This month’s miscellany of truncated articles takes a look at breakthroughs made by innovative individuals and companies, and shares a bit of practical advice. These are the full versions of the “Drilling Deeper” news items that appeared as abbreviated versions in the print edition of PBOG’s February 2016 issue.

Craddick Receives Hearst Energy Award

Commissioner Craddick (right) receiving the 2015 Hearst Energy Award for Government Service from Midland Reporter-Telegram energy reporter, Mella McEwen. Photo courtesy of Midland Reporter-Telegram.

Railroad Commissioner Christi Craddick is the 2015 recipient of the Hearst Energy Award for Government Service. Craddick received the honor at the 20th annual Midland Reporter-Telegram Hearst Energy Awards in Midland on Nov. 13. The annual ceremony recognizes industry excellence in technology, company performance, government service, lifetime achievement, and environmental stewardship.

“Aside from contributing to more than a third of our state’s economy, the oil and gas industry has shaped a way of life in Texas for over a century,” Craddick said.

“Oil and gas production has kept this state growing, creating jobs for our families and generating surplus revenue for important state budgetary items like health care and education for all Texans. Today, almost every aspect of modern life is impacted by oil and gas. Texas is blessed with an abundance of mineral resources that will provide economic opportunity for our state for many years to come.”

Commissioner Craddick reflected on the substantial impact of the Commission during her time in office on the industry, and on the state of Texas, with regard to oil and gas production and regulation as a whole.

“We have accomplished a number of milestones during my first three years in office that have comprehensively driven the commission forward as a trailblazer in oil and gas regulation,” Craddick said. “Major rule amendments have been key, as well as budget and efficiency initiatives, an IT overhaul and a new communications strategy. The Commission has often led the regulatory discussion with exemplary rules and regulations as innovation and technology continues to transform industry best practices. The past three years have been no different. Today, we are a fully funded, more efficient and transparent agency participating in an open dialogue with Texans about the state’s important mineral resources and the commission’s long history of regulatory leadership. These are long-term initiatives, we still have a lot of work to do, and I am looking forward to the next three years.”

Past recipients of the Hearst Energy Award for Government Service include Railroad Commissioners Victor Carrillo and Charles Matthews, Congressmen Lamar Smith and Joe Barton, State Senator Kel Seliger, and State Representatives Tom Craddick and Warren Chisum.

Odessa Tops in Manufacturing

As oil prices continue to spiral downward, the shares of oil producers from the Permian Basin are among the top performing energy stocks in the country, leading several sources to call the West Texas region a “rare glimmer of hope” for the energy industry (The Wall Street Journal). And right in the middle of our nation’s top oil producing region is one star burning brighter than the rest: Odessa, Texas.

From its prime location in one of the largest production areas in Texas, to its innovative, tech-savvy, and booming industries, Odessa is continuing to makea name for itself as a leading manufacturer and distributor throughout the United States. This oil-rich region is now known as a haven for investors, as producers from all across the country are flocking to Odessa.

“The reason why we’re the number one project that the Department of Energy has for clean power initiatives right now is because of the city of Odessa,” says Laura Miller, Director of Projects at Summit Power Group.

“The elected officials, the citizens, the chambers, everyone who believes in this project and knows that this will put Odessa on the map internationally for clean power and forward thinking economies.”

Nobody can argue that Odessa has made a name for itself as it dominates the energy industry in the United States, but this West Texas region is beginning to take the lead in other sectors as well as its entrepreneurial spirit begins to take shape.

“This oilfield town is a 24-hours-a-day, 7-days-a-week industry; has a nonunion workforce; it has a support system; manufacturing support where there’s welding, fine machine work, electrical motor repair, pump supplies,” reports Nick Fowler, owner of Rextac, LLC. “Being located here, amongst this oil field economy, actually is a strong advantage and would be for any heavy manufacturer.”

Odessa’s overwhelming success in the energy industry is being used as a base for others to build their own businesses off of too. With notable gains in the manufacturing sector, one of Odessa’s strongest assets is the La Entrada al Pacífico highway. This highway stretches from Chihuahua, Mexico, up through the Alpine area, and into Odessa, allowing for unmatched distribution to and from Mexico, expanding industries, and connecting the Permian Basin perfectly.

“The reason this is vital is we can actually become part of a wholesale distributor and basically diversify our economy by doing this,” says David Turner, Mayor of Odessa. “There are so many products coming into Texas from Mexico. ”

Odessa is taking newsstands, investors, entrepreneurs, and the country by storm as it maintains its status as an energy innovator and begins to take the lead in a variety of other business ventures.

