Conference Takes Aim on Third Year

Water is life, someone once said. Water is also the element that unlocks the hydrocarbons in the Permian Basin, and keeps the O&G world turning.

Having notched two filled-to-capacity events in their two-year existence, the Permian Basin Water in Energy Conference (PBWIEC) expects its highest attendance ever as it welcomes attendees to a third conference Feb. 19-21 at the Midland County Horseshoe Arena in Midland, Texas. There is to be a ticketed opening reception on the 18th at the Petroleum Museum.

PBWIEC was founded in conjunction with the University of Texas Permian Basin (UTPB) with an emphasis on commercial‐free, and industry relevant, discussions related to water in energy.

Attendance at the inaugural conference in 2018 numbered 430 registered participants. In 2019, that figure stood at 513. This year, organizers are looking for a turnout in excess of 700.

The event’s donation to UT Permian Basin reached $100,000 last year, a tenfold increase over the corresponding figure in the debut year of 2018.

The agenda now can be accessed on the organization’s website at pbwiec.com. Organizers recently put out a call for student posters, and details about the program can be found on the site. A new twist for 2021 will be the introduction of the “Churpon Awards,” and that program, too, can be explored on the site.

Getting “Chirpy” with It

The conference will launch an awareness campaign that, per their view, “takes a churpon’s approach to water in energy.”

As the organizers state: “We proudly introduce these two terms (‘Chirpy’ and Churpon) here as a prelude to our upcoming Year Four at PBWIEC. In India, where the possibility of running out of fresh water is a constant and harrowing reality, the villagers treat water as a most precious commodity. To preserve water and assure equal distribution, the villagers appoint water managers, known as Churpons, to oversee the collection of snowmelt into catchment ponds and dole it out through an ancient network of canals and sluices that run downhill past family farm plots. They ensure that families with plots at higher elevations who get the water first leave a fair share for families with plots at lower down.”

PBWIEC will introduce the Churpon Awards in 2021 at its fourth annual conference. Look for theirr Call for Submissions for consideration of this industry-award by June of 2020 at their website.

The Permian Basin Water In Energy Conference was founded in conjunction with the University of Texas Permian Basin (UTPB) with an emphasis on commercial‐free, and industry relevant, discussions related to water in energy.

Their stated vision: “Through the engagement of local and worldwide business leaders, the Permian Basin Water In Energy Conference will provide an annual conference to facilitate the development and sharing of information regarding the evolving usage and role of water in the Permian Basin’s Energy Industry.”

The PBWIEC may invest a portion of net proceeds towards educational grants and/or towards improving the quality of the annual PBWIEC conference.

Attendance at the inaugural conference in 2018 numbered 430 registered participants. In 2019 (shown here), that figure stood at 513. This year, organizers are looking for a turnout in excess of 700.

Drill, Baby, Drill

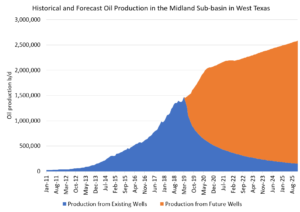

Oil and gas operators in the Permian Basin, the most prolific hydrocarbon resource basin in North America, will have to drill substantially more wells just to maintain current production levels and even more to grow production, owing to the high level of recent growth, according to an analysis by IHS Markit, a leader in critical information, analytics, and solutions. Data from the new IHS Markit Automated Well Forecasting Technology showed that the base decline rate of the more than 150,000 producing oil and gas wells in the Permian Basin has “increased dramatically” since 2010. The surge in shale drilling and output in recent years has been accelerating that inherent production decline because newer, younger wells decline much faster than older wells.

“Base decline” is calculated by identifying the actual or forecasted production of all the wells onstream at the start of the year, then tracking their cumulative decline by the end of the year. Understanding those base declines is critical for engineers/operators, who must determine what level of drilling and production targets must be achieved for their company to grow production and, hopefully, maintain performance and provide returns to investors.

