FORT WORTH, TEXAS—Someone needs to take those video productions that Hart Energy creates to kick off its Permian Basin conferences—those narrated tributes replete with dynamic drone footage, stirring commentary, and soaring musical scores—and put them on VR headsets and circulate them to every worker in the Basin, because if they did, this region’s already record-setting production would touch new highs. They’re that exhilarating. But then, those video producers have some good materials to work with. The Basin is booming and the frontiers are beckoning.

FORT WORTH, TEXAS—Someone needs to take those video productions that Hart Energy creates to kick off its Permian Basin conferences—those narrated tributes replete with dynamic drone footage, stirring commentary, and soaring musical scores—and put them on VR headsets and circulate them to every worker in the Basin, because if they did, this region’s already record-setting production would touch new highs. They’re that exhilarating. But then, those video producers have some good materials to work with. The Basin is booming and the frontiers are beckoning.

With the crowd thus warmed up, the conference itself went all conference-mode, which is to say, all business-like and data-saturated. But that’s to be expected. Even in boom times, everyone’s trying to find a way to turn things up a notch. So everyone’s trying to solve a problem. But these are good problems to have.

In the interests of brevity—lacking space here to do justice to an entire conference—we share just some select remarks and snippets from the proceedings of the conference’s first full day (May 17), to impart at least a flavor of the proceedings.

Chevron’s Position

First up, as a speaker, was Steve Green, Chevron’s president of North America E&P.

Green, explaining Chevron’s own success story in the Basin, began by saying that the company continued drilling during the Covid pandemic.

“We didn’t stop completely, but also we didn’t complete nearly as many wells during the pandemic. So, we had quite a DUC [drilled, but uncompleted] inventory. As demand recovered, we were able to add completion crews and with the factory approach that we utilize in the Permian, and with the technology of our service providers being very efficient, we actually began to work through that DUC inventory.

“We’re not through [that inventory] completely—we like to keep a little margin there. But it worked down considerably from where it was as we exited 2020 and into mid ’21.”

Green said that investors in Chevron “have made it loud and clear” that they expect the company to be able to generate and distribute returns to them through the commodity price cycle. So, the way we approached that is… we’ve set our business up, we’re a global company, and some major capital projects that are under development, they get funded. But we spend our discretionary capital on the highest return products. Whether that’s in Permian—the Permian competes very well in our portfolio–or the Deep Water Gulf of Mexico or wherever it may be. And so, as our CEO Mike Worth has publicly stated several times,to investors, one thing they can count on Chevron for is capital discipline.

Speaker1:

That’s frustrating for Washington right now because they mistakenly believe the industry can just run out, set up a bunch of rigs and grow production overnight. I was there a month ago and had a long conversation the administration about that. But I think every player in the sector now is focused on running their business with an eye on returns and earnings rather than just chasing a production number or how many rigs we have running. That’s really not our measure of success. It’s what are we returning for our shareholders on those investments.”

Citi’s Place in the Basin

To kick off his presentation, which was titled “M&A: Frac’ing the Bid/Ask,” Tony Fernandez, managing director and global head of energy A&D at Citi Bank, took a moment to “credentialize” his place of employment. “I can’t help it, I’m a banker, so give me a couple minutes to tout some things,” he quipped. “First of all, think of us like a super major. We are diversifying, yet we’re well integrated. I think of folks like yourselves think of Citi as a beacon of stability in the sector. We’re very large. In fact, we used the headwinds and the downturn of the last couple of years in order to bulk up and take the cream of the crop. That’s what we’ve got performing right now. We’re very proud of it. Other banks have their specialties and they’re best-in-class in certain product lines. We go toe-to-toe with them in those product lines. What really sets us apart is that we are diversified and we’ve got product offerings that, in combination, make us a very, very powerful partner for folks like yourself.”

Proceeding, Fernandez said, “I’m highlighting some of the Permian/Eagle Ford activity up here [in his slide show] over the last couple years, but I should say that we’re not just a Permian/Eagle Ford bank. You wouldn’t know it by the end of this presentation, cause we’ll be super-focused on the Permian/Eagle Ford, but there are other basins out there. We in particular have been very busy in the gas basins. That sector is experiencing a globalization real-time. That’s a topic for another conference, but it’s got us very busy as well.”

Fernandez said that, as far as the Permian Basin is concerned, Citi has been experiencing a very busy 15 months there, ever since coming out of the Covid lull. “In the Permianm specifically, we’re particularly proud of the fact that, last year, when you look at some of these projects, there are a substantial amount of buy-sides. In fact, we had a 100 percent success rate in our buy-sides in the Permian last year. It’s a great statistic for us in particular. We’re proud of it because banks always prefer the sell sides. I think the combination of Citi’s aggressive lending platform, along with the deep technical knowledge that our technical team has, and our relentless coverage platform, just give us access to the boards that is really unparalleled for our clients.”

One Operator’s View

Mike Oestmann, president and CEO, Tall City Exploration III LLC, spoke on his company’s activity in the Delaware Basin.

