In this month’s roundup of news and views, we share some reports that, taken together, reflect the ups and downs, as well as the bullishness/bearishness, that jockeys for influence in the oilfield circa 2020. These are the full versions of the “Drilling Deeper” news items that appeared as abbreviated versions in the print edition of PB Oil and Gas Magazine’s April 2020 issue.

GlobalData: U.S. to Lead

in LNG Exports by 2025

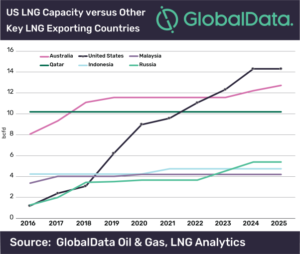

From a starting point of approximately 1.2 billion cubic feet per day (bcfd) of export capacity in 2016, the United States will become the third most important liquid natural gas (LNG) exporting country with a total capacity of 8.9bcfd by the end of 2020, according to leading data and analytics company GlobalData.

Adrian Lara, Senior Analyst Upstream Americas at GlobalData, comments: “By the year 2025, the additional capacity from new trains in existing plants, as well as from newly constructed plants, will reach an estimated 14.3bcfd.

“However, several approved LNG plants could start production as early as 2023 if they are able to move ahead with a final investment decision (FID). At the moment there is too much uncertainty, not only because of the existing oversupply of LNG but also due to a potential decrease in demand and a shift towards more flexible and short term contracts.”

The second wave of LNG projects consists of plants which have received an approval by the U.S. Federal Energy Regulatory Commission (FERC) but are not yet under construction. Most of these projects are expected to reach FID during the current year but this seems overoptimistic given the current global LNG market.

Specifically LNG developers feel pressure from potential buyers to offer more flexible terms in their selling contracts. Under such circumstances developers opt to wait for viable customers that accept some tradeoff between pricing terms and volume committed to buy. There is arguably also an incentive for pushing first production to after 2025 when industry players see a change in the cycle with LNG demand surpassing supply.

Lara concludes: “The United States currently has a total of 32 projects on different stages from feasibility to commissioning and their total capacity adds to almost 42bcfd, which is almost the current LNG worldwide trade of approximately 45bcfd.

“Overall, it is this high number of projects that increases the chance of having the United States become the leading LNG exporting country in this decade regardless of the timing for FIDs in individual projects.”

Why Are E&Ps Slow in Recovering?

By Glenn Sniezek

While the rest of the U.S. economy is enjoying one of its longest bull runs in modern history, the same, unfortunately, cannot be said for the E&P industry, where the road to recovery continues to be challenged, especially for middle-market companies. Pricing for oil, natural gas and NGLs have remained depressed. The sector has squeezed as much out of costs to maintain and develop shale plays as they could over the past few years to the point where the focus has shifted to capital discipline and shareholder returns rather than growth at all costs.

In addition, slumping oil prices have pummeled shares of energy companies in recent years—the S&P 500’s energy sector has been the worst-performing group in the broad index over the past two years and recently notched its worst January on record.

Deleveraging transactions, whether in- or out-of-court, were not sufficient during the first round of restructurings in the mid-2010s to sustain businesses as they still maintained too much debt. This has caused many E&P companies to file for bankruptcy protection in 2019 and the beginning of 2020, with many of them going into bankruptcy for a second time.

According to Reuters, U.S. and Canadian oil and natural gas exploration and production company bankruptcies totaled 42 in 2019, up from 28 in 2018, citing data tracked by law firm Haynes and Boone, and the trend is likely to continue in 2020.

Multiple Dynamics At Play

With poor shale economics and depressed pricing seeming to be the new normal, E&P asset valuations have cratered. A few years ago, E&P assets were being priced at the PDP PV 10 range for deals. Now, we’re seeing pricing in the PDP PV 12-15 range as the new norm. This has created a new dynamic for asset-based lenders in recent bankruptcies and out-of-court debt restructurings where they’re now having to start taking equity in companies as part of the restructuring process. This is in stark contrast to the restructurings that occurred in the mid-2010s where asset-based lenders were able to come out relatively intact and subordinated debt was converted to equity or wiped-out.

This dynamic is also forcing many E&P companies to pursue the Section 363 sale route in bankruptcy as they cannot restructure around their existing assets given the current market conditions or their lenders/creditors aren’t seeing enough value in the assets to convert their debt to equity ownership. A primary method to accomplish a “clean” asset sale under Chapter 11, this route references Section 363 of the U.S. bankruptcy code, 11 U.S.C.§ 363, which allows the bankruptcy trustee, or debtor-in-possession (DIP) with bankruptcy court approval, to sell some or all of the company’s assets free and clear of liens, claims and interests. This process generally maximizes sales prices as prospective buyers can:

1. Gain the benefit of being able to purchase assets on a free-and-clear basis and limit the potential liabilities assumed with the purchase; and

2. Benefit from competitive bidding, as an auction of the assets is held to promote bidding for the assets subject to court-approved bidding procedures. This benefit was evident in the bankruptcy filings of Alta Mesa/Kingfisher, Approach Resources, EdgeMarc Energy, White Star Petroleum and Southland Royalty Co., to name a few.

