Such is the story nearly everywhere we look. These are the full versions of the articles shown in truncated form in the print version of our February issue.

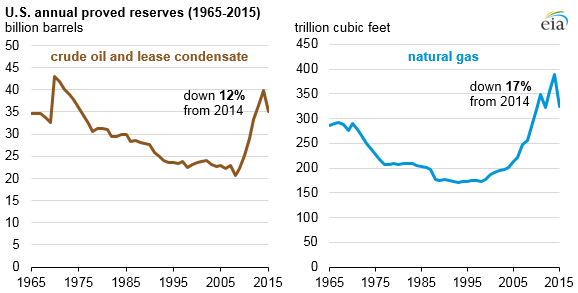

EIA: U.S. Proved Reserves in 2015

Declined Due to Lower Prices

U.S. crude oil proved reserves declined 4.7 billion barrels (11.8 percent) from their year-end 2014 levels to 35.2 billion barrels at year-end 2015, according to EIA’s recently released U.S. Crude Oil and Natural Gas Proved Reserves report. U.S. natural gas proved reserves decreased 64.5 trillion cubic feet (Tcf), a 16.6 percent decline, reducing the U.S. total to 324.3 Tcf at year-end 2015. The significant reduction in the average price of both oil and natural gas between 2014 and 2015 resulted in more challenging economic and operating conditions, important factors in determining proved reserves. West Texas Intermediate crude oil spot prices declined nearly 50 percent, from $94.55 per barrel in 2014 to $50.00 per barrel in 2015. The natural gas spot price at the Louisiana Henry Hub declined more than 40 percent from $4.55 per million Btu in 2014 to $2.62 per million Btu in 2015. These price reductions led to reduced drilling activity and lower reported proved reserves across a broad range of U.S. producers in 2015.

Proved reserves are volumes of oil and natural gas that geologic and engineering data demonstrate with reasonable certainty to be recoverable under existing economic and operating conditions. Because they depend on economic factors, proved reserves shrink or grow as commodity prices and extraction costs change. EIA bases its estimates of proved reserves on an annual survey of domestic oil and natural gas well operators.

API: EPA Distorts Science

On Dec. 13, API blasted the Environmental Protection Agency (EPA) for what it called “abandonment of science” in revising the conclusions to the Assessment Report on hydraulic fracturing. “It is beyond absurd for the administration to reverse course on its way out the door,” said API Upstream Director Erik Milito. “The agency has walked away from nearly a thousand sources of information from published papers, technical reports, and peer reviewed scientific reports demonstrating that industry practices, industry trends, and regulatory programs protect water resources at every step of the hydraulic fracturing process. Decisions like this amplify the public’s frustrations with Washington.

“Fortunately, the science and data clearly demonstrate that hydraulic fracturing does not lead to widespread, systemic impacts to drinking water resources. Unfortunately, consumers have witnessed five years and millions of dollars expended only to see a conclusion based in science changed to a conclusion based in political ambiguity. We look forward to working with the new administration in order to instill fact-based science back into the public policy process.”

Hydraulic fracturing supports millions of U.S. jobs, has increased supplies of oil and natural gas and has helped to put downward pressure on energy prices. It also has strengthened America’s energy security and geopolitical position.

The United States is not only leading the world in the production of oil and natural gas due to frac’ing, it is also leading the world in reducing carbon emissions. In fact, clean-burning natural gas has driven emissions in the U.S. power sector to 25-year lows. Consumers are also saving an average of $1,337 in energy costs per household and drivers saved $550 in fuel costs in 2015.

When asked earlier this month about the finalized report, EPA Administrator Gina McCarthy said: “We’re going to stick with the science.” EPA’s original findings are supported by academics and specialists in oil and gas engineering operations, hydrology and geology. The list of supporting evidence includes findings that no drinking water contamination as a result of hydraulic fracturing was found in the Marcellus, the Utica, the Barnett, the Permian, the Eagle Ford, the Woodford, the Fayetteville, the Haynesville, the Bakken, the Denver-Julesburg, the Piceance, the Raton, or any other shale formation where oil and gas resources are being developed through hydraulic fracturing.

Anadarko More Permian- and DJ-Centric

Anadarko Petroleum Corporation (NYSE: APC) announced Dec. 21 it has agreed to sell its operated and non-operated upstream assets and operated midstream assets in the Marcellus Shale of north-central Pennsylvania to Alta Marcellus Development, LLC, a wholly owned subsidiary of Alta Resources Development, LLC, for approximately $1.24 billion. The midstream assets in the Marcellus owned by Western Gas Partners, LP (NYSE: WES), Anadarko’s sponsored master limited partnership, are excluded from the agreement.

“With this transaction, we have announced or closed monetizations totaling well in excess of $5 billion in 2016, while principally focusing Anadarko’s U.S. onshore activities on our world-class oil-levered assets in the Delaware and DJ basins,” said Al Walker, Anadarko Chairman, President and CEO. “Our Marcellus team has done a superb job of maximizing the value of our position in this natural gas play, and we are grateful for their efforts and dedication.”

The Marcellus Shale divestiture includes approximately 195,000 net acres and, at the end of the third quarter of 2016, sales volumes from these properties totaled approximately 470 million cubic feet per day.

The transaction is expected to close during the first quarter of 2017, subject to customary closing conditions and adjustments. Jefferies LLC marketed the assets, and Sidley Austin LLP served as Anadarko’s legal counsel.

Solid Drilling Waste and Operational Costs

Rodger Keller, Scott Environmental Services, Inc.

