In this month’s roundup of news and views, we share some reports that take an eye to the future. These are the full versions of the “Drilling Deeper” news items that appeared as abbreviated versions in the print edition of PB Oil and Gas Magazine’s March 2020 issue.

Fewer Recessions Due

to the Shale Revolution

By Steve Goreham

Of the seven U.S. recessions since 1969, high world oil prices were the primary cause of three of the slumps and a contributing factor in two other recessions. Oil price shocks played a major role in both U.S. and global economic instability over the last 50 years.

But during the last three decades, U.S. geologists and petroleum engineers learned to extract oil and natural gas from shale rock formations by using the technological breakthroughs of hydraulic fracturing and horizontal drilling. This U.S. shale revolution now appears to have removed oil shock as a factor in economic instability.

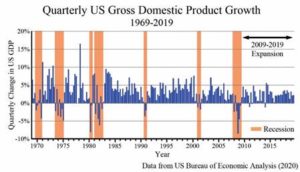

The United States economy currently enjoys the longest period of expansion in history. The economy has been growing for more than ten and a half years, since the end of the Great Recession of 2007-2009. Behind the current expansion is the rise of the United States to become the world’s leading energy producer.

The National Bureau of Economic Research (NBER) defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real gross domestic product (GDP), real income, employment, industrial production, and wholesale-retail sales.” U.S. recessionary periods trigger business failures, changes in political leadership, and impact the daily lives of U.S. citizens.

According to NBER, there have been seven U.S. recessions during the last 50 years. The recession of 1969-1970 coincided with attempts to close budget deficits from the Vietnam war and the raising of interest rates by the Federal Reserve.

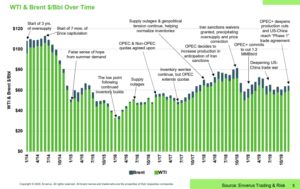

In 1973, the Organization of Petroleum Exporting Countries (OPEC) quadrupled oil prices, triggering the 1973-1975 recession, which at the time was the most severe recession since World War II. Rising gasoline prices hammered consumers and unemployment reached 9 percent. The federal government mandated a 55-mph speed limit and established the Strategic Petroleum Reserve. This was the first of recent recessions caused by high oil prices.

The next decade brought a short recession in 1980, followed by a deeper recession in 1981-1982. The Iranian Revolution of 1979 caused oil prices to rise to more than $120 per barrel, causing a world energy crisis. To counter rising inflation from the 1970s, the Federal Reserve tightened monetary policy, boosting home mortgage rates to double digit levels. Unemployment soared to 10.8 percent.

The recession of 1990-1991 was caused by a combination of the 1987 stock market crash, and the collapse of the U.S. savings and loan industry. Soaring oil prices from Iraq’s invasion of Kuwait in the summer of 1990 also contributed to the slowdown.

The economic slump of 2001 was one of the few recent recessions where oil prices were not involved. This recession was caused by a combination of the collapse of the speculative dot-com bubble, the stock market pull-back in 2001, and the September 11, 2001, attacks. This recession ended the decade-long period of growth in the 1990s.

The Great Recession of 2007-2009 was 18 months long, the longest since the Great Depression of 1929. The subprime mortgage crisis caused the recession, leading to the collapse of a U.S. housing bubble and the failure of several financial institutions. World crude oil prices spiked to $164 per barrel in June of 2008, adding to the crisis.

Of the seven U.S. recessions since 1969, high world oil prices were the primary cause of three of the slumps and a contributing factor in two other recessions. Oil price shocks played a major role in both U.S. and global economic instability over the last 50 years.

But during the last three decades, U.S. geologists and petroleum engineers learned to extract oil and natural gas from shale rock formations by using the technological breakthroughs of hydraulic fracturing and horizontal drilling. This U.S. shale revolution now appears to have removed oil shock as a factor in economic instability.

Prior to the shale revolution, U.S. crude oil production fell from 9.6 million barrels per day in 1970 to 5 million barrels per day in 2008. U.S. oil production, an annual $200-billion industry, was in long-term decline. Industry experts proclaimed that we had reached “peak oil” and that world oil output would soon fall.

