Red-Headed Stepchild

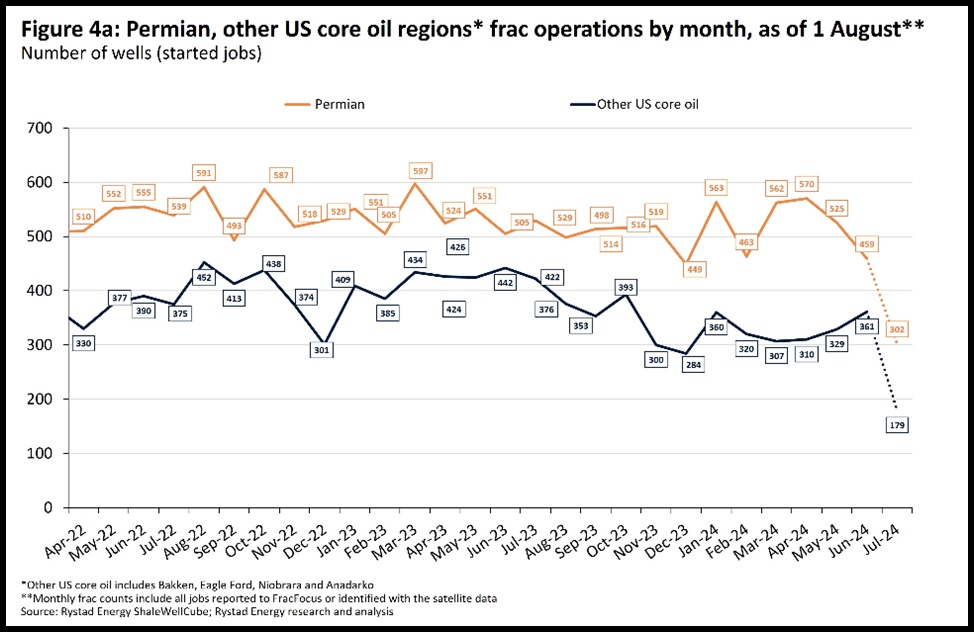

Pressure pumping seems like constant football, getting kicked around, winning or losing. First, things go flat. The observation that we know how to manage spiking growth and plummeting drops, but not flat times, was made by many to me. Pricing gradually erodes. Now account for the consolidations we have seen in E&P and the slowdown in activity that always follows such a trend. Smaller players have to work at lower prices to keep their crews busy. And the rig count falls. The dreaded “double whammy.” Now the Q2 results have shown some pressure pumping revenues are down 17 percent sequentially. That is big in one quarter considering it doesn’t feel like a complete crash throughout the industry. Then this headline: “NexTier Says Tier 2 Frac Service Pricing Has Dropped To Breakeven Levels.” As expected, Tier 1 is doing better. But that is a relative term. “Frac Monitor: July weakness continues as month ends.” Another one. Everyone believes that Q3, or at worst Q4, would see a bottom in the rig count and then everything will start to trend up. Investors heard that a year ago about how oil was headed north and hard. Everyone agreed. Investors don’t stick around for the very detailed and nuanced reasons we were wrong. Just that we were wrong. Pressure pumping will come back but the inherent volatility seems to attract many more traders than investors. Below is a Rystad chart on frac activity. Hello volatility.

They’re baaaaack. Weatherford reported earnings with EBITDA margins of 26 percent, announced a $1/year dividend, a $500 million stock buyback, and earnings of $1.66 per share. Bernard left nine years ago. Many haven’t been paying attention. You should.

An Opinion on OFS. Morgan Stanley: “We think shale activity finds a floor in 2024 and begins to rebound in 2025+,” with pricing and margins stable. They prefer International to North American exposure and in the United States, prefer drillers over pumpers. They are lowering their U.S. activity estimates by 5-15 percent. Internationally, they are lowering their land rig count forecast by 5 percent, primarily due to weakness in Latin America but raising activity estimates for the Middle East.

Amen!

