News of policies, changes, and collaborations are all served up in this month’s miscellany of truncated articles. These are the full versions of the “Drilling Deeper” news items that appeared as abbreviated versions in the print edition of the May 2015 PBOG.

Rio Grande LNG Doubles Site

NextDecade LLC announced March 5 that it has signed an option-to-lease agreement with the Port of Brownsville that will expand the company’s site to 1,000 acres for its proposed Rio Grande Liquefied Natural Gas (“RGLNG”) export terminal, doubling its initial agreement. This decision follows NextDecade’s recently completed Basis of Design (“BOD”)—also known as PreFEED—for the LNG terminal facility and its accompanying 130-mile Rio Bravo Pipeline linking the terminal with the Agua Dulce market hub. NextDecade is currently preparing to kick off FEED.

“NextDecade has taken a major step forward by securing such a prime site for our Rio Grande LNG project,” said Kathleen Eisbrenner, founder and CEO of NextDecade. “We have worked diligently to complete our Basis of Design to ensure a competitive, well thought out and executable project and are committed to working with the Federal Energy Regulatory Commission (FERC), our industry-leading partners and the local community to bring this project to fruition.”

The Rio Grande LNG site, located on the northern shore of the Brownsville Ship Channel, provides an optimal location for an LNG export terminal with substantial expansion opportunities. Securing a sizable site with deep-water access represents one of the more significant milestones for LNG projects. In addition, the RGLNG site is close to the Gulf, providing access to major global LNG markets, while the additional acreage will provide increased design flexibility and expansion capability, greatly increasing the attractiveness of the project both to potential off-takers and investors.

NextDecade is currently engaged in a detailed assessment of every aspect of the site to ensure that all safety and environmental requirements are met as it prepares for initial FERC pre-filing process submissions later this month, and is actively conducting community consultations.

Port of Brownsville Director and CEO Eduardo A. Campirano said, “The Port of Brownsville welcomes NextDecade’s interest in the Port. The development of a project such as this will bring jobs and additional economic development to the entire Rio Grande Valley.”

Scott Environmental Services, Inc. Announces Registration as Engineering Firm

Scott Environmental Services, Inc., a solid drilling waste management technology company, announced March 19, 2015, its registration with the Texas Board of Professional Engineers, authorizing Scott to offer professional engineering services to the public.

“Scott Environmental’s practices are based on established engineering principles and sound evidence-based science, so registering as an engineering firm seemed to be the most logical next step,” said Blake Scott, president of Scott. “I am pleased we’ve become a full service firm.”

Scott’s Firmus and Duro processes for managing solid waste produced at drill sites utilize breakthrough “solidification/stabilization” technology, an in-situ remediation field technology that encapsulates contaminants and/or makes them immobile. The processes meet the recycling and/or treatment definition under the EPA and API waste hierarchy.

Services include the engineering for waste disposition, pit closure, and the necessary labor and confirmatory testing by an independent, third-party laboratory following placement of the material. By preparing mud and cuttings through solidification and stabilization, both processes provide similar benefits, which meet supporting loads and environmental closure criteria. These methods provide safe disposal and also produce materials that can be used in high-quality civil engineering structures, i.e., the roads and drill pads needed on many drill sites.

Influence: The Ultimate Power Tool

By Robert Cialdini, Ph.D.

In business today, effective influence is essential. Want your ideas implemented? You must influence others to act on them. Want more clients? You must influence people to buy from you. Want more advancement or responsibility? You must influence executives to see the value you offer. And to be an effective leader you must be able to influence others. In all respects, being able to influence others is the ultimate power tool.

So, what makes people say “yes” to your requests? Researchers have been studying influence for over 60 years. While it’s nice to think that we are all logical beings who study facts and information to guide our thinking and decision making process, scientific research shows otherwise. Following are the six proven universal principles of persuasion, that when used ethically, can influence others to change their behavior.

1. Reciprocity

There’s a powerful rule that says that we should try to repay what others have done for us. If someone gives us a gift, we feel compelled to give a gift in return. If someone extends us an invitation, we should extend one to them. And if someone does us a favor, we owe them a favor in return. By virtue of the Reciprocity Principle, people feel obligated to the future repayment of items, actions, favors, and gifts.

You see, Reciprocity is initiated in business every day, even if you don’t immediately recognize it. From suppliers sending relevant industry specific information to clients, to managers providing personalized guidance, to co-workers helping each other meet a deadline, Reciprocity can be initiated in many ways. The key to effectively using Reciprocity is to be the first to give, give unconditionally, and be sure that your “gift” is personalized and unexpected.

2. Scarcity

Have you ever noticed that people seem to want more of those things they can have less of? That’s the Scarcity Principle at work. Marketers know the power of this principle, which is why their ads often contain such phrases as “Limited Time Only” or “Limited Quantities Available.”

