Four months into the new Administration, oil and gas—especially Permian Basin oil and gas—are seeing a buildout of infrastructure and a buildup of production and capacity. Read on for coverage of this topic and others in this roundup of recent Basin activity.

Xcel Begins Transmission Line

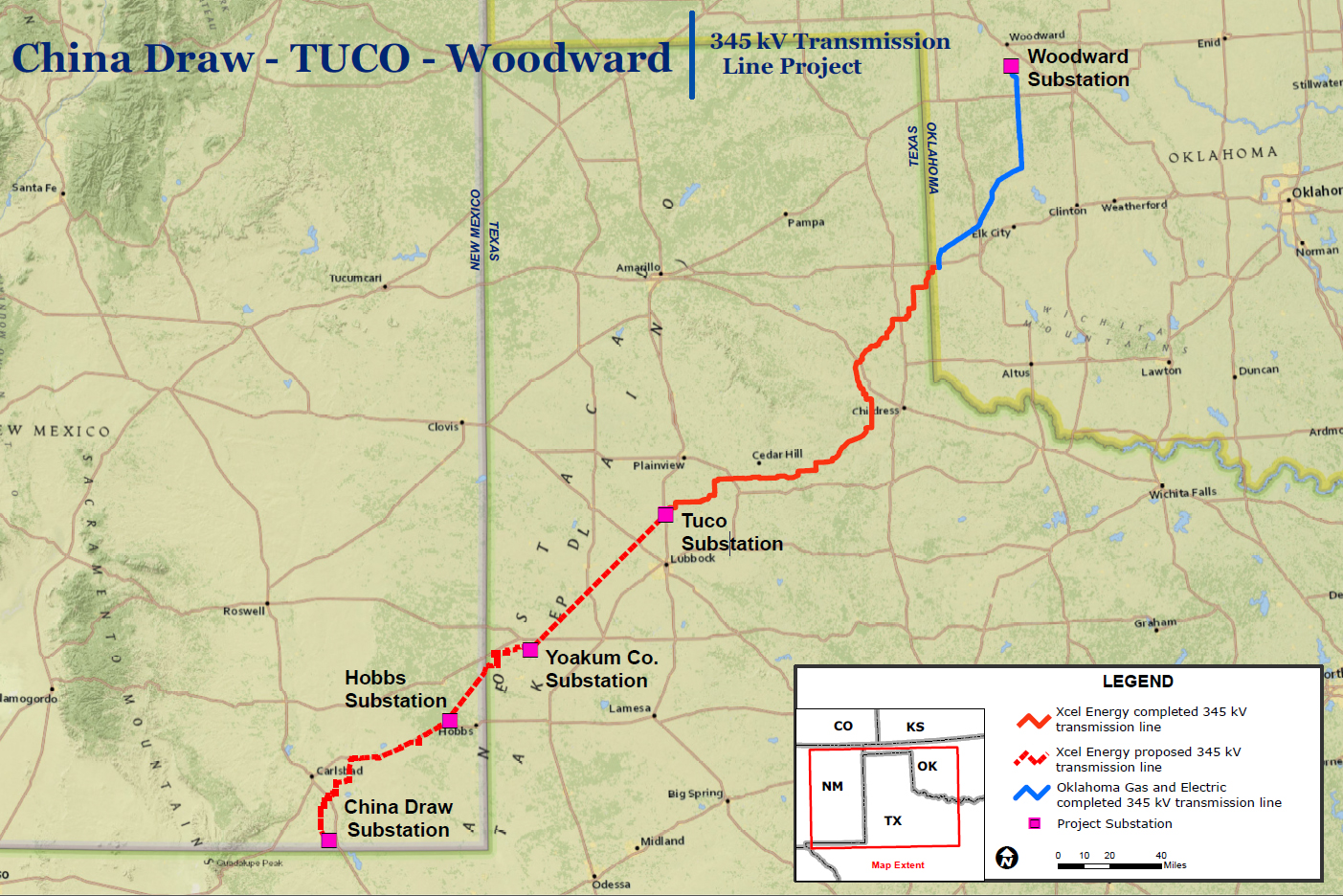

Construction crews have started work in southeast New Mexico on the first of several high-voltage transmission line segments that will come together as a single, 240-mile “Power for the Plains” corridor linking Texas with New Mexico, delivering what administrators say will be a more reliable, abundant, and economic electricity supply to customers in both states.

A 90-mile line between Hobbs, N.M., and a new substation called China Draw southeast of Carlsbad, N.M., has been approved by the New Mexico Public Regulation Commission and is now under construction. By this summer, nearly 250 workers will be involved in the development of this line. Additional line segments to be built by 2020 will connect the New Mexico line to TUCO Substation north of Lubbock, Texas. The combined cost of the completed line segments is estimated at $400 million.

A similar transmission project was completed in 2014 connecting the TUCO Substation to a substation near Woodward in northwestern Oklahoma. When all the segments between TUCO and China Draw are completed by 2020, a 345-kilovolt line will stretch more than 400 miles from western Oklahoma to southeastern New Mexico.

