It’s a New World

In this month’s roundup of news and views, we share some headlines that, five years ago, few would have expected to see. But that is how much things have changed since the previous boom cycle. These are the full versions of the “Drilling Deeper” news items that appeared as abbreviated versions in the print edition of PB Oil and Gas Magazine’s November 2019 issue.

Nearing the End of the I.C.E. Age?

If you dare, flash back to October 1990 when rapper “Vanilla Ice” hit the Billboard charts, where the hit “ICE, ICE, Baby” spent seven days at the top. The words, “All right stop / Collaborate and listen / ICE is back with my brand-new invention” dominated the airways, and then it was gone, a one-hit wonder. But unlike the “ICE” of the 1990s, some observers boldly predict that today’s ICE—the Internal Combustion Engine powered by gasoline and diesel—isn’t vanishing anytime real soon, despite its “demise” becoming a regular feature in the popular media. Until the time when electrified mobility approaches significant scale, gas and diesel engines will continue to improve. Customers will demand it; manufacturers are invested in it; and society needs it to ensure continued incremental progress on cleaner air and lower CO2 emissions. Read on to see what thought leaders and leading manufacturers have to say on the topic.

If you dare, flash back to October 1990 when rapper “Vanilla Ice” hit the Billboard charts, where the hit “ICE, ICE, Baby” spent seven days at the top. The words, “All right stop / Collaborate and listen / ICE is back with my brand-new invention” dominated the airways, and then it was gone, a one-hit wonder. But unlike the “ICE” of the 1990s, some observers boldly predict that today’s ICE—the Internal Combustion Engine powered by gasoline and diesel—isn’t vanishing anytime real soon, despite its “demise” becoming a regular feature in the popular media. Until the time when electrified mobility approaches significant scale, gas and diesel engines will continue to improve. Customers will demand it; manufacturers are invested in it; and society needs it to ensure continued incremental progress on cleaner air and lower CO2 emissions. Read on to see what thought leaders and leading manufacturers have to say on the topic.

* “While Cummins has a vigorous electrification program under way, our other key message at IAA is that the diesel engine is not standing still. With our technical developments, we see diesel remaining as the primary source of power in the commercial vehicle sector for the foreseeable future.” (Cummins, Tom Linebarger, Chairman and CEO)

* “We expect to see a mix of combustion engines and electric vehicles on the road for a long time to come, despite the current debate about diesel-powered passenger cars in particular, and the decline in new diesel vehicle registrations in Europe. This is because existing powertrain concepts can also play an important role in improving air quality and reducing CO2, especially since the wide-scale adoption of electromobility requires further substantial upfront investments in engineering and infrastructure. Viable diesel and spark-ignition engines that have hardly any effect on air quality even at inner-city air-pollution hotspots are now within reach.” (BOSCH, 2018 Annual Report)

* “We look forward to harnessing the power of both Caterpillar’s and Argonne’s industry-leading research expertise and world-class facilities to develop ground-breaking solutions for diesel engine design.” The organizations plan to build and test heavy-duty diesel engines that reduce emissions and improve fuel economy. (Caterpillar, Jon Anders, Principal Investigator and Senior Engineering Specialist in the Innovation and Technology Development Division, March 2019)

* “Volvo Group acknowledges that there is no single fuel that can meet all needs. Conventional diesel fuel, with increasing renewable or synthetic content, will likely remain the dominant fuel for most types of commercial transport for many years to come.” (Volvo Group, 2018 Annual Report)

* “We will continue to build diesel engines. But they will be even cleaner and feature more smart technologies. And we will devote more of our energy to meeting ever-growing demands for hybrid solutions, the electrification of drive systems, and the use of alternative fuels and gas power. With our Green and High-Tech program, we have shown that we have a progressive vision on how to meet the huge challenges of the energy turnaround and new trends in mobility.” (Rolls Royce Power Systems-MTU, Andreas Schell, Chairman of the Board)

* “Isuzu and Cummins recognize the advanced diesel engine is, and will continue to be, an important power choice for global customers in commercial vehicle and industrial applications. This is especially true in developed countries where power sources are used for high-intensity operations, as well as in emerging countries where social infrastructure conditions are severe.” (Isuzu,Masanori Katayama, President and Representative Director, announcing power-source partnership agreement with Cummins, May 2019)

