The Cline Shale, a play that has fueled more speculation and conversation than any other West Texas oil find of recent vintage, is starting to come into its own.

By Lana Cunningham

How hot is the Cline Shale today?

It depends on the view of the person with whom you are talking. Some people describe the Cline Shale as simmering, while others see the activity as ranging from barely bubbling to boiling over. Whether it’s simmering or boiling, communities located in the region are getting ready for the accompanying increased economic activity.

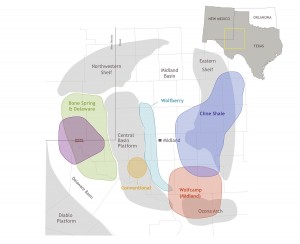

The Cline Shale is located on the eastern edge of the Permian and also is known as the Lower Wolfcamp or the Wolfcamp D. It runs 140 miles north to south and is about 70 miles wide. Counties that include at least parts of the Cline are Mitchell, Coke, Fisher, Glasscock, Howard, Irion, Nolan, Reagan, Scurry, and Sterling. Some reports add Upton, Tom Green, Crockett, and Schleicher counties to the list. It is reported to run 200 to 550 feet deep.

Talk of the new discovery started hitting the news in 2011, and companies already in the region began to look at the Cline. Laredo Petroleum was one of those companies that decided early in the game to add the Cline to its list of projects, even before the major announcements.

The Laredo Petroleum website notes: “We have expanded our drilling program to include a horizontal component targeting the Cline and Wolfcamp Shales. The drilling of the Cline Shale, located in the lower Wolfberry, was initiated after our extreme technical review that included coring and testing the Cline separately in multiple vertical wells. We believe the Cline Shale exhibits similar petrophysical attributes and favorable economics compared to other liquids-rich shale plays operated by other companies, such as in the Eagle Ford and Bakken Shale formations. We have acquired 3D seismic data to assist in fracture analysis and the definition of the structural component within the Cline Shale.”

Mark Elliott, vice president of geology/development-Permian for Laredo Petroleum, said his company drilled its first Cline well in 2009.

“We have since drilled 41 horizontal Cline wells and they are all absolutely productive,” Elliott said. “We are still very excited about the Cline, and it is still very much a part of our drilling program.”

When Laredo started on its 41-well program, they were drilling 4,000-foot laterals. That expanded to 7,500-foot laterals and eventually went to 10,000 feet on one well, according to Elliott.

The Tulsa-based company has 154,000 prospective acres centered in Glasscock and Reagan counties, with some in Howard and Sterling counties.

“We’ve de-risked 136,000 acres in the Cline. That’s a lot of locations,” Elliott said. “We’re also drilling in the Upper, Middle, and Lower Wolfcamp. That’s part of the multi-stacked, multi-lateral program. We’ve identified and de-risked four horizontal targets.”

The geologist, who came to Midland in 1978 in the middle of a boom, explained what tests showed on the Cline. “Our depositional model shows the Cline to be a medial to distal plane environment. It’s a silica rich shale, very rich, and highly fractured. Based on the silica content and brittleness, we can easily frac the Cline. And you’re talking a large area. In our evaluation of the Cline, Laredo gathered a lot of data and developed an earth model that involves petrophysical, geophysical, and reservoir characteristics and attributes that help us prioritize our development areas.”

Laredo personnel are putting together the 2015 drilling program, and Elliott couldn’t predict what the company’s plans are for next year. He knows, though, Laredo will be remaining in the Permian. “The reason we’re focused on the unconventional play instead of the conventional is because of the improved technology. As technology keeps advancing it will mean more opportunities in the future,” he said.

Another company that has developed a major presence in the Cline Shale counties is Apache Corporation, based in Houston. In the organization’s second quarter report for 2014 to investors, it was noted, “Apache continued our active drilling program in the Deadwood Field in Glasscock County (Midland Basin), drilling nine Lower Cline horizontal wells in the second quarter. Apache is also testing new areas including eastern Ector County at the Augusta Barrow field (Central Basin Platform) with very strong initial results. The Augusta Barrow #1418H recently generated a peak 24-hour IP of 1,268 boe/d.”

Bill Mintz, Apache’s senior advisor—public affairs, referred to the company’s Cline Shale report that shows plans to expand its horizontal drilling program. The focus is on Glasscock County, and Apache has drilled 51 wells to date across three fields and increased the resource by over 20 MMBOE since 2012. Three horizontal rigs were planned for that area in 2014.

Apache calls the Midland Basin a multi-play growth engine. The Investor Report revealed that the company owns 950,000 gross acres across the Midland Basin and is involved in significant drilling across multiple plays, from vertical Wolfberry to Cline and Wolfcamp Shales. The company’s Midland Basin net production was reported at 22,000 Boe/d in early 2011 and that figure has steadily risen to end 2013 at almost 60,000 Boe/d.

“Apache is the most active driller in the Permian,” Mintz said. “We have activity in most of the major plays. While we’re active in the Cline, we are also active in the Wolfcamp and several of the other major plays.”

