By Steve Hendrickson, president, Ralph E. Davis (RED) Associates

In late May, RED Associates made a case for significantly higher oil prices over the next few years due to a set of converging factors that would create a supply/demand imbalance, pushing oil prices above $100 per barrel.

This argument could be summarized like this: resumption of pre-pandemic demand plus continued population growth will increase demand for oil while sources of new supply (U.S. Shales, OPEC spare capacity, and supermajors’ long-lead-time projects) will be unable to meet increased demand, primarily due to a lack of capital or willingness to develop new supply sources. Let’s take a closer look at the rationale.

Resumption of Pre-Pandemic Demand—It seems likely that once economies are fully open, much of the pre-pandemic demand will rebound; however, there are reasons to suspect that it won’t rebound fully. Our experience in the pandemic has shown us that many jobs can be done remotely at nearly the same productivity as in an office setting, and that out-of-town business meetings can often be replaced by video conferences. It now seems very likely that we won’t completely eradicate the coronavirus and regional flare-ups will persist indefinitely. I expect both will contribute to less commuting and travel in the western economies, and prevent an immediate return to full pre-pandemic demand.

Global Population Growth

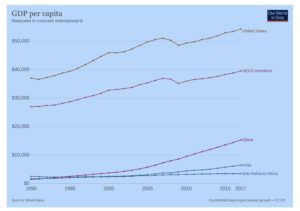

The author is correct that the global population is expected to continue to grow; however, virtually all of this growth will be in countries with very low energy use per capita. According to the World Bank, the per capita GDP of Sub-Saharan Africa (where much of the population growth is forecasted) is less than one-tenth that of the OECD countries, and it isn’t growing. Meanwhile, the countries that account for the most oil consumption have very low population growth and aging populations that’ll consume less per capita.

U.S. Shales No Longer a Source of Growth

The argument is made that shale producers no longer have the desire/ability to pursue growth due to capital constraints and little remaining inventory in the best areas. I doubt this because I believe capital can always be expected to move to attractive returns. Also, as oil prices rise, economic inventories will expand along with the free cash flow operators need to develop them.

OPEC Spare Capacity

There’s a meaningful amount of oil production off the market due to OPEC production quotas, much of which will be needed to meet post-pandemic demand, and these countries have increasing sovereign cash needs. Nevertheless, many of these countries have ample low-cost development opportunities (typically the cheapest in the world) and I expect they’ll be able to continue to grow production to meet a portion of future demand increases. I don’t expect the top OPEC producers to starve their industry the way a few countries have.

Supermajor Reticence

The author contends that the supermajors will slow the development of major projects due to a shift to renewables, and uncertainty regarding future prices makes it tough to invest in long-term projects. Although renewables are consuming more capital in these companies, I find the idea that the leaders of these companies are challenged by oil price uncertainty unpersuasive. Price uncertainty is hardly a new aspect of the business, yet they’ve invested heavily in major projects in the past.

Overall, I’m skeptical of the author’s thesis that we’re on the verge of a multi-year bull market for oil. I do believe that price spikes are reasonable to expect, but just as the cure for low oil prices is low oil prices, high oil prices have a way of self-correcting by reducing demand and stimulating supply.