“Base decline is the volume that oil and gas producers need to add from new wells just to stay where they are—it is the speed of the treadmill,” said Raoul LeBlanc, vice president of Unconventional Oil and Gas at IHS Markit. “Because of the large increases of recent years, the base decline production rate for the Permian Basin has increased dramatically, and we expect those declines to continue to accelerate. As a result, it is going to be challenging, especially for some companies with cash constraints, just to keep production flat.”

The new IHS Markit production outlook expects total U.S. oil production growth to flatten by 2021 due to a major slowdown in growth from U.S. shale. The new IHS Markit outlook for oil market fundamentals for 2019-2021 expects total U.S. production growth to be 440,000 barrels per day in 2020 before essentially flattening out in 2021. Modest growth is expected to resume in 2022. But those volumes would still be in stark contrast to the boom levels of recent years, LeBlanc said.

The Permian provides the comparison between traditional wells and shale wells. At the start of 2010, IHS Markit noted that production for the Permian Basin was approximately 880,000 barrels per day, with virtually all production coming from conventional operations. By the end of 2010, that group of wells produced 767,000 barrels per day—a decline of 110,000 barrels per day, or 13 percent of production.

Fast forward to 2019 when most wells drilled in the Permian Basin were shale wells (hydraulically fractured), which decline much faster, and the situation became even more dramatic. In 2019 Permian Basin production started the year at 3.8 million barrels per day, a million barrels per day higher than the year before. IHS Markit expects that base production will decline by approximately 1.5 million barrels of oil per day by the end of 2019–a staggering 40 percent base decline rate.

“Unless intentionally choked back, new, individual unconventional wells decline very rapidly, often 65 percent to 85 percent in the first year, so companies with many young wells in their inventory see significant declines in production compared to companies with a balance of younger and older wells,” LeBlanc said. “However, these high initial decline rates of individual shale wells become shallower over time, with older wells showing annual declines of 20 percent or less. So, the key here is that older wells in an operator’s inventory help offset the rapid declines of newer wells.”

Because of these older wells, base declines can also decelerate if the weighted average age of the wells in the production base rises. Just as a production base with mostly young wells exhibits high decline rates, the older the production base, the more stable it is, IHS Markit said.

Companies with the highest growth in recent years have the steepest base decline rates, and vice versa. The challenge of base declines is, therefore, different for each operator, depending on multiple factors, but especially on the decisions the firm has made concerning production growth and capital allocation, IHS Markit said.

Virtual Reality is a… Reality

Oil and gas companies are finding innovative ways to capitalise on the benefits of virtual reality (VR) technology, according to GlobalData, a leading data and analytics company.

The company’s latest report, Virtual Reality in Oil & Gas – Thematic Research details how oil and gas companies are using VR for subsurface studies, training, and simulation, and for developing and improvising processes and products.

These leading oil and gas companies adopting virtual reality trends, as identified by GlobalData.

Baker Hughes (GE)

Baker Hughes, a GE company, deploys VR technology to simulate oil and gas facilities within the training rooms. VR helps the company to focus on the digital design of the equipment to the minute details. It offers a higher level of accuracy and clarity about the equipment and working mechanism before the installation phase.

BP Plc

Virtual reality aids BP’s workforce to become well-trained for real-life challenges. BP, in collaboration with Maersk Training, has established a platform to enhance the knowledge of offshore drilling teams. Using simulation facilities in Svendborg, Denmark, and Houston, Texas, BP has pioneered in creating physical conditions during drilling activities.

Chevron

Chevron uses virtual reality at its El Segundo refinery in California to reduce considerable time and money spent on the maintenance process. VR goggles simulate the refinery equipment and sensor data superimposed on the 3D model, allows a technician to identify problem and provide solutions promptly.

ConocoPhillips

ConocoPhillips embraces virtual reality to make better utilisation of its existing communication and visualisation technologies. The company’s Norway division has established Onshore Drilling Centre (ODC) to operate drilling activities in the North Sea. The ODC includes a 3D visualisation suite to create a virtual team consisting of domain experts. The virtual team evaluates real-time data along with 3D visualisation of downhole drilling equipment.

