“The sub-industry of water handling and water midstream has evolved pretty dramatically over the last three or four years,” said Bill Zartler, CEO of Solaris Midstream Holdings. Solaris designs, owns, and operates water midstream systems in the Permian Basin.

Solaris itself has grown exponentially since starting from scratch in 2016. They bought a small company called Water Midstream. In 2017 they were moving about 25,000 barrels of water per day. Within two years they were moving 150,000 barrels per day and in 2020 they’re piping over 600,000 barrels daily.

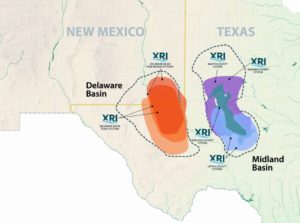

Assets are in New Mexico and Texas counties of the Delaware Basin, including Eddy and Lea in New Mexico, along with Loving, Culberson, Midland, Martin, and Howard Counties in Texas.

Water has long been a major byproduct of oil production. But with the rise of unconventional wells, around 2010, with water-to-oil cuts as high as 10-1 and overall production levels reaching record highs, water became a greater issue than ever. Plus, those unconventionals required massive amounts of fresh water for completions, which raised a completely new water issue.

When Solaris opened for business, many majors were constructing their own water midstream systems. Smaller operators were simply buying fresh water from ranchers and paying to truck produced water to a nearby SWD. By 2016, producers of all sizes were realizing that this flood of water in both directions, with its attendant environmental concerns, was becoming too big to easily handle. Outsourcing this investment of capex and time to Solaris and other water midstream companies became balance sheet wisdom.

“The evolution is that the industry sees the capital efficiency for outsourcing some of this activity,” Zartler said. Producers who build out water transfer and disposal capacity, then see stranded disposal capacity left behind as they move to other fields when production plays out, have decided to farm these things out.

“What it means is that you need a third party to do it for you if you don’t have a large contiguous area.”

When asked what size producer would be a typical Solaris client, Zartler observed, “The size of the E&P doesn’t matter as [much as] what their acreage looks like and how contiguous it is, whether or not they choose to do it in-house or if it makes sense to outsource it to a third party like us.”

Water midstreams like Solaris can create a staff of experts specifically in water management, he noted, something that E&Ps don’t have the resources to do without taking away from their primary focus.

XRI operates in both the Delaware and Midland Basins. Solaris Midstream, the other company discussed in this report, likewise works those basins.

“The infrastructure we provide allows us to do significantly more efficient recycling for reuse in frac’ing.”

That outsourced infrastructure also allows efficient sharing between sources. “In Midland County we have water coming in from 4-5 producers, and we were cleaning it up, treating it, and selling it back to one producer for their fracs,” he said. Similarly, in the Delaware Basin, they take water from about 15 customers and recycle it for 4-5 clients for fracs. Horizontal well fracs require an average 600,000 barrels over just four days, Zartler said. Such projects need significant infrastructure to transfer that much water on a short schedule.

As an example, Zartler recalled that in the fall of 2019 E&Ps were delaying fracs due to lack of water, especially in New Mexico. This issue can often be solved by recycling produced water.

Downturn-related falloffs in drilling and completions have created a surplus of produced water, Zartler noted. “We saw a peak in April as folks stopped completing wells, so the recycling slowed down, water came into the system for disposal, and we didn’t have much going out for recycling” which meant more went downhole.

As producers shut in wells in May, the volume of produced water shrank, somewhat alleviating the issue.

June and July brought some of those wells back online, and producers inched back into drilling new wells and completing DUCs (drilled, uncompleted wells), meaning the availability and the need for treating produced water also began to come back.

Another water midstream company operating in the Midland and Delaware Basins is Midland-based XRI holdings. Founded in 2013, they currently operate 300 miles of pipeline combined among the two basins. In April of 2019 the company bought Fountain Quail’s water treatment and recycling division, combining it with their own operation.

