In an article posted this week entitled, “Oil Rebounds with Economic Data Outweighing Virus Resurgence,” Bloomberg’s Hailey Waller and Grant Smith set forth some much-needed positive news for the oil and gas industry.

It’s the question that is on everyone’s minds. When will the price of crude oil rise to a level that can sustain (and maybe even grow) the Permian Basin’s energy marketplace?

Optimism is a trait that is in too-little supply after months of Covid-talk and a battering from the markets. It wasn’t that long ago that many (maybe most?) Basin industry observers voiced some expectation that a rebound was coming before this year is over. For some, it would be in the third quarter. For others, in the fourth. Even those who demurred from the 2020 uptick talk were mostly confident in a 2021 rebound.

But who talks that way in the last week of June 2020? The so-called “Second Wave” squelched the remnants of enthusiasm from U.S. industry observers. Search online for any fresh talk of a rebound this year and you’ll be hard pressed to find anything at all among the U.S.-based voices.

But beyond the United States? It is there that we see at least a couple of glimmers of hope on the horizon. Sources in Saudi Arabia and India express some optimism that a turnaround is in the works, and that the turnaround is not far to seek.

On Tuesday (June 30), IHS Markit released the highlights of a conversation between IHS’s vice chairman, Daniel Yergin, and Saudi Aramco President and CEO Amin H. Nasser. According to Nasser, “the worst is behind us” in oil markets. He says that already-recovering demand has him “very optimistic” for the second half of 2020 and that countries are now better prepared for a second wave of COVID-19 if and when it occurs.

“We went from -$40 to +$40 with WTI,” Nasser said. “In April we were looking at demand of about 75-80 MMbd with significant supply at that time. Currently you are looking at almost close to 90 MMbd. I’m very optimistic about the second half of this year. We see it in China today—it’s almost at 90 percent. In gasoline it’s around 95 percent in China. Gasoline and diesel are picking up to pre-COVID levels. Jet fuel is still lagging in terms of less air travel. More countries will start opening up. So, we see that reflected in the demand on crude.

“There are different forecasts looking at between 95 and 97 MMbd by year-end,” he added. “So, it will all depend on whether there will be a second wave of coronavirus or not. But I am also not as concerned about a second wave because I think we are much better prepared now. All countries, all medical establishments are much better prepared. We learned a lot from the first wave.”

Meanwhile, in India, the prognosis is likewise a positive outlook.

A June 29 article from Bloomberg shared the sentiments of India’s Oil Minister Dharmendra Pradhan. His office expects fuel demand to return to normal earlier than projections by the International Energy Agency and OPEC.

“If you look at the trend of the past few weeks, I’m confident that by the end of [the quarter ending in September], demand will be as usual,” Dharmendra told Bloomberg at the BloombergNEF Summit. “At the end of June, we have already achieved 85% of our demand compared to June 2019.”

According to Bloomberg, the world’s biggest lockdown put in place on March 25 in India pummeled demand for transportation and industrial fuels by as much as 70 percent forcing a reduction in crude processing and oil imports by refiners. The IEA and the Organization of Petroleum Exporting Countries expect India’s demand to not normalize until the end of this year.

“Unlocking process has started and a lot of economic activities are going on for more than one-and-a-half months,” the minister said. “Petrol, diesel, LPG and other commercial fuels are coming back to original demand. We are a little bit apprehensive about aviation fuel.”

Elsewhere, a Different Mood

What follows is a quick roundup of views from this week’s (week of June 29) latest reports.

The website Oann.com on June 29 carried a Reuters story that stuck closely to the Covid narrative. Said Reuters: “Oil prices were mixed on Monday, supported by improving economic data and supply cuts by major producers, but held in check by sharp spikes in new coronavirus infections around the world that have forced some countries to re-impose partial lockdowns. Crude prices found some support as profits at China’s industrial firms rose for the first time in six months in May, suggesting the country’s economic recovery is gaining traction.”

Nonetheless… “Fears of a second wave of the pandemic took the shine off the improving economic data. The death toll from COVID-19 surpassed half a million people on Sunday, according to a Reuters tally. Looking ahead, anxiety is likely to remain heightened as the epic fight against the coronavirus pandemic continues. This spells bad news for risk assets [such as oil] which will inevitably remain under pressure.” This last from Stephen Brennock of broker PVM. Find the full article here: https://www.oann.com/oil-falls-in-second-straight-session-as-virus-cools-demand/

Supply Keeps Mounting

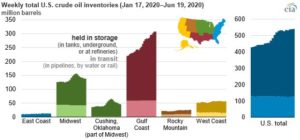

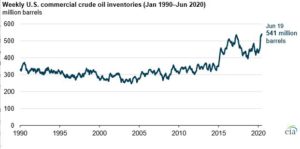

The United States Energy Information Administration stated this week that recent declines in demand for petroleum products have led commercial crude oil inventories in the United States to reach an all-time high of 541 million barrels as of the week ending June 19, which is 5 million barrels more than the previous record set in late March 2017.

