In this month’s miscellany of truncated articles, innovation, influence, and even intrigue are the ingredients of an informative mix. These are the full versions of the “Drilling Deeper” news items that appeared as abbreviated versions in the print edition of PBOG’s January 2016 issue.

Bakken, Eagle Ford Stay Flat

Oil production from key shale formations in North Dakota and Texas remained relatively flat in October versus September, according to Platts Bentek, an analytics and forecasting unit of Platts, a leading global provider of energy, petrochemicals, metals, and agriculture information.

Oil production from the Eagle Ford shale basin in Texas continued a flat streak in October, increasing only 6000 barrels per day (b/d), or less than one percent, versus the previous month, the latest analysis showed. The Eagle Ford basin demonstrated production growth, albeit minimal, for the fourth consecutive month. Similarly, crude oil production in the Northeast Dakota section of the Bakken shale formation of the Williston Basin grew less than one percent month-on-month in October, marking a second flat month of production, following a period of slight decline during the summer.

The average oil production from the South Texas, Eagle Ford basin in October was 1.5 million barrels per day. On a year-over-year basis, that is up close to 65,000 incremental barrels per day, or about five percent higher than October 2014, according to Sami Yahya, Bentek energy analyst. The average crude oil production from the North Dakota section of the Bakken in October was 1.2 million b/d, or about 13,000 b/d from year ago levels.

“In this challenging pricing environment, producers are doing whatever they can to stay afloat,” said Yahya. “Reducing the number of days to drill a well and/or figuring out ways to bring down completions costs has been on everyone’s agenda most of this year. But some producers are starting to target other formations within a basin to bring costs down or to hold acreage by production.”

For example, said Yahya, in the Eagle Ford, the production boom traditionally targeted the Austin Chalk and Upper Eagle Ford, before the Lower Eagle Ford was developed and yielded much better returns. “However, with diminishing rates of return, some producers are going back and targeting the Austin Chalk and Upper Eagle Ford again, where it is shallower and cheaper to drill.”

The latest analysis from Platts Bentek noted another advantage of drilling in the Austin Chalk or Upper Eagle Ford is to hold acreage. Some acreage leases require producers to produce within a set period of time or the lease would expire. With capital expenditures cuts increasing, some producers are left with little budget to continue drilling and producing from their best acreage in the Lower Eagle Ford. Focusing on the shallower formations gives them the opportunity to continue production while keeping the status of the lease active.

“Much like the Eagle Ford, producers in the Bakken shale are also consistently looking to reduce costs to hold production steady,” said Yahya. “In September 2014, 77 percent of the total wells drilled in the basin were drilled in the core counties (McKenzie, Dunn, Williams and Mountrail) and that metric has since risen to 92 percent in October 2015. Beginning in September 2015, producers have taken this process a step further and are migrating within the core. The number of wells drilled in Dunn and McKenzie counties rose 20 percent for the same time period. Conversely, the number of wells drilled in Mountrail and Williams counties declined 20 percent.”

Bentek analysis shows that from October 2014 to October 2015, total U.S. crude oil production has increased by about 320,000 b/d.

Eagle Ford prices have also steadied with the October average at $47.12 per barrel (/b), a marginal two percent decrease from the January average, noted Luciano Battistini, Platts managing editor of Americas crude.

“Prices for Eagle Ford crude were pretty stable for October, similar to what we saw last month,” Battistini said. “However, the Louisiana Light Sweet (LLS) discount to Brent averaged $2/b, compared to just a penny in October and that theoretically should have helped condensate exports out of the U.S. Gulf Coast.”

Eagle Ford crossed the $52/b mark on July 23 and has continued to slide, said Battistini. “Bakken prices at the Williston basin, received some support from the Enbridge Line 9 reversal, rising 11 percent in October when compared to January.”

The Platts Eagle Ford Marker, a daily price assessment launched in October 2012 and reflecting the value of oil out of the Eagle Ford Shale formation in South Texas, has decreased held steady between January and October, with an average price of $54.02/b for the first 10 months of 2015. But it is down 45 percent from year-ago levels. The marker has ranged between $41.42/b and $66.23/b since the beginning of this year.

The price of oil out of the Bakken formation at Williston, North Dakota, was up 11 percent between January and October, with an average price of $46.85/b for the first 10 months of 2015, according to the Platts Bakken assessment. Platts Bakken, however, is down 40 percent when compared to last year’s corresponding month. The wellhead assessment has ranged between $33.35/b and $59.32/b since the beginning of January.

