The term “shale play”—generally a misnomer when applied to most oil and gas resource plays—is more likely a “tight sand” or “tight rock” play. We tap an expert for a primer on “play” terminology, as well as an assessment of today’s emerging plays. by Jesse Mullins

When PBOG settled in with Philip H. “Pete” Stark, Ph.D. and senior research director and advisor for Denver-based IHS for the discussion that follows, the first words out of our mouth were “shale plays.” After all, we’d decided upon running a feature on “Shale Plays: The Ever-Changing Map,” and with an industry-leading expert as our source, the big question was, “Where are the new shale plays?” But to our surprise, Pete challenged us on our terminology, and what he had to say makes a great starting point, not just for PBOG, but for, we think, a reading public as well.

“I’d like to back up and address what you mean by ‘shale play,’” Stark said. “Do you mean tight oil and gas reservoirs? Or do you mean strictly shale reservoirs? The term ‘shale play’ is totally misused and abused.’”

Stark indicated that the subject can become unduly complicated, not to mention misleading, unless the terminology is clear. And the American media has fostered a false impression by the way it has applied “shale play” to any unconventional resource play out there.

Now, most of the oil-rich plays are indeed associated with organic rich shaley source rock, so in that sense they are arguably a “shale” play, but the real production that is achieved in most of the hydraulically frac’d, horizontally drilled oil wells is obtained not from the shale but from the non-shaley porous rock beds that are intermixed with the shale beds.

[Note: When Stark says that the shale is the “source rock,” he refers to the fact that the oil and gas that is produced from resource plays is generated from the organic rich muds that were deposited along with siltstones, sandstones, and carbonates that make up the current petroleum systems associated with these plays. As these sediments are buried over geological time, increasing temperatures and pressures transform the mud to shale and the organic materials (kerogen) are transformed to oil and gas. Increasing pressures drive the oil and gas into the nearest available porous rock or fractures where it may be trapped. In the case of resource plays, the oil and gas are trapped in rocks with low porosity and permeability. All of the pore space in the associated petroleum system may be saturated with oil and gas and tends to be over-pressured (higher than normal pressure associated with weight of the rocks at any depth).]

Unconventional or “shale play” terminology can be clarified in context to this basic understanding.

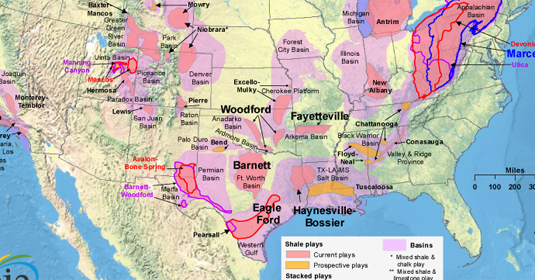

“Many credit the start of modern unconventional gas developments to Section 29 of the Natural Gas Policy Act of 1978, which granted tax credits to gas produced from geopressured brine tight sands, Devonian shales, and coalbed methane,” Stark said. “Tight sand and coalbed methane production flourished for almost 25 years before the so-called shale gale was ushered in with breakthroughs in gas production from horizontal wells and hydraulic fractures in the Barnett shale. Operators found they could produce commercial volumes of gas from the brittle and naturally fractured Barnett shale through the application of these technologies. Operators then successfully demonstrated their ability to produce commercial gas from other fractured shale source rocks like the Fayetteville, Haynesville, Woodford, Eagle Ford, and Marcellus. Gas molecules are small enough to flow readily and can be produced by horizontal bore holes that intersect the natural fractures and hydraulically induced fractures in the shale itself. The terms ‘shale gas’ and ‘shale play’ are correctly used in context to these plays.”

Almost coincident with the breakthroughs in the Barnett, operators successfully demonstrated that they could use horizontal wells and hydraulic fractures to economically produce larger oil molecules from the middle Bakken dolomite at the Elm Coulee Field in Richland County, Mont. Stark observed that at Elm Coulee, the dolomite is sandwiched between the upper and lower Bakken shale source rocks. Earlier attempts to produce from the Bakken shale source rocks had failed. By placing the horizontal bore hole in the more porous dolomite, the induced hydraulic fractures added enough permeability for oil to flow at commercial rates. In this case, the organic rich upper and lower Bakken shales are the source rock but the dolomite is the reservoir and production conduit, Stark said.

From there, the industry expanded its experimentation to yet other efforts.

“After the collapse of natural gas prices during 2009, operators moved up dip to test shallower oil- and liquids-prone parts of shale gas plays,” Stark said. “They succeeded in producing liquids-rich gas and oil from horizontal bore holes placed in high resistivity zones in the Eagle Ford and Barnett shales. The high resistivity zones tend to be more calcareous and more porous. Similar to the middle Bakken dolomite, the porous high resistivity zones serve as a reservoir and production conduit for horizontal bore holes. In these cases the term ‘shale oil’ seemed to be appropriate but hydraulic fractures in horizontal and vertical wells now produce from a variety of tight rocks, including limestones, such as the Mississippi lime in Oklahoma, and thick sections of interbedded sandstones, such as the Spraberry in the Midland Basin. Consequently, we at IHS prefer to use the terms ‘tight gas’ or ‘tight oil’ to refer to the wide variety of unconventional oil and gas plays that are being developed.”