According to EIA. commercial crude oil inventories do not include crude oil held in the U.S. Strategic Petroleum Reserve, which totaled 654 million barrels as of June 19. Total commercial crude oil inventories include volumes held at refineries and tank farms, as well as some amount of pipeline fill (crude oil held in pipelines) and stocks in transit by water and rail. When estimating storage capacity utilization, EIA removes the pipeline fill and stocks in transit so that utilization reflects the stocks held at refineries and tank farms as a percentage of working storage capacity.

According to EIA. commercial crude oil inventories do not include crude oil held in the U.S. Strategic Petroleum Reserve, which totaled 654 million barrels as of June 19. Total commercial crude oil inventories include volumes held at refineries and tank farms, as well as some amount of pipeline fill (crude oil held in pipelines) and stocks in transit by water and rail. When estimating storage capacity utilization, EIA removes the pipeline fill and stocks in transit so that utilization reflects the stocks held at refineries and tank farms as a percentage of working storage capacity.

As of June 19, U.S. net commercial crude oil inventories were at 62 percent of total available storage capacity. The majority of capacity and inventories are located in the Gulf Coast, a region which is also home to the majority of U.S. refining capacity and a key area for exporting crude oil. The EIA’s assessment is available on this webpage: https://www.eia.gov/todayinenergy/detail.php?id=44256

Concerns over Fuel Demand

Reporting on June 29, the website tradingpedia.com cited two days of falling prices for crude as sufficient to raise concerns over fuel demand.

According to the site, “Futures on U.S. West Texas Intermediate Crude Oil retreated, as ongoing surge in new COVID-19 cases in the United States… and elsewhere heightened concerns that renewed partial lockdowns could restrict demand for fuel.

“The second wave contagion is alive and well,” Howie Lee, an economist at OCBC bank in Singapore, said. “That is capping the bullish sentiment that we’ve seen in the last six to eight weeks.”

The site quoted Howie Lee, an economist at OCBC Bank in Singapore: “The second wave contagion is alive and well. That is capping the bullish sentiment that we’ve seen in the last six to eight weeks.” TradingPedia continued: “Weighing on oil prices at this point are also factors such as poor refining margins and record-high crude inventories in the United States, the largest producer and consumer of oil globally.” Find more here: https://www.tradingpedia.com/2020/06/29/commodity-market-us-crude-oil-falls-a-second-day-as-spiking-covid-19-cases-raise-concerns-over-fuel-demand/

Chesapeake Bankruptcy Sent Ripples

World Oil on June 29 carried news from Bloomberg that the well publicized Chesapeake Energy bankruptcy marks a milestone in shale’s trajectory—a flattened trajectory, per many.

Per Bloomberg: “The shale bust has reached a grim milestone by claiming the pioneer of America’s drilling renaissance. But Chesapeake Energy, which filed for bankruptcy protection on Sunday, is just the latest in a long list of casualties.

“More than 200 North American oil and gas producers, owing over $130 billion in debt, have filed for bankruptcy since the beginning of 2015, according to a May report from law firm Haynes & Boone. This year alone, at least 20 have gone under after oil prices plunged amid the Covid-19 pandemic.”

The full article appears here: https://www.worldoil.com/news/2020/6/29/chesapeake-joins-more-than-200-other-bankrupt-us-shale-producers

But then…

But as was stated at the outset of this piece, the “bullish” views, if any can be called such, belong to those in oilfields far from the United States. Nasser, of Saudi Arabia, said:

“I still believe that oil and gas will continue to be strongly part of the energy mix over the long-term. However, it’s going to be cleaner because we are working to make sure that we are reducing our carbon footprint. We have a leading position when it comes to our carbon emissions in terms of our carbon intensity in the upstream: 10 kilograms of CO2 per barrel of oil equivalent and methane intensity of .06. That leading position didn’t come all of a sudden. This is because of our focus since inception in reducing emissions and putting the right investment and using the right technologies.

“Climate change is a priority. You see it in a lot of our centers, in addition to discovery and recovery, and improving our cost. Climate change, carbon capture and sequestration, turning CO2 into useful products, the use of hydrogen from crude oil or from gas, ultra-clean engine fuel systems. Non-metallic, this is a focus area for us—not only in pipes, you are looking at non-metallics for construction; that will also find different use for our hydrocarbons and at the same time will reduce our carbon footprint significantly. Crude-to-chemical, that’s part of our strategy in acquiring SABIC. The highest sector in terms of use of oil demand up to 2040 is chemicals. Climate change and reducing carbon footprints and identifying new usage for oil is a focus area for Saudi Aramco going forward.” Watch the complete video at: www.ceraweek.com/conversations

Lastly, we turn again to Minister Pradhan in India.

Pradhan expects India’s energy demand to grow multifold over the next decade upon emerging from the pandemic and is looking at all energy sources to meet the expanding appetite.

“We import 85 percent of our energy, and we will continue to import,” Pradhan said, adding the country is boosting output of energy from alternative and renewable resources to move toward the goal of becoming self-reliant.

___________________________________________________________________________________________________

By Jesse Mullins