* “Actually for the diesel engines, we are also continuously working on that in order to achieve the ideal diesel engine. Especially these days, SUVs are quite popular—that means vehicles are bigger and heavier, for those types of vehicles, in terms of reducing CO2, diesel engines still have the advantage… [we have] no plans to phase out diesel.” (Mazda, Ichiro Hirose, Managing Executive Director of Powertrain Development)

* “Various projections for the United States suggest that by 2030, some 10 to 25 percent of vehicles might be electrified. The question then remains, what about the other 90 to 75 percent? And what about the large trucks and ships that run on diesel fuel? There are, as yet, no convincing electric options for those vehicles. That is why it is still so important to continue working on internal combustion engines and make them as clean and efficient as we can.” (Massachusetts Institute of Technology, John Heywood, Professor of Mechanical Engineering)

* “Perkins is focusing on the third incarnation of diesel engines. Power 3.0 will see research and development focus on how to create an engine that is focused on sustainability, as well as capable of delivering more productivity while consuming less fuel. Power 3.0 is the next stage. The hybrids and electrics will be part of that story.” (Perkins, Oliver Lythgoe, Product Concept Marketing)

* “I wouldn’t see the termination of internal combustion engines on the horizon. We are still working on the next generation of gasoline engines. They will become more fuel efficient. We will have 48-volt start-stop systems and mild-hybrid systems. There is still a lot of improvement going in there. But, on the other hand, the improvement—engine generation after engine generation—will be reduced because there’s just not much more [efficiency] in this. The low-hanging fruits are gone. In many countries, you don’t have renewable energy available. And then, if you make the counts, diesel is probably still the best option for a low CO2-emission mobility. We are just working on the next generation of diesel engines, becoming even cleaner now, with additional catalytic converters in the car, with additional effort on cleaning, and they become really clean now. We will have a market for these in Europe and many other places. Probably not here, because diesel here always was a niche on the passenger-car side. But also here, the bigger cars, the higher driving distances, diesel becomes more of a rational [choice]. When it comes to big SUVs, diesel still makes sense.” (Volkswagen, Herbert Diess, CEO)

* “We expect diesels to survive for at least 20 more years and gasoline for at least 30 more years.” (BMW, Klaus Froelich, BMW group Board Member)

So what will keep ICE at the top of the transport charts for the foreseeable future? Continued gains in efficiency and lower emissions. Increased pairing with hybrid powertrains. Increasing use of advanced renewable fuels. All are factors that will contribute to diesel and gasoline engines playing a key role well into the future.

Oil Demand Limping Lower

as U.S. Economy Slows

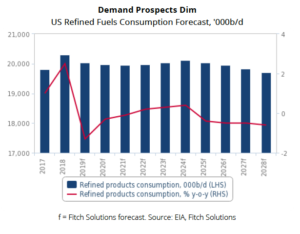

Fitch Solutions Macro Research has revised down its refined fuels consumption forecast for the United States. The firm now forecasts demand growth to decline by an average of 0.6% y-o-y in the three years to 2021; its previous forecast was for flat growth across the period. The U.S. market has posted several years of reasonably strong demand, with growth averaging 1.4 percent y-o-y in the five years from 2014, supported by a mix of lower retail fuels prices and a firming economy. However, demand tends to move in peaks and troughs and many of the tailwinds for growth have now begun to fade. At this point, downgrade notwithstanding, the firm believes that the balance of risk to the forecast lies to the downside.

to decline by an average of 0.6% y-o-y in the three years to 2021; its previous forecast was for flat growth across the period. The U.S. market has posted several years of reasonably strong demand, with growth averaging 1.4 percent y-o-y in the five years from 2014, supported by a mix of lower retail fuels prices and a firming economy. However, demand tends to move in peaks and troughs and many of the tailwinds for growth have now begun to fade. At this point, downgrade notwithstanding, the firm believes that the balance of risk to the forecast lies to the downside.