When true, Scarcity affects the value of information too. In other words, information that is exclusive is more persuasive. So the next time you gain access to information that is not readily available and that supports an idea or initiative you would like the organization to adopt, gather the key players and say, “I just got this information today. It won’t be distributed until next week, but I want to give you an early look at what it entails.” Your listeners will lean forward and listen intently. The key to using Scarcity successfully, whether for a product, service, or information, is to not just honestly tell people the benefits they’ll gain, but also point out what’s unique and what they stand to lose if they don’t move in your direction.

3. Authority

Research shows that people typically follow the lead of those they perceive as credible and knowledgeable experts. For example, physical therapists are able to persuade more of their patients to comply with programs if they display their medical diplomas on their office walls. That’s because people tend to defer to legitimate experts for information and guidance on what to do.

Surprisingly, people mistakenly assume that others recognize their experience. To ensure that they do, first determine what your relevant background, experience, and expertise are for the person you are trying to influence. If you don’t do this, you will be sabotaging the power of your own message. For maximum impact, arrange to have a third party communicate this information.

Another option is to direct the person you want to influence to something in writing that highlights your credentials (i.e. LinkedIn profile, your bio on your website, etc.) The key to using Authority successfully is to signal to others what makes you credible and knowledgeable before you make your influence attempt.

4. Consistency

People feel compelled to be consistent with their prior behaviors or statements they have made. When someone makes a commitment actively, either by writing it down or speaking it out loud, it’s even more likely that they’ll follow through with that commitment. You can activate the Consistency Principle by looking for or asking for small initial commitments.

For example, suppose you want an employee to submit reports in a timelier manner. Once you believe you’ve won agreement, ask him to send you a summary of that decision in writing. By doing so, you’ll have greatly increased the odds that he’ll fulfill the commitment, because people tend to live up to what they’ve written down. The key to using Consistency successfully is to look for voluntary, active, and public commitments…and get them in writing.

5. Liking

People prefer to say “yes” to those they know and like. But what makes someone like you? Science tells us there are three important factors that contribute to likeability: 1) we like people who like us (and tell us); 2) we like people who are similar to us; and 3) we like people who cooperate with us toward mutual goals.

The key to using Liking successfully is to be honest in your praise, find genuine similarities, uncover opportunities to work together toward common goals, and get to know people more meaningfully before talking business.

6. Social Proof

Humans are social creatures. And as such, we rely heavily on the people around us for cues on how to think, feel, and act. In other words, people look to the actions of others to determine their own. This is why using testimonials from happy and satisfied customers is so effective in marketing campaigns.

You can use Social Proof when attempting to get your ideas implemented. Imagine that you’re trying to streamline your department’s work processes, but a member of your group is resisting. Rather than try to convince this group member yourself, ask a couple of veteran employees who support the initiative to speak up for it at a team meeting. The veterans’ testimony stands a much better chance of convincing the group member than yet another speech from the boss, as Social Proof is often better exerted horizontally rather than vertically. The key to using Social Proof successfully is to have similar others share their positive story to your target.

Exert Your Influence Today

Influence is a very powerful tool. When you ethically implement these six scientifically validated principles of persuasion, you’ll be making small, practical, and often costless changes that can lead to big differences in your ability to change others’ behavior. In the end, you’ll not only achieve your objectives, but you’ll also guide the other party to the best decision for their needs. That’s when true success transpires for everyone involved.

About the Author

INFLUENCE AT WORK (IAW) was founded by Robert Cialdini, Ph.D, Professor Emeritus of Psychology and Marketing and author of the New York Times bestseller, Influence. Dr. Cialdini is a highly sought after keynote presenter on the ethical business applications of the Science of Influence. Additionally, IAW offers customized, in-house Principles of Persuasion (POP) Workshops conducted by Cialdini Method Certified Trainers. For availability call 480-967-6070 or visit www.INFLUENCEATWORK.com. Follow him at @robertcialdini.

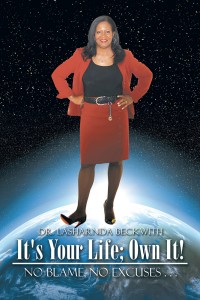

Ditch the Excuses

By Dr. LaSharnda Beckwith

When it comes to self-improvement and future plans, there seems to be a myriad of reasons why something can’t be done. How would people change if they started saying yes to their life goals, instead of taking a passive approach to life?

For LaSharnda Beckwith, maintaining a successful, ideal life is possible through responsibility, direction, and empowerment. In her new book, It’s Your Life; Own It!, Beckwith shares the necessary tools and helpful advice for achieving goals, despite professional and personal obstacles.

Beckwith pulls from her more than 25 years of experience working for the Army and Air Force Exchange Service, as well as a career in teaching and business ownership, to share tools for personal growth and living in an active, motivated manner.

“I have experienced everything you can imagine related to being pushed aside and feeling marginalized,” Beckwith said. “But, I still excelled because I continued to polish my skills and work towards my goals.”

“It’s Your Life; Own It!” combines the importance of commitment with a Christian perspective. The focus on Biblical principles inspires self-reflection and change that starts with a positive attitude and clearly defined purpose.