“We select the best zone in which to initiate a frac and we believe selecting

that best zone clearly has an impact on ultimate recovery.” Mike Oestmann of

Tall City served up a primer on his company’s activity in the booming Delaware

Basin.

Oestmann said that Tall City closed on 20,000 acres in February of 2019 in south-central Reeves County, in the southern Delaware Basin. This footprint gave them a good position to build upon.

“The assets there were producing about 3,000 BOE per day at the time,” Oestmann said. “We’re now surrounded by producing wells in acres tightly held by other operators like Chevron, Talon, Colgate, Upcurve, and Centennial. We began drilling in May of 2019 and drilled into the pandemic in May of ’20. We resumed in May of ’21, picked up a second rig in November of ’21, and we are continuing today with two rigs funded through our cash flow and credit facility. This weekend we passed through about 12,300 BOE per day. That’s 55 percent oil, about 75 percent liquids. We’ll exit 2022 at a little over 20,000 BOE per day. That’ll give us an annualized EBITDA at prices if they’re anywhere close to where they are now, at over $400 million and we’ll have about 400 locations remaining in our inventory at that time.

Oestmann said Tall City’s wells yield about 150,000 barrels of oil in the first six months. “We have 11 DUCs this morning, and we’ll have about 15 or 16 when we start our next frac program in June and July. That gives us pretty clear line-of-sight toward that 20,000 BOE a day and $400 million EBITDA.

“Were moving toward fully developing three of four benches on all of our DSUs. Our drilling’s pretty well evenly-split between the Wolfcamp A and B. The Bone Spring produces nearby but not on our asset and we won’t drill below the middle of Wolfcamp B in ’22 but we’re convinced and we have strong indications that there are deeper benches that are productive on the block as well.”

In his session on “Price Inflation’s Impact on Economics and Activity,” Enverus’s Akash

Sharma referenced this chart showing the trend in day rates for rigs in the Permian Basin.

Oestmann said they try to lease high-quality rock. “And by that I mean rock with multiple benches and high oil-in-place,” he said. “We select the best zone in which to initiate a frac and we believe selecting that best zone clearly has an impact on ultimate recovery. We simply pump big fracs into the wells, we try to keep our OpEx and CapEx low, and if we do those things right, we have an opportunity to build scale. By that I mean inventory, production, EBITDA, and free cash flow. We think we’ll have free cash flow at the end of this year as well.

“Of course, the key to leasing high-quality rock is understanding the geology. The structural transition from the Alpine High to the southwest onto the acres that we have is sharp and sudden, and so is the transition from gas to oil. The acres that we acquired from the other operators is at a depth of about 10,000 feet, significantly lower for the offsetting acres to the southwest. It’s sharply separated from that—the oil liquid concentrations are high, the reservoir is slightly over pressure, a little more in the B than it is in the A.

“So, were in good rock. We’ve completed 30 wells to date. We’ve demonstrated production on par with other operators in the southern Delaware Basin…. We’re in the fairway and that’s why Ryder Scott deemed a large number of our future locations as proven.”

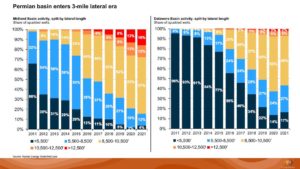

The Three-Mile Lateral

Cole Wolf’s presentation on the emergence of the 3-mile lateral included this side-by-side comparison of Midland Basin wells vs. Delaware Basin wells, with lateral

lengths charted per each, per (passing) year.

Cole Wolf, analyst/Upstream Research for Rystad Energy, gave a presentation that bore the interesting title, “The Three-Miler and More.” This session was billed as “a look at the 3-mile lateral’s impact on F&D, continuous penetration of simul-fracs, sustainable well productivity improvements in non-core parts of the Basin, and implications for service demand and basin-wide supply.”

Whew—lots of ground to cover there. And Wolf did a good job. Again, we lack space to do justice to his talk or so many of the others’. But we’ll end here with one of his remarks:

“Tying this all together, from some of the parts we’ve seen going on from 2020, 2021, and into 2022, we look at the costs. It’s been a very standard design that we built with one mile length. With two-mile length we see a significant reduction in cost of BOE extracted. However, we’ve seen also numerous tests going on, so [as we look to that actual] full three-mile length, we’re seeing additional marginal improvements. Therefore justifying the opportunity to continue drilling these laterals further and further—if the production is there and the cost of BOE extraction is also relatively in the same ballpark.”

To sum up this conference in so many words: inflation is the topic of the day—how will it affect everyone? Three-mile laterals are not just a thing, they are a going thing. Cash flow is flowing. Service companies are raising rates. Capital discipline is still paramount. Good rock is always good to find. The government is not the Basin’s best friend. And yet, despite all that, opportunities abound.

Cole Wolf of Rystad Energy analyzed the impact wrought by ever-increasing lengths of laterals in horizontal wells.

Go to Hart Energy’s site (HartEnergyConferences.com) for more information on this event.

By Jesse Mullins