Demand Prospects Dim:

U.S. Refined Fuels Consumption Forecast

Diesel is driving the heaviest of the declines, as the U.S.-China trade war drags down on domestic economic activity and shale production growth continues to slow. The shale sector is an important source of diesel demand, as can be seen in the loose correlation between oil output and consumption seen over recent years. Production growth

has slowed sharply over the past 12 months, falling from a peak of 33 percent y-o-y in August 2018, to 14 percent in August 2019. Weak and volatile oil prices and pipeline capacity bottlenecks in the Permian have largely led the decline. The start-up of the EPIC (400,000b/d), Cactus (670,000b/d), and Gray Oak (900,000b/d) pipelines should ease takeaway constraints by early 2020. That said, we do not expect growth will stage any very substantial recovery, as oil prices remain subdued and shale E&Ps maintain focus on profits over revenue.

Slowing Shale Growth Dragging On Consumption:

U.S. Diesel Demand Growth, % chg y-o-y 6mma (LHS)

And U.S. Shale Production Growth, % chg y-o-y (RHS)

Of greater concern is the widening rift between the United States and China. An escalating trade war has dragged down on global trade and depressed manufacturing activity in the United States. Road freight is a cornerstone of diesel consumption and with little hope of a resolution to the war in sight, the outlook on demand is poor.

Although Washington and Beijing are preparing to restart trade talks in October, the two sides remain fundamentally opposed on key issues, including Chinese

industrial policy, its treatment of intellectual property rights and its approach to cybersecurity. In light of the this, the prospects for any very substantive deal are slim.

Hopes for a more superficial settlement have also dimmed in recent months. For its part, Beijing has been hardening it stance and there are signs that it may look to slow-play negotiations, to rundown the clock and ratchet up the pressure ahead of the November 2020 presidential elections in the United States.

Meanwhile in Washington, as public opinion on China sours and bipartisan support for a more hawkish trade position builds, President Trump is left with little headroom politically to adopt a more concessional approach to the talks.

Gasoline demand growth is also sliding deeper into negative territory, as the low price stimulus continues to fade and vehicle sales and vehicle miles travelled struggle to pick up pace. Gasoline demand in the United States is relatively price elastic and the collapse in oil prices in 2014 provided a boost to domestic consumption. As prices at the pump began to slump, U.S. consumers showed an increasing preference for SUVs and other less fuel-efficient vehicles, while vehicle miles traveled picked up markedly. Although we do not forecast any meaningful increase in pump prices over the coming years, we also do not anticipate significant further declines, such as would be needed to revive growth back into positive territory.

Price Boost Fading:

U.S. Gasoline Demand, % chg y-o-y 6mma

And U.S. Vehicle Miles Travelled, % chg y-o-y

A few other factors signal weak demand in the coming years. Firstly, although monetary conditions in general remain relatively accommodative, interest rates attached to autos loans—and consumer credit more broadly—have increased substantially in recent years. Given that a large chunk of sales are dependent on financing, this is a bearish sign for sales growth.

Consumer Credit Tightening

It is also worth noting that the U.S. consumer has remained relatively well-insulated from the U.S.-China trade war to-date, as most of the tariffs have targeted intermediate goods. The latest round of tariffs—set to take full effect by December—also bring final consumer goods into the crosshairs and could put strains on U.S. households. Importantly, this is happening in context of a slowing domestic economy, with high frequency indicators signalling softening real wage and labour growth. This—alongside weaker domestic vehicle production—informs our Autos team’s bearish outlook on passenger car sales.

Sales Deep In Negative Territory

Our long-term outlook is broadly bearish, in particular for gasoline, as rising fuel efficiency and electrification of the transport sector pulls demand into secular decline. Over the 10-year forecast period, fuel efficiency gains will be the larger driver of demand destruction. Electric vehicle (EV) sales continue to grow apace, but much of this is low-base effects and our Autos team forecast that by 2028, EVs will continue to account for less than 3.0% of the total U.S. vehicle fleet. That said, we anticipate efficiency gains in the United States to lag that of other developed markets, given a continued preference among U.S. consumers for SUVs and other large vehicles. Additional upside risk to demand stems from U.S. President Trump’s plans to rollback the tighter fuel efficiency standards spearheaded by former president Barack Obama. Initially, we had anticipated that tighter standards imposed at the state level would blunt the impact of the federal rollbacks. However, on September 18, President Trump announced that he would revoke California’s authority to set efficiency standards more stringent than those imposed by federal authorities. Although California will look to block the move, if upheld, the impact could be significant: California has the largest vehicle fleet of any state in the United States and has been at the forefront of efforts to improve fuel economy standards and curb emissions growth.