But because of breakthroughs in shale oil technology, U.S. crude production soared beginning in 2008, reaching 12 million barrels per day last year, more than double the 2008 output. Production of natural gas also more than doubled from 2008 to 2019.

In 2011, the United States surpassed Russia as the world’s largest producer of natural gas. In 2018, the United States became the world’s largest producer of crude oil, passing Saudi Arabia. Oil prices are now largely determined by U.S. production, rather than OPEC or Russia output.

Back in 2005, 60 percent of U.S. consumption of petroleum products was provided by imports. This year will be the first year in more than 70 years that the United States is a net exporter of petroleum products, thanks to the shale revolution.

On September 14 of last year, 25 drones and missiles exploded at two oil processing facilities of Saudi Arabia. More than 5.7 million barrels of Saudi production capacity was taken offline, more than half of Saudi output. But oil prices hardly budged.

On January 8 of this year, Iran fired more than a dozen missiles at two Iraq facilities housing U.S. military personnel. Yet, world oil prices today remain at low levels, just above $50 per barrel. The missile attacks on Saudi Arabia and Iraq in previous decades would likely have triggered large oil price spikes.

The shale revolution and ramping U.S. oil production brings a new level of stability to U.S. and world economic systems. There will still be recessions, but U.S. recessions will be less frequent and less severe since oil dependency and price shock are no longer significant factors.

Steve Goreham is a speaker on the environment, business, and public policy and author of the book Outside the Green Box: Rethinking Sustainable Development.

Oversupply Nears, Producers

Pump Brakes on Production

Enverus, an oil and gas SaaS and data analytics company, released on Jan. 15 its latest FundamentalEdge report, “Pumping the Brakes.” This market outlook service presents Enverus’ current view of crude oil, natural gas, and NGL fundamentals and where they are headed over the next five years.

“The United States is the world’s number one producer, and that comes with a whole new set of responsibilities for tight oil producers,” said Jesse Mercer, Senior Director of Crude Market Analytics at Enverus. “As the driver of global supply growth, U.S. tight oil producers have to simultaneously focus on the road ahead, as well as what others are doing. OPEC and allied non-OPEC producing countries decided to yield in order to reduce the size of global inventory builds this year. That is good, but U.S. producers also need to do their part to avoid a crash in prices.”

“That is why everyone right now is pumping the brakes on production even as we continue to have occasional price spikes caused by geopolitical factors,” Mercer said. “The recent increase in tensions between the United States and Iran, and subsequent drop in prices when these tensions de-escalated, exemplifies this perfectly. As soon as the immediate risks to supply were lifted, crude went back to trading in line with the fundamentals.”

In Pumping the Brakes, Enverus’ analysts evaluate leading factors moving crude oil prices, ongoing trade talks with China, Saudi Aramco’s IPO, OPEC production cuts, rig counts, anticipated declines in natural gas production, liquified natural gas (LNG) exports, and the growth of natural gas liquids (NGLs).

Key Takeaways from the Report:

• Crude oil prices trended upwards over the final weeks of 2019, as the United States and China took steps toward a “Phase 1” trade deal and OPEC+ agreed to deeper production cuts in the first quarter of 2020. Despite the deeper production cuts and a downwardly revised outlook for U.S. crude and condensate production growth in 2020, global petroleum liquids inventories are still likely to post large builds in early 2020. Ambiguity about whether the new OPEC+ agreement will be extended beyond the end of the first quarter of 2020 may temporarily keep many U.S. producers from increasing capital expenditures, but their caution cannot be expected to last forever. As time progresses, it will be increasingly difficult for OPEC and its allies outside the organization to contain the impact of the growing U.S. production on prices.

• The month of January traditionally settles at one of the highest prices of each calendar year, but due to strong supply (production growth in 2019 and high inventory levels) and a no-show winter, Henry Hub prices set a record low for January 2020. Based on preliminary EandP guidance, a much-needed slowdown in gas production growth is expected in 2020. However, Enverus expects gas prices to remain depressed throughout much of the year including sub-$2.00/MMBtu monthly settlement prices.