“How you think is how you live,” Beckwith said. “The life you live today will set the stage for the kind of life you ultimately would like to have.”

For more information, visit www.beckwithleadership.com or www.bookstore.authorhouse.com.

“It’s Your Life; Own It!”

By Dr. LaSharnda Beckwith

ISBN: 97814969495233

Available in softcover

Available on Amazon, Barnes & Noble and AuthorHouse

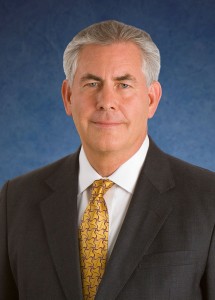

Sound Policies Needed

The U.S. government needs to adjust its energy policies to ensure that America can realize all the benefits of the new era of energy abundance, Rex W. Tillerson, chairman and chief executive of Exxon Mobil Corporation (NYSE:XOM) said.

“We need sound energy policies—policies equal to the innovation that has redefined the modern energy landscape,” Tillerson said in an address to The Economic Club of Washington. “It is time to build policies that reflect our newfound abundance—that view the future with optimism, that recognize the power of free markets to drive innovation, and that proceed with the conviction that free trade brings prosperity and progress.”

As examples, Tillerson said that Congress and the White House need to enable U.S. exports of oil and natural gas, approve the Keystone XL pipeline, and make the regulatory process less burdensome and more transparent.

“With free trade in energy and common-sense regulatory reforms, the U.S. energy industry can strengthen U.S. energy security and continue to pioneer the innovations that make possible the safe and responsible development of energy,” Tillerson said. “No one can say for sure how the industry will evolve next or where it will go—but one of the enduring lessons of our industry is that sound policy rewards wide and disciplined investments, spurs economic growth and improved environmental performance, and leads to greater peace and prosperity.”

Tillerson also hailed the recent growth in the U.S. energy sector, and its impact on the American economy, noting that while the energy sector accounts for just under seven percent of the American economy, it has accounted for about 30 percent of the nation’s economic growth since the 2008 financial crisis.

“The energy industry has been an economic engine for the entire nation at a time of recession, slow growth, and falling labor participation rates,” Tillerson said.

A major driver in the industry’s expansion, Tillerson said, has been breakthroughs in the integration of hydraulic fracturing and horizontal drilling, a renaissance that is now bringing economic benefits to all 48 states in the continental U.S. along with unanticipated environmental gains.

“Because natural gas emits up to 60 percent less carbon dioxide than other major sources when used for power generation, our abundant and reliable supplies have been instrumental in reducing our nation’s carbon dioxide emissions to levels not seen since the early 1990s,” Tillerson said.

He noted that industry has a responsibility to meet the two-pronged challenge of providing for the world’s energy needs while protecting the environment.

“The global economy will need sound economic reasoning and more sensible policies to fully leverage this moment to meet the energy and environmental challenges of the future,” said Tillerson.

Couche-Tard to Acquire 21 Stores, 151 Dealer Sites

Couche-Tard Inc. (“Couche-Tard”) (TSX:ATD.A/ATD.B) announced March 16 that it has signed through its wholly-owned indirect subsidiary, Circle K Stores Inc., and agreement with Cinco J Inc. (doing business as Johnson Oil Company), Tiger Tote Food Stores and their affiliates to acquire 21 stores, 151 dealer fuel supply agreements and five development properties. The 21 stores and development properties are located in the State of Texas whereas the 151 dealer fuel supply agreements are located in the States of Texas, Mississippi and Louisiana. The transaction is anticipated to close by the end of Couche-Tard’s first fiscal quarter which ends July 19, 2015, and is subject to standard regulatory approvals and closing conditions. The parties have signed a confidentiality agreement precluding the parties from disclosing the purchase price for this acquisition at this time. Available cash dollars will pay for the transaction.

These convenience stores operate under the store brands “The Tote” and “Tiger Tote” and offer Exxon andChevron branded motor fuels, whereas the branded dealer business offers Chevron, Shell, Texaco, Valero,Exxon and Citgo fuel brands. As a result of the transaction, Couche-Tard plans on keeping the existing fuel brands and would buy the land and buildings for 18 locations and would assume or enter into a lease for the three remaining locations. Following the acquisition, all of the stores would be operated under the Circle Kbrand by Couche-Tard’s Southwest Division.

“Subsequent to this transaction, Couche-Tard’s network in the Circle K Southwest Division would include a total of 335 company operated-stores and 67 locations under wholesale or franchise agreement. These stores occupy strategic locations within their respective trade areas. This acquisition would be a great addition to Couche-Tard’s expansion and growth plans for the Southwest Division,” commented Kelly McGuire, Vice-President Operations, Southwest Division.

Petroquest Energy Elects Not To Proceed

PetroQuest Energy, Inc. (“PetroQuest” or the “Company”) (NYSE: PQ) announced March 11 that it has elected not to proceed at this time with its previously announced public offering of 10,000,000 shares of its common stock. The Company determined that proceeding with the offering in light of current market conditions was not in the best interests of its stockholders.