The Platts Bakken, introduced April 22, 2014, is a daily assessment of price for oil closest to the wellhead prior to determination of transportation by rail or pipe. The assessment reflects a sulfur content of 0.2 percent or less and an American Petroleum Institute (API)** gravity of 42 or less, similar to the nature of North Dakota Light Sweet crude. The Platts Eagle Ford Marker reflects the value of a median 47-API Eagle Ford crude barrel, based on the crude’s product yields and Platts product price assessments, adjusted for U.S. Gulf Coast logistics.

Platts introduced the world’s first independent daily price reference valuing crude oil produced from a shale formation in May 2010 when it began assessing Bakken Blend shale oil injected into pipelines at Clearbrook, Minn., and Guernsey, Wyo.

For more information on Platts price assessments methodology visit these links: Details of Platts Bakken and Platts Eagle Ford Marker. Platts Bentek’s shale oil production figures are derived from proprietary data models using publicly available data. For more information on data models, reports or Platts Bentek’s methodology, please contact info@plattsbentek.com.

* The Bakken formation spans North and South Dakota, Montana, Saskatchewan, Manitoba and Alberta.

** API gravity is a measure of how heavy or light a grade of crude oil is compared to water.

API and Climate Talks

On Nov. 16, API urged leaders to use the proven results of America’s market-driven model for addressing climate challenges during an upcoming conference in Paris.

“America’s private sector has already taken the lead on reducing greenhouse gas emissions, even as we increase economic activity and domestic energy production to keep energy reliable and affordable for consumers,” said API President and CEO Jack Gerard during a conference call Monday with reporters. “Our success is driven not by government mandate or legislative fiat, but through innovation, investment, and entrepreneurial spirit.”

Gerard shared a new analysis by API, which demonstrates how the United States has become the world leader in reducing carbon dioxide emissions. He also cited EPA data showing that methane emissions are plummeting, with the largest reductions coming from hydraulically fractured natural gas wells.

“The fact is that the nation’s 21st century energy renaissance, which has made domestically produced natural gas cheap and abundant, has helped us achieve substantial and sustained emissions reductions without command and control style regulatory intervention,” said Gerard. “By contrast, the administration continues to hew to last century’s thinking that increased energy production and achieving climate goals are mutually exclusive, pursuing costly government mandates to detriment of the American consumer and our economy.

“Where other nations have pledges, we have progress and results. America’s market-driven success should be the model for the Paris conference. As the President and his advisers work on a climate deal, they should keep consumers and our economy at the forefront.”

API is the only national trade association representing all facets of the oil and natural gas industry, which supports 9.8 million U.S. jobs and 8 percent of the U.S. economy. API’s more than 625 members include large integrated companies, as well as exploration and production, refining, marketing, pipeline, and marine businesses, and service and supply firms. They provide most of the nation’s energy and are backed by a growing grassroots movement of more than 25 million Americans.

RRC Calls for Stronger Border

Railroad Commissioner David Porter renewed his call for a stronger commitment from the Obama Administration and Department of Homeland Security to protect Texas’ critical infrastructure through securing the border. Chairman Porter expressed the urgency of such action in a letter to U.S. Secretary of Homeland Security Jeh Johnson.

“It’s been more than a year since I first asked the Department of Homeland Security to take the threat of a terrorist attack against our critical infrastructure seriously, and we are still in the same position,” said Porter, who is now the Chairman of the state’s chief energy regulator. “In light of the Paris attacks, I am compelled to reiterate concerns I have vocalized about the security of our energy industry, which is the backbone of the Texas economy.”

Chairman Porter first registered his concerns last year to the Homeland Security Agency’s office of Customs and Border Protection about the failure of the federal government to secure the U.S. border, and how that failure endangers Texas’ critical energy infrastructure. More than 425,000 miles of pipeline are in place to carry our state’s oil and gas to market, and a significant portion of this infrastructure is in the Eagle Ford Shale in South Texas, which remains vulnerable due to its proximity to the unsecured border.

Chairman Porter cited recent attacks by ISIS against oil and gas pipelines and facilities as a modus operandi that they may use against one of Texas’ most abundant and valuable economic resources. In his letter, Chairman Porter pointed to one ISIS coordinated attack on three continents, which included a natural gas plant in France that left one employee decapitated. Other accounts include reports from Egypt where radicals attacked their own country’s energy infrastructure to destabilize the government. Another included Yemeni terrorists attacking major oil pipelines as a tactic in their war against the West. The Yemeni oil minister said that these attacks cost their country nearly $1 billion in lost revenue in 2012.

