In the selective recovery, some spots shine brighter than others—exports being one of them. These are the full versions of the articles shown in abbreviated form in the print version of our April issue.

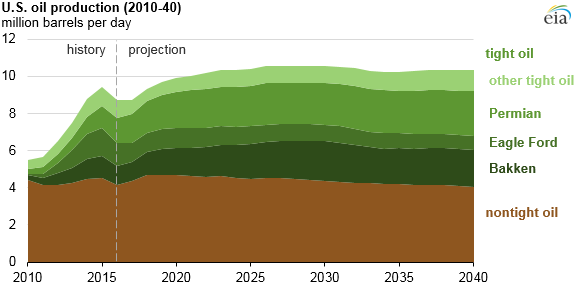

Tight Oil Production Through 2040

EIA’s recently released Annual Energy Outlook 2017 Reference case projects that U.S. tight oil production will increase to more than 6 million barrels per day (b/d) in the coming decade, making up most of total U.S. oil production. After 2026, tight oil production remains relatively constant through 2040 in the Reference case as tight oil development moves into less productive areas and as well productivity decreases. Side cases with different resource and technology assumptions result in different tight oil and total U.S. oil production projections.

U.S. production of tight oil has increased significantly since 2010, driven by technological improvements that have reduced drilling costs and improved drilling efficiency in major shale plays such as the Bakken, Eagle Ford, and the Permian Basin. Production from tight oil plays surpassed 50 percent of total U.S. oil production in 2015 when tight oil production reached 4.9 million per day (b/d). Tight oil production and overall U.S. oil production are expected to increase through around 2030 in the Reference case.

In the Reference case, tight oil production from the Eagle Ford and Bakken—two of the largest tight oil regions in the country—begins to decline after 2020 and 2030, respectively. Production in the Permian Basin (which includes the Spraberry, Avalon/Bone Spring, and Wolfcamp plays) remains relatively high through 2040. Compared with the Eagle Ford and Bakken, the Permian Basin has more geographic extent and contains multiple stacked plays, providing drillers with more opportunities for continued long-term development.

Two side cases included in the AEO2017 analysis apply alternative assumptions regarding technological advances and resource availability, which lead to very different projections for tight oil production. In the High Oil and Gas Resource and Technology case, which uses more optimistic technology and resource assumptions, tight oil reaches 11.0 million b/d by 2035, or 66% of total U.S. production, as higher well productivity reduces development and production costs, spurring additional resource development. In the Low Oil and Gas Resource and Technology case, which applies more pessimistic technology and resource assumptions than in the Reference case, tight oil provides less than half of total oil production after 2030, and total U.S. oil production in 2040 is well below its current level.

Platts Analyzes EIA Data

U.S. commercial crude oil stocks rose 1.501 million barrels to a record-high 510.184 million barrels in the week ended February 24, as exports fell from record levels and imports edged higher, according to U.S. Energy Information Administration (EIA) data and a commentary by Jack Laursen, S&P Global Platts oil editor. Crude oil prices showed a relatively muted response to the data, in part because the inventory build was lower than analysts’ expectations and followed seven consecutive stock builds.

New York Mercantile Exchange (NYMEX) April light sweet crude oil futures fell slightly, trading 12 cents lower. Intercontinental Exchange (ICE) May Brent was trading 10 cents higher day on day at $56.41/b, but had also been higher before the release of the data, reaching $57.05/b.

Analysts surveyed by S&P Global Platts expected crude stocks to rise 2.1 million barrels. The reported build was significantly smaller than the 2012-16 average build of 5.5 million barrels for the same reporting week. Crude oil imports rose 303,000 b/d to 7.589 million b/d, while exports fell from a record 1.211 million b/d to 721,000 b/d. The EIA reported that imports from Iraq, Saudi Arabia, and Canada rose significantly.

Refinery utilization rose 1.7 percentage points to 86% of operable capacity, still well below 88.3% seen at this time last year. Analysts were looking for rates to have risen 0.3 percentage points. The rise in refinery utilization may have limited the size of the crude build but also limited the size of the draw in gasoline inventories.

Gasoline stocks fell 546,000 barrels to 228.585 million barrels, EIA said, but surveyed analysts were looking for stocks to have dropped 1.7 million barrels. Gasoline demand has been underwhelming in recent weeks, with product supplied at 8.681 million b/d as a four-week average. At this time last year, that figure stood at 9.256 million b/d.

Distillates inventories fell 925,000 barrels to 164.208 million barrels, slightly more than analysts’ expectations of a 700,000 draw. Distillates exports underpinned the stock draw, with shipments rising 277,000 b/d to 1.284 million b/d in the reporting week, according to the data.

NYMEX April reformulated blend stock for oxygenate blending (RBOB) futures was trading lower following gasoline’s less-than-expected draw and soft demand indications, down 3.6 cents at $1.6934 per gallon (/gal). NYMEX April ultra-low sulfur diesel (ULSD) was relatively steady, trading 1.14 cents lower at $1.6285/gal.