This news release does not constitute an offer to sell or solicitation of an offer to buy any security, nor will there be any sale of these securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The offering may be made only by means of a prospectus supplement and related base prospectus.

Fossil Bay Announces Chairman

Fossil Bay Energy LLC, an emerging leader in portable Exhaust Gas CO2 EOR (Enhanced Oil Recovery) technologies, announced March 12 that former Valerus and Hanover Compressor co-founder Mike McGhan has joined the company as its chairman.

McGhan will help Fossil Bay exploit its exclusive U.S. license rights to certain Exhaust Gas Injection and Pressurization patents owned by Weatherford Technology Holdings by incorporating those patents into a new fleet of Exhaust Gas Processors for Enhanced Oil Recovery in pressure-depleted reservoirs.

Thousands of mature and abandoned oil reservoirs in America, that previously produced millions of barrels of oil during their primary oil recovery phases, still contain millions of barrels of stranded oil that can be recovered by Fossil Bay’s Exhaust Gas CO2 EOR equipment. These mature depleted oil reservoirs may have lost their primary gas drive but can be re-pressurized to re-mobilize and extract stranded oil.

According to Fossil Bay COO Larry Shultz, “I’ve worked with Mike McGhan over the last ten years and am proud to have him join Fossil Bay Energy’s management team, validate the profit-potential of our business plan, and do for exhaust gas compression and injection EOR what he and his previous teams at Valerus and Hanover Compressor did for wellhead, midstream, gas-processing, and pipeline natural gas compression.”

Just as horizontal drilling and multi-stage fracking unlocked the value of numerous multi-billion barrel shale gas and shale oil plays over the last five years, Fossil Bay’s modular gas injection CO2 EOR technologies promise to usher in a new era of low-cost oil production that can unlock the value of America’s multi-billion barrelstranded oil resources.

According to Mike McGhan, “With the price of oil so low, exhaust gas injection CO2 EOR represents one of the most cost-effective ways for royalty owners and oil well operators of EOR-worthy properties to increase their income, exploiting old assets they already own to produce new EOR revenues. I look forward to working with Dan and Larry to make Fossil Bay Energy a major player in this growing EOR market for exhaust gas re-pressurization equipment and services.”

Brownstein Continues Predictions

Rocky Mountain Resources CEO Chad Brownstein announced he has again correctly predicted trends in the oil market. Recent predictions that Chad Brownstein made publicly on CNBC, CNN, Bloomberg Television include:

Oil bottom prior to Jordan war

Market “War Premium”

OPEC would not alter output

Global margin call

Investors can’t price risk

Oil below $50

Rocky Mountain Resources has a proven track record of success strategizing the formation, development, and monetization of scalable natural resource enterprises. Recent comments by the company’s CEO, Chad Brownstein, on OPEC oil pricing strategies, among other prescient and public calls, have proved to be accurate, reaffirming the company’s position as one of the unique teams in the natural resource sector.

On a recent in-studio segment on Bloomberg “Market Makers,” Brownstein correctly predicted that the Middle Eastern “War Premium” would be a factor prior to Jordan’s war efforts.

Mexico Host Mexico Energy Reform Focus

Adam Veltri, partner in charge of Burleson’s Denver office, and Ken Witt, a partner in Denver, shared critical insights on land and regulatory issues arising from Mexico’s energy reform at a special event co-hosted by the firm and the Urban Land Institute—Mexico on March 25. The seminar was held at Restaurante La Hacienda de los Morales in Mexico City.

Fernando Zendejas Reyes, who oversees the legal affairs unit of Mexico’s Ministry of Energy, served as the event’s keynote speaker. The seminar featured a panel of energy experts, which included Veltri as a panelist and Witt as the moderator.

The group provided United States and Mexican perspectives on a wide range of topics, including:

The energy reform land rush

Recent regulatory developments

Land strategies and insights on handling acquisitions, negotiations for surface use, and ejidos (communal agricultural land)

Regulatory concerns related to well permitting, drilling spacing units, and conflicts between operators

“The adoption of Mexico’s energy reform is establishing a radically different framework that is reshaping the industry and expanding the opportunities available in the region,” said Witt, a seasoned corporate and securities attorney who is well versed in a number of sophisticated transactions. “But it’s also creating a lot of questions among private and foreign investors looking to tap into Mexico’s energy potential.”

Veltri, who has more than 25 years of experience in commercial transactions and corporate finance, added, “This seminar will open a dialogue on a number of important land and regulatory issues that exploration and production companies should consider. It will leave attendees with some practical tips to help them effectively manage their investments.”

Burleson has a dedicated Latin American Practice designed to deliver legal counsel to North American clients seeking to enter the Latin American market and to Latin American clients looking to expand and enhance their presence in the United States. Attorneys are bilingual, multicultural, and licensed to practice in various jurisdictions.

