.

R&D pipe President Ron Underwood and Trident Steel CEO Kevin Beckmann have both seen better times, but neither is certain when those will return, at least for their sector.

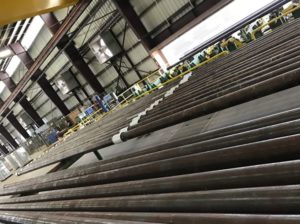

Casing in particular is tied directly to drilling, Underwood pointed out. Beckmann noted that the rig count is down 73 percent year-over-year from 2019. That means the casing market has dried up, leaving pipe yards full of unsellable inventory.

“Surface pipe, intermediate strengths, production strengths, it’s all been dried up,” said Underwood. “The mills are suffering, the manufacturers, the people who’ve been importing pipe have had tremendous cutbacks in their need to bring oil country tubular goods into the country.”

With most wells descending 10,000 feet then extending laterals out another 10,000 feet, “that’s a tremendous amount of tubulars—and when you start cutting those rigs back,” that’s a huge amount of pipe no longer being used.

Much drill pipe supply is outsourced to third parties in what Underwood called “stocking programs.” Those third parties bought pipe early in 2020 based on expected demand, looking to be paid when clients took delivery on the inventory. When demand instead came to a halt those providers now face the double whammy of backlogs of inventory without any way to pay their suppliers for it.

Underwood noted that the President Trump’s campaign to buy steel pipe from American makers “has played some role in stimulating more available activity for the domestic mills,” which he sees as good for those companies.

But for Beckmann, the unintended consequences are that OCTG costs have skyrocketed for end users, feeling that U.S. mills have raised prices due to reduced competition from everywhere except South Korea.

For every $100 of pipe a typical supplier bought earlier in 2020, Beckmann sees them trying to sell it at $80 in order just to cover payments to the mill. Those firms, he said, are looking to hold on until things turn around, for which he holds limited hope. “There’s not going to be a turnaround,” at least not any time soon because “there’s not going to be an increase in demand” back to the pre-COVID days.

Almost no pipe companies are buying inventory now because, he said, “The risk is not worth the reward. Their liquidity is gone.” That’s because they’re spending reserves on covering payments for inventory they thought they could sell during Q1 and Q2 of 2020.

The moral? “Don’t buy what you can sell, buy what you can pay for,” Beckmann said, adding, “Consignment typically does not work for any party except the consignee and this 2020 series of events brought that home to roost.”

Making matters worse, investor money has dried up for pipe vendors, just as it has for the rest of the industry. Said Beckmann, “The financial situation is now akin to a ‘great lack of funds liquidity depression.’” Bank credit lines are shrinking and investor funding has dried up, just when an influx of cash survival has become critical for many companies.

Not surprisingly, Beckmann sees dominoes beginning to fall. “Bankruptcies for the first 6-7 months of 2020 have exceeded all that occurred in 2015 [the last oil price crash]. The general sentiment is, ‘Can it get any worse?’ Lack of money, which is the lubricant for all the gears, is rather a serious issue right now.

Not surprisingly, Beckmann sees dominoes beginning to fall. “Bankruptcies for the first 6-7 months of 2020 have exceeded all that occurred in 2015 [the last oil price crash]. The general sentiment is, ‘Can it get any worse?’ Lack of money, which is the lubricant for all the gears, is rather a serious issue right now.

“Many have already done staff reductions, salary cuts, and furloughs of staff to cut overhead,” he said. “That will in my opinion continue for the second half of 2020 as I do not see any noticeable rebound in demand what so ever.”

For R&D’s Underwood, casing demand dropped precipitously in spring 2020 because of its close ties to drilling and completions. Most types of surface use pipe have seen demand dry up as well. “The mills are suffering, manufacturers, people that are importing pipe have had tremendous cutbacks in their need to bring oil country tubular goods into the country,” he observed. But there is still some inflow.

As Beckmann noted, Underwood agreed that it’s the middlemen that are hurting the worst. “People who were involved in stocking programs, they were stocking pipe they had to buy and pay for.” These parties only got paid back for their investment when the client E&P took the pipe out of inventory for downhole use.

The rig count dropped so quickly and for so long (approximately 16 weeks in a row), that Underwood reported being ecstatic at the first report showing no decrease in rig counts for one week. Just that the freefall had stopped was at least somewhat encouraging.

As prices began to recover in late summer, Underwood saw the reopening of previously shut-in producing wells, which created more opportunities for workovers of those sites. “That stimulates the tubing business. We [R&D] are really focused on corrosion mitigation products. We’re going to grow our business in that direction.”

He believes every existing well could benefit from pipe coating for issues including reduction of friction coefficients to improve flow efficiency, for product purity or corrosion caused by CO2, H2S, sand, or other abrasives in the production flow and more. Each situation should be evaluated as to whether the coating would pay out in reducing pipe replacement requirements, he said, but it should at least be considered.

Pipe sizes most commonly coated include 2-3/8”, 2-7/8”, 3-1/2”. Most recently coating is becoming common on larger sizes including 4-1/2”, both tubing and casing, and ranging up to 5-1/2 and 7”, “for these high volume disposal wells where they’re trying to move tremendous amounts of very corrosive fluid.”

As long as there is any reasonable price for oil, Underwood sees pipe coating as a way to stave off replacing existing pipe in order to save costs, somewhat like repairing existing equipment instead of buying new during a downturn.

With prices sticking at around $40, “I think we’ll see workover activity beginning to pick up, I think we’ll see an increase in tubing consumption and small diameter casing consumption for these production and disposal wells.” Underwood counts himself as “cautiously optimistic” about the near future of the pipe business. R&D has not only avoided layoffs, they have hired an additional sales person in order to create more opportunities among companies that are still active.

With prices sticking at around $40, “I think we’ll see workover activity beginning to pick up, I think we’ll see an increase in tubing consumption and small diameter casing consumption for these production and disposal wells.” Underwood counts himself as “cautiously optimistic” about the near future of the pipe business. R&D has not only avoided layoffs, they have hired an additional sales person in order to create more opportunities among companies that are still active.

For the year 2020, the saying, “The only thing constant is change” describes the situation just about every moment. Everyone in oil and gas—and pretty much every industry—will be forced to adapt quickly in order to survive. That situation is not likely change anytime soon.

_____________________________________________________________________________________________________

Paul Wiseman is a freelance writer in the oil and gas industry.