Looking Ahead

The outlook for the oil complex remains murky, with a wide array of views on a number of key factors for prices, including the lasting impact of the output cuts associated with the November 30 OPEC/non-OPEC agreement and the direction of U.S. oil production. In recent weeks, hedge funds have piled into long positions in the crude futures market at record levels, while oil producers seem content to hedge production with crude trading steadily in the low $50s per barrel (/b) for several months.

The net length position held by money managers increased 21,796 contracts to yet another record high of 405,328 contracts in the latest reporting period, U.S. Commodity Futures Trading Commission data showed in February. On the other hand, the data showed the producer/merchant category increasing its short position by 22,481 contracts to 341,911 contracts.

“Speculators are waiting for the OPEC/non-OPEC supply cuts to kick in and magnify the crude drawdowns that typically begin in earnest in the U.S. in a couple of months,” said Anthony Starkey, manager of energy analysis at Platts Analytics, a forecasting and analytics unit of S&P Global Platts. “Physical players appear comfortable holding significant short derivative exposure against the currently bloated inventories despite a narrowing contango* and largely consensus expectations that inventory drawdowns will be significant as the year progresses into higher demand season.”

The money managers’ bullishness flies in the face of eight consecutive builds in U.S. crude inventories, with new records set each week, but reflect expectations of a tightening global crude market, apparent in a tighter contango market structure across both NYMEX and ICE crude futures. The front-second month NYMEX crude spread averaged minus 46 cents/b in February, compared with minus 78 cents/b in January. Farther out, the front-sixth month spread narrowed to minus $1.54/b from minus $2.93/b in January.

With time-spreads tightening, S&P Dow Jones Indices said Friday that passive funds tracking the S&P GSCI Enhanced Commodity Index must now sell December 2017 Brent futures and buy June 2017 Brent futures after a backwardation rule in the index was triggered. With the gap between money managers’ long positions and producers’ short positioning widening each week, both groups have plenty to lose if prices break out in either direction.

“Whatever the outcome, there is sure to be a flurry of activity in oil trading at some point this year which will be fascinating to watch, as the bets in the derivative space between future expectations and the current state of affairs are separated by some 1 billion barrels of financial crude oil,” Starkey said.

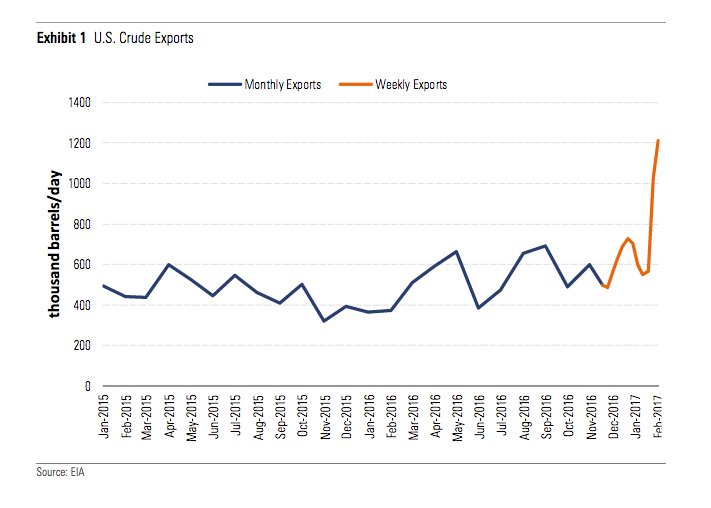

Crude Exports Top 1 Million Barrels/Day

By Sandy Fielden, Director Oil and Products Research, Morningstar Research

U.S. crude exports jumped dramatically in the first two weeks of February 2017 to over a million barrels/day according to weekly data from the Energy Information Administration (see Exhibit 1). Such growth was unexpected by the market after exports showed scant evidence of growth and averaged a little over half a million bbl/d through November 2016 per the latest monthly data. This despite Congress having lifted 1970s-era regulations restricting crude exports except to Canada at the end of 2015—raising prospects for growth. Volumes in the weekly EIA reports show increases in December and January and then a jump to 1 million bbl/d during the week ending Feb. 10 and 1.2 million bbl/d for the week ending Feb. 17, 2017. This surge has come about, at least partly, in response to production cuts implemented by OPEC in January 2017. By filling this gap, the U.S. has temporarily assumed the role of swing producer. Yet, as we explain, crude exports remain opportunistic in the near term—responding to price drivers rather than becoming systematic in nature.

