In recent months I have discussed multiple stock investment opportunities in the broad Permian Basin. Today, I will focus on two that are bargains in the Delaware Basin specifically.

The Delaware has a higher percentage of natural gas to oil production than the Midland. While in the past companies were very focused on oil, the gas in the Delaware has suddenly become more valuable for two reasons.

First, takeaway has expanded with new pipelines. This is allowing higher prices on natural gas.

Second, as discussed in a recent month’s article, natural gas is used to power data centers.

As the Delaware becomes more profitable with the natural gas realizing higher prices, two producers stand out to me right now as bargains.

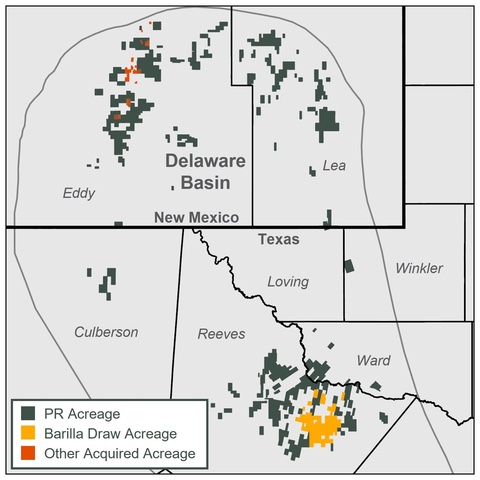

The first is Permian Resources (PR) which recently completed a bolt-on acquisition of Delaware acreage, wells, and infrastructure from Occidental Petroleum (OXY). According to the company, the transaction highlights include:

- Large, contiguous acreage position, offset existing core operating areas

- Adds >200 gross operated, two-mile locations with high NRIs, which immediately compete for capital

- Substantial midstream assets, including >100 miles of oil and natural gas pipelines, robust water infrastructure system with a ~25,000 Bbls/d water recycling facility, and >10,000 surface acres

- Purchased at an attractive valuation: 3.4x 2025E EBITDAX and ~17% free cash flow yield

- Accretive to cash flow per share, free cash flow per share, and NAV per share

- Conservatively financed through combination of equity and debt

- Expect to maintain leverage of ~1x net debt-to-EBITDAX

Permian Resources stock has shown weakness much of the past six months. With its free cash flow yield likely to jump in 2025 on the back of its recent M&A and higher natural gas prices, I see it as a bargain in the middle teens per share. Management is also open to further M&A deals, as is their history, and I think it is likely at some point that they go from acquirer to being acquired.

Permian Resources stock has shown weakness much of the past six months. With its free cash flow yield likely to jump in 2025 on the back of its recent M&A and higher natural gas prices, I see it as a bargain in the middle teens per share. Management is also open to further M&A deals, as is their history, and I think it is likely at some point that they go from acquirer to being acquired.

Coterra Energy (CTRA) is another significant Delaware Basin producer with about 296,000 net acres. Their other major assets include natural gas focused Marcellus Shale and acreage in the Anadarko Basin that represents about 8 percent of the company’s production.

I see two paths for Coterra. In either case, I expect the company to sell their Anadarko assets to free up cash and resources—the company has already reduced operations in the gas-rich play. Adjacent producers are likely to offer a fair price to offload the assets.

What comes next is that either Coterra parts off their Delaware acreage to adjacent producers in the Delaware to focus on their Marcellus position or sells their Marcellus position to focus on their Delaware.

I see selling off their Permian assets as most likely. Doing so would allow them to pay off their roughly $2.6 billion in debt and leave them as a debt free Marcellus natural gas pure play. On that path they would be able to throw off substantial cash to shareholders in the form of buybacks and dividends. Their free cash flow yield has been as high as 20 percent in recent years and consolidating to a debt free Marcellus natural gas pure play would likely see those numbers again.

Coterra stock has also seen weakness with the broader industry in the past six months. I see it as a buy in the middle $20s. If the company engages in selling off assets to pay down debt and focus on the company’s operations, I see a breakout to new highs soon on top of higher dividends.

My firm and I own stock in Permian Resources and Coterra Energy. For disclaimers and deeper dives, please visit my investment letters at FundamentalTrends.com or MOSInvesting.com or my Registered Investment Advisor firm Bluemound Asset Management, LLC.

A change analyst and investment advisor, Kirk Spano is published regularly on MarketWatch, Seeking Alpha, and other platforms.