He continued: “Common denominators for tight oil plays include: organic rich source rocks in the oil generating window; overpressure; the presence of tight, porous rock to serve as a reservoir and conduit for production; lateral continuity of the reservoir rock to accommodate horizontal bore holes. Calcareous rich reservoir rocks are preferred for oil but thick interbedded tight sands also produce. Tight gas and tight oil reservoirs must be hydraulically fractured to produce economic volumes of oil or gas.”

Getting the SCOOP

As for which plays are getting the most attention as emerging prospects, Stark opted to consider oil plays, as they are the ones “getting all the action. ” The chart in Figure 1 illustrates the range of average oil and gas volumes from initial potential tests of selected tight oil plays. There are many to choose from but the discussion could start with an emerging play—the Woodford Shale in the Anadarko Basin—that had too little data to make the cut for the chart.

“The new part of the Woodford play is an expansion from the gas-prone Woodford Cana play along the southeastern flank of the Anadarko Basin in Oklahoma,” Stark said. “Continental Resources was one of the principal operators who established this important oil-prone fairway. They call it the South Central Oklahoma Oil Province—or SCOOP for short. They identified a deeper and thicker calcareous-rich depositional environment [within the Woodford] that is oil-rich but with important gas content that helps drive the oil out of the rock. Because it’s thicker, the wells record larger barrels of oil equivalent reserves than the Woodford Cana wells. Operators estimate this new Woodford fairway could add several billion barrels of technically recoverable oil resources. Operators plan to drill more than 150 wells and to invest almost $150 billion in the overall Anadarko Woodford play during 2013. The SCOOP development, like many other important emerging tight oil plays, is an extension of an already known producing area. The Cline shale play in the Midland Basin is another example of an important new tight oil play that has evolved from expansions of the “Wolfberry”–Wolfcamp plays.”

Other Emerging Plays

“Recent high volume well completions also indicate the emerging Tuscaloosa Marine Shale (TMS) could be establishing commerciality,” Stark said. High well costs associated with the deep reservoir—with true vertical depths greater than 11,000 feet—have been a concern for this play. But a favorable fairway seems to be developing along that horizontal east/west boundary between South Louisiana and Mississippi. The Tuscaloosa Marine was deposited along the eastern extension of the Eagle Ford play fairway and a report by the LSU Basin research Institute estimated the play could yield seven billion barrels of reserves. Both Encana and Goodrich have reported recent high volume completions [greater than 1,000 b/d] from long horizontal laterals with more than 20 frac stages. If they can replicate that performance going forward, it looks like parts of the Tuscaloosa Marine will be a commercial viable play.”

Asked what plays are the most important—regardless of whether they are the latest finds or not—Stark named several.

“Even though most of the active tight oil plays produce significant amounts of gas, it is best to separate the dry shale gas plays from tight oil when considering key trends,” he said. “With respect to gas, there’s been a very interesting and gradual revelation about the top plays. At one time the Haynesville was thought to be the “King Kong” of the shale gas plays. But after the price of natural gas collapsed, operators in the Marcellus continued to improve well performance and to shift developments to liquids rich areas where they continue to thrive—even with gas prices less than $4 per MCF. Even though U.S. gas drilling dropped

below 400 rigs, growth in Marcellus production has offset declines in the rest of U.S. lower 48 gas production. The Marcellus has become an absolute dominant shale gas play out. It’s huge in size. Well performance has improved dramatically. Two years ago, the best Marcellus wells in northeast Pennsylvania were 9 or 10 million cubic feet a day. Now the best wells are 20-25 million cubic feet a day.

“So, a key driver across the country in all of the active tight oil and gas plays is continued process improvement. All operators are improving their knowledge of the geology and they’re improving their knowledge in how to apply the horizontal and hydraulic frac’ing technology. They have to tune technology to the geology of each play, and the learning curve is alive and well.”

Which Brings Us To…

“So, now, on the oil side, you really have three dominate plays – the Bakken-Three Forks, the Eagle Ford, and the Permian Basin,” Stark said. “Within the Permian Basin, the dominant subsets are the combination of the Spraberry and the Wolfcamp, or the so-called ‘Wolf Berry’ in the Midland basin and its twin Bone Springs/Wolfcamp, or ‘Wolfbone,’ in the Delaware Basin. Operators in both plays leverage deep vertical wells and horizontal wells to tap appropriate parts of this thick sequence of producing rocks. Vertical wells are now drilled and completed from the Spraberry down through the Strawn-age Pennsylvanian rocks, and horizontal wells are now testing two or three different zones in the Wolfcamp, including the Cline Shale, or the ‘Wolfcamp D,’ as some call it.”

The diagram in Figure 2 illustrates the evolution of deep vertical well drilling in the “Wolfberry” play. Operators like Pioneer also are segregating sandstone beds in the Spraberry that they can successfully complete with horizontal wells.

“This is another excellent example of the continuous process improvements that are sustaining the tight oil and gas revolution,” Stark said in conclusion. “These continuous improvements are revolutionizing the recoveries of oil and gas. I would say the Midland Basin Spraberry/Wolfcamp is leading the way for the Permian basin as the the 3rd leg of the Big Three U.S. tight oil plays. And, of course, the parallel developments in the Bone Spring/ Wolfcamp in the Delaware Basin, which also contribute to the substantial production growth in the Permian Basin.”

Pete Stark is senior research

director at IHS in Denver, Colo.

IHS is a leading supplier of information services and insights to the worldwide petroleum industry.