“In light of these facts, I would encourage you to pressure the White House and instruct Customs and Border Protection to take these concerns seriously, instead of waiting until it is too late. My office is at your disposal to provide advice and counsel, so we can take this issue head on, and ensure that our people and infrastructure are protected from any and all nefarious groups,” said Chairman Porter.

The RRC is the chief energy regulator for the state of Texas, having primary regulatory jurisdiction over the oil and natural gas industry, as well as pipelines, natural gas utilities, the propane industry, and coal and uranium surface mining operations. The agency works to ensure fair and consistent energy regulation in Texas so businesses can safely, efficiently, and economically produce the energy that is needed to power Texans and the Texas economy.

Industrial IoT for Directional Drilling

Headquartered in Calgary, Alberta, Ammolite RT provides performance drilling solutions for oil and gas customers using Industrial IoT technology. By connecting WITS based field devices with the DeviceLynk application, Ammolite is able to centrally monitor all aspects of the drilling process in real-time.

“The first generation of the Ammolite service powered by DeviceLynk allows us to collect, view, log, analyze and report on data received from any WITS device onsite,” said Dave Smith, technology director for Ammolite. “That enables our experienced staff to provide real-time drilling guidance without having to be at the location.”

Ammolite’s unique approach employs a 24/7 Drilling Operations Support Center that is operated and manned by experienced drilling personnel who are trained to analyze live drilling data. These senior technicians offer technical and troubleshooting support for any type of drilling application.

This groundbreaking “expertise as a service” approach enables Ammolite to offer services ranging from auxiliary operational support for fully manned drilling operations, to actively managing and directing reduced personnel operations.

DeviceLynk Certified Hardware is placed onsite at the drilling rig, linking the real-time telemetry data to the DeviceLynk application, where staff at Ammolite’s Operations Support Center view drilling information provided in context to the real-world functional limitations of the equipment being utilized onsite by the operation.

This at-a-glance perspective allows Ammolite personnel to make informed adjustments to specific drilling parameters that improve operational performance and immediately identifies when equipment is being operated outside of recommended limits, reducing downtime due to equipment failures and unplanned maintenance.

“The Industrial IoT technology delivered by DeviceLynk enables us to skip custom development and get to market 12-18 months ahead of schedule. For us and our customers, that’s immediate value,” said Ross Dahl, managing director at Ammolite.

“Our partnership with Ammolite shows the truly innovative solutions that are capable with Industrial IoT technology. The ability of DeviceLynk to deliver ‘Actionable Information’ from remote field equipment, combined with the deep industry knowledge and years of field experience from Ammolite personnel, enable this solution to deliver real value for the oil and gas industry–which is particularly relevant in this down economy,” said Adam Strynadka, managing director at DeviceLynk.

About Ammolite Resource Technologies: Ammolite is an experienced team focused on bringing innovation and integration products to the Oil & Gas Industry. Tools to manage and control the different aspects and services involved in drilling for oil and gas. Real-time engagement with the operations at hand, and the ability to oversee multi-rig projects. Specializing in Directional Drilling we show our value in real data, real time, real decisions (www.ammolitert.com).

About DeviceLynk: DeviceLynk is an Industrial IoT solution focused on transforming raw equipment data into actionable information. Through technology partnerships, DeviceLynk combines cloud capabilities, software agents, and certified hardware to empower users with informative dashboards, reporting, and alerts. Jumpstart your IoT Strategy and extend the life of your existing assets with DeviceLynk (www.devicelynk.com).

Real-Time Answers in the Field

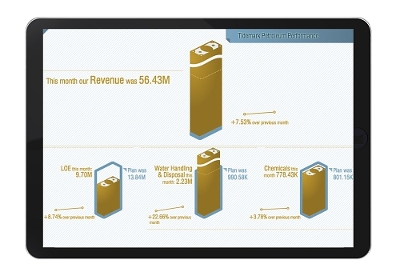

On Nov. 5, Tidemark, maker of modern cloud business planning and enterprise analytics apps, introduced new packaged processes designed to help energy companies of all varieties manage performance across all parts of the business—from headquarters, throughout the supply chain, and into the field—in real-time.

With fluctuations several times a day in site conditions, weather, logistics, gas prices, operating costs, and financial capital, renewable energy, along with oil and gas companies, are moving away from the rigid systems of the past, turning to modern applications that can turn complex data sets into actionable insights that employees at all levels can understand and rely on to drive better outcomes. Whether at headquarters, in a remote location, or on a commute, employees can now access the new Tidemark Planning and Analytics for Energy for all of their performance-related data to build what-if scenarios, develop or adjusts plans in real-time, and predict forecasts.