“Xcel Energy is committing a large amount of capital as a sign of our faith in the economies of eastern New Mexico and West Texas,” said David Hudson, president, Xcel Energy-New Mexico, Texas. “We are focusing resources on projects that will not only provide our communities the safe, abundant, and affordable power they need to develop, but do it in such a way that we can deliver billions of dollars of savings over the next three decades. The Power for the Plains transmission enhancement program is a foundational aspect of that strategy.”

The new line will boost one of the nation’s most prolific oil- and gas-producing regions—a region also primed for agricultural, mining, and renewable energy growth—by delivering less expensive power supplies to the area. And the economic value of the line will extend even further.

“Xcel Energy’s investment in New Mexico is far reaching, and because the transmission line will cross State Trust Lands, even public school children will benefit from this ambitious endeavor,” said State Land Commissioner Aubrey Dunn. “I appreciate Xcel Energy for their efforts to boost America’s energy supply and thank them for doing business with the State Land Office.”

The Hobbs-to-China Draw portion of the 345-kilovolt transmission line project links the Hobbs Plant Substation, located about 11 miles northwest of Hobbs, with the new China Draw Substation located about 22 miles south of Carlsbad. The project will be constructed in three segments:

- Hobbs Plant Substation to the new Kiowa Substation, located about 15 miles northeast of Carlsbad

- Kiowa Substation to the new North Loving Substation, located about eight miles southeast of Carlsbad

- North Loving Substation to the China Draw Substation

The Hobbs-to-China Draw project is expected to be in service in 2018. The estimated cost of the project is $163 million. By 2020, additional line segments from Hobbs to north of Lubbock will be completed that will link the Hobbs-to-China Draw line to the TUCO Substation in Texas, bringing the total project cost to about $400 million.

These projects are part of a larger capital investment initiative launched in 2010 that is improving the grid across Xcel Energy’s 50,000 square-mile New Mexico and Texas service area. Information on these and other projects can be found at www.powerfortheplains.com.

About Xcel Energy

Xcel Energy (NYSE: XEL) provides the energy that powers millions of homes and businesses across eight Western and Midwestern states. Headquartered in Minneapolis, the company is an industry leader in reducing carbon emissions and producing and delivering clean energy solutions from a variety of renewable sources at competitive prices. For more information, visit xcelenergy.com or follow them on Twitter and Facebook.

Saulsbury Lands Second Toyah Contract

EagleClaw Midstream recently awarded Saulsbury Industries the overall construction contract for its second 200MMSCFD gas processing train (and third train overall) located at the East Toyah Natural Gas Cryogenic Processing Facility located in Reeves County, Texas. This will bring the total capacity at the facility to 460MMSCFD. This project will involve the installation of a cryogenic plant, as well as refrigeration, amine, stabilization, residue compression, and all associated equipment. Saulsbury previously completed the first two trains (60MMSCFD and 200MMSCFD) at this facility.

EagleClaw and Saulsbury have built a solid relationship over the last three years through the outstanding execution and dedication of the construction management and field teams. The first 60MMSCFD project was awarded the Dick Saulsbury Project Excellence Award for the excellent execution by the Saulsbury project team helped by the support provided by EagleClaw and their project team.

“We are extremely pleased to have been awarded the third cryogenic plant project for EagleClaw Midstream,” said Bubba Saulsbury, shareholder and SVP of Business Development of Saulsbury Industries. “This award marks Saulsbury’s 38th Natural Gas Cryogenic Processing Facility project and 25th 200MMSCFD project in the last 10 years. We look forward to the successful execution of this project with EagleClaw Midstream and their many more projects on the horizon.”

EIA: Permian Production Keeps Climbing

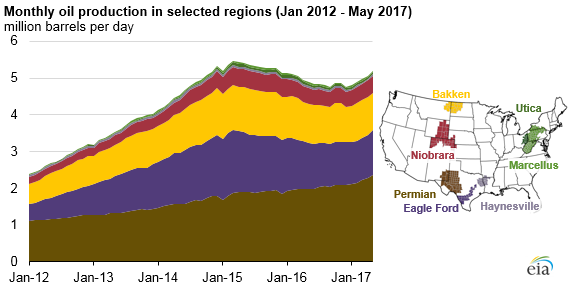

Crude oil production in the Permian Basin was expected to increase to an estimated 2.4 million barrels per day (b/d) in May, based on estimates from the U.S. Energy Information Administration’s Drilling Productivity Report. Between January 2016 and March 2017, oil production in the Permian Basin increased in all but three months, even as domestic crude oil prices fell. As production in other regions fell throughout most of 2015 and 2016, the Permian provided a growing share of U.S. crude oil production.

With rising oil prices over the past year, the Permian continues to be attractive to drillers, as reflected in rising rig counts. As of April 21, 2017, the number of rigs in the Permian Basin reached 340, or 40 percent of the 857 total oil- and natural gas-directed rigs operating in the United States. The Permian rig count reached as high as 568 in late 2014 before falling to a low of 134 in spring 2016.