Upstream O&G M&A and Capital Deals Hit $130 billion in Q2

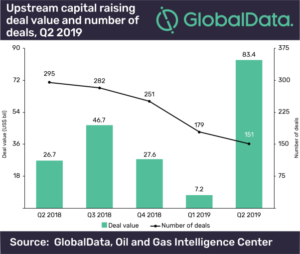

The global mergers and acquisitions (M&A) and raising activity in the upstream oil and gas sector totaled $130.5 billion in Q2 2019. This was a substantial increase from the $27.8 billion in Q1 2019. On the volume front, the number of deals decreased marginally from 316 in Q1 2019 to 315 in Q2 2019, according to GlobalData, a leading data and analytics company.

Praveen Kumar Karnati, Oil and Gas Analyst at GlobalData, commented: “A total of 107 M&A deals, with a combined value of $21.1 billion, were recorded in the conventional segment, and 44 deals, with a combined value of $62. billion, were recorded in the unconventional segment in Q2 2019.”

Capital raising, through equity offerings, witnessed a substantial increase in deal value, recording $13 billion in Q2 2019, compared with $1.5 billion in Q1 2019. The number of equity offering deals also increased by 19 percent from 88 in Q1 2019 to 105 deals in Q2 2019.

Capital raising, through debt offerings, registered an increase of 48 percent in the number of deals and 62 percent in deal value with 49 deals, with a combined value of US$28.8bn, in Q2 2019, compared with 33 deals, with a combined value of US$17.8bn, in the previous quarter. In the upstream industry in Q2 2019, 10 private equity/venture capital deals, with a combined value of US$5.3 billion, were recorded, compared with 16 deals, with a combined value of US$1.3bn, in Q1 2019.

Karnati continues: “The top M&A deal of Q2 2019 was Occidental Petroleum’s acquisition of Anadarko Petroleum for US$55bn, including the assumption of Anadarko’s debt. As of year-end 2018, the company had proven (1P) reserves of approximately 667 million barrels (mmbbl) of oil, 268 mmbbl of natural gas liquids (NGLs), and 3,230 billion cubic feet (bcf) of gas. In 2018, the company had production of approximately 140 mmbbl of oil, 38 mmbbl of NGLs, and 390 bcf of gas. The transaction implies values of US$82,613.17 per boe of daily production and US$37.33 per boe of 1P reserves.”

One of the top capital raising deals of Q2 2019 was Occidental Petroleum’s agreement to issue 100,000 shares of cumulative perpetual preferred shares, at a price of US$100,000 per share, to raise gross proceeds of US$10bn. The shares will be subscribed to by Berkshire Hathaway Inc. The preferred stock will accrue dividends at 8 percent per annum (or with respect to dividends that are accrued and unpaid, 9 percent).

One of the top capital raising deals of Q2 2019 was Occidental Petroleum’s agreement to issue 100,000 shares of cumulative perpetual preferred shares, at a price of US$100,000 per share, to raise gross proceeds of US$10bn. The shares will be subscribed to by Berkshire Hathaway Inc. The preferred stock will accrue dividends at 8 percent per annum (or with respect to dividends that are accrued and unpaid, 9 percent).

Occidental Petroleum will also issue warrants to purchase up to 80 million shares of Occidental common stock at an exercise price of US$62.5 per share. The warrant to be issued with the preferred stock may be exercised in whole or in part and from time to time, until one year after the redemption of the preferred stock. The placement is contingent upon Occidental entering and completing its proposed acquisition of Anadarko.

