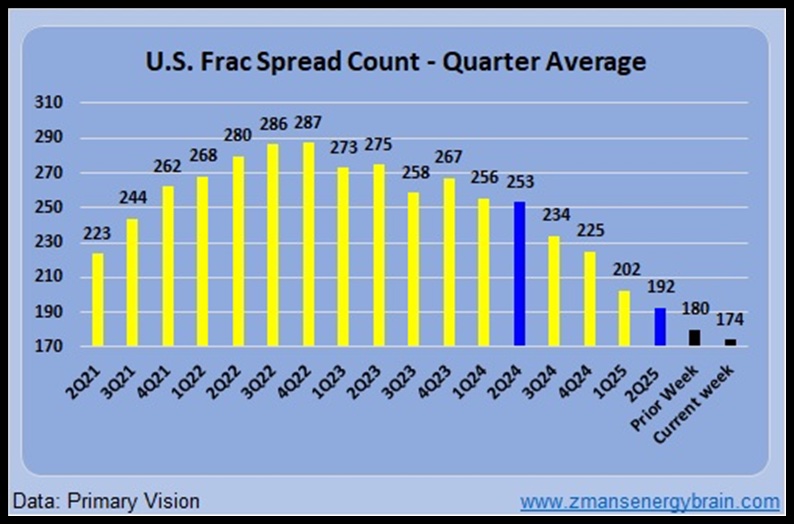

Earnings and Warnings Continue. Few beats, few hits, more misses, and almost everyone lowered guidance. That [was] the earnings report for the OFS sector [in late July]. As an analyst and investor, what you did last quarter matters most. It gives me insight into the trailing market. But what happens now? That is what matters. And what is happening now, for most of the oil and gas industry, both E&P and OFS, appears to be less, not more. E&P will outperform. At 50 dollar oil [which is what some analysts forecast], an oil company’s value has been cut significantly. That puts the value of a drilling rig about even with a boat anchor. For the last several years, E&P has benefited from the technology developed by the OFS sector. But, for many reasons, that has come at the expense of the OFS sector.

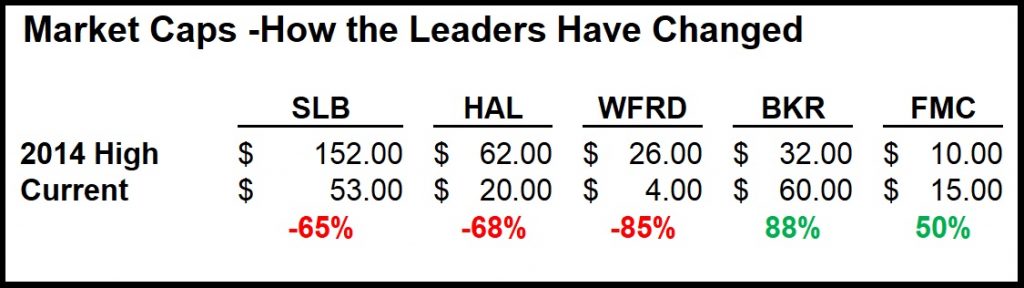

A Big Change in Scale. This deal (Baker Hughes purchasing Chart Industries for $13.6 billion) will put BKR’s market cap at just shy of $60 billion. That is 3x bigger than Halliburton and larger than Schlumberger. SLB clocks in at $53 billion and that is after the ChampionX acquisition. Halliburton is at $20 billion, NOV is at $5 billion, and Weatherford is just above $4 billion. Not as mainstream as some, TechnipFMC has also been a beneficiary of the LNG and power trends and now boasts a market cap of $15 billion. On June 30, 2014, SLB’s market cap hit $152 billion. Today it is $53 billion. Halliburton hit $62 billion at the same time and is now $20 billion. Baker trailed then at only $32 billion, about half the size of Halliburton. Weatherford hit $26 billion but now sits at $4 billion. NOV hit $37 billion, and is now at $4 billion.

Soap Box. New research this week said that shoppers are shunning items over plastic packaging. It struck a note. A couple of years in a row, I went fly fishing off the southern coast of Mexico on the Gulf side. The amount of plastic trash and plastic bags that filled the mangroves was just stunning. I came back and immediately became a member of the Plastic Alliance. I was just telling my son the other day, while we were shopping, to only buy eggs in paper cartons and not to buy the eggs in plastic and expanded polystyrene foam, also known as Styrofoam. This all comes from a research study by a sustainability consulting firm. The consultants found that 37 percent of consumers surveyed had decided against buying something because it was unsustainably packaged. Have you ever seen a banana for sale at the airport, sitting on a Styrofoam plate and wrapped in plastic? There was a push in corporate America to reduce the amount of plastic, but companies like Coca-Cola and Unilever are now easing those initiatives. Wrong decision, in my humble opinion. Little things add up. Look and see how quickly your garbage can fills up every week and look at what takes up most of the space. The heck with calories. Let’s start paying attention to packaging.

Texas. A man starts to interview someone and begins to ask him, “Where are you from?” but stops himself. The other man asks, “What were you going to ask me?” He replies, “I was going to ask where you were from, but I realized if you were from Texas, you would have already told me. And if you aren’t, why should I embarrass you by asking?”

Subscribe to Jim Wicklund’s full e-newsletter, “Things I Learned This Week at…,” distributed weekly via email, by signing up for free at this webpage: https://www.pphb.com/newsletters. Jim is Managing Director / Client Relations and Business Development for investment banking firm PPHB. Leveraging deep industry knowledge and experience, Houston-based PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt, and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.

Subscribe to Jim Wicklund’s full e-newsletter, “Things I Learned This Week at…,” distributed weekly via email, by signing up for free at this webpage: https://www.pphb.com/newsletters. Jim is Managing Director / Client Relations and Business Development for investment banking firm PPHB. Leveraging deep industry knowledge and experience, Houston-based PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt, and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.