How the U.S. Became a Swing Producer

Market sources indicate that a good portion of February’s increased export volume from the U.S. (and from Europe) is headed to Asia, where it is needed to fill a gap left by OPEC cuts. OPEC and other producers, including Russia, decided last year to cut production by 1.8 million bbl/d during the first half of 2017 to prop up prices. To best preserve their income, producers chose to cut cheaper heavy sour crudes over lighter more expensive grades—leading to a shortage of heavy sour crude in Asian markets where OPEC producers normally sell these crudes. The result was an increase in prices for heavy crude in Asia, including the regional benchmark Dubai grade. Dubai prices traded at a premium to U.S. benchmark West Texas Intermediate, or WTI, for the first time in a year, and the Dubai premium to Gulf of Mexico heavy benchmark Mars crude was even wider (Exhibit 2)—justifying the freight cost to Asia. At the same time, seasonal refinery maintenance at plants along the Gulf Coast reduced throughput and left surplus heavy crude produced offshore in the Gulf of Mexico like Mars and Southern Green Canyon available for export.

Not all heavy crude bound for Asia to fill the OPEC gap has come from the United States. Other crudes, such as North Sea Forties, have also been shipped east to take advantage of higher prices. A tightening in the North Sea crude market has also widened the regional marker crude Brent’s premium over WTI to about $3/barrel over the past few weeks. That Brent premium has also encouraged more exports of light U.S. crude, contributing to the record February volumes. As we detailed in our December note, U.S. crude export volumes have normally been tied to premiums for Brent crude over WTI because both are light sweet crudes and the U.S. generally has a surplus of light shale crude available for export. So at the same time as we have seen rare exports of Gulf of Mexico heavy crude, the Brent premium has justified several shipments of light crude from the Gulf Coast. Some of these cargoes are also headed to Asia—for example, Trafigura and BP are said to have shipped cargoes of Eagle Ford crude to Singapore and China. But other export cargoes making up February’s record volumes are blends of light U.S. crude with heavy overseas barrels from Venezuela or Colombia (see our May note on Venezuela Buying U.S. Exports for more on this topic) that are customized to meet specific refiner needs.

No Grand Plan

What should be noted is that despite record volumes, U.S. crude exports remain opportunistic, driven by price arbitrage and negotiated by traders on a cargo-by-cargo basis. There is no grand plan to systematically export U.S. crude. This contrasts with the growth during the past year in U.S. exports of liquefied natural gas. Midstream companies have purposely built export infrastructure backed by investment from term shippers committed to regular export volumes. For the crude market, there have been build-outs of dock infrastructure for exports, but term shippers with intent to export regular volumes have not committed to back these investments.

No Natural Surplus

Plans to systematically export crude would require surplus production looking for a home as seen in LNG and LPG. Although domestic production is increasing again as prices rise in response to OPEC cuts, the U.S. still imports roughly 8 million bbl/d of crude. Export barrels are usually light crude that Gulf Coast refiners don’t need because their plants are configured to process heavier barrels. Every export barrel competes first in the domestic market with imports—there is no natural crude surplus waiting to be shipped overseas. As shale production increases (assuming prices stay attractive) then we expect domestic refiners to absorb more light crude—either through blending or reconfiguring their plants—further pushing out imports. Exports will continue to occur when arbitrage windows open, as currently experienced in response to OPEC tightening the international market by cutting production.

Future Prospects

Looking forward several years, imports could be significantly reduced by increased domestic production such that surplus barrels need to be exported on a sustained basis. At this point, we would expect to see purposely built export infrastructure. That would include deep-water ports capable of loading very large crude carriers and, for example, pipelines to the West Coast to allow competitive crude exports to Asia. Before then, though, the U.S. crude market must navigate the stormy waters of the proposed Border Adjustment Tax, which will distort market pricing and affect both new production and the volume of exports in ways that aren’t clear yet.

Borets Acquires Midland Operations Facility

Borets, a leader in the engineering, manufacturing, sales, and service of electric submersible pump (ESP) systems, has purchased a new operations facility in Midland, Texas. The 11.2 acre site, located at 1100 S FM 1788, Midland, provides more than 58,000 sq. ft. of manufacturing and service capabilities, along with approximately 10,000 sq. ft. of state-of-the-art office space. Strategically located, the new Borets facility will accommodate assembly and dismantle operations, a full service cable shop and the sales and field service teams equipped to serve Borets’ customers throughout the Permian Basin. “This is a very exciting time for Borets,” said Obren Lekic, CEO of Borets U.S., “As part of our ongoing commitment to servicing our customers, this new facility will provide us the much-needed additional capacity required to accommodate our growing US operation.”

About Borets

Borets is the global leader in artificial lift engineering, manufacturing, sales and servicing of electric submersible pump systems. Founded in 1897, the company’s key product lines include electric submersible pumps; progressive cavity pumping systems; surface horizontal pumping systems; and permanent magnetic motors. With headquarters in Moscow and U.S. operations in Houston, the company has more than 9,000 employees worldwide and operates in more than 24 countries, providing exceptional equipment and services to international oil companies. Borets is committed to the highest quality standards, and this commitment is confirmed by ISO 9000, 14000, OHSAS 18000 and API Specification Q1 certifications. For more information, visit www.borets.com.

Subscribe to receive PBOG delivered to your front door.

[maxbutton id=”15″]

Sign-up for PBOG email updates.