Another water midstream company operating in the Midland and Delaware Basins is Midland-based XRI holdings. Founded in 2013, they currently operate 300 miles of pipeline combined among the two basins. In April of 2019 the company bought Fountain Quail’s water treatment and recycling division, combining it with their own operation.

President and Vice Chairman of XRI Holdings, John R. Durand, said this transaction had helped his company weather the drilling downturn.

“Almost immediately following the acquisition, XRI began integrating FQWM’s industry-leading treatment and recycling facilities into our water distribution midstream infrastructure,” he said. “This integration allowed XRI to enter into long-term takeaway agreements for an operator’s produced water and then treat, recycle, and redistribute the treated produced water via our water distribution networks. XRI refers to these facilities as Water Exchange Terminals™ and enables our company to meet our E&P client’s increasing demand for utilization of treated produced water for frac supply rather than relying on groundwater sources.”

There was a brief decline in recycled volumes, but within a few weeks XRI’s volumes exceeded those of the pre-pandemic market. Durand stated that, “Essentially all of our E&P clients remain very focused, as are we, on ESG and long-term sustainability initiatives. Therefore, continued growth in the use of recycled water is a tremendous component of XRI’s collaborative strategies with our customers.”

XRI and Solaris have both experienced growth during times that were squeezing expansion capital availability even before COVID-19. On that topic, Durand observed, “There is no doubt that private equity investment in the space is much harder to come by today versus what the water management sector experienced from 2014 to 2019, when a number of private equity-backed companies came into being.”

Success in this climate depends on two main factors, the first of which is managing balance sheets and keeping a lid on debt. Additionally, said Durand, “Another key to success during uncertain times is the caliber and financial quality of your customer portfolio and the tenor and strength of the contracts you have with those customers. Given that the vast majority of the capital XRI has deployed since inception has been organically driven, we have a very healthy balance sheet and employ an extremely disciplined approach to the financial management of our business.

“Our financial health is largely a reflection of the long-term contract structures in place with our investment grade quality E&P clients. In addition, we are extremely fortunate to have had Morgan Stanley Energy Partners as our capital provider since 2016.”

The wave of buyouts and bankruptcies in the E&P and service sector will likely sweep through water treatment and midstream as well, Durand believes. “It is my belief that 2021 has the potential to be a year of considerable consolidation for the industry as a whole,” he said, “with the water management sector being no exception. So much depends, however, on a number of variables as we head into the 3rd and 4th quarters of 2020.”

Variables include lingering effects of the COVID-19 shutdown as well as the outcome of the 2020 national elections.

One coping mechanism Durand suggests would be to expand on the idea of sharing resources. Already sharing water among internal clients, he sees even greater advantage to water midstreams sharing the resource between themselves. He noted, “One strategy that XRI has embarked upon during this most recent downturn is to proactively work with upstream operators as well as peer midstream companies to seek ways to more effectively utilize existing infrastructure already in the ground. Whether that is with underutilized disposal capacity or pipeline capacity, in certain areas there are opportunities to interconnect systems, provide treatment and recycling, enter into capacity arrangements, and potentially exchange volumes between systems.”

He believes sharing resources would improve the opportunities to balance a sprawling system in which water is equal parts blessing and challenge.

Durand uses a unique word to describe the balance of cooperation and competition. “If the industry can effectively engage in healthy and efficient ‘coopetition,’ the water midstream sector can lead the way in providing efficient and cost-effective solutions to benefit not only the upstream sector, but also provide superior returns to their capital providers and other companies investing in the water management sector.”

Durand and Zarlter both feel the economics of treating produced water sufficiently for municipal use are in the distant future. But a commitment to reducing fresh water demand by funneling increasing amounts of produced water into fracs would seem to be a big step toward protecting quality of life for the individuals and families who do the work, by protecting the water table from depletion.

_____________________________________________________________________________________________________

Paul Wiseman is a freelance writer in the oil and gas sector.