by Simon Flowers, Greig Aitken, and Scott Walker, of Wood Mackenzie

Upstream M&A activity is inversely correlated to commodity price volatility. The extreme movements in gas and oil prices killed dealmaking last year, with buyers and sellers unable to align on price. This year, prices are more settled and M&A activity, while still at relatively modest levels, is picking up. Buyers have emerged, but they are choosy and on the lookout for good-quality assets.

A big feature is the return of the Majors to the buy-side in 2023. The invasion of Ukraine has underlined the importance of energy security and the need to develop oil and gas supply for some years yet. The Majors have been active sellers of non-core assets to right-size portfolios over the last few years. But now political and investor sentiment has shifted, and they have been given some latitude to build again in upstream. Moreover, after a bonanza year or two, the companies are well-placed to do deals with cash or, in the case of U.S. Majors, the optionality to use higher-rated equity.

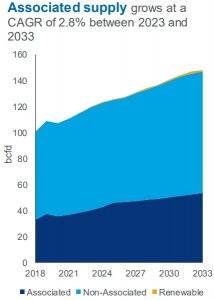

The deals done so far by the Majors have been material in scale, but not transformational. Demonstrating value is key—capital discipline still rules, and no buyer wants to destroy hard-won, but still fragile, investor confidence. Deals must also make sense strategically. Gas, the more resilient fuel in most transition scenarios, has been a prominent target.

Greig Aitken and Scott Walker of our M&A team identified two themes driving deals so far in 2023.

Strengthening the Core Portfolio

Chevron has acquired PDC for $7.6 billion in an equity-financed deal, securing a big position in Colorado’s DJ Basin. It also complements the Major’s existing exposure of comparable size.

Chevron’s rationale? Diversification—more gas for Chevron’s heavily oil-weighted global portfolio and U.S. Lower 48 basin diversity. The deal dilutes its giant Permian position—PDC adds around 10 percent by value to Chevron’s core U.S. Lower 48 NPV. It also brings economies of scale, including $400 million in capex efficiencies, and leaves the Major less exposed to Permian cost inflation.

As important is the value opportunity. Chevron is buying a business on a much lower multiple than its own, despite PDC’s strong growth profile. As an indicator of its financial strength, Chevron’s share buyback program will have repurchased all the shares issued for the deal within two quarters at the current run rate.

TotalEnergies acquired CEPSA’s upstream assets in UAE in March 2023, valued by WoodMac at $1.68 billion. TotalEnergies’ rationale? The deal bolsters the French Major’s position in Abu Dhabi, adding to its existing long tail of projects in the country. The deal also places advantaged low-cost, low-emissions Middle East oil barrels at the core of TotalEnergies’ strategy (adding close to 50,000 boe/d to its net oil production in the country) and strengthens its longstanding partnership with ADNOC.

Upstream Transition Deals

Eni announced the acquisition of Neptune Energy ($4.9 billion) on 23 June. Eni’s rationale? Neptune’s gas-weighted portfolio fits with the Italian Major’s goal to replace its Russian gas imports by 2025, and lifts gas from below 50 percent of total production today to 60 percent by 2030. There’s a deal within a deal, with Neptune’s assets in Norway to be purchased by Eni’s 63 percent owned Norwegian subsidiary, Var Energi. Neptune’s Indonesia, Australia, Egypt, and Algeria assets complement Eni’s positions in those markets.

BP and ADNOC each acquired 25 percent of NewMed Energy in March 2023, with BP’s investment $1.4 billion. BP’s rationale? Increased exposure to East Mediterranean gas through NewMed’s giant Leviathan field (in production) offshore Israel and future projects, including Aphrodite in Cyprus. There’s the intriguing prospect of whether this rare IOC/NOC partnership leads to more deals in future.

Finally, What’s Next?

The Majors will do more upstream M&A, with others also getting in on the action. Shell’s Capital Markets Day earlier this month signalled it still has an appetite in upstream, Chevron needs even more diversity in its portfolio in our view, and Equinor may consider filling a gap in its project pipeline after the slippage of its big Canadian projects.

ExxonMobil, currently focused on organic investment in Guyana and the Permian, has one advantage over others it could bring to the M&A market—its premium-rated equity.