In recent articles I discussed some bullish oil and gas investment ideas in the Permian. Energy though, as you well know, is in a massive transition period.

Over the next decade, three things will happen that are not in much doubt anymore.

U.S. onshore oil production in the Lower 48 will peak and then start to fall.

Eventually falling oil production will put pressure on natural gas production as affiliated gas production diminishes.

Cleaner, though not necessarily 100 percent clean, energy will become a much larger percentage of the energy mix.

Cleaner, though not necessarily 100 percent clean, energy will become a much larger percentage of the energy mix.

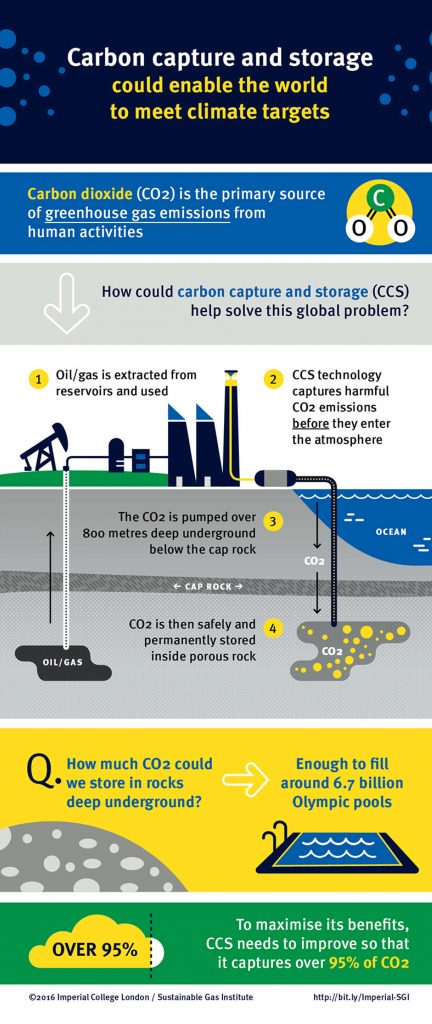

A fourth thing, carbon capture, is in doubt, but has the potential to become a very big deal if it can be done in an economic manner. Successful carbon capture businesses could keep the Permian profitable a lot longer than the oil and gas resource can on its own.

There are multiple carbon capture approaches. Here is the short-hand:

- Post-combustion capture: This method involves capturing CO2 from the flue gases produced by combustion of fossil fuels or biomass. It is the most common approach, applicable to existing power plants and industrial processes. Techniques include chemical absorption using amine solvents, as well as membrane separation and cryogenic separation.

- Pre-combustion capture: This approach captures CO2 before combustion takes place. It involves gasification of fossil fuels to produce syngas (CO and H2), followed by a water-gas shift reaction to convert CO to CO2. The resulting CO2 is separated, and the hydrogen is used as a clean fuel.

- Oxyfuel combustion: In this method, fuel is burned in pure oxygen instead of air, resulting in a flue gas composed mainly of CO2 and water vapor. The water is easily removed by condensation, leaving a high-purity CO2 stream for capture and storage.

- Direct air capture (DAC): DAC involves removing CO2 directly from the atmosphere using chemical sorbents. While more expensive than capturing from concentrated sources, it has the potential for negative emissions. Oil companies like Occidental Petroleum are investing in DAC startups like Carbon Engineering.

- Enhanced oil recovery (EOR): CO2 captured from industrial processes is injected into depleted oil reservoirs to increase oil production. This approach provides an economic incentive for carbon capture while also storing CO2 underground.

- Geological storage: Captured CO2 is compressed and injected into deep geological formations like saline aquifers or depleted oil and gas reservoirs for long-term storage. The oil industry has expertise in subsurface characterization and injection from its exploration and production activities.

- Carbon capture and utilization (CCU): Instead of permanent storage, captured CO2 is used as a feedstock for products like fuels, chemicals, and building materials. This approach aims to create a circular carbon economy, but the climate benefits depend on the permanence of CO2 storage in the products.

Chevron (CVX), Exxon (XOM), and Occidental (OXY) all have significant carbon capture programs. Exxon’s acquisition of Denbury jumped it into a leadership position after an interval when it was lagging. Chevron has been a leader for years. Occidental has pushed into carbon capture in a big way.

The company I think is the safest way into carbon capture though is a massive backdoor play. Berkshire Hathaway (BRK.B) is cleared to take 50 percent ownership of Occidental Petroleum and that should happen by next year. Berkshire also has a substantial Chevron holding.

The main reason I prefer Berkshire to Occidental, or any of the others, is that Berkshire is probably the strongest company on the planet financially. Their cash and short-term U.S. Treasury position currently is about a half-trillion dollars.

The nuances of Berkshire’s Occidental stake go underappreciated by the investing public. Berkshire taking 50 percent ownership of Occidental will give them the ability to participate in the Inflation Reduction Act’s carbon capture tax credits. This will give Berkshire even more financial flexibility.

Berkshire is also a top financier of alternative energy, including solar. Going forward, regardless of what happens in energy, Berkshire is positioned by balance sheet and business exposure to whatever the winners end up being. Buy the dips on Berkshire Hathaway.

My firm and I own stock in Chevron, ExxonMobil, Occidental, and Berkshire Hathaway. For disclaimers and deeper dives, please visit my investment letters at FundamentalTrends.com or MOSInvesting.com or my Registered Investment Advisor firm Bluemound Asset Management, LLC.

A change analyst and investment advisor, Kirk Spano is published regularly on MarketWatch, Seeking Alpha, and other platforms.