Bad Forecast. Rystad Energy has its monthly look at frac activity, and it does not bode well for pressure pumping over the intermediate term. It is expected that the number of frac fleets in unconventional basins will be between 200 and 210 over the next 12 to 18 months. That is not considered good. They also say that the market will likely witness a more pronounced seasonality in oil plays due to budget exhaustion and that “all pumpers are hungry for work to fill their calendars for 4Q 2024.” Rystad expects smaller pumpers to declare bankruptcy and exit the industry over the next year, forced to dissolve and put their equipment up for auction. Don’t shoot the messenger. With the continuing consolidation slowing down current market activity, it is also forcing the smaller players out, regardless of price cuts, based on scale and level of modern equipment. A further shakeout in the pressure pumping business??

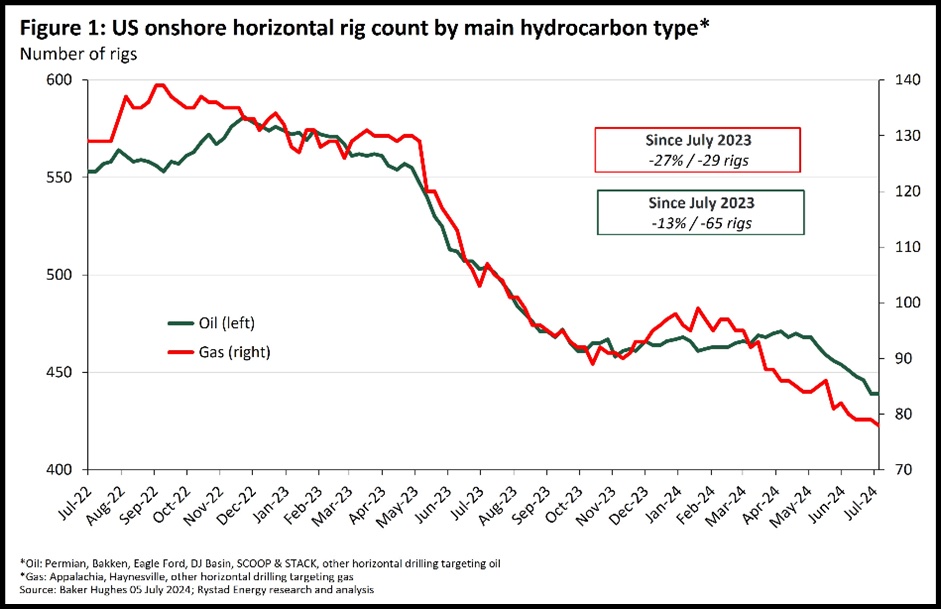

The Rig Count. U.S. oil and natural gas production continues to rise. Activity continues to decline. Reversal? Or are our improvements and efficiencies that great? The $64,000 question.

OKC. If you happen to find yourself in Oklahoma City on September 18th, I have an idea for you. The Energy Workforce and Technology Council (EWTC) is holding its Oklahoma Chapter Luncheon. It is at the Hamm Institute for American Energy, on 9th Street. The speaker is Kevin Turner, the Emissions Program Manager for Continental Resources, Harold Hamm’s company. The EWTC does an excellent job in promoting, educating, and assisting our industry, across disciplines and borders. Then someone gives a quick market outlook. Hope to see you there.

—Jim

Subscribe to Jim Wicklund’s full e-newsletter, “Things I Learned This Week at…,” distributed via email, by signing up for free at this webpage: https://www.pphb.com/newsletters. Jim is Managing Director / Client Relations and Business Development for investment banking firm PPHB. Leveraging deep industry knowledge and experience, Houston-based PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt, and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.

Subscribe to Jim Wicklund’s full e-newsletter, “Things I Learned This Week at…,” distributed via email, by signing up for free at this webpage: https://www.pphb.com/newsletters. Jim is Managing Director / Client Relations and Business Development for investment banking firm PPHB. Leveraging deep industry knowledge and experience, Houston-based PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt, and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.