“When our customers see Odessa in our name, they know that it’s synonymous with oil and gas,” says Sondra. “It lends integrity to our business, and they immediately will come to us and say ‘that’s oil and gas’ and ‘you can do the job that we need’ because they know that we’ll be experienced in what we’re doing.”

An Alternate For Law Suits

As courts in several states began to have long delays and backlogs of suits on the docket for trial, they sought a means of shortening the delays and getting resolutions.

The judges and attorneys devised a group called Alternate Dispute Resolution (ADR) and it adapted certain rules to allow this group to act as a first choice to settle disputes before incurring huge lawyer fees and before lengthy court proceedings were necessary.

As people became trained to help opposing parties to resolve disputes, they were referred to as “mediators.” The process became known as “mediation.” Although some had legal training, the mediators were not required to be lawyers and often were businesspersons who knew about the business or events being disputed from experience.

This process consisted of one person sitting down with two opposing parties in a neutral setting and hearing each tell their story in detail. Having this opportunity served the purpose of each party “having been heard,” or “having their day in court,” though the outcome was often directed by mediators.

The advantages soon became evident in that there were no lawyer fees, and the mediation was confidential, meaning it could not be used in court if the conflict was not resolved. The mediator did not provide the solution, but guided the mediation to let the parties come to a common understanding and the agreement became visible to each party.

Today, mediation is mature and states have certification programs for develop skills to lead parties to solutions outside of the court room.

Fees vary, but usually mediation is less than $2,000, and generally, the dispute ends with a simple common language resolution agreement drawn by the mediator.

During mediation, each party learns what would have been discovered in a long court trial and mediation is usually done in a one-day session.

The next time you think you may have to sue someone, consider the cost, the delay, the mental anguish, and the publicity you will endure in doing so. Then, consider mediation.

About the author:

Max Dillard, began his career as a crewman on a drilling rig. After college, his oilfield career progressed as a drilling engineer, superintendent, operations manager, vice president, and president of domestic onshore and offshore drilling companies. In 1978, he founded and became CEO of D.I. Industries (now Grey Wolf, Inc.), which grew to become one of the largest publicly traded drilling companies in the United States. This growth was accomplished through internal expansion, and significant acquisition activity. Since 1996, Mr. Dillard has served as managing director of The Dillard Anderson Group. Mr. Dillard is a certified mediator and registered professional engineer, and holds a Bachelor of Science degree in Petroleum Engineering from The University of Texas.

O&G Companies Find Silver Lining

As U.S. crude oil prices hover around $40 per barrel, challenging real estate decisions lie ahead for energy companies and property investors alike. However, opportunity remains for those companies who can afford to make strategic moves and know where to look, according to a new JLL report that examines the real estate market dynamics driven by the oil and natural gas sector.

“There’s a unique combination of capital market, industry, and real estate forces that provide credit-worthy tenants with attractive options to reduce cost or monetize their real estate portfolios,” said Bruce Rutherford, co-leader of JLL’s global Oil & Gas practice group.

“Energy companies with strong credit, for example, have the opportunity to negotiate purchase contracts for real estate they currently lease, assign those contracts to synthetic lease sources and in that process convert conventional leases into dramatically less-expensive synthetic leases.”

“Owned assets can also be sold to financing sources and converted to credit tenant leases retaining the features of ownership. The key is for those in the industry to utilize their portfolios as a strategic resource to mange costs and liquidity needs.”

Seize the day for competitive advantage

No one can predict the future of crude oil prices, but energy companies can review and align their real estate portfolios with long-term business strategies, said Rutherford. For those companies financially strong enough to look beyond mere cost cutting, the report’s recommendations include:

- Make strategic moves in tenant-friendly office markets: In some energy-intensive cities and submarkets, the drop in oil prices has led to a corresponding drop in real estate pricing. That means a window of opportunity to lock down long-term leases at favorable rates and terms—while accessing a high-quality talent pool of experienced engineers and well-trained entry-level professionals.

- Contain costs: Cost-savings opportunities can come in many forms, including identifying possible exit strategies buried in lease terms or exploring sale-leasebacks. If a leased location is in a flat real estate market, the landlord may be willing to offer aggressive rent discounts or restructuring to retain tenants. In other markets, subleasing can be a profitable option for offices in landlord-friendly markets, where other industries may covet valuable space controlled by energy firms.

- Realign space after a merger or acquisition: Companies engaged in consolidation should evaluate the combined real estate footprint early to identify the best opportunities to reduce space obligations or secure room for expansion. If financially possible, think long-term about future location needs.

