Everything pivots on commodity pricing. The price of oil or natgas drives not just the E&P sector but the services sector as well. So what’s the story with prices? Come Oct. 1 we’ll tell you all about it–online.

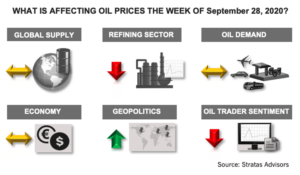

What’s Affecting Oil Prices This Week?

During this year the oil market has seen Brent crude spot prices plummeted from $65 to $22 in three months, the US lost 3 million b/d of crude production, and European refiners needing to reduce utilization rates to less than 50% for several weeks. These are just some highlights of what 2020 has meant for oil markets so far, however, the worst quarter may yet be just around the corner…

https://stratasadvisors.com/Weekly-Oil-Price/092820-HardYearsNight

Sept. 9 Short Term Energy Outlook EIA

U.S. Energy Information Administration

https://www.eia.gov/outlooks/steo/marketreview/crude.php

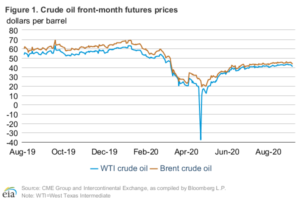

Brent crude oil prices increased for the fourth-consecutive month, driven by continued increases in global oil consumption amid reduced oil supply. As of the end of August, oil prices had moved into an increasingly narrow trading range with some of the lowest levels of price volatility since 2015. Although considerable uncertainty in the global economy and oil markets remains, price volatility may have declined primarily as a result of the large volume of oil inventories accumulated during the first half of 2020 and a slowing rate of oil consumption growth. EIA estimates that total commercial petroleum inventories in the Organization for Economic ooperation and Development (OECD) as of the end of August 2020 were sufficient to meet 71 days of current OECD oil demand, compared with 63 days on average for August over the past five years (2015–19). However, crude oil prices fell on September 4 and 8, breaking out of the narrow trading range amid heightened volatility.

Indicators of economic activity have largely been higher than market participants’ expectations, particularly in sectors such as housing and in indicators like new durable goods orders. Nonetheless, economic recovery in some sectors that are important for oil consumption, such as personal travel and tourism, has been slower. EIA estimates that global oil consumption in August grew by 1.0 million barrels per day (b/d) from July, the slowest month-over-month increase since consumption began to recover in May and the first time during that period that consumption growth was surpassed by growth in world oil production. Despite the different pace of increase between global oil production and consumption during August, EIA forecasts oil market balances to continue tightening for the remainder of 2020 as a result of continued demand recovery, restrained production from members of the Organization of the Petroleum Exporting Countries and partner countries (OPEC+), and price-related declines in production from the United States.

Although crude oil prices have increased slightly since mid-July, crude oil futures price spreads have developed a wider contango (when near-term prices are lower than longer-dated ones) during the same period. The five-day moving average of the Brent 1st–13th spread widened by 93 cents/b since July 15 to settle at -$3.41/b on September 3, 2020, and that of the WTI 1st–13th spread widened by 99 cents/b during the same period to settle at -$2.83/b (Figure 2). A wider contango can indicate reduced refiner purchases or increased oil supply availability, which could suggest some slower growth in the outlook for global oil consumption and smaller inventory withdrawals. EIA forecasts that the large inventory withdrawals during the second half of 2020, averaging 3.4 million b/d, will subside in 2021 into a more balanced market and that global inventory withdrawals will average 0.3 million b/d for the year.

The top executives at some of the world’s largest independent oil traders do not expect global oil demand to materially improve over the next six to nine months—Instead, they expect oil prices to remain stuck in a narrow range in the $40s at least until the middle of 2021.

The senior executives at commodity trading giants Vitol, Mercuria, and Gunvor are not optimistic about the demand recovery in the near term, they said at the FT Commodities Global Summit on Tuesday.

Russell Hardy, chief executive at the biggest independent oil trader in the world, Vitol Group, expects global oil demand to stay flat until the summer of 2021, and has “modest expectations” about oil prices, Reuters quoted Hardy as telling the summit.

Hardy himself appeared quite bullish on oil inventories drawing down two weeks ago. The world’s stockpiles of oil have diminished by around 300 million barrels since peaking at 1.2 billion barrels early this summer, and are expected to decline by another 250 million-300 million barrels between September and December, Hardy told Bloomberg in mid-September.

This weekend, Vitol’s executive committee member Chris Bake said on Gulf Intelligence’s weekly energy podcast that demand is looking more uncertain amid a “huge amount of uncertainty” about COVID-19, economies, monetary stimulus, and oil demand.