Gas Prices Falling to 1970s Levels

Oversupply will push average price in 2020 below two dollars per million British Thermal Units (MMBtu), a new forecast says. According to IHS Markit, a persistent oversupply of natural gas will drive the 2020 average price at the Henry Hub down (in real terms) to a level not seen in decades. The oversupply—to be reinforced by a new surge in associated gas production from the Permian Basin—will push the average price down below $2/MMBtu for the year, IHS Markit said. That is the lowest prices have averaged in real terms since the 1970s. In nominal terms, the last time that prices fell below $2 was 1995.

Prices are expected to fall despite robust domestic demand—which has increased by 14 billion cubic feet per day (Bcf/d) in annual average demand since 2017—as well as rising levels of exports. The United States is expected to export an additional 3 Bcf/d of liquified natural gas (LNG) in 2020. IHS Markit is recognized as a leader in critical information, analytics, and solutions.

It still will not be enough to absorb production that has grown by more than 14 Bcf/d since January 2018. IHS Markit expects production to average more than 90 billion cubic feet per day in 2019 and 2020, IHS Markit said.

“It is simply too much too fast,” said Sam Andrus, executive director/IHS Markit, who covers North American gas markets. “Drillers are now able to increase supply faster than domestic or global markets can consume it. Before market forces can correct the imbalance, here comes a fresh surge of supply from somewhere else.”

That next surge of production is expected to come from the Permian Basin in West Texas. Growth from the region will more than compensate for declines elsewhere—sustaining the oversupply and the downward pressure on prices that it creates, IHS Markit said.

“Nearly all the growth in U.S. natural gas demand over the next few years will come from LNG exported to other countries. The added supply from the Permian will match—if not exceed—those volumes,” Andrus added.

Two key factors will drive the Permian surge. Associated gas—the source for much of the region’s production growth—is a byproduct from oil well production, meaning that it is less sensitive to natural gas price signals. And additional pipeline capacity is expected to alleviate transportation constraints. The Gulf Coast Express pipeline, scheduled to come online in October, will allow for an additional 2 Bcf/d production capacity. Overall, Permian gas takeaway capacity is expected to increase 6 Bcf/d through 2022.

“In all events the gas is going to get produced out of the oil well. The real change here is the transportation capacity,” said Michael Stoppard, chief strategist for global gas, IHS Markit. “You go from a situation where producers, in many cases, were paying someone to take their gas to having an economic means of getting it to market.”

Signs of the coming price shift can already be seen, IHS Markit said. Gas prices fell by more than a $0.60/MMBtu between March and August as inventories climbed towards their five-year rolling average—despite record use of natural gas to generate electricity and growing LNG exports. Going forward IHS Markit predicts that the U.S. lower-48 storage inventory will come out of the winter at 2.1 Tcf—or 263 Bcf higher than the rolling five-year average—and head towards 4.0 Tcf in the fall of 2020.

Eventually the downward pressure on prices from rapid growth of associated gas will curtail drilling activity and bring the market back into balance. IHS Markit expects prices to rebound and average $2.25 per MMBtu for 2021, though that figure is still a downgrade from previous estimates.

“Markets work in the end,” said Shankari Srinivasan, vice president, energy, IHS Markit. “Rising prices stimulate supply and falling prices curtail it. What is unique here is the extent of reduction required. But signs still point to this coming price fall having a limited shelf life rather than being the new normal.”

Downstream Sector Trends

by Matt Flanagan

While overall corporate strategies haven’t changed all that much since 2018, the oil and gas industry will continue to see a fair amount of headwinds and tailwinds within its downstream energy sector. There are some key trends that we in Opportune’s Energy Consulting practice are closely monitoring in 2019 that will certainly have broader implications impacting this dynamic sector going forward heading into 2020. For one, there is M&A activity. Outside of Marathon Petroleum’s acquisition of Andeavor last year, the U.S. downstream M&A market has been relatively quiet until recently. We have seen several refining transactions take place over the last 12 months, which signals refiners are seeking opportunities to expand and optimize their downstream supply chains, as well as capitalize on attractive bid-ask spreads for assets.

1. Notable acquisitions this year include Par Pacific acquiring assets from U.S. Oil & Refining Co. in Washington and PBF Energy acquiring the Shell Martinez Refinery in California. It is worth noting that we do see some distressed companies from time to time in the downstream sector. For example, Philadelphia Energy Solutions recently entered bankruptcy for the second time in three years—this time on the heels of a large explosion at their Philadelphia refinery. As a result, it is likely that one of the oldest refineries in the United States will permanently close this year.