• Natural Gas Liquids (NGL) production continues to climb, mainly out of PADD 3, as pipeline projects have come online to move gas out of the region. More pipeline projects are slated to come online in 2020, mainly out of the Permian, to move NGLs to the Gulf Coast. These volumes will be delivered to greenfield fractionators that are slated to hit the market in 2020 and 2021. However, while both pipeline and fractionation capacity are expected to alleviate bottlenecks, Y-grade supply growth is not keeping pace with increases in capacity, creating a risk of over-build in both Y-grade pipelines and Gulf Coast fractionators.

• On the operator level, companies are seeing lower costs and higher productivity. Many reported lower 2019 capex with higher production estimates for the year. 2020 capex will be lower than this year, but many are still predicting production growth. Smaller players are struggling with liquidity issues, which will contribute to offsetting continued production growth from the larger operators and majors.

To find and download the full report, go to the enverus.com website and navigate to the Newsroom section.

TXOGA: O&G Innovation

Has Revolutionized Life

Few industries can match the rapid rise of technology and innovation of the Texas oil and natural gas industry. From the state’s first gushers to modern day hydraulic fracturing, a relentlessly pioneering spirit has been the driving force for the industry that has defined Texas. Over the decades, as technology evolved, game-changing innovations gleaned from the industry’s commitment to research and development have revolutionized not only energy, but life as we know it. (This commentary by the Texas Oil and Gas Association (TXOGA) is shared as part of the organization’s year-long celebration of its centennial anniversary.)

Not only have industry’s advancements propelled humankind, they have resulted in lower-emissions operations, services, and products. The combination of hydraulic fracturing and horizontal drilling, perfected right here in Texas, has led to America leading the world not only in production of oil and natural gas, but in reduction of greenhouse gas emissions.

Indeed, greater use of clean natural gas has driven U.S. carbon emissions to their lowest levels in a generation. Advancements in frac’ing have also saved Texas families hundreds of dollars in energy costs, led to a revival of manufacturing and high-tech jobs in Texas, and provided billions in funding for our state’s public schools and universities, roads, first responders, and other essential services.

As the world has transformed over the decades, the energy industry’s creativity, best practices and unmatched investments have produced state-of-the-art operations. The industry has embraced digitalization and new technologies, such as data analytics, cloud computing, digital oil field, robotics, automation, Artificial Intelligence, virtual reality, 3-D imaging and modeling, and more. Oil and natural gas companies are also pioneering breakthrough technologies to capture, store, and reuse carbon dioxide and investing in advanced technologies like optical gas imaging cameras and drones to detect leaks.

The industry is always inventing. A Texas oil and natural gas company is engineering the world’s largest direct air capture (DAC) and sequestration facility, located in the Permian Basin, that removes carbon dioxide (CO2) directly from the atmosphere. Captured CO2 can be used in enhanced oil recovery, a process where CO2 is used to free trapped oil and then safely stored underground permanently.

Management of produced water, including the acquisition and recycling and reusing of produced water, has evolved dramatically. Today, water from exploration and production activities is being safely recycled for use beyond the oil fields for things like irrigation, construction, and industrial purposes.

In the midstream sector, pipelines are smarter and safer than ever before—making them the safest and most reliable method of transporting oil, natural gas and fuel. Precision in engineering, construction, and operations, 24/7 monitoring, and use of high-tech inspection tools like inline smart pigs ensure the integrity of the pipe to safely and reliably transport products.

Our cars, SUVs, trucks, and buses are 98-99 percent cleaner now than they were 50 years ago thanks to the industry’s investment of billions of dollars in research, modernized refining practices, and the development of cleaner and improved fuels. In fact, no one is investing more in low-carbon technology than the U.S. oil and natural gas industry.

Innovations and technological advancements like these are truly making a difference by elevating communities, improving quality of life and building economies at home and around the world. Whether it is increased agricultural productivity, economic growth, longer life spans, higher quality and more accessible health care, communication, computers, and mobility—just to name a few—some of the most impactful technological advancements and breakthroughs in modern history can trace their roots to the Texas energy industry. For 100 years, the Texas oil and natural gas industry has led the way, and we can rest assured knowing the innovations that have had such a profound imprint on modern life will only multiply as the industry builds a future that is smarter and cleaner still.