“The conventional wisdom going into the fourth quarter was that things were going to improve,” Bake said, noting that “it doesn’t feel like we have a huge catalyst” for the rest of the year.

Mercuria’s CEO Marco Dunand said on the FT summit on Tuesday that he doesn’t see oil demand recovering to the pre-crisis levels for a few years, and expects oil prices to remain broadly flat around $45 per barrel over the next six months.

Torbjörn Törnqvist, chief executive at Gunvor, also sees oil prices staying in the $40s until the middle of 2021, ranging from mid- to high $40s.

By Tsvetana Paraskova for Oilprice.com

Sept. 28

https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Stuck-In-Limbo-As-Uncertainty-Mounts.html

Oil prices are unlikely to move much higher from the current levels in the low $40s, at least not for the rest of the year, a growing number of analysts and industry professionals say. Oil has been stuck in a narrow trading range in the low $40s more or less since July after the market began to worry that even with large supply cuts from OPEC+ and curtailments in the U.S., demand will not recover fast and strong enough to draw down the record-high inventories that had built in the second quarter.

Oil prices are unlikely to move much higher from the current levels in the low $40s, at least not for the rest of the year, a growing number of analysts and industry professionals say. Oil has been stuck in a narrow trading range in the low $40s more or less since July after the market began to worry that even with large supply cuts from OPEC+ and curtailments in the U.S., demand will not recover fast and strong enough to draw down the record-high inventories that had built in the second quarter.

This year has been a year of uncertainties on all markets, including the oil market, but it looks as if uncertainties have grown since we entered the second half of 2020, instead of abating as analysts had predicted earlier this year.

Uncertainties about a second wave of COVID-19 and renewed restrictions on social gatherings in several major European economies are weighing on oil market sentiment. China’s ability to continue propping up oil demand with record-high crude oil purchases is also called into question. The U.S. election is another major uncertainty and whatever the result, the markets, including the energy market, will be impacted.

In recent weeks, uncertainties over when (if ever) oil demand will return to the pre-crisis levels have increased with demand recovery basically stalled and China appearing to slow down its oil imports.

A lot of the major players on the oil market, including some of the largest independent oil traders such as Trafigura and Mercuria, have been bearish on oil near term, expecting global stocks to build in the fourth quarter – due to weak demand – before starting to decline. The biggest independent oil trader in the world, Vitol Group, however, was quite bullish two weeks ago. The world’s stockpiles of oil have diminished by around 300 million barrels since peaking at 1.2 billion barrels early this summer, and are expected to decline by another 250 million-300 million barrels between September and December, Vitol’s chief executive Russell Hardy told Bloomberg in mid-September.

But another executive at Vitol, executive committee member Chris Bake, said on Gulf Intelligence’s weekly energy podcast on Sunday that demand is looking more uncertain amid a “huge amount of uncertainty” about COVID-19, economies, monetary stimulus, and oil demand.

“The conventional wisdom going into the fourth quarter was that things were going to improve,” Bake said, noting that “it doesn’t feel like we have a huge catalyst” for the rest of the year.

According to Bake, there is a “big push-pull between the demand and supply side, and the demand side right now looks very uncertain; the supply side probably will need to adjust to that.”

The deteriorating demand outlook comes just as OPEC+ is preparing to further ease – as of January – the current production cuts, leading to speculation that the group is set for a turbulent dialogue in the fourth quarter about its supply-fixing decisions.

There is uncertainty about OPEC+ “holding the line without making another move,” Vitol’s Bake said on the Gulf Intelligence podcast.

Many economies in Europe also face increased uncertainty with surging COVID-19 cases. The City of London’s biggest employers, banks, had just started slowly returning staff to offices, encouraging employees to drive to work with cash incentives or paying their taxi fares, when UK Prime Minister Boris Johnson said last week that everyone who can, should work from home. Banks reversed plans for employees returning to the office, stricter local restrictions are imposed in some areas in the UK, and London faces a local lockdown with a possible ban on household mixing if it wants to avoid a full lockdown. France also announced stricter restrictions last week, while the Spanish capital Madrid is also tightening restrictions but stopping short of a city-wide lockdown.

No government in Europe is inclined to repeat a nationwide lockdown, looking to avoid another devastating economic hit, but local restrictions are already happening.

The uncertainty isn’t helping either consumer confidence or the economy and is stalling oil demand recovery. At the same time, supply is set to grow from Libya after a tentative truce and the re-opening of some of the ports.

If the huge amount of uncertainty in demand persists in the fourth quarter, the OPEC+ group may be forced to review its supply-fixing policy, potentially fracturing the alliance, again.

By Tsvetana Paraskova for Oilprice.com