2. Impending Marine Sulfur Regulation: The upcoming International Maritime Organization (IMO) bunker fuel standards scheduled to go into effect on January 1, 2020, will dramatically lower the acceptable levels of sulfur in bunker and marine fuels. Many U.S. refiners don’t have facilities that can produce fuels at these new levels, so capital investment will be required—OR they can purchase the fuel from refiners that can produce to conform with the new specification.

3. Vertical Integration Opportunities: Downstream organizations with exposure to downstream logistics and marketing (including retail marketing) have seen higher earnings than the pure independent/merchant refiners. The importance of vertical integration was seen in 2015-2016 when oil prices fell to multi-year lows. Motiva Enterprises’ recent acquisition of Flint Hills Resources’ chemical plant adjacent to its Port Arthur, Texas, oil refinery is evidence of a value chain integration play. Investments further downstream serve as a hedge against low oil prices Look for continued investments into expanding midstream assets, as well as potential expansion into marketing, and even petrochemicals.

Matt Flanagan is a Partner in Opportune’s Energy Consulting practice and leads its Downstream Industry Sector. Matt brings nearly 25 years of experience in global refining and marketing, midstream pipelines and transportation (liquids and gas), exploration and production, petrochemicals and mining, encompassing corporate strategy, operations, transportation, marketing, and back-office functions. His primary focus areas include mergers and acquisitions, business operations and planning, energy trading and risk management, manufacturing execution systems, supply chain management, logistics, asset maintenance and reliability, and leading large-scale business transformation initiatives.

MMEX Lines up Project Financing

MMEX Resources Corp., a development stage company focusing on the acquisition, development, and financing of oil, gas, refining, and infrastructure projects in Texas and The Americas, announced Sept. 17 that it has selected debt and equity sources for financing of its projects. Jack W. Hanks, President and CEO of MMEX Resources Corp., commented, “We have now selected the financial entities to move forward with due diligence and final agreements to fund, in stages, two crude distillation units and related infrastructure in Pecos County and terminals in the Texas Gulf Coast. Completion of the funding is dependent upon final agreements. As previously announced, we have entered into off-take agreements to market our refined products, including diesel, naphtha, and residual fuel oil meeting the International Maritime Organization 2020 marine fuel regulations. As we build out Phase 1 and Phase 2 and the related infrastructure, we expect to be processing about 20,000 barrels per day of crude oil in Pecos County in two separate crude distillation units.” Hanks further commented, “ With this potential financial underpinning we have asked our EPC’s to start the detailed engineering which will compress the construction period by several months.” About MMEX Resources Corp. MMEX Resources Corporation (MMEX) is a development stage company formed to engage in the exploration, extraction, refining, and distribution of oil, gas, petroleum products, and electric power. For more information about MMEX, visit www.mmexresources.com.

The Parent-Child Well Syndrome:

Well Spacing Comes of Age

Grasping the importance of spacing and parent-child well relationships is emerging as a make-or-break distinction in today’s free cash flow era, according to Enverus, a leading oil and gas SaaS and data analytics company. Enverus has released a new report in its Fundamental Edge series highlighting the importance of well spacing, utilizing more than 300 comprehensive attributes in its calculations. Decisions on optimal well spacing are multidimensional and are a function of numerous geological, engineering, operational, and economic variables.

“Well spacing is complex and incredibly important in today’s current free cash flow era,” said Sarp Ozkan, Energy Analysis Director at Enverus. “As documented in this report and the case studies supporting it, understanding well spacing is like peeling back an onion. It is far more complex than something that can be understood by a single distance measurement. An inaccurate, simple spacing metric has ripple effects across all parts of the industry,” he said. The report addresses some of the biggest challenges for U.S. onshore field development and points to various case studies indicating how proper spacing may result in less drilling, but more hydrocarbon production.

Also, at the forefront of the industry, is the impact of parent-child well development and well interactions, raising questions about neighboring wells interacting with each other, potential degrading well performance, and offset well interference from newly drilled infill wells.