- Combine real estate strategy with human resources: Almost 55 percent of the energy industry workforce may retire over the next decade, so companies need to recruit STEM-trained millennials and retain experienced professionals. Choosing a location within the right markets will help to fuel this strategy.

Opportunities and challenges inside oil-rich markets

The downturn in the oil and gas industry has brought to light vast differences in the real estate markets of energy-intensive cities. JLL’s report examines real estate market conditions in the following markets:

- Houston: Houston’s office market has experienced a jump in vacant space due to the combination of energy-sector job losses and continued energy industry M&A. However, the industrial market is likely to grow in the next 24 to 48 months, as new manufacturing plants come online.

- Calgary and Edmonton, Alberta, Canada: As the nerve center of the Canadian oil and gas industry, Alberta’s two primary office markets have experienced a growing amount of space offered for sublease. However, demand for industrial and production real estate remains strong.

- Denver: Despite depressed oil prices, energy remains one of Denver’s primary economic drivers. Of the 636,000 square feet of sublease space released by energy companies since January 2015, nearly 20 percent has already been re-absorbed—mostly by other energy firms. Denver continues to be a strategic location for energy companies because of its strong base of STEM workers and appealing live-work-play setting. Additionally, the nearby shale fields represent low-cost production locations.

- Dallas/Fort Worth: Dallas’s market has remained stable, while Fort Worth has felt the brunt of the energy industry slowdown because of its high concentration of energy tenants. Fort Worth is likely to see additional office vacancies as a result of the downturn.

- Pittsburgh: The Pittsburgh industrial market has been particularly affected by energy industry volatility, and its tenants have typically signed short-term leases. Within the office market, demand from energy tenants has declined, but the Southpointe submarket in particular offers an opportune place—and time—for companies preparing for expansion now or in the future.

In response to increased vacancy and lack of demand for space from the energy industry, landlords and companies with significant space available for sublease are aggressively pursuing tenants from growth-oriented industries such as technology, insurance and healthcare. Some are finding replacement tenants among Canadian energy companies, as some are shifting operations to the United States in search of highly specialized engineering talent.

“Bold real estate moves are well-timed at this point in the oil and gas industry economic cycle; business doesn’t stop because revenues are down,” said Lindsay Brown, co-leader of JLL’s global Oil & Gas practice group. “Expansion into STEM-educated millennial talent-rich markets like Denver and Pittsburgh is being driven by Canadian and U.S. companies alike. This is a great time to tackle the industry’s pending talent shortfall as the current generation of senior executives begin to look towards retirement.”

About JLL’s Energy Outlook

The report offers detailed North American market intelligence, strategic recommendations to help energy companies make smart decisions and analysis of which oil-focused regions are thriving thanks to diversified economies.

About JLL

JLL (NYSE: JLL) is a professional services and investment management firm offering specialized real estate services to clients seeking increased value by owning, occupying and investing in real estate. A Fortune 500 company with annual fee revenue of $4.7 billion and gross revenue of $5.4 billion, JLL has more than 230 corporate offices, operates in 80 countries and has a global workforce of approximately 58,000. On behalf of its clients, the firm provides management and real estate outsourcing services for a property portfolio of 3.4 billion square feet, or 316 million square meters, and completed $118 billion in sales, acquisitions and finance transactions in 2014. Its investment management business, LaSalle Investment Management, has $57.2 billion of real estate assets under management. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit www.jll.com.

Post Oak Energy Stakes UpCurve for $100 Million

Post Oak Energy Capital, LP (Post Oak), through investment partnerships it manages, announced that it committed to a $100 million line of equity to UpCurve Energy, LLC (UpCurve) on Dec. 9. UpCurve’s management team will co-invest alongside Post Oak.

UpCurve is a newly formed upstream-focused oil and gas company headquartered in Houston. CEO Denis Pone, a technical visionary who holds four patents in enhanced oil recovery and production optimization, leads the company’s management team. Pone is credited with pioneering ConocoPhillips’ highly successful horizontal refracturing program. Other members of the UpCurve management team, also from ConocoPhillips, include Zach Fenton, COO; J.J. Oshins, SVP of business development; and Brett Clair, CFO.

UpCurve will initially focus on leveraging its expertise in both horizontal recompletions and unconventional development in prolific shale formations such as the Eagle Ford, Haynesville, and Bakken. These basins not only harbor thousands of refrac opportunities due to the presence of older, less-advanced completions, but also possess equally attractive undeveloped opportunities.