Unless there’s a fundamental change in commodity pricing, it appears that E&P companies will continue to struggle and the parade of companies heading into bankruptcy will not slow down in 2020.

Consultancy Group Urges

Pivot from Oil to Gas

International energy consultancy Xodus Group on Feb. 28 launched new analysis contending that a rapid pivot to gas will be required to deal with rising global energy demand.

In contrast to some recent future energy scenarios, Xodus believes worldwide energy consumption will continue to increase, driven by economic growth in developing countries, and that approximately half of that demand will need to be fulfilled by natural gas.

The ‘Rapid Pivot to Gas’ report by Xodus’ Advisory team, demonstrates that under this model, approximately $20 trillion would need to be spent on natural gas exploration and production over the next 20 years. The forecast would require significant advancements in technology to produce the gas responsibly, including carbon capture and storage (CCS) of the carbon dioxide produced. The scenario includes the phasing out of coal and oil in response to vehicle electrification and environmental pressures and a rapid and robust increase in renewable production.

Andrew Sewell, Director of Subsurface at Xodus Group said: “Recent forecasts take a developed world view showing either a plateauing or fall in energy consumption, but growing populations in developing countries mixed with increasing wealth are much more likely to result in a surge of overall primary energy consumption. We are anticipating an unprecedented decline in oil and coal, but even with energy from renewables modelled to the most aggressive increase, our analysis shows that a much more rapid pivot to gas is required to meet increased demand. Securing that gas sustainably by quickly enabling CCS and other decarbonisation technologies must move further up the agenda of governments and industries around the world.”

The report shows that over the past 25 years, per capita energy consumption of developing countries out with the Organisation for Economic Co-operation and Development (OECD) has grown at just over 2.0 percent annually. In the OECD, on average per capita consumption has fallen by about 0.2 percent annually in the same period. These growth rates were used to project future energy demand by region. The UN projects the OECD population to grow from 1.3 billion people in 2018 to around 1.4 billion people in 2040, whereas the non-OECD population grows from 6.3 billion in 2018 to 7.8 billion in 2040.

Based on these numbers, the overall primary energy consumption will surge from 14,300 million tons of oil equivalent (Mtoe) per year to 21,500 Mtoe per year in 2040, presenting a challenging supply and demand scenario.

Xodus predicts that crude oil and coal will decline to 1,500 Mtoe per year and 1,200 Mtoe per year respectively by 2040. Unconventional oil and other liquids are projected to increase over the entire period as is nuclear energy, assuming no major changes in policies. Aggressive growth rates have been assumed for renewables, particularly wind and solar at over 1000 percent each by 2040. In addition to sustained installation capacity, the uptime and efficiency of new capacity is projected to keep improving for the next 20 years.

Mr Sewell continued: “Assuming that natural gas supplies the difference in total demand, we estimate that consumption could grow up to 200 percent by 2040 accounting for half of all primary energy consumption and 73 percent of the fossil fuel component. Energy industries need to consider this potential gas demand spike in the landscape of the necessary decarbonisation of our global energy supply along with the huge exploration and production expenditure it would require.”

Xodus advises on business transactions in excess of $10 billion each year. Advisory experts are involved in reserves audits, revenue projections, capital requirements, asset integrity and decommissioning liabilities and they regularly work with banks, private equity firms and oil and gas operators. The team has recently advised on deals including North Sea and Middle East infrastructure investments, North Sea and West Africa asset investments, and a North Africa project finance.

The full Rapid Pivot to Gas report is available to download from www.xodusgroup.com

Select Energy Year-End Results

Helped by Pipeline Completion

Select Energy Services Inc., a provider of water management and chemical solutions to the U.S. unconventional oil and gas industry, on Feb. 24 announced results for the fourth quarter and 2019 year.

Holli Ladhani, president and CEO, stated, “We advanced our strategy throughout the year by divesting our non-core businesses, paying down our debt balance in full, completing our New Mexico pipeline system, adding incremental chemicals manufacturing capacity in the Permian Basin, acquiring a strategic water treatment business, and returning cash to shareholders via open market share repurchases, all while continuing to generate and build cash on the balance sheet.

“We finished 2019 with another strong free cash flow quarter and significantly exceeded the top end of our full year free cash flow target. We were disciplined in our approach to capital allocation throughout 2019, generating consistent free cash flow and further enhancing our financial flexibility. With our debt-free balance sheet, we are well positioned to capitalize on opportunities as they arise and navigate the potentially volatile market ahead of us.

