Two competing narratives dominate the talk today where crude oil prospects are concerned. There is the break-your-spirits pessimism parroted by the Covid-crisis crowd, beating their drumbeat of disaster. For them, the lockdowns ought be locked in a year or more at a crack. Then there is the bullishness of the glass-half-full crowd, finding positivity in their indicators and espousing recovery on the approaching horizon. Whose forecasts are worth heeding? Interestingly, U.S.-based voices seem characteristic of the first set, and foreign interests fall more into the optimistic camp. In mid-July, Russian Energy Minister Alexander Novak said that global oil demand will recover significantly “next month.” That

meant August. That means, like, starting right now. Novak said we’d reach within 10 percent of pre-Covid levels. Well, will we?

The oil industry’s hyper-fixation on oil demand is symptomatic of a more elemental fixation, and that is the industry’s focus on oil prices. Where will crude prices go from here? It’s a given that the movement of crude prices will track with the movement of crude demand. And crude demand will go up as supply goes down.

Yesterday (July 28) Reuters reported that an inventory drop for crude oil brought a jump in prices. The increase was modest, but in these times even modest improvements get close attention.

West Texas Intermediate (WTI) crude futures rose 26 cents, or .6 percent, to $41.30.

West Texas Intermediate (WTI) crude futures rose 26 cents, or .6 percent, to $41.30.

“Inventories of crude oil in the United States dropped by 6.8 million barrels last week to 531 million barrels, data from the American Petroleum Institute showed on Tuesday [July 28],” Reuters stated. “Analyst expectations in a Reuters poll were for an increase of 357,000 barrels.”

Normally, such a demand drop would stimulate prices higher. But, as Reuters noted, worries about coronavirus fears among the public is keeping alive concerns about falling fuel demand.

Officials at Rystad Energy observed on July 26 that they are changing their base case scenario for oil demand, incorporating what they describe as a “mild second wave [coronavirus] effect.” The company assumes a temporary pause in global demand recovery, citing the offsetting effects of Covid-19 ‘outbursts’ in the Americas and Asia.

“There is downside risk to our base case,” Rystad said in a prepared release. “We have identified a category of oil demand at risk—that is, the maximum number of barrels that could be lost if a full lockdown is reinstated globally. In this worst-case scenario in which strict lockdown measures return, we expect demand to edge around 3.7 million bpd lower for the rest of 2020, compared to our updated base case scenario.

“Even if the disease is not reined in and this full-blown second wave manifests, the effect on oil demand will not be as destructive as during the first shock in April 2020. That is because the world is better prepared to introduce smarter and more targeted lockdowns, handle infections, and also because the global economy can simply not afford another steep economic meltdown.

“In this update, instead of gradually recovering monthly, global oil demand in our base case is now expected to stay relatively flat from July to October 2020 and then inch up again from November, albeit at a much slower rate than previously estimated. In July, oil demand is now expected to average 90.2 million barrels per day (bpd) and then improve to an average of 90.6 million bpd for August, September and October. In November, oil demand is likely to reach 93 million bpd and in December climb a bit more to 94.7 million bpd – still a far cry compared to the pre-Covid oil demand average level of more than 99 million bpd in 2019.”

In the wake of the Saudi-Russian Price War, it’s understandable if some care not what the Saudis think about the fortunes of oil and gas in what remains of 2020. That said, there is, for those who care to hear it, a profession of optimism from the Saudi’s top oilman.

IHS Markit reported that Saudi Aramco president and CEO Amin H. Nasser said, in conversations with IHS vice chairman Daniel Yergin, that “the worst is behind us” in oil markets and that already-recovering demand has him “very optimistic” for the second half of 2020. Nasser also believes that countries are now better prepared for a second wave of COVID-19 if and when it occurs.

Nasser spoke with Yergin about maintaining operations during the pandemic and how the 2012 MERS outbreak better prepared Saudi Aramco for COVID-19; about the importance of shorter, more resilient supply chains; about applying lessons from the United States in developing its own shale resources; about the strategy behind the acquisition of SABIC; and more. A complete video is available at: www.ceraweek.com/conversations

The International Energy Agency (IEA) in its July 2020 report, also injected a note of optimism in its outlook.

“We started the second half of this extraordinary year hoping that the worst of the oil market turbulence is behind us,” IEA stated. “Only time will tell if the [lingering] economic impact [of Covid-19] will be serious. In the meantime, in the past few weeks benchmark crude oil futures prices have been remarkably stable with both Brent and WTI hovering around $40/bbl and the contango seen in both futures curves has flattened. Futures markets are anticipating a transformation in the oil market from substantial surplus in the first half of the year to a deficit in the second half.

“New data confirm that the worst of the demand destruction was in the first half of the year when demand fell by 10.75 million barrels per day (mb/d). For the second half we expect an improvement in the level of decline to 5.1 mb/d. We estimate that global oil demand this year will average 92.1 mb/d, down by 7.9 mb/d versus 2019, a slightly smaller decline than forecast in our last monthly report. This is mainly because the decline in 2Q20 was less severe than expected.

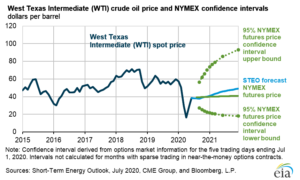

Meanwhile, earlier in July, the U.S. Energy Information Administration (EIA) raised its Brent and West Texas Intermediate (WTI) oil price forecasts again.

“According to [our] latest Short Term Energy Outlook, the EIA now expects the Brent spot price to average $40.50 per barrel in 2020 and $49.70 per barrel in 2021. In the EIA’s June STEO, the Brent spot price was expected to average $38.02 per barrel in 2020 and $47.88 per barrel in 2021. Back in May’s STEO, the 2020 and 2021 Brent spot price was projected to average $34.13 and $47.81 per barrel, respectively.

“In July’s STEO, the WTI spot price is expected to average $37.55 per barrel this year and $45.70 per barrel next year. In June these prices were forecasted to hit $35.14 per barrel in 2020 and $43.88 per barrel in 2021 and in May they came in at $30.10 per barrel in 2020 and $43.31 per barrel in 2021.

“Oil prices rose in June as numerous regions worldwide began to lift stay at home orders and as global oil supply fell as a result of production cuts by the Organization of the Petroleum Exporting Countries (OPEC) and partner countries (OPEC+),” the EIA stated.

The forecast of rising crude oil prices reflects EIA’s expectation of declines in global oil inventories during the second half of 2020 and through 2021, the EIA added.

_____________________________________________________________________________________________________

By Jesse Mullins