located entirely in one county and owned by at least four property owners to hold a public meeting in that county to allow the public to learn more about the acquisition.

Finally, this potential legislation contains a provision “designed to prevent low-ball offers.” The bill would require a court to award additional damages to a landowner if the award made by a special commissioner is vastly higher than the initial offer, with varying formulas for varying levels of damages.

Eminent domain reform has been a process that has continued for several sessions, noted Stephen Robertson, PBPA executive vice president.

“Changes to eminent domain authority for private entities could have great impact on midstream and electrical transmission and distribution companies,” he continued. “As many know, the Permian Basin is currently experiencing takeaway constraints and electrical delivery and reliability issues because of the growth in production in the area.

“Further constraints on takeaway or delivery of electricity through negative eminent domain reform will impact operations in the Permian Basin and hamper prosperity for the entire State of Texas,” Robertson concluded.

As of May 1, S.B. 421 and H.B. 991 were left pending in the House Land and Resource Management Committee, along with the other 11 bills discussed at the marathon committee meeting.

Texas Generate Recurring Oil Wealth (GROW) Fund

H.B. 2154/ House Joint Resolution 82 filed by Rep. Brooks Landgraf and Rep. Tom Craddick would direct state funds “to make drastically

needed improvements to expand roads, boost public safety, and enhance educational opportunities across energy-producing areas.”

A committee substitute was voted out of the House Committee on Appropriations on April 29.

Road Funding

House Bill 42 by Rep. James White, which calls for allocating a portion of the oil and gas production tax revenue to the counties from which the oil and gas originated, has been left pending in the House Ways and Means Committee.

Property Tax Reform

On April 15, the Floor Substitute for Senate Bill 2 made changes

from the Senate Committee Report. The final version includes:

*a 3.5 percent rollback rate for cities, counties, and other entities requiring a mandatory November election if the entity raised 3.5 percent more in property tax revenue than the previous year, with school districts still facing the 2.5 percent threshold under the original version of the bill (revenue generated on new construction does not count toward the threshold); and

*an 8 percent rollback rate with a mandatory election for entities with a total levy of $15 million or less, but these entities must hold a referendum in May 2020 to determine if they also are reduced to the 3.5 percent rate.

As of press time, the House version of the property tax bill, House Bill 2, was scheduled for floor consideration. If the House version is different than the Senate version, the final bill will be written by a conference committee comprised of five senators and five representatives appointed by the lieutenant governor and the speaker of the house.

To monitor all Texas legislation, go to https://capitol.texas.gov/Home.aspx.

New Mexico Recap

The New Mexico Legislature began its 60-day session on Jan. 15 and adjourned on March 16.

Mike Miller, government affairs spokesman for PBPA in New Mexico, offered the following summary of important legislation:

H.B. 2 – The General Appropriations Act

Spending for the fiscal year increased some $700 million – mostly for education – to $7 billion.

S.B. 489 – Energy Transition Act

This legislation was launched as the bill to securitize the closing of the San Juan power plants in the Farmington area, which it does; however, the bill soon became the vehicle for increasing the Renewable Portfolio Standards as follows:

• 50 percent by 2030;

• 80 percent by 2040; and

• 100 percent by 2050.

The Energy Transition Act was one of the priority bills as listed by N.M. Gov. Michelle Lujan Grisham.

H.B. 6 – Tax Changes

Combined tax reporting and deductions for foreign-source dividends are a couple of the important provisions of H.B. 6. The Senate amendments removed increases in personal income taxes and capital gains increases. The final version of this bill that came out of conference committee was basically the same bill that the Senate had passed earlier. Amendments added included:

increased working family tax credits;

reduced capital gains from 50 percent to 40 percent;

newly established top personal income tax rate of 5.9 percent contingent on FY20 general fund recurring revenues;

increased motor vehicle excise tax from 3.5 percent to 4 percent (the incremental .5 percent goes to the general fund for two years and thereafter goes to the road fund);

Internet sales technical correction; and

eCigs/Vaping language change.

