The journal entries below are excerpted from recent installments of James Wicklund’s “Things I Learned…” newsletter.

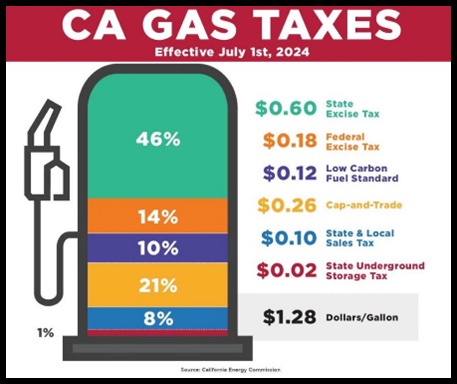

Funk. The oil and gas business continues in a funk, with oil prices around $70, the world fairly awash in oil and the hopes for demand growth not yet materializing. The sector has held the line on capex and spending, holding on to the people and assets they already have and being very cautious about adding. And with the latest oil price move and a number of issues discussed below, we would not be surprised to see another round of reductions soon. The second half of the year is expected to be below the activity levels of the first half and 2025 is a big unknown. Doing more with less continues to move ahead even as oil and gas prices stall. Hang on. Combine. Merge. Consolidate. Find new businesses. While I would not want to own a hydrogen plant or a wind farm or a solar field, lots of money will be spent and I like getting in the way of money being spent even if I don’t like the long-term business I am building for. “Thinking outside of the box is” a saying made for times like this.

Opinion. “As we had previously expected, pressure pumping activity in U.S. land is slowing into year-end. This is due to strong efficiency gains in the first half of the year driven by longer lateral wells and a concentration of activity in high graded acreage. We anticipated customer budget exhaustion in the fourth quarter and a lack of urgency by operators. The debate will now center around the start of 2025. This softening market is coming right in time for the annual price discussions. It is going to be a challenge for operators to maintain flat production next year at the current levels of rigs and frac spreads.” —James West, Evercore. Onshore Oracle.

Warning from the Top. Weatherford reported $2.06 in earnings, beating the consensus by $0.41. From the release: “We have observed a gradual softening in activity, particularly in short cycle oil projects and onshore programs. E&P operators are taking a measured, cautious approach, and we expect this trend to continue in the near-term. In the third quarter of 2024, despite the revenue headwinds, adjusted EBITDA margins came in as expected at 25.2 percent.” The company’s debt burden received virtually no mention other than the CEO saying debt reduction is still a priority. Net leverage is currently at 0.5x.

Warning from the Top. Weatherford reported $2.06 in earnings, beating the consensus by $0.41. From the release: “We have observed a gradual softening in activity, particularly in short cycle oil projects and onshore programs. E&P operators are taking a measured, cautious approach, and we expect this trend to continue in the near-term. In the third quarter of 2024, despite the revenue headwinds, adjusted EBITDA margins came in as expected at 25.2 percent.” The company’s debt burden received virtually no mention other than the CEO saying debt reduction is still a priority. Net leverage is currently at 0.5x.

Unbelievable. This would normally be a comment in my Snippets section, but… “Jeep recalls 154,000 hybrid SUVs, urges owners to park outdoors due to fire risk.” Excuse me??

The Next Big Thing?? We have written a great deal about hydrogen—the pros and cons. So far, it has mostly been “cons,” unless you are just a contractor building facilities or selling equipment, but for the latter, don’t gear up too much. The only issues are the process that makes it, how to safely transport it, and finding some demand for it. I know, I know… There are a raft of other issues. My friend Robert Bryce has put out a note on numerous hydrogen projects around the globe being cancelled or delayed, due to high costs and a lack of a market for the output. It is nice when a smarter guy agrees with you!

Bomb What? Israel announced this week that it would only “attack” Iranian military locations and not oil and gas installations. Oil dropped 5 percent. Are we an industry that embraces violence and dislocation? No. It does point out the reality, which is a world with a current crude oil surplus. And even if Israel’s retaliation negatively impacted Iran’s oil production, OPEC+ could accelerate the return of 2.2+ million barrels of oil per day, offsetting the losses of Iran’s production. Any spike in oil prices could be very short-lived.

Uh Oh. Britain’s natural gas output is declining faster than expected and leading to greater reliance on imports, according to an industry group seeking government relief to spur investment.

Postscript—We promised last month to share with you the winners of the “Fair Food” competition at the Texas State Fair, so here you go: the Dominican Fritura Dog by Justin Martinez won “Best Savory,” Rousso’s Cotton Candy Bacon won “Best Sweet,” and the Texas Sugar Rush Pickles by Heather Perkins won “Most Creative.”

Subscribe to Jim Wicklund’s full e-newsletter, “Things I Learned This Week at…,” distributed weekly via email, by signing up for free at this webpage: https://www.pphb.com/newsletters. Jim is Managing Director / Client Relations and Business Development for investment banking firm PPHB. Leveraging deep industry knowledge and experience, Houston-based PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt, and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.

Subscribe to Jim Wicklund’s full e-newsletter, “Things I Learned This Week at…,” distributed weekly via email, by signing up for free at this webpage: https://www.pphb.com/newsletters. Jim is Managing Director / Client Relations and Business Development for investment banking firm PPHB. Leveraging deep industry knowledge and experience, Houston-based PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt, and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.