With energy demand increasing substantially in recent years, energy and utilities companies are preparing for immediate growth opportunities, and they are using mergers and acquisitions (M&A) as a tool to increase operational efficiencies, integrate new technologies, and create greater stability within the sector.

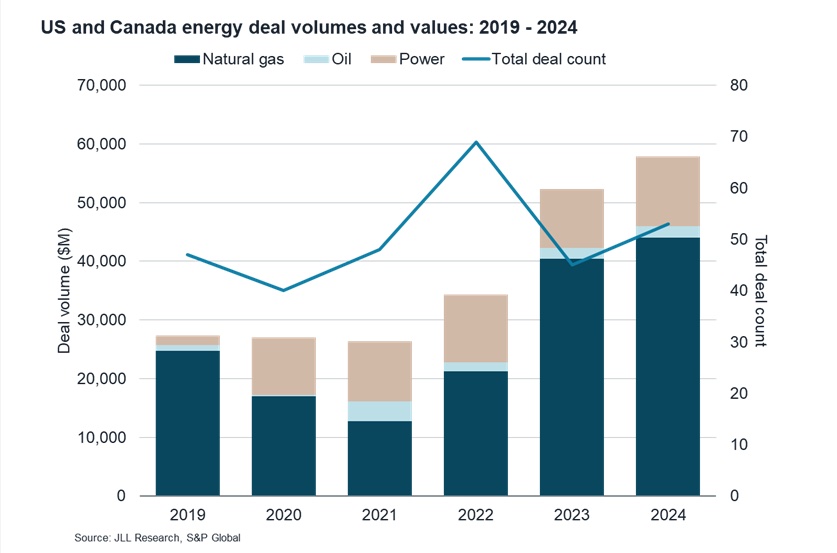

Energy sector M&A is gaining significant momentum, with transaction volumes exceeding $57B in 2024—more than double the pre-pandemic totals of 2019. This builds on a strong performance in 2023, when energy M&A deals reached $52 billion, an increase of over 50 percent from 2022.

While the number of completed deals has decreased slightly since 2022, companies are executing higher value transactions as energy demand spikes and increased sector volatility have created increased opportunities for the scaling and modernization of operations.

The natural gas subsector is leading this growth, accounting for nearly 60 percent of all completed deals and over 70 percent of total transaction volume since 2022 (see chart).

On the real estate side, consolidation likely means portfolio optimization, as companies will need to rationalize their combined real estate footprints, potentially leading to dispositions of surplus properties but also strategic investments in key locations. Higher natural gas M&A activity may drive demand for specialized industrial facilities, pipeline infrastructure, and office space in energy hubs like Houston, Denver, and Pittsburgh.

Additionally, energy companies pursuing operational efficiencies will seek modern buildings with lower operating costs, and new capital investments may flow to regions with favorable energy policies, infrastructure, and access to resources, creating localized real estate demand spikes.

As U.S. policy goals shift, JLL anticipates there will be a continued emphasis on energy M&A activity, particularly within traditional energy subsectors.

by JLL Research