“We are incredibly pleased to establish a relationship with these industry leaders,” said Post Oak Managing Director Frost Cochran. “Their expertise positions UpCurve for strong growth and vast opportunities across numerous shale plays.”

“Fully capturing the tremendous resources revealed by the shale renaissance will require a proper integration of technical expertise, financial strength and entrepreneurial spirit,” Pone said. “I am privileged to embark on this amazing journey with a dynamic management team and to grow UpCurve with Post Oak’s strong financial backing and industry knowledge.”

About Post Oak Energy:

Post Oak, which was established in 2006, is an energy-focused private investor based in Houston, Texas. Its management team has executive management experience and a broad network in the energy business as well as significant expertise in equity investments, operations, development, finance, acquisitions, and divestitures. The firm pursues private investments primarily in the upstream sector of the oil and gas industry in North America and, to a lesser extent, in oilfield service and related infrastructure. Post Oak works in close partnership with operating management teams to build businesses, accelerate growth and enhance shareholder value. www.postoakenergy.com.

About UpCurve Energy, LLC:

UpCurve Energy is a Houston-based oil and gas company focusing on the drilling, development, and refracturing of unconventional resources. UpCurve will initially focus on joint ventures, farm-ins, organic leasing efforts, and acquisitions its efforts in unconventional shale plays throughout the Contiguous United States. http://www.upcurveenergy.com/

What they don’t teach in business school, but should…

A new report, published by global executive search and leadership consulting firm Borderless, offers a real-world perspective of how business school education is perceived by international executives.

Based on the findings of a recent Borderless survey, the firm offers the following recommendations to enhance business school curricula development:

- Favor developing general managers.

“There is a decline in opportunities for executives to develop general management skills to equip them for the most senior general management roles,” explains Borderless Founding Partner, Andrew Kris, who presented the results during the international meeting of the Accreditation Council for Business Schools and Programs, in Barcelona.

“This is due to two phenomena. 1) The centralization of functional leadership in a matrix has meant that local managers no longer benefit from broad multi-functional responsibilities or true bottom-line accountability in early careers. 2) The reduction of high-cost expat roles has meant that executives receive less exposure to multicultural experiences needed to lead complex international businesses,” explains Andrew. “There is an opportunity for business schools to create programs that support the development of these skills.”

- Seek in-house partnerships.

“Business schools need to view their students as customers. These are the people who will go into industry and become future sponsors of students,” says Andrew. “Furthermore, schools should not just view corporations as financial sponsors, but should extend collaboration to include providing opportunities for professors to work within companies to understand how the business school curriculum could evolve to address real-world challenges.”

- Balance development of hard skills and soft skills – intellect and emotion.

“Above all, as reported in the study, companies are demanding that business schools focus on not just hard skills but soft skills too, in equal proportion. Behavioral development needs to be integrated and practiced as part of the program and not relegated to a one-semester course on ‘interpersonal skills.’

“Developing great strategies doesn’t necessarily lead to great corporate results,” explains Andrew. “Strategies are implemented by motivated people, and to get that, right leaders must learn how to capture the hearts and minds of those they lead.”

For more information contact Taunya Renson-Martin at taunya.renson@borderless.net or tel: +32 475 604 096.

About Borderless:

Borderless finds and attracts senior-level executives for multinational companies in the Process & Converting, Life Sciences, Oil & Gas and Food & Drink sectors. The firm identifies leaders for Board positions, as well as for senior management, finance, human resources, administration, marketing and sales, operations, logistics, R&D and specialist roles. Additionally, Borderless consultants assess the effectiveness of corporate Board, Management and Executive teams, helping companies align organizational design with strategy. http://borderless.net

EOR Tech Licensed in Texas Oil Projects

Texas EOR Associates, developer of cost-effective Enhanced Oil Recovery (EOR) technologies and opportunities, announced on Dec. 2 that it haslicensed exclusive U.S. Waterflood, Fracking, and Gas Injection-EOR rights to patented Oil Flow Optimization technologies based on reservoir pore-clearing EOR surfactant solvents, micro-clustered injection water and rig-less solvent-application tools developed by SCT LLC of Bakersfield, California.

Texas EOR Associates intends to bring its new EOR technologies, expertise and investment capital to the thousands of old and under-produced oil fields in America that are currently closed and non-producing, but which still contain millions of barrels of stranded oil left in the ground after their primary oil recovery phases ended years ago.