Although the group focuses on oil and gas law, it also counsels multinational clients on a wide range of matters related to IPOs and debt offerings, mergers and acquisitions, due diligence, corporate law, commercial transactions, litigation, tax planning, and foreign investment assistance.

SP Permian, Inc., Prices Stock

RSP Permian, Inc. (“RSP” or the “Company”) (NYSE: RSPP) announced March 17 that it has priced an underwritten public offering of 5,000,000 shares of its common stock by the Company and 4,000,000 shares of its common stock by certain of the Company’s stockholders at $25.80 per share. Total gross proceeds (before the underwriter’s discounts and commissions and estimated offering expenses) will be approximately $129.0 million to the Company and approximately $103.2 million to the selling stockholders. The Company and the selling stockholders have granted the underwriter a 30-day option to purchase up to 750,000 and 600,000 additional shares of the Company’s common stock, respectively. The offering is expected to close on March 23, 2015, subject to customary closing conditions.

The Company intends to use the net proceeds from this offering, including the proceeds from any exercise of the option to purchase additional shares of common stock, to repay all outstanding borrowings under its revolving credit facility and the balance for general corporate purposes, which may include funding its drilling and development program and future acquisitions. The Company will not receive any of the proceeds from the sale of the shares of common stock by the selling stockholders.

Barclays Capital Inc. is acting as the sole underwriter of the offering.

The offering is being made pursuant to an effective shelf registration statement filed with the Securities and Exchange Commission (the “SEC”) on March 17, 2015. The offering will be made only by means of a prospectus supplement and the accompanying prospectus, copies of which may be obtained by sending a request to: Barclays Capital Inc., c/o Broadridge Financial Solutions, 1155 Long Island Ave., Edgewood, NY 11717, by calling toll-free (888) 603-5847 or by email at barclaysprospectus@broadridge.com.

ONEOK Announces Notes Offering

ONEOK Partners, L.P. (NYSE: OKS) announced March 17 that it has priced an offering to sell $800 million of senior notes, consisting of $300 million of five-year senior notes at a coupon of 3.8 percent and $500 million of 10-year senior notes at a coupon of 4.9 percent. The notes will be issued under the partnership’s existing shelf registration statement previously filed with the Securities and Exchange Commission.

The net proceeds, after deducting underwriting discounts and commissions, are expected to be $793.8 million. ONEOK Partners expects to use the proceeds to repay amounts outstanding under its commercial paper program and for general partnership purposes.

The joint book-running managers for the offering are J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Mitsubishi UFJ Securities (USA), Inc. and U.S. Bancorp Investments, Inc. ONEOK Partners expects the notes offering to close on March 20, 2015.

This news release is neither an offer to sell nor a solicitation of an offer to buy any of these securities and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale is unlawful.

A registration statement relating to the notes was previously filed with, and became effective under the rules of, the Securities and Exchange Commission. ONEOK Partners offered the notes to the public by means of a prospectus and prospectus supplement, which are part of the registration statement.

A copy of the prospectus and prospectus supplement may be obtained by contacting the joint book-running managers as follows:

J.P. Morgan Securities LLC

383 Madison Avenue

New York, New York 10179

Attention: Investment Grade Syndicate Desk – 3rd floor

Phone: (212) 834-4533

Fax: (212) 834-6081

Deutsche Bank Securities Inc.

60 Wall Street

New York, New York 10005

Attention: Prospectus Group

Phone: (800) 503-4611

Email: prospectus.CPDG@db.com

Mitsubishi UFJ Securities (USA), Inc.

1633 Broadway, 29th Floor

New York, New York 10019

Attention: Capital Markets Group

Phone: (877) 649-6848

Fax: (646) 434-3455

U.S. Bancorp Investments, Inc.

214 N. Tryon Street, 26th Floor

Charlotte, North Carolina 28202

Attention: High Grade Syndicate

Phone: (877) 558-2607

Fax: (877) 774-3462

First Traditional VSAT Operator to Distribute Global Xpress

Inmarsat (LSE:ISAT.L), the leading provider of global mobile satellite communications services, announced March 18 the appointment of SpeedCast (ASX:SDA), a leading global network and satellite communications service provider, to its Enterprise Global Xpress (GX) Value Added Resellers (VARs) program. SpeedCast is the first GX VAR for Inmarsat Enterprise to come from the VSAT industry. Recognising the value in the GX platform and Ka-band network, which offers both fixed and mobile satellite services on a global basis, GX will bring a unique offering to SpeedCast’s customers in media, mining, oil and gas and NGOs, as well as corporate multinationals.

Rash Jhanjee, Head of GX Business Development and Strategy, Inmarsat Enterprise said, “We are extremely excited about this signing with SpeedCast, who have a wealth of knowledge and expertise in deploying satellite communications solutions across a broad range of Enterprise customers. This appointment further endorses Inmarsat’s entry into the VSAT market and reflects how our global Ka-band network is attracting leading operators from the VSAT industry.”