Equinor

In a joint development between Oslo-based Hydro and Bergen-based Christian Michelsen Research (CMR) institute, the team designed a 3D simulator using VR technology – known as ‘Cave’ – to support oil and gas operations. Equinor is incorporating this technology to create a 3D simulation of offshore assets and operations. Wearing 3D glasses, the geophysicists, geologists and drilling engineers can study geologic structures in minute detail and observe the various layers of oil, gas, and water present in the reserves.

ExxonMobil

At its research centre in Qatar, ExxonMobil launched a 3D immersive training platform in collaboration with EON Reality to enhance field training methods. The platform creates a virtual plant environment to provide knowledge about equipment and processes to plant operators and engineers. The simulated facility mimics variety of real-life scenarios, such as unplanned shutdown, abnormal operation, and emergency response in a safe, controlled environment.

Gazprom

Gazprom is using VR technology in its marketing and distribution operations to enhance customer engagement. In order to enrich the user experience and bridge the gap between end-user and company, Gazprom has introduced a VR-enabled platform that depicts how fuel is being made available to the end-user. With the help of VR glasses, consumers at Gazprom-operated filling stations can experience the entire fuel distribution value chain on a short virtual tour.

Halliburton

Halliburton, one of the world’s largest oilfield services companies, is partnering with Microsoft to transform oil and gas operations using virtual reality. The company is leveraging Microsoft technologies to enhance its ability to study oil and gas operations with new dimensions. The collaboration is helping in simulation and 3D modelling of oil and gas reserves and creating designs for digital representation of physical assets.

Royal Dutch Shell

Shell is deploying virtual reality along with 3D simulation for deepwater safety training to its workforce stationed at the Malikai project, offshore Malaysia. Training on a simulated environment is helping technicians to deal with potential hazards due to unsafe actions and understand the steps to overcome any unforeseen event.

Saudi Aramco

The adoption of VR technology is proving to be quite beneficial for Saudi Aramco in undertaking training exercises. Its employees are being trained to operate the critical equipment in oil and gas facilities in the correct way. In collaboration with Eon Reality Inc., the company has built a practical training platform, which demonstrates different processes that need to be adopted in real-life situations at an oil and gas facility.

Sinopec

A strategic partnership between Sinopec and Siemens has led to the adoption of digital technologies in the company’s petrochemical plants. One of the outcomes of this partnership is the Comos Walkinside virtual reality platform, which is helping to propel the company to develop and test functional modules of petrochemical plants in a simulated scenario.

Milestone Reaches Milestone

Milestone Environmental Services (Milestone), a provider of oilfield waste disposal services, announced Dec. 17 the opening of its newest facility in the Permian Basin. The Big Spring slurry injection facility in Howard County, serving the northern Midland Basin, is located eight miles north of Big Spring, near the intersection of U.S. Highway 87 and FM 1584.

The Big Spring facility, Milestone’s eighth slurry injection facility in Texas and fifth in the Permian Basin, is now accepting drilling, completion, and production waste streams, as well as providing full-service truck washouts and frac tank washouts. The opening of Milestone’s Big Spring facility comes on the heels of a successful opening of its first landfill facility in Orla, Texas, earlier this month.

Big Spring is the second of three facilities in Milestone’s previously announced 2019 construction plan, and is the continuation of a multi-year infrastructure development plan to build the largest, most environmentally conscious oilfield waste disposal network in the Permian Basin.

“Delivering on our promise, Milestone is committed to positioning our facilities nearby our customers in order to provide them with a cost-efficient and environmentally responsible option for their oilfield waste disposal needs,” said Gabriel Rio, president and CEO. “Our newest facility in Big Spring is conveniently located in close proximity to rig sites in the northern Midland Basin, addressing the demand for waste disposal solutions in this high-producing area.”

Vacuum truck loads of oil-based and water-based muds, flowback, tank bottoms, dirty water, and produced water are now being accepted, and the site is operating 24 hours a day, seven days a week