During President Trump’s first term he was able to streamline regulations and support infrastructure development. Much of that infrastructure is now complete.

Going forward, the most important things that a new Trump administration is likely to achieve is loosening environmental regulation, which has bordered on onerous, and allowing a continued move to consolidate assets.

Under President Biden, methane mitigation became more expensive and difficult to achieve. That is likely to be loosened by Trump regulators. The impact will likely drop down to the bottom line for many companies.

While much gas flaring has also been eliminated, more flexibility on this is also likely. Interestingly, the rise of AI data centers’ need for natural gas in the region (covered last month) has reduced the need to flare at all. Another example of markets solving problems.

Importantly, FTC Chair Lina Kahn, who has been pushing back on M&A in oil and gas, is likely out of a job come inauguration. This should free up companies to optimize their operations, a step that’s necessary for economic development. I see several deals likely coming in 2025.

In addition, President Trump is fully on board with natural gas exports. I see this as key for increasing revenues and profits for many companies. As we all know, exporting excess natural gas is supportive of pricing, which, in turn, allows for more development.

Here’s what I see happening in the Permian under the new administration. First, I think the Delaware will be more impacted. The Delaware is more gassy than the Midland. It will benefit from the takeaway capacity of Matador’s new pipeline connections, the Delaware Gas Pipeline and Dela Express.

With the development of AI in West Texas, that is also a market to sell natural gas close to the source as power plants are in various phases of being built. The Texas Energy Fund has already approved 17 natural gas power plants as of this autumn.

Besides energy nearby, West Texas has a couple other advantages, when it comes to building data centers. Data centers need cooling, and building those data centers in non-residential areas allows for less expensive air cooling versus liquid cooling.

Summarizing, I see Permian natural gas pricing rising significantly in coming years from the combination of (1) export demand, (2) newer takeaway capacity, (3) AI data center energy demand, and (4) natural gas fired power plants under President Trump.

Who will benefit the most? While every player in the Permian benefits, I see a few companies benefiting most when M&A considerations are included.

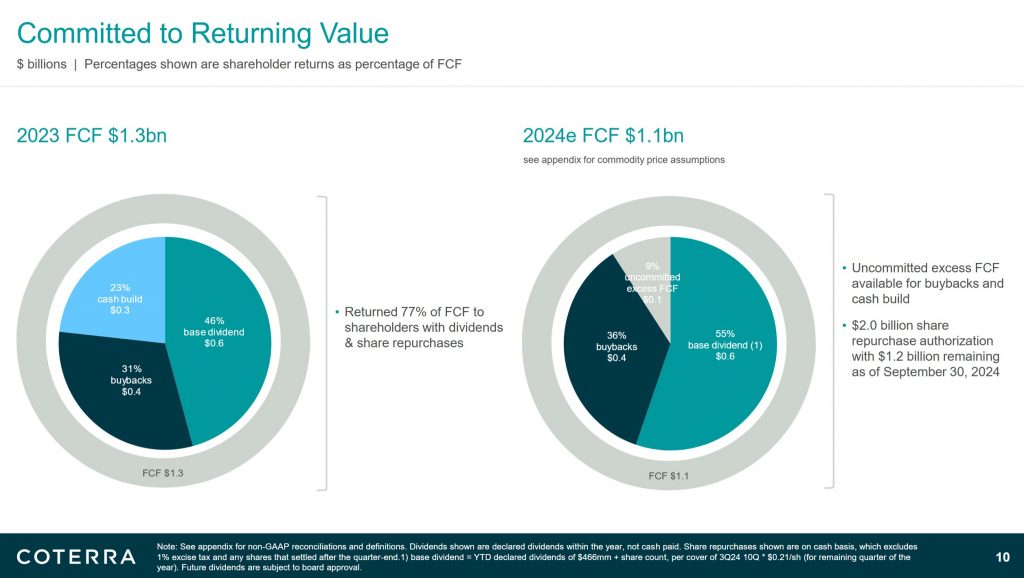

Again on my list is Coterra (CTRA). Coterra holds approximately 296,000 net acres in the Delaware Basin, primarily focusing on the Wolfcamp Shale and Bone Spring formations. These areas are located in Culberson and Reeves Counties in Texas and Lea and Eddy Counties in New Mexico.

The company also owns 182,000 acres in Oklahoma’s Anadarko Basin and 186,000 acres in the Marcellus, which is seeing minimal development now.

Coterra has allocated a bit over half of their capital investment in the Permian at about $1.05 billion in 2024. While focused on oil in the Delaware, they are also seeing substantial natural gas production—more than 500 million cubic feet per day.

I do not see the stock market as properly valuing the natural gas production. Charlie Munger often discussed finding assets the market did not recognize. Coterra’s stock has been choppy for months as natural gas prices languished. I see this moment as a very good spot to take a position and I have expanded mine from a starter position of less than 1 percent of portfolios to a 2-3 percent position.

Other companies with substantial Delaware production that might not be properly valued by the market are Permian Resources (PR) (which I own shares in and is the only pure play), Devon Energy (DVN), Diamondback (FNG), and EOG Resources (EOG).

My firm and I own stock in Permian Resources and Coterra Energy. For disclaimers and deeper dives, please visit my investment letters at FundamentalTrends.com or MOSInvesting.com or my Registered Investment Advisor firm Bluemound Asset Management, LLC.

A change analyst and investment advisor, Kirk Spano is published regularly on MarketWatch, Seeking Alpha, and other platforms.