Enverus Intelligence Research (EIR), a subsidiary of Enverus, an energy-dedicated SaaS company, released a report Sept.23 highlighting the impending depletion of North America’s core oil and gas inventory and its implications for global energy markets.

“North America’s dominance in supplying global oil demand growth is waning. Over the next decade, its contribution to consumption growth is expected to fall below 50 percent—a stark contrast to the previous 10 years when it supplied more than 100 percent,” said Alex Ljubojevic, director at EIR.

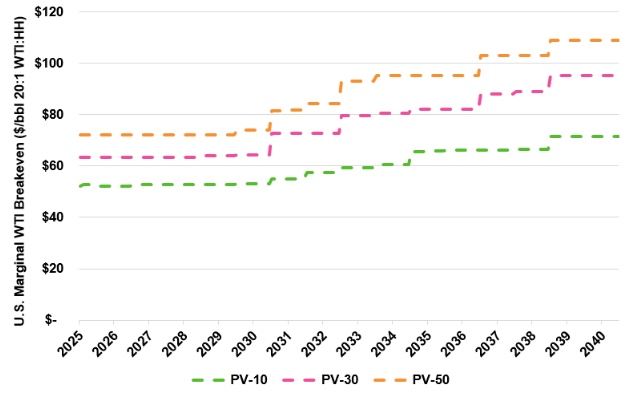

“As core shale oil inventory in the United States depletes, the industry is entering a new era of higher costs and more complex development. This shift will reshape the cost curve and redefine investment strategies across the continent,” Ljubojevic said.

Key Takeaways:

- Rising costs ahead: The marginal cost of U.S. oil supply is projected to rise from $70/bbl WTI today to $95 by the mid-2030s, driven by a shift from economically proven inventory to more speculative locations.

- The Permian and Canadian oil sands lead:The Permian Basin and Canadian oil sands are the continent’s lowest-cost sources of scalable oil supply. The oil sands benefits from strong Western Canadian Select (WCS) prices and sunk infrastructure costs.

- Gas inventory tightens post-2035:While U.S. gas inventory is ample in the near term, very low-cost supply becomes scarce beyond 2035, particularly in the Marcellus, Haynesville, and Utica.

- Canadian growth hinges on infrastructure:Canada’s oil production is forecasted to grow by 450 Mbbl/d by 2030, with natural gas output reaching 22 Bcf/d. However, given the country’s vast low-cost oil and gas resources, expanding export capacity infrastructure could unlock significant upside to these estimates.

Leave a Reply