Enverus Acquires RS Energy

Enverus, an energy SaaS and data analytics company, announced Feb. 12 that it has acquired RS Energy Group, a technology firm focused in the upstream oil and gas industry. Enverus’ management said in a prepared statement that the acquisition combines the companies’ complementary strengths to accelerate technology, machine learning, and advanced analytics across the energy market.

For more than 20 years, each company has independently established a reputation for providing unique value to its customers. Backed by Genstar Capital, Enverus’ technology enables operators, investors, and oilfield service companies to make what the company believes are better, faster decisions. The company also delivers in-field business automation software and capabilities. Since Warburg Pincus partnered with RSEG in 2015, the traditionally research-focused firm has grown nearly six-fold into a technology and data science-driven organization that allows investors and corporate executives to operationalize analytics and increase transparency at enterprise scale.

“This is about accelerating innovation through high-powered technology and is another active step for Enverus in breaking down silos by building workflows across engineering, geology, land, operations, and so much more. Our aligned vision, client-centric focus, and a relentless commitment to innovation will help our customers solve their most complex challenges. These values will never change,” said Jeff Hughes, CEO and President of Enverus.

As co-CEO and Presidents of RSEG, Jim Jarrell and Manuj Nikhanj share Hughes’ excitement in the potential value being created for customers. Going forward, Jarrell and Nikhanj will join Enverus as co-Presidents overseeing Enverus’ Oil and Gas Analytics Division.

“Combining forces with Enverus carries an enormous opportunity for both companies and their clients. We have built extremely successful businesses and share a deeply embedded culture focused on client success. That is in our DNA. Timing of this transaction is amazing as the energy industry is in the first innings of its digital transformation. Our shared vision and combined resources allow us to ramp up the delivery and innovation of solutions to the industry’s toughest challenges. It’s full speed ahead and we are focused on the future together,” says Jarrell.

“In today’s energy environment, it’s no longer an option to ignore the power of data and analytics. Companies that are leveraging cutting-edge advanced analytics and technologies are building sustainable, long-term strategies. With Enverus, we will be creating a single solution that is vertically integrated from the technical teams to the board room. Together we will continue to fast-track the industry’s digital transformation,” explains Nikhanj.

“This is a monumental milestone for both companies, and a significant opportunity to demonstrate even greater value for our clients. What’s most exciting is how this combination brings together the best people and technology available in the industry,” adds Hughes. “The most important assets in a software company are the people not the products. With this combined team our future has never looked brighter.”

Clients of both Enverus and RSEG will immediately derive value with access to new data sets and unique insights. Enverus and RSEG encourage existing clients to contact their account manager for any additional questions.

Goldman Sachs served as the exclusive financial advisor to Enverus. Credit Suisse and Jefferies served as financial advisors to RSEG and Warburg Pincus. Kirkland & Ellis, LLP served as legal counsel for RSEG. Simpson Thacher, Weil, Gotshal and Manges LLP, Ropes and Gray LLP, and Irell and Manella LLP served as legal counsel for Enverus.

Tenaris Acquires IPSCO

Tenaris S.A. announced Jan. 2 the completion of its previously announced acquisition of IPSCO Tubulars, Inc., a U.S. manufacturer of steel pipe, from PAO TMK. The acquisition price was determined on a cash-free, debt-free basis, and the final amount paid in cash, following contractual adjustments, was $1,067 million (including approximately $220 million in working capital). Tenaris will consolidate IPSCO’s balance sheet and results of operations in its consolidated financial statements beginning in the first quarter of 2020.

In connection with the closing of the transaction, the parties entered into a 6-year master distribution agreement whereby, beginning on Jan. 2, 2020, Tenaris will be the exclusive distributor of TMK’s OCTG and line pipe products in the United States and Canada.

“The IPSCO acquisition marks a new chapter in our U.S. expansion and represents another milestone in Tenaris’s history. Together, we are uniquely positioned to serve the U.S. oil and gas industry, with an extensive geographic deployment throughout North America and an unmatched product range,” said Paolo Rocca, Chairman and CEO of Tenaris.