Key Takeaways from the Report:

* Spacing is a complex problem. Solving it leads to optimal spacing within a drilling unit. Additionally, it is key to proper development of a particular formation in an area to get the highest per well returns and minimize productivity degradation and handle parent/child interactions.

* Figuring out how to optimize well spacing to maximize productivity is an incredibly complex challenge. This changes from basin to basin, formation to formation, sometimes even section to section.

* Understanding parent-child relationships and optimized spacing at a basin level is important to understand trends. It’s essential to get more granular and dive deeper to get the full picture and this requires a reliable, robust, and engineered dataset.

* Enverus’ Well Spacing Solutions give the user the ability to dive through the most comprehensive Well Spacing dataset available. By combining geology, completion, production, M&A, and well placement and timing data sets rather than looking at well spacing metrics in a vacuum, Enverus reveals the important factors that impact operations and productivity.

* The parent/child interactions, future field developments and inventory studies, cost savings through spacing pilot, and formation delineation programs must be mastered to facilitate operations excellence as well as deliver growth, cash flow, and returns for shareholders. Enverus’ Well Spacing Solutions is a comprehensive and technically robust well-spacing solution that can help companies navigate through all these challenges and drive values.

Borderlands Gets Grant

Permian Basin Area Foundation is providing a $300,000 grant to the Borderlands Research Institute (BRI) to support stakeholder engagement and outreach as part of the Respect Big Bend Coalition’s efforts in West Texas.

Respect Big Bend is a collaboration between local landowners, community residents and leadership, scientists, industry, researchers, and conservationists formed to address energy development’s impact in the greater Big Bend region of far West Texas. The coalition aims to inspire and empower all stakeholders to conserve unique resources and protect iconic communities of the greater Big Bend region of Texas while developing energy responsibly.

“Permian Basin Area Foundation is a well-respected philanthropic organization that has been committed to investing in projects to improve the quality of life in West Texas for three decades,” said Dr. Louis Harveson, who is the Dan Allen Hughes, Jr., BRI Endowed Director and a professor of Wildlife Management at Sul Ross State University. “We are so pleased they are supporting the efforts of the Respect Big Bend Coalition, and these funds will enable us to engage the many stakeholders who should have a seat at the table.”

BRI is taking a leadership role in coordinating and implementing the outreach and education aspects of the project. Stakeholder groups that have been identified for this project include landowners, mineral owners, energy industry and service providers, community members, conservation partners, and regulators. BRI will be primarily responsible for communicating and meeting with the varied stakeholders through a variety of strategies, from private one-on-one meetings to broader community forums.

“Borderlands Research Institute is a great asset to West Texas, and we applaud their scientific approach in advancing best practices for land and wildlife conservation,” said Guy McCrary, president and CEO of Permian Basin Area Foundation. “We are pleased to join with the Cynthia and George Mitchell Foundation and others in supporting the Respect Big Bend Coalition. We believe that BRI is well-positioned to advance this important initiative.”

BRI is coordinating the first landowner workshop for the effort in partnership with the Texas Agricultural Land Trust. The workshop title is “Saving Working Lands: Preparing Landowners for Energy Development,” and it is scheduled Nov. 14, 2019, from 10:00 a.m.–2:00 p.m. The workshop will be held at the Espino Conference Center at Sul Ross State University. The agenda is still being worked on and will be posted online at bri.sulross.edu.

“This workshop is our first tangible effort to provide resources to area landowners to assist them with energy development opportunities on their properties,” said Billy Tarrant, BRI’s Associate Director for Stewardship Services who also serves as Regional Coordinator for the Respect Big Bend Coalition. “By engaging them in this process, we will be able to provide the support they need to help them benefit from economic opportunities that may arise while maintaining the character and heritage of Big Bend area working lands.”

The Respect Big Bend Coalition launched with support from the Cynthia and George Mitchell Foundation, a Texas foundation that seeks innovative, sustainable solutions for human and environmental problems. The Cynthia and George Mitchell Foundation works as an engine of change in Texas, supporting high-impact projects at the nexus of environmental protection, social equity, and economic vibrancy. Find out more about the project at RespectBigBend.org