The ESG sector (Environmental, Social, and Governance considerations) has been identified as a key area of interest for merger and acquisition (M&A) activity, according to analysis of GlobalData’s Job Analytics Database. The data and analytics company reveals that there were more than 60,000 job postings in Q1 2022 that had “deal making” keywords (including M&A) as a theme. More than 15,000 jobs were related to ESG.

Sherla Sriprada, Business Fundamentals Analyst at GlobalData, says: “ESG is appearing as a theme around Deal Making [M&A] jobs for multiple sectors. Firms are looking at deals that have a sustainability angle to contribute to their net-zero roadmap.”

Sriprada adds: “TotalEnergies posted a ‘Business Development and M&A’ indicating that the company is growing its Indian business through organic investments, partnerships, and M&As in the open access solar and rooftop solar markets. Meanwhile, tech company Diligent Corp posted a ‘General Manager of ESG, Data Services, and Due Diligence’ role, which focuses on ESG-related analytics. In the job description, the post noted that it was looking how to expand its offerings through M&A opportunities.

“Additionally, power company ERM Group was hiring a ‘Principal Consultant / Infrastructure M&A and Sustainable Finance’ role to lead due diligence assignments around ESG and regulatory drivers for deals. The role looks at green energy transitions for construction and power.”

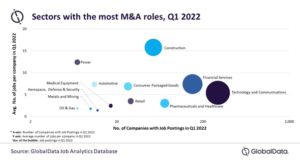

GlobalData’s report also notes that the number of dealmaking-related (M&A) jobs were particularly high within the financial services, technology and communications, power, and oil and gas sectors, as well as within the aerospace, defense, and security (ADS) field.

Sriprada continues: “GlobalData’s Job Analytics database reveals that ADS firms were hiring for roles around big data and space systems.

For example, Blue Origin was seeking a ‘Director of New Shepard Business and Program Operations’ to help create and implement expansion strategies for its New Shepard (reusable suborbital rocket) business while anchoring client contracts, strategic collaborations, and M&As.

Financial services companies have continued to focus on hiring staff for non-fungible token (NFT) creation, payment solutions, crypto custody, and crypto wallets in the first quarter of 2022.

Sriprada adds: “Crypto company Coinbase is looking to expand globally. The company appears to be considering M&A opportunities, based on its postings such as its ‘Director of Equity Administration’ role, which notes that the company is looking at deals with complex M&A equity. CoinSwitch Kuber and CoinDCX in India, Bitso in Latin America, and Rain in the Middle East are some examples of its international ventures.”