Now this remaining oil can be economically recovered today using Texas EOR Associates’ advanced EOR technologies and services. The E4EOR solvent has been demonstrated and proven effective in California heavy oil wells in which the solvent has been used to make extremely heavy oil flow so it is easier to extract. E4EOR solvents have the ability to inhibit buildup of unwanted asphaltene solids and paraffin wax precipitants whose high molecular weights choke the flow of oil by not only plugging wellbore-tubing and surface-equipment, but also they clog and block reservoir pore-space around injection wells and production wells (preventing EOR injectants from reaching and dislodging the stranded oil targeted behind the blocked pores).

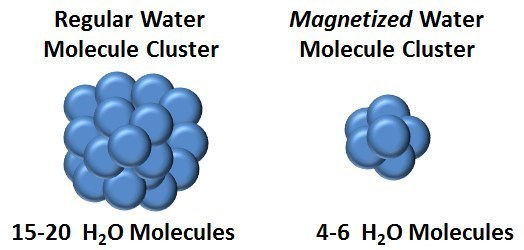

Texas EOR Associates’ Micro-Clustered Magnetized Water Treatment technology ionizes large macro-clustered oil field injection water molecules to form smaller water-molecule micro-clusters, less than one-quarter in size, which may better permeate and penetrate reservoir pore-space to deliver chemical injectants more effectively by making better contact with and sweeping more oil off of the target reservoir sands for potentially increased oil recovery.

While most current EOR projects are “flying blind” with no real-time reservoir feedback, Texas EOR Associates intends to marry use of its EOR solvents, micro-clustered water and reservoir-injection platforms with new in-situ, sub-surface Real-Time EOR Injectant Tracking and Reservoir Monitoring technologies to see in real-time precisely where and at what rate its water-flood chemicals and N2+CO2 gas injectants are flowing into and through a target reservoir’s pore-space.

Texas EOR engineers can then use this real-time reservoir injectant feedback to optimize and adjust injectant dispersal, water or gas pressure-drive and oil flow to the production well for oil extraction.

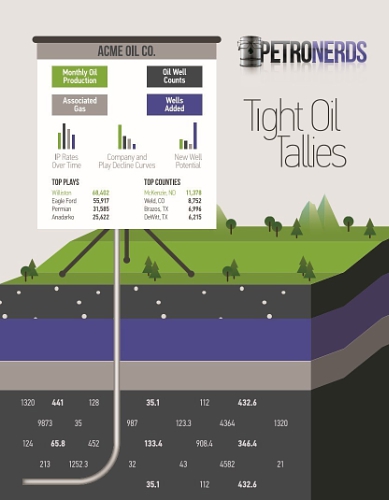

PetroNerds Announces Tight Oil Tallies

PetroNerds, LLC announces the availability of their new product, Tight Oil Tallies,at PetroNerds.com. Tight Oil Tallies is a monthly report that provides criticalproduction information for the top 50 shale and tight oil producers throughout the United States’ six primary tight oil plays.

“Tight Oil Tallies is the perfect resource for anyone with a stake in the oil patch performance of U.S. shale oil companies, such as equity analysts, private equity investors, midstream companies, policymakers, and energy market analysts,” said Ben Montalbano, co-founder of PetroNerds.

“It is data-rich yet cost-effective and easily absorbed. In the time it takes to read a single earnings call transcript, Tight Oil Tallies enables subscribers to catch up on the recent activity of 50 companies that, combined, produce nearly 5-million barrels per day of crude oil and condensate. Subscribers will be kept abreast of the latest liquids and associated gas production figures, well counts, well additions, IP rates, decline rates, active rig counts and much more, with play-by-play breakouts of each company’s activity.”

In all, each month’s issue of Tight Oil Tallies encompasses nearly 200,000 wells and contains approximately 190 pages of facts, figures, and data. The 50 companies with the highest aggregate daily liquids production across the following six plays are tracked: The Williston Basin, which includes the Bakken shale; the Eagle Ford; the Permian Basin; the Denver-Julesburg Basin; the Anadarko Basin; and the Powder River Basin. This includes companies such as EOG Resources, Continental Resources, Pioneer Natural Resources, and many more.

A free sample of the November 2015 issue of Tight Oil Tallies, featuring Statoil and Oasis Petroleum Inc., can be downloaded at PetroNerds.com/pdfs/tightoiltalliessample.pdf.

The full Tight Oil Tallies product guide is available at PetroNerds.com/tight-oil-tallies-guide/.

About PetroNerds:

PetroNerds, LLC was founded in 2015 by Ben Montalbano, former director of research and operations of the Energy Policy Research Foundation, Inc. (EPRINC), and Trisha Curtis, EPRINC’s current director of research – Upstream and Midstream and a Visiting Research Fellow at the Oxford Institute for Energy Studies (OIES).