The company’s stats show that Apache has 640,000 gross acres with 510,000 net acres in the Cline Shale. “We’re planning to drill 35 horizontal wells this year,” Mintz added.

Firewheel Energy, LLC, is headquartered in Midland and is focusing on the Cline Shale. According to its website, “Firewheel has leased over 170,000 acres (about 100,000 net) in the Indian Blanket Prospect in the new and promising Cline Shale play. Leasing operations began in October 2011 with drilling operations commencing in June 2012.” The website notes that Firewheel has successfully drilled seven wells in that formation.

Pioneer Natural Resources sees the Cline as a major producing area. In May 2014, President and Chief Operating Officer Tim Dove told the Midland Reporter Telegram, “There is a vast amount of shale to deal with. If you look at the Eagle Ford, there’s about 300 feet of shale; in the Bakken, there’s about 150-200 feet. In the Permian Basin, there’s 3,500 to 4,000 feet, almost 10 times as much.”

With drilling hitting the boiling-over stage for Laredo Petroleum and Apache, and sitting at “simmer” for other companies, the Cline Shale Alliance is prepping all communities located in the Cline Shale counties for a possible explosion in economic activity. More housing, restaurants, roads, schools, and hospitals are targeted to meet demand.

Greg Wortham, mayor of Sweetwater, saw the problems that hit Midland, Odessa, and the surrounding towns when they were not prepared for this recent boom in activity. When he heard the news about the Cline, he helped form the Cline Shale Alliance as a means to pull together the area’s small towns and start preparing for the spillover from the Permian Basin activity.

“Our group is actively involved in getting the eastern Permian Basin ready as a region for all the activity that is coming,” said Wortham, executive director for the Cline Shale Alliance. “Companies are moving from the western side of the Permian to the east. Our Alliance is about business development in the eastern part.”

Early reports predicted the Cline could produce 30 billion barrels over its lifetime. At the same time that the Cline was being discovered, petroleum experts were seeing more clearly how much oil is in the U.S. “There’s not as much frenzy to develop this right now,” Wortham said. “Some companies are saying, ‘Let’s take our time and get it right.’ We’re seeing the shift now throughout the Permian to horizontal drilling. Those technologies and the equipment are becoming the new system. They have to have it for the deep Cline.”

As the end of 2014 approaches, Wortham said the rate of drilling will slow, which is typical. But he expects it “will be hotter out here” next spring. “There is a lot of drilling planned for around Scurry and Nolan counties and around the towns of Big Lake, Sterling City, and Garden City.”

The Alliance had one advantage over Midland-Odessa as it has pulled together the communities to begin strategizing for their infrastructure needs: wind. Many towns in the Cline Shale already were benefiting from the wind turbine business and its accompanying infrastructure needs and benefits.

“Wind energy brought enough money to build state-of-the-art schools in towns that were ready to close their schools 15 years ago,” Wortham noted. Wind energy projects in Fort Stockton already total $20 billion, and another $15 billion is planned. “Because of wind energy we have built new schools and have solidified the communities. This all happened just in time for the oil expansion in the Cline. Other areas that were hot, such as the Bakken and the Eagle Ford, weren’t ready like this area. Many of those communities have taken a lot of bruises. We have the Interstate that other regions didn’t have. We have airports and sophisticated jet capability.”

He pointed out that hospitals in small towns like Stanton and Colorado City are in good shape. Sweetwater will see a new law enforcement center soon and a $50 million expansion at the local hospital. Texas Department of Transportation has plans to re-stripe some highways to accommodate an increased traffic load.

“Because we’re working together, this is happening smoothly,” Wortham added.

The Cline Shale Alliance sponsors a quarterly symposium at various locations around the eastern part of the Permian. The most recent one in October was based at Sweetwater. Among the topics discussed were construction of the $50 million BNSF (Burlington Northern Santa Fe) rail facility, a 1,450+ MW natural gas power plants, a 450-mile 300,000 bbl/day oil pipeline, a regional transmission grid, and a 1.2 million bbl oil storage facility, plus numerous operations centers and industrial expansions.

“We move these meetings around each quarter so people will go and see what is happening in the towns,” Wortham said.

Looking at residents and their habits, the director said many people stay within their area of a community and don’t see what is happening along the Interstate or the industrial area. “People will finally see something going up and say, ‘There’s never been development in that area.’ Now, dirt is being moved. Every time I drive back into this region [from out of town] I see companies and trucks that weren’t there. We’re seeing new workover rigs and pumps moving in over a weekend.”

Getting all the pieces in place takes time and the Alliance is working as a catalyst to speed up the process. Wortham doesn’t expect the predictions about the Cline Shale’s reserves to prove false or the current oil boom to halt, as has happened numerous times in the past.

“Whether it’s Midland-Odessa or Snyder, oil has been the economy for a long time. Every projection says this is not a boom in the Permian, but is the new normal. “

While the pot is set on simmer for some areas, it may be boiling over come next spring.

Lana Cunningham is a freelance writer who has lived in Midland since it was a pleasant city of 60,000 people.