“Looking forward, while we expect full year activity to decline year-over-year, we have already seen activity pick up in the early part of 2020 and expect improvements across all three segments in the first quarter. Absent signals of further increases in activity levels, we will invest our capital judiciously, with a capital expenditure range of $55 million to $70 million expected in 2020. We will continue to target a balanced capital allocation strategy including the evaluation of opportunistic and strategic growth focused on expanding our ability to bring full life-cycle solutions to our customers, as well as in technologies that support our operational efficiency initiatives and service differentiation,” concluded Ladhani.

Hess Voices Doubts

About Shale Viability

John Hess’s candid statements about the future of U.S. oil & gas production echo data-driven findings by industry analyst, J. David Hughes

Recent comments by John Hess, CEO of Hess Corporation, offer a rare acknowledgement from within the U.S. oil and gas industry that the “shale revolution” may not have staying power.

According to a Reuters report from Feb. 6, Hess, while speaking at the Argus Americas Crude Summit in Houston, Texas, warned that “production in the Eagle Ford Shale in South Texas is starting to plateau, while the Bakken field in North Dakota… will hit its peak production levels within the next two years, [and] the Permian Basin, the top U.S. shale field in Texas and New Mexico, will plateau in mid-decade and is already facing well interference issues.”

These public statements, while reflective of the private views of some producers and government agencies, are rare coming from the oil & gas industry. But they confirm the analysis of earth scientist J. David Hughes, who has been raising critical doubts about the long-term viability of U.S. shale gas and tight oil production, based on detailed analysis of play-by-play production, technological improvements, and geological realities.

“John Hess’s statements are not at all surprising and fit well with my recent analysis of the major tight oil and shale gas plays, including the Bakken, Eagle Ford, and Permian,” said Hughes “After the price collapse in 2014, industry went to great lengths to increase well productivity and profitability, including focusing on sweet-spots, multi-well pad drilling, longer horizontal laterals, and a several fold increase in injection volumes of water and proppant. Nonetheless, many companies remain cash flow negative and there have been many bankruptcies. The high production decline rates of shale wells require high rates of drilling and capital input to maintain production. As sweet spots become exhausted [several plays are exhibiting well interference from well over-crowding as noted by Mr. Hess], rates of capital input will have to increase to maintain production as drilling moves into lower productivity parts of plays, but investors are becoming increasingly reticent to provide the capital needed. Mr. Hess’s observations are certainly consistent with my analysis of the future outlook for shale production, which will almost certainly peak within this decade.”

“It’s refreshing to hear a leading voice within the oil and gas industry speak honestly about the inevitable limitations of the shale boom,” said Asher Miller, Executive Director of Post Carbon Institute, which commissioned Hughes’s analysis, “but U.S. energy policy remains dangerously wedded to a false vision of long-term domestic oil and gas abundance, driven by the optimistic forecasts coming from the U.S. Energy Information Administration. Even if the current Administration denies the urgent threat of climate change, basing our energy policy on resources that are rapidly depleting and ever more difficult to extract, sets our nation up for the worst of all possible scenarios.”

AI Comes to Artificial Lift

Ambyint, a provider of AI-powered production and artificial lift optimization, on Feb. 4 announced a $15 million Series B funding round led by Cottonwood Venture Partners with additional investment from Mercury Fund and Ambyint’s management team. Building on its successful adoption among oil and gas producers, Ambyint will extend its suite of optimization solutions across all wells and artificial lift systems.

“Improving margin on producing wells is more important than ever for operators,” said Ryan Gurney, managing partner at Cottonwood Venture Partners. “Ambyint has delivered significant financial benefits for its customers with the application of advanced physics and artificial intelligence, over and above traditional approaches to production optimization. We’re excited to see them expand further in the market with solutions that span the entire lifecycle of the well.”

“Producers flourish—even in a down market—when they understand how exploiting their data effectively can increase productivity and reduce costs,” said Adrian Fortino, managing director at Mercury Fund. “Ambyint turns data into higher yield, more efficient oil and gas production with proven optimization technologies. We’re excited to continue our partnership with such a great company and investor syndicate.”

Ambyint solutions optimize producers’ wells at-scale by automating detection of production and equipment anomalies, recommending controller setpoint changes, and providing production vs. plan analytics to enable real-time corrective decisions. The company applies advanced physics-based models, deep subject matter expertise, and artificial intelligence fueled by the industry’s largest repository of labeled, high-resolution training data totaling more than 250 million operating hours. Ambyint has deployed solutions in every major North American basin increasing production, reducing operating expenses, and lowering failure rates for mid- to large-sized operators such as Equinor and Husky.

“Our physics-grounded approach to AI is the difference maker and explains our strong growth in the market as well as our expanding list of marquee customers,” said Ryan Benoit, chief technology officer, of Ambyint.

“This funding round is an important milestone for Ambyint, and we’re pleased to benefit from unwavering support among our investors to boost Ambyint to its next phase of growth,” said Alex Robart, CEO of Ambyint. “It is also a proof point for our approach of combining advanced physics and artificial intelligence, deployed on a scalable software infrastructure, to deliver 10-20 percent margin gains in a market where meaningful improvements have been hard to achieve.”