Under this agreement, SpeedCast will now be able to expand their existing satellite service portfolio with the addition of GX, with its unique platform and capabilities, to bring new service options to their customers. With the first GX satellite commercially available, they look to immediately expand their product offerings for their customer base in geographies such as Europe, Africa, Middle East, and Asia.

“We are delighted to be appointed as a Global Xpress Value Added Reseller with the Enterprise business unit, which further solidifies our strong partnership with Inmarsat” said Andrew Burdall, VP of Strategic Business Development of SpeedCast. “Global Xpress is a perfect fit for media organizations that need to stream live video, NGOs supporting critical missions in remote areas, as well as energy companies that require higher bandwidth for business applications from their remote sites. Inmarsat’s portfolio of satcom solutions, including the Global Xpress service, is a valuable addition to our comprehensive suite of satellite solutions.”

GCC Oilfield Auxiliary Rental Equipment Market Reach $35 Billion

According to a new report by Allied Market Research, titled “GCC Oilfield Auxiliary Rental Equipment Market,” the GCC oilfield auxiliary rental equipment market is forecast to reach $35 Billion by 2020, growing at a CAGR of 9.4 percent during the period 2014 – 2020. The market would primarily be driven by an increased demand of energy sources and the need of cost optimization.

Oilfield auxiliary equipment are machines and instruments that are used to supplement the drilling process at oilfields. The auxiliary equipment consist of sewage systems, mud labs, lighting system, distribution panels, storage tanks, debris junk catchers, transportation system, heat exchangers, flaring systems, drilling instruments, and others.

To view the report, visit the website at http://www.alliedmarketresearch.com/auxiliary-rental-equipment-market

The oilfield auxiliary equipment industry in GCC countries, has witnessed tremendous growth in the past based on the rise in oil production. With a steep decline in the oil prices, the revenue derived from oil industry is anticipated to reduce notably. In such a scenario, the auxiliary oil equipment rental market is expected to receive a boost, as investors would tend to avoid huge long-term investments in infrastructure and oilfield machinery. Thus, the drop in oil prices would act as a driver for the auxiliary rental equipment market. Additionally, many oil-producing companies prefer renting auxiliary equipment for fulfilling their temporary or permanent operations.

Within the GCC region, Saudi Arabia is expected to be highest revenue-generating country for the oilfield auxiliary rental equipment market, valued at USD 11.08 billion in 2014. With a rise in the oil production since the past few years, the Saudi Arabian oilfield auxiliary rental equipment market has witnessed a notable growth and is expected to demonstrate a similar trend in the future. Bahrain would be the fastest growing market for the analysis period. Growth in Bahrain is supplemented by rapidly maturing oil fields due to years of extraction.

View all reports related to Energy and Power at http://www.alliedmarketresearch.com/energy-and-power-market-report

Key findings of the study:

The oil and gas division contributes to approximately 73 percent of the total export earnings for the GCC region.

Saudi Arabia is the largest revenue generating country which is expected to attain a market value of USD 16.92 billion by 2020, growing at a CAGR of 7.3% during 2014-2020.

Bahrain would be the fastest growing market with an expected revenue of USD 45.5 million by 2020, growing at a CAGR of 26.7% during the forecast period.

QATAR—The oil and gas sector accounts for approximately 55 percent of the country’s total GDP (Gross Domestic Product). Numerous international oil companies such as Shell, ExxonMobil, Total, and others have largely invested resources, technology and expertise in various oil projects across the country.

In order to understand the key trends in the market, leading players are profiled in the report which include Schlumberger, Weatherford International Inc., The Olayan Group, Key Energy Services Inc. and others. Numerous International Oil Companies (IOC) such as Occidental Petroleum, Total, Shell, BP, Partex, KoGas, Respol and CNPC have marked a presence in this region. These companies are in the process of facilitating expansions and increasing their capital investments with an objective to capture a large market share.

Big Data and Analytics

In order to improve longevity of production, oil and gas firms are rapidly adopting solutions that seamlessly collect, integrate, analyze and visualize data flows from assets, equipment, process systems, and personnel in critical upstream operations. The numerous accessibility and visibility benefits that can be achieved from a single application provide a clear business case for adoption of big data and analytics platforms. For example, collation of drilling data using intelligent sensors downhole improves production rates, increases the lifespan of the drill, and reduces maintenance.

New analysis from Frost & Sullivan, Emerging Upstarts and Market Transitions in the Global Digital Oilfield Data Management Market, finds that analytics is the fastest growing segment as end users look to derive additional value from connected devices. Using its Competitive Advantage and Market Positioning (CAMP) tool, Frost & Sullivan predicts that Ayasdi, Inc., Ayata, Datawatch, Flutura, Karmasphere Inc., Mtell, Neudesic LLC, Pivotal Software, Inc, Predikto, RapidMiner, Skytree, Inc., and TempoIQ are the top companies to watch.

For complimentary access to more information on this research, visit: http://bit.ly/NF08-10.