Today, oil and gas prices are at, below, or barely above breakeven costs in the majority of oil and gas play regions. In order to help restore profitability, it is critical for operators to find ways to reduce the cost of each component that contributes to the total cost of a well. Two items that can impact the cost of a well beyond their face value are the disposal of solid drilling waste and the construction of drill pads and lease roads.

Although solid drilling waste disposal and transportation costs represent a small percentage of total well cost, this expense can significantly cut into an operator’s profit margin. Costs at a conventional disposal facility are typically high and often include numerous add-on expenses. The trucking of solid drilling waste also contributes significantly to disposal costs and can be very expensive, especially when a well site is far from a disposal facility. These are all factors that make costs difficult to predict and budget in an Authorization for Expenditure (AFE).

Overlooking solid drilling waste disposal can increase liability.

Liability costs of conventional solid drilling waste disposal is another area often overlooked. Once an operator’s solid drilling waste is unloaded at a disposal facility, it becomes commingled with waste from other operators, or with other types of waste. This disposal method intertwines the operator’s waste liability with that of every other waste generator that has disposed at the facility. If solid drilling waste is disposed of through landfarming or landspreading, the operator has a significant potential liability through possible land and water impacts, as well as commingling. Disposal practices are a major factor in the calculation of an operator’s liability risk number, which affects costs outside of those typically captured in the total cost of drilling a well.

Oil-based muds are a primary driver of solid drilling waste disposal costs. However, oil-based muds are usually required to achieve the necessary rate of penetration (ROP) and drilling reliability to minimize drilling time, and thus reduce the total cost of a horizontal well.

Delays can be very costly, but are preventable.

Operational delays increase the time to drill and complete a well, resulting in an increase in total well cost. A problem often overlooked among oil and gas operators is operational delays due to poor construction of a location pad or lease road. A poorly constructed location pad or lease road creates difficult operating conditions, especially during and after weather events with precipitation. Rig up and rig down time is increased, as well as drilling time, due to difficulty moving trucks, equipment, and materials to and from the rig. In severe cases, the location pad loses the ability to bear the load of the rig, thus causing drilling operations to temporarily cease in order for the location to be reconstructed.

Completions operations also slowed down when trucks and equipment have difficulty navigating lease roads and drill pads that have structurally failed. Delivery of proppants and completions fluids will also require more time. In severe cases, as with drilling completions, operations are delayed for a location pad or lease road to be reconstructed. Even after a well is completed, poor construction can interrupt routine production and maintenance activities. For example, if saltwater tanks for a well are full and tankers cannot access the location, the well may have to be temporarily shut in to enable the location or access road to be reconstructed, resulting in lost production. In any case, these types of delays to drilling, completion, and production operations are very costly but preventable.

Maintenance or reconstruction costs for location pads and lease roads are also overlooked or poorly tracked. Even though these costs are a small percentage of production costs, they can be reduced by proper construction. The amount of maintenance or reconstruction necessary for a location pad or lease road depends on the quality of the initial construction. A poorly constructed pad or road can result in significant maintenance costs throughout the life of the wells served, often ranging from tens of thousands of dollars to hundreds of thousands of dollars per location.

Scott’s next-generation solid waste management helped an operator increase profitability.

How can an operator reduce costs before, during, and after drilling, while enhancing operational reliability and reducing current and future liability? These goals do not need to be mutually exclusive.

Scott Environmental Services helps operators to achieve these goals by providing the next generation of solid drilling waste management in two fundamental ways:

- Process waste to build engineered pads and/or lease roads using Scott’s Firmus process.

- Process waste on the generating lease to build engineered load-bearing areas of pads and/or lease roads using Scott’s Duro process.

Each of Scott’s processes can be combined or customized to meet an operator’s needs.

Recently, Scott’s Firmus process played a key role in enabling an operator to drill a best-in-class, super-extended lateral for a major play in record time at a significantly reduced completed well cost on a location with severe soil problems.

The operator selected the location to be constructed with drill cuttings using Scott’s Firmus process. Scott personnel evaluated the location and discovered it was spongy, wet, and very sandy. The soils had no strength and could not support trucks and equipment. Construction equipment would sink and get stuck in the mud, with heavy rains aggravating the situation. Additionally, the spud date was quickly approaching.

Scott coordinated closely with the operator to develop the optimum cost-effective solution for the location’s soil problems. One benefit of the Firmus process is that each job is customized and engineered specifically for each site. In this case, the Firmus process was engineered to address the extremely poor soil conditions. Approximately 3,500 tons of drill cuttings from three wells were recycled in the Firmus process to construct the location pad. Scott’s quality assurance and quality control testing program ensured that the final product met or exceeded the design specifications, thus demonstrating the reliability of the pad. In fact, construction of the drilling pad with the Firmus process was completed with time to spare before the spud date.

While reducing construction and cuttings disposal costs, Scott’s Firmus process also eliminated the costs of operational delays due to poor location construction. The drilling pad was designed and constructed for safer and more reliable operations in all weather conditions. This not only eliminated delays to drilling, completions, and production due to poor construction, but also enabled the operator to drill a best-in-class, super-extended lateral well in record time at a significantly reduced completed well cost.

Minimizing all components of total well cost is critical for oil and gas operators in the current economic environment. The costs of solid drilling waste disposal, waste liability, and operational delays due to poor location pad and lease road construction are expensive and often unexpected. AFE budgets can be met by reducing costs during all phases of the drilling process, enhancing operational reliability and reducing current and future liability.