Consolidation and asset rationalization continue to change the landscape in the Permian Basin. Among the winners is Permian Resources (PR), which just bought nearly 30k net acres in the Delaware Basin from Occidental Petroleum (OXY) for $817.5 million or just over $27k per acre.

Occidental was looking to sell assets in order to pay down its acquisition of CrownRock. For Permian Resources, the purchase is complementary to their transformative merger with Earthstone Energy.

Permian Resources is financing the deal with a secondary offering of 26.5 million shares and a private placement debt offering of $750 million. The company is actually raising about $200 million more than this deal requires, which gives the company balance sheet breathing room, but more likely, gives it cash for another “bolt on” transaction.

While the deal is not “crash-price” cheap for Permian acreage, I would place it in the middle-low end of the range. The purchase was made at about 3.4x 2025 EBITDAX and a roughly 17 percent free cash flow yield. By comparison, many deals are made at free cash flow yields at or below 15 percent.

Understand that if the company engages in no further M&A, the acreage pays for itself in about 6 years. If oil heads to over $75 per barrel and/or natural gas exceeds $3/MMBtu on average in coming years, the free cash flow yield on these assets would rise.

Permian Resources got what I consider a “private equity” valuation on the deal at about 6x free cash flow yield. By comparison, the stock market, or an acquirer looking to build more scale, would often pay around 10x. This implies a potential long-term gain over 50 percent.

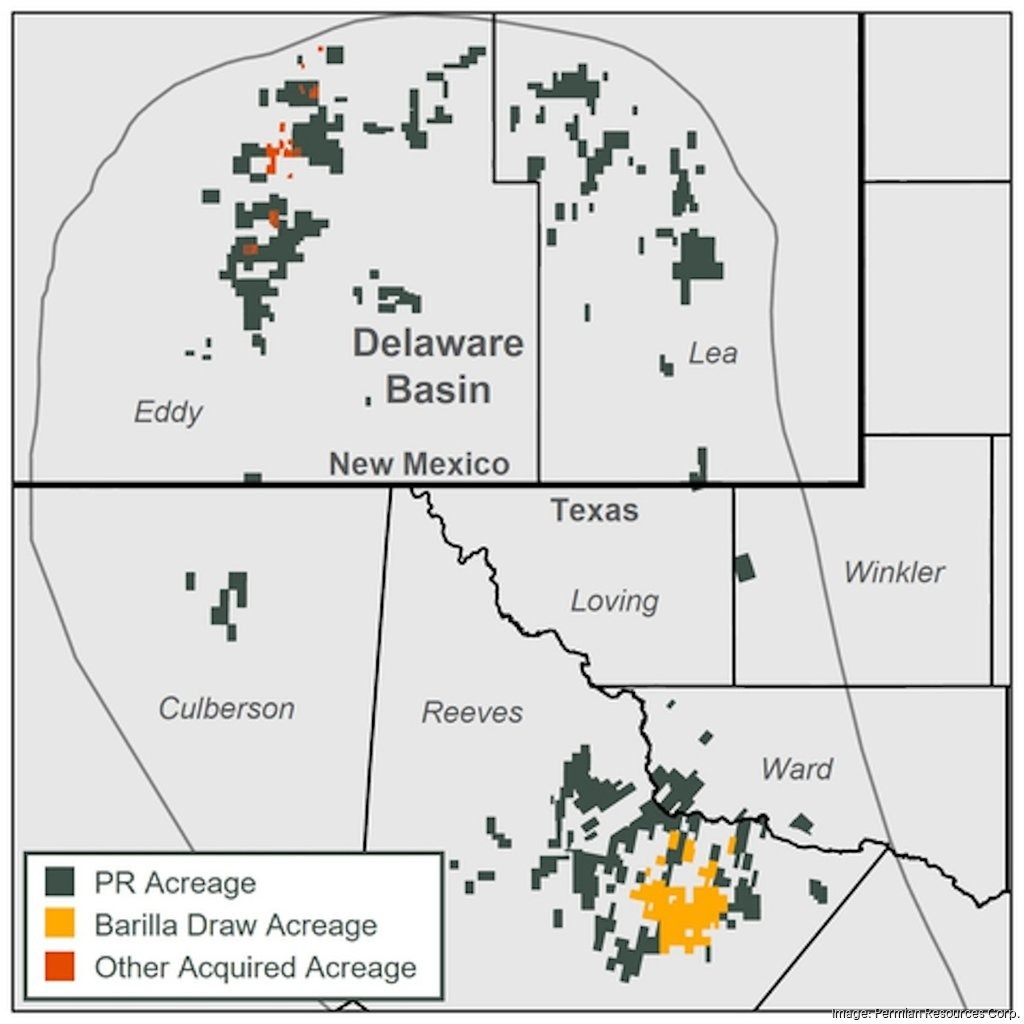

According to Permian Resources, the acreage is adjacent to existing positions, which will allow it to use longer, more economically efficient, laterals when they drill. The purchase adds about 200 gross operated wells with the potential for additional 2-mile lateral drill sites.

Permian Resources’ acquisition of Oxy acreage is a deal that fits well with PR’s existing footprint in the Delaware.

The acreage has minimal drilling requirements, as 99 percent of the acreage is already held by production. By adding about 15k boe/day and presuming oil prices staying range bound, the deal is highly accretive, meaning there is little risk in the deal.

My expectation is that Permian Resources can maintain the production levels with minimal relative cost and stretch out the reserves longer than either company could have done by not joining the acreage. This should yield a longer window for profitable production and make the company more attractive to a buyout or for a merger.

BP seems like a potential acquirer, as they have been vocal about building their Delaware position. EOG, Devon Energy, and ConocoPhillips could also be in play as M&A partners. I expect a major strategic transaction by decade end or sooner, potentially much sooner.

All things considered, this is a low risk, long tail acquisition that positions the company. They are well positioned to increase their variable dividend and continue to buy back shares. Because of that, they have the leverage to hold for the long term if they cannot get a buyout price.

Matador CEO Joe Foran indicated at Hart Energy’s recent SuperDug Oil and Gas conference that some of the biggest winners might just “own it forever.” For dividend investors this is a winner. The buyout potential is just icing on the cake and provides a margin of safety.

I have a position in Permian Resources common shares and have been “buying the dips.” I have also been actively selling $15 cash-secured puts (options) at different expirations which adds income to my portfolios.

My goal is to accumulate a 4-5 percent portfolio position across client accounts as I consider Permian Resources one of the lower risk, good rock, good balance sheet oil and gas plays. My analysis indicates a potential capital gains upside of about 50 percent in the 3-5 year window on top of dividends that I expect will add a few points per year.

My firm and I own stock in Permian Resources (as noted above) and Occidental Petroleum. For disclaimers and deeper dives, please visit my investment letters at FundamentalTrends.com or MOSInvesting.com or my Registered Investment Advisor firm Bluemound Asset Management, LLC.

A change analyst and investment advisor, Kirk Spano is published regularly on MarketWatch, Seeking Alpha, and other platforms.