“Challenges such as increased data traffic and data types from diverse assets onsite, changing reservoir dynamics that dampen recovery rates, equipment failures, production inefficiencies and high maintenance, repair and operational costs have created a push towards big data and analytics in upstream operations,” said Frost & Sullivan Industrial Automation and Process Control Senior Research Analyst Rahul Vijayaraghavan. “Post data capturing and sorting, end users can use application specific analytical platforms to extract actionable insights and validate key performance metrics, a growing requirement in today’s competitive and price sensitive environment.”

The shift from diagnostic to predictive analytics and more recently to prescriptive analytics, which identify impact on surrounding environments, has further resulted in an influx of niche solution providers offering state-of-the-art analytical platforms. High costs incurred from operational downtimes and the extra manpower required for repairs will continue pushing end users towards adoption of best-in-class predictive and preventive analytical platforms.

For instance, predicting failure of electric submersible pumps deployed in oil wells and subject to high temperatures can reduce maintenance costs significantly. While traditional methods employ periodic maintenance inspections, current analytical platforms collate vital pump data and use statistical models to predict the likelihood of failure more quickly.

“Niche solution providers continue improving their product portfolios, offering secure cloud-based, open source frameworks for data storage, agnostic data connectors for data integration, proactive and prescriptive approaches for data analytics, and intuitive dashboards for data visualization,” noted Vijayaraghavan. “Strategic partnerships with information management giants dominating the market will further enable vendors to provide a holistic solution to take on a wider spectrum of oil and gas applications.”

Emerging Upstarts and Market Transitions in the Global Digital Oilfield Data Management Market is a Market Insight that is part of the Industrial Automation & Process Control Growth Partnership Service program. The study provides a competitive assessment of Big Data and analytic solutions used in the upstream oil and gas industry. The study covers key market, technology, and competitor dynamics, detailed CAMP analysis, company assessment of niche solution providers, and trends by product type (data storage, integration, analytics and visualization).

Great Plains Well Logging, Inc. Selects Paradigm Geolog

Paradigm (www.pdgm.com) announced Feb. 23 that Great Plains Well Logging, Inc., has selected the Paradigm Geolog formation evaluation software suite as its corporate standard for petrophysical analysis, replacing a competitive software package. Use of Geolog will help the company offer its customers faster and more reliable petrophysical analysis results on any size of projects.

“We are one of the most active mud logging companies providing formation evaluation on new emerging horizontal plays,” said Nikolaus Svihlik, geoscience manager for Great Plains. “With Geolog’s clear technological superiority, we can grow our business and enhance our services with confidence in any area of the country, as new plays emerge.”

Paradigm Geolog offers advanced petrophysical and geological analysis tools, well data management, superior graphics, and robust data integration. Recognized as the industry standard for petrophysical software, Geolog enables easy and scalable visualization and interpretation of all borehole related data.

“We are very pleased that Great Plains Well Logging has chosen Geolog as its formation evaluation and petrophysical analysis solution,” said Michael Beaver, regional vice president of North America for Paradigm. “Armed with the accurate results enabled through the use of Geolog, Great Plains can help its clients reduce uncertainty and further its goal of growing its presence as a nationwide geological service company.”

For more information on Paradigm products and services, visit www.pdgm.com, or e-mail info@pdgm.com.

Community College Enrollment Among Vets Soars

An unprecedented demand for middle-skills jobs in the petrochemical industry has veterans flocking to community colleges along the Texas Gulf Coast where companies are rolling out the welcome mat for graduates with jobs starting at $30 an hour.

At Lee College in Baytown, located 25 miles east of downtown Houston, veterans have doubled their ranks in the last three years. As a result, the two-year college has opened a new Veterans Center, staffed by veterans and open daily, to help transition students from the armed forces to civilian life and a good-paying job with guidance on housing, course selection, financial aid, and other services.

“Companies in the area, particularly those in petrochemical, want to hire veterans who come through our two-year program,” notes Ehab Mustafa, head of the Lee College Veterans Center. “Through their military service, they’ve been trained to be disciplined, reliable, and understand the importance of safety.”

In the Gulf Coast region, middle-skills jobs requiring more than a high school education but less than a four-year degree account for roughly two thirds of the estimated 59,000 employees working in the petrochemical industry. High-demand, good-paying jobs also are available in information technology, finance and healthcare. Nationwide, three out of four nurses attended a community college.

“Returning veterans just feel better about talking to someone who understands their needs, that’s why we staffed the center with veterans,” notes Lee College President Dr. Dennis Brown.

“Community colleges also are developing programs which allow veterans who work full or part time to manage a community college education as a full-time student, thereby ensuring a faster-transition into good-paying careers,” Brown adds.

At Lee College, a Weekend College program will be introduced this fall where students can choose from one of four degree programs with courses presented using a hybrid approach combining online instruction with in-person, block-schedule classes on Friday evenings and all-day Saturday. A dedicated completion coach provided by the college will ensure students are on track to complete their courses.

Lee College, which services approximately 6,000 students per year, projects the Weekend College will double its graduation rate within three years. The campus offers more than 50 associate degree and certification programs for a variety of sought-after careers.

