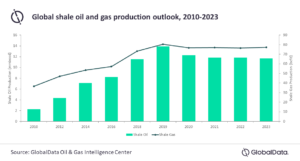

The global shale industry is on a recovery path after an 8.1 percent production decline in 2020, according to a recent report from GlobalData.

Global shale production has taken a drastic hit in 2020, where shale oil is expected to drop by 11.7 percent year-on-year and shale gas production may see a 4.5 percent fall, according to projections by GlobalData, a leading data and analytics company. Market demand for oil and gas plummeted globally from March 2020, following the COVID-19 pandemic. Unless an effective vaccine is made available, the uncertainty in global energy demand will continue to weigh down oil prices, and delay shale industry recovery.

GlobalData’s latest thematic report, “Shale,” notes that the United States led the global shale industry in 2019, with more than a 98 percent share in shale oil production and more than a 78 percent share in shale gas production. Apart from the United States, shale oil and gas production is also carried out in Canada, China, and Argentina. The effect of the COVID-19 pandemic has been particularly harsh on the U.S. shale industry. As oil prices fell, shale operations became unviable in many U.S. plays due to higher breakeven cost.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, comments: “The U.S. shale market has been vibrant since recovering from the 2014 price crash. Shale oil and gas production across major plays was generally on an upward trend in 2018 and 2019. However, the downturn this year has brought in unprecedented challenges to the shale industry. It has disrupted the recent momentum of the industry and may take years to recover.”

The shale industry, especially in North America, has faced the brunt of the economic downturn. This has led oil and gas companies involved in shale operations to reduce their planned capital expenditure for 2020. In the Permian Basin alone, major shale drillers reduced their planned capital expenditure for this year by over $18 billion.

Puranik adds: “Independent shale operators in the United States are among the worst hit from this downturn as operations in some wells of the Bakken or Eagle Ford shale are no longer sustainable. Operators have resorted to taking wells offline to manage costs. Debt-ridden operators are even facing difficulty in drawing liquidity from financial institutions to sustain operations. Consequently, Chesapeake Energy, Whiting Petroleum, and a few other shale players have filed for bankruptcy in 2020.”

Oil prices have stabilized of late around the $40 mark. Comparatively low company valuations and gradually improving oil prices have encouraged some operators to undertake M&As in the shale industry.

Puranik concludes: “Low energy demand and the low oil prices is expected to have a significant impact on the M&A activity within the shale industry. Companies operating in the shale industry could attempt to mitigate the losses borne during the downturn through consolidation. The events of this year are likely to hasten the M&A trend in the shale industry.”