H.B. 546 – Fluid Oil and Gas Waste Act (produced water)

This bill passed the House, was amended in Senate Judiciary to basically add the penalties bill (S.B. 186), and passed the Senate. The amended bill went to the House for concurrence and was passed with the penalties amendments.

“The penalties part of the bill, many in industry think, was a win for industry,” Miller shared. Minor infractions carry a penalty of up to $2,500 per day, and infractions deemed to pose a greater risk will carry fines up to $10,000 per day with penalties capped at $200,000 without going to court.

“The department and others wanted greater penalties, and some in industry wanted a lower cap, so this was a good compromise,” Miller summarized.

S.B. 553 – Oil Conservation Commission Fees

This legislation imposes fees very similar as those the Railroad Commission imposes in Texas. Cabinet Secretary Sarah Cottrell Propst of the Energy, Minerals, and Natural Resources Department worked with representatives from the oil and gas industry to put the fees in place.

Finally, bills were also passed to address road issues in Southeast New Mexico, specifically U.S. 285, N.M. 128, and N.M. 31.

For more information on the New Mexico and Texas legislatures, go to https://pbpa.info/.

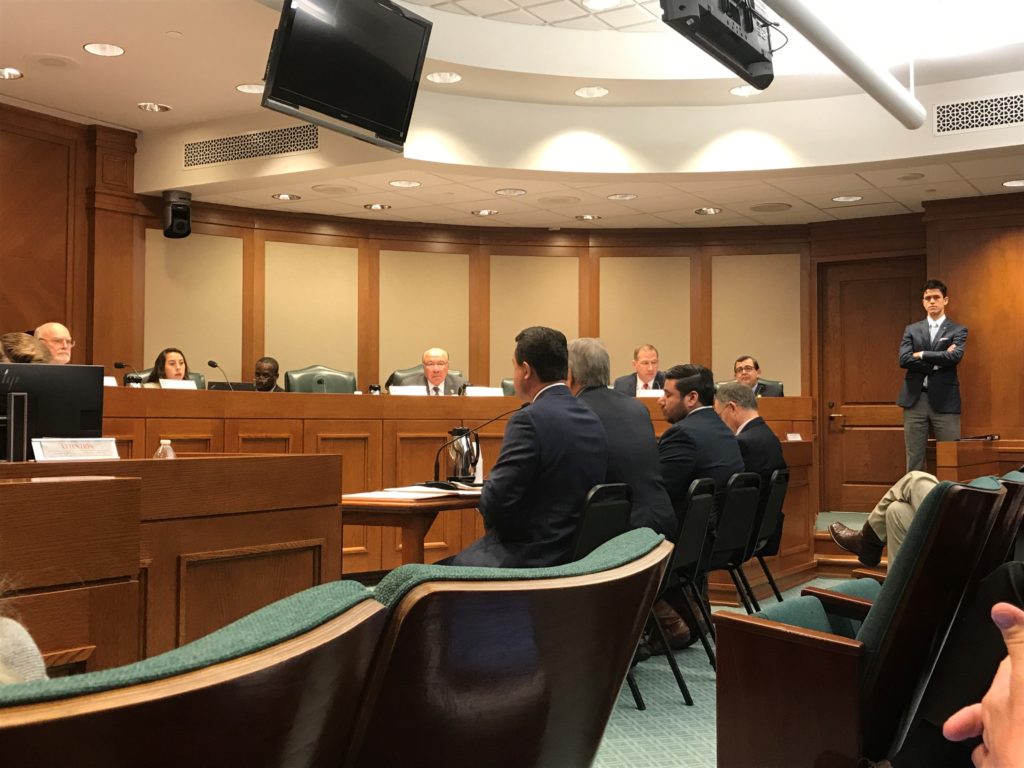

CAPTION:

Michael Lozano, third from left among those facing the panel, testifies on Senate Bill 2260 on April 17 during a public hearing of the Senate Transportation Committee. Lozano, director of government affairs for the Permian Basin Petroleum Association, testified for the legislation, which calls for focusing road grant funding in energy-producing areas.