To learn more about opportunities for veterans at Lee College, go to www.lee.edu/veterans.

ALERT: California Gas Prices Up More Than 50 Cents

Consumer Watchdog said Feb. 23 that the retail price per gallon of gas in California had soared 53 cents from February 2 through Feb. 23, when Tesoro began shutting down its refinery in Martinez. A regular gallon of California gasoline now costs an average of $2.96 a gallon.

Consumer Watchdog has twice written state officials, calling for them to investigate artificial price manipulation—once after the Martinez shutdown, and once after an explosion and fire damaged Exxon’s Torrance refinery on Feb. 18. The group has not yet heard back.

“It’s clearly time for lawmakers to hold refineries accountable through public hearings,” said Consumer Advocate Liza Tucker.

The shutdown of Tesoro’s Martinez facility, paired with the Exxon Torrance blast, affects 16.5 percent of California’s refinery capacity.

For the letters, see: http://www.consumerwatchdog.org/resources/refineryletterfeb18.pdfhttp://www.consumerwatchdog.org/resources/steelworkersstriketesoroltr.pdf

As soon as steelworkers began to strike, Tesoro announced it would shut down its Martinez facility completely rather than leave it partially running for routine maintenance and gas prices began to soar in a straight line. That line spiked sharply again right after the Torrance explosion.

The price of gas tracks the price of crude oil. Crude has risen from a low of $45 a barrel at the end of January to $50 a barrel today. But the price of regular gas in California has risen more steeply than in the rest of the United States where an average gallon of gas costs about $2.31 a gallon.

“The state needs to ensure that refineries, making almost all our gas due to our special more environmentally-friendly blend, don’t take advantage of consumers,” said Tucker. “They have every reason to try to raise gas prices by restricting supply and capitalizing on windfall profits while they can.”

In its December report, Pump Jacking California’s Climate Protection, Consumer Watchdog warned that oil companies might artificially cut back on gasoline production and inflate gasoline prices to undermine new rules to control greenhouse gas emissions. The report can be viewed here: http://www.consumerwatchdog.org/resources/OilIndustryManipulationReport.pdf

Consumers Remain Price Sensitive

Even with gas prices near six-year lows, U.S. consumers are still looking for the best gas prices. Three in five (63 percent) consumers say they would drive five minutes out of their way to save 5 cents per gallon. An even greater percentage (72 percent) would pay by cash if they could save five cents per gallon, according to the results of a new consumer survey released Feb. 2 by the National Association of Convenience Stores (NACS).

Nearly three in four consumers (71 percent) say the price is the most important factor in determining where they buy gas. Also, consumers are increasingly seeking out discounts for their gas purchases: Two in three (65 percent) say that they have taken advantage of a discount, such as using a loyalty card or paying by cash to save money buying gas.

“It doesn’t matter whether gas prices are $4.00 or $2.00 per gallon, consumers still want to find the best price possible,” said Jeff Lenard, NACS vice president of strategic industry initiatives. “Retailers are constantly fighting to attract price-sensitive drivers to their stores, especially given that 35 percent of gas customers say that they also go inside the store after fueling.”

While consumers continue to seek out the best price for their gas, they are driving more because of lower gas prices. Overall, 95 percent of consumers say that low prices make it easier for Americans to go on vacation, and one in five (20 percent) say that they are driving more because of lower gas prices.

They also are less likely to seek out alternatives to driving. As a reflection of lower gas prices, consumers say that gas prices would have to increase by $1.53 per gallon before they would try to reduce the amount that they drive. This is the largest gap between current prices and the price at which consumers would change driving behavior in any NACS consumer survey.

Consumers overwhelmingly say that low gas prices are good for the U.S. economy (91 percent agree), but they expect that prices will increase, with two in three (67 percent) agreeing that gas prices increase in the spring. And they predict that prices will be $2.95 on January 1, 2016.

The survey results were released as part of the 2015 NACS Retail Fuels Report (www.nacsonline.com/gasprices), which examines conditions and trends that could impact gasoline prices. The online resource is annually published to help demystify the retail fueling industry by exploring, among other topics, how fuel is sold, how prices affect consumer sentiment, why prices historically increase in the spring, and which new fuels are likely to gain traction in the marketplace.

NACS, which represents the convenience store industry that sells 80 percent of the gas sold in the country, conducts the monthly consumer sentiment survey to gauge how gas prices affect broader economic trends. The NACS survey was conducted by Penn, Schoen and Berland Associates LLC; 1,108 gas consumers were surveyed January 6-8, 2015.

Founded in 1961 as the National Association of Convenience Stores, NACS (nacsonline.com) is the international association for convenience and fuel retailing. The U.S. convenience store industry, with more than 152,000 stores across the country, posted $696 billion in total sales in 2013, of which $491 billion were motor fuels sales. NACS has 2,100 retail and 1,600 supplier member companies, which do business in nearly 50 countries.