Source: U.S. Energy Information Administration, Drilling Productivity Report

The land area over the Permian Basin covers more than 75,000 square miles in 43 counties of western Texas and southeastern New Mexico. However, more than half of the rigs that have been added in the Permian are concentrated in just five counties: Reeves, Loving, Midland, and Martin counties in Texas and Lea County in New Mexico. Oil production from these five counties averaged 882,000 b/d as of November 2016 and accounted for approximately 42% of total Permian Basin oil production (2.1 million b/d) in that month. As more rigs continue to be moved to these counties, production from these areas is expected to continue to increase, which will drive the increases in total Permian production.

Source: U.S. Energy Information Administration, based on Baker Hughes

Recent geological surveys have further explored the resources contained in the Permian Basin. In November 2016, the U.S. Geological Survey (USGS) estimated that technically recoverable tight oil and shale gas resources in the Midland Basin portion of Texas’ Permian Basin (specifically the Wolfcamp shale formation) could exceed 20 billion barrels of oil, 16 trillion cubic feet of natural gas, and 1.6 billion barrels of hydrocarbon gas liquids. The technically recoverable resource estimate for tight oil in the Midland is higher than any previous USGS assessment of tight oil resources in any domestic resource basin.

Source: U.S. Energy Information Administration, U.S. Geological Survey, University of Texas Bureau of Economic Geology, and Drillinginfo

More information about the Permian Basin and other major production regions in the United States is available in EIA’s Drilling Productivity Report.

API Lauds Priority on Domestic Energy

API President and CEO Jack Gerard on April 28 welcomed the Trump administration’s executive action to advance domestic energy production.

“We are pleased to see this administration prioritizing responsible U.S. energy development and recognizing the benefits it will bring to American consumers and businesses,” said Gerard. “Developing our abundant offshore energy resources is a critical part of a robust, forward-looking energy policy that will secure our nation’s energy future and strengthen the U.S. energy renaissance.

“The administration has taken important steps towards increasing the safe development of our energy resources onshore by ordering a critical examination of how previous administrations’ frequent and sweeping use of the Antiquities Act has reduced the availability of multiple use public lands and the resources they hold for the benefit of the American people.”

“The U.S. oil and natural gas industry has a long history of safe operations that have advanced the energy security of our nation and contributed significantly to our nation’s economy. And 80 percent of American voters support increased domestic oil and natural gas production. We look forward to continuing our work with the administration and Congress on policies that will fully embrace our nation’s offshore and onshore energy potential to meet the energy needs of American consumers and businesses.”

API is the only national trade association representing all facets of the oil and natural gas industry, which supports 9.8 million U.S. jobs and 8 percent of the U.S. economy. API’s more than 625 members include large integrated companies, as well as exploration and production, refining, marketing, pipeline, and marine businesses, and service and supply firms. They provide most of the nation’s energy and are backed by a growing grassroots movement of more than 30 million Americans.

Brazos Announces Projects in Delaware Basin

Brazos Midstream Holdings recently announced the completion of multiple crude oil and gas gathering and processing projects in the southern Delaware Basin, one of the most active oil and gas producing basins in the United States. Brazos commenced operation of a new 60 million cubic feet per day (MMcf/d) natural gas processing plant (“Comanche I”), several new compressor stations, and approximately 150 miles of large diameter, low and high-pressure gas gathering pipelines. The project also included the construction of 35 miles of crude oil gathering pipelines, two crude oil storage terminals with a combined capacity of 50,000 barrels (bbls), and connections to multiple downstream crude oil pipelines.

“We are excited about the high-quality assets our team has constructed over the past 18 months,” said Brad Iles, Chief Executive Officer at Brazos. “Our investment creates a franchise with enhanced midstream service offerings in one of the most economic oil and gas producing regions in the country.”

The fully-operational Comanche I cryogenic natural gas processing plant and associated pipelines are located in Ward, Reeves and Pecos counties, Texas. Brazos also announced it has begun construction of a second gas processing plant (“Comanche II”), which will add 200 MMcf/d of incremental processing capacity. Comanche II is expected to be operational during the first quarter of 2018 and will increase Brazos’ total operated processing capacity in the Delaware Basin to 260 MMcf/d.

“With multiple productive zones in and around our area of operation, we expect drilling activity and volume growth to remain strong for years to come,” Iles continued. “This further emphasizes the critical importance of our strategically-located platform and the timely expansion of our processing capacity.”

Brazos’ midstream infrastructure is anchored by long-term acreage dedications covering over 200,000 acres with top-tier Permian operators currently moving towards full-scale development. The Company’s gathering systems have been designed to support multi-well pad development, which is anticipated to accelerate throughout 2017 and 2018. Brazos anticipates further expansion of its announced processing capacity, which could include an additional 200 MMcf/d natural gas processing plant, as early as 2018.

About Brazos Midstream

Brazos Midstream Holdings LLC is an independent midstream energy company headquartered in Fort Worth, Texas. The Company is focused on crude oil gathering, natural gas gathering and processing, compression, treating, water and condensate handling and stabilization. Brazos currently owns and operates approximately 185 miles of natural gas and crude oil pipeline, a natural gas processing complex and 50,000 barrels of crude oil storage in the Delaware Basin. The Company is supported by equity commitments from Old Ironsides Energy, LLC and a revolving credit facility.