A Tenaris employee in Freeport, Texas, uses the firm’s PipeTracer pipe-by-pipe identification system.

Tenaris’s existing U.S. industrial and service network—located primarily in the South—is complemented by IPSCO’s facilities located mainly in the mid-western and northeastern regions of the country. IPSCO’s steel shop in Koppel, Pa., is Tenaris’s first in the United States, providing vertical integration through domestic production of a relevant part of its steel bar needs. Its Ambridge, Pa., mill adds a second seamless manufacturing facility and complements Tenaris’s seamless plant in Bay City, Texas.

“With IPSCO, we will be able to strengthen our Rig Direct offering with shorter lead times and more responsive service capabilities,” added Rocca. “We look forward to integrating IPSCO’s team and serving our customers more efficiently.”

*

Find, Develop Your Vision

by Jeff Tippett

Have you ever played a board game with friends and everyone starts to quibble over the rules midway through the game? It might have seemed as if you were on the same page, but if it comes to a point where your mutual understandings of the game fall apart, and it’s impossible to complete the game.

The same threat applies to your business. If you assume that everyone understands the rules of the game, your vision for progression, things will probably seem to be going fine. But then, inevitably, something will happen. Someone will be unsure of the goal or the path to get there. This is where a firmly and clearly articulated vision comes into play.

As is clear by this point, you must develop a clear understanding of your vision. But, of course, you may need help in building out that vision. It may not be initially apparent. That’s perfectly natural.

The first step in finding and developing your vision is to narrow it. It needs to be rather specific, and achievable. “Making the world a better place” is as noble as any vision statement. But is it something that you alone can achieve? Moreover, there’s not likely a clear path to achieving it. Be bold, but realistic. Your vision should be the most you can reasonably expect to achieve.

Another aspect to consider is whether you’ve crafted your vision in terms that are concrete. This is a concept similar to one that I cover in my last book, Unleashing Your Superpower. When conveying your vision, be sure to use specific language, not abstract. Fully describe the goals and how you expect to reach them.

For example, which makes more sense in terms of really understanding the goal? (1) “We will lead the market in production” or (2) “We will become the preeminent supplier of this product, overtaking competitors while maintaining outstanding quality.” The same message is being conveyed, but the second option adds meat to it and makes clear that the goal is more than just making money; it’s about maintaining the work ethic and quality that brought your business to this point.

Concrete language focused on a narrow message is critical to improving your vision statement and ensuring that everyone buys in. And having a shared resolve among your team is indispensable. There’s a difference between a vision and a shared vision. A successful leader nurtures the latter. You can’t lead if the rest of your team is blindfolded. Ensure that they understand the goal and that there are clear benchmarks along the way so that everyone can stay on track and recognize progress.

A good leader doesn’t just lead; a good leader listens. Solicit feedback from your team on a regular basis, but particularly when moving in a new direction. Some folks will be hesitant to speak up if they have questions or concerns. But when encouraged to do so, they’ll be more inclined to speak up. Just because someone doesn’t tell you they have an issue doesn’t mean they’re completely on board. Take time to address concerns.

I like this quote from Antoine de Saint-Exupery:

“If you want to build a ship, don’t drum up men to gather wood, give orders,

and divide the work. Rather, teach them to yearn for the far and endless sea.”

Remember: Everything isn’t about you. If you can focus on the win for your team and how change can be a good thing for them, they’ll join you on the journey without issue.

You also want to remember that everyone in the digital age has 50 things competing to take their attention in 50 different directions. Make your message short and sweet. Take, for example, IKEA’s: “Our vision is to create a better everyday life for many people.” That’s it. But it captures everything about their organization, and every member of their organization can understand and recite it. It’s also obvious to every person involved how their individual role impacts the mission, be it as a customer-facing clerk or as the chief financial officer. The goal remains the same.

Take these suggestions and begin thinking about how your vision statement might look and how to make it narrow, concrete and easy for your team to absorb. This isn’t everything you’ll need to perfect your vision statement, but it should be a groundwork upon which you can build.