“For EPM to travel beyond the world of finance and into lines of business, it is critical that it provide easily accessibility, engage all kinds of users and help them contribute meaningfully to organizational goals from their perspective. Achieving those objectives requires having product design in front of technology,” said Surya Mukherjee, Senior Analyst, Ovum Research. “Tidemark uses its cloud only model to further user engagement, offering multiple ways to consume, collaborate, and turn content into actionable insights.”

Built on its modern cloud, unbound by rigid constraints from cubes, Tidemark leverages the power of the SPARK computation services, enabling both financial and operational users to find answers to virtually any question and act on them in the context of financial and operational performance. Designed with guidance and input from Tidemark’s portfolio of energy customers, the new packaged processes include pre-configured, industry-specific measurements that look at emission rates, unit-level and process-level optimization, LOS (lease operating statement), LOE (lease operating expense), BOE (barrels of oil equivalent) metrics and more. With no customization needed, energy companies who turn to Tidemark can get up and running live within 90 days so they can equip managers and field workers alike to immediately understand the financial implications of every operational decision.

With the new Tidemark Planning and Analytics for Energy, executives, managers and foremen can:

- Input or adjust information into Tidemark from virtually any device and instantly see the impact it will have on current and future financial and operational metrics in the field

- Leverage predictive modeling and forecasting to see where to hire and retain, what skills to improve, and how wage and merit changes impact business performance

- Generate a solid audit trail no matter what action is taken or on which device

- Bring more supervisors and foremen into the FP&A process with a self-service environment and empower quick time-to-action on P&L statements and clarifications

- Easily and pro-actively review budgets to understand where money is being allocated and whether or not it aligns with goals

- Adjust, model, and predict budgets as external factors change

- Manage and analyze payroll expenses and budgets

ENGIE Group, Laredo Petroleum Source Answers and Results From Tidemark

ENGIE Group is a multinational corporation and an expert operator in the three key sectors of electricity, natural gas, and energy services. The global company relies on Tidemark to capture large amounts of data from multiple levels throughout its organization—from operations, finance, human resources, marketing, and sales—into one environment, automatically structuring the information into context for the 152,900 employees on five continents and in 70 countries for the number one independent power producer in the world. Regardless of location, all employees now operate under the same set of numbers, collaborating across different business units as they make decisions that drive the performance of their customers and their own organization.

The use of Tidemark is also transforming planning and forecasting at oil and gas supplier, Laredo Petroleum, which operates over 1,000 wells on more than 150,000 acres in the Permian Basin of West Texas. Before implementing Tidemark, Laredo Petroleum supervisors and foremen had to wait up to two weeks to learn how much revenue a particular rig was producing or whether it made financial sense to continue or stop drilling on a site. Today, managers and field personnel alike can access Tidemark’s modern-cloud, mobile-first platform to get answers to those questions immediately, enabling them to save expenses by taking the right actions sooner.

“Tidemark is a great illustration of the strength of the cloud-first model with a provider that specializes in a specific area,” said Lars Crotwell, vice president and CIO of Laredo Petroleum. “The platform has really potent and powerful innovations, like Business Initiative Planning, that will further our ability to forecast more accurately.”

“Tidemark Planning and Analytics for Energy demonstrates how we’re able to apply our unique, modern cloud architecture to recognized processes in a particular industry so companies that can’t afford to wait on time-consuming customizations can see much faster time-to-value,” said Christian Gheorghe, founder and CEO of Tidemark. “We’re grateful to have collaborative customers like Laredo, Veolia Environnement, ENGIE and others who chose to partner with us to not only improve their own operational excellence, but also bring forward-looking practices to an entire industry needing change and transformation.”

With the transformation of global energy supply taking place, upstream energy, oil and gas companies face a diverse range of challenges. Successful transformation requires resource optimization, operational flexibility, and accelerated performance. Available to help immediately, Tidemark Planning and Analytics for Energy builds on the company’s award-winning series of packaged processes introduced with its customers, adding to Tidemark’s collection of specialized offerings for higher-education, hospitality, insurance, retail and recurring revenue business.

About Tidemark: Tidemark is a new breed of enterprise performance management (EPM) software with its modern cloud and mobile-first design. Innovative brands like Netflix, ENGIE Group, Valspar, La Quinta Holdings, AAA, Brown University, and HubSpot rely on the Tidemark platform and advanced analytics cloud to sharpen decision-making, reduce risk and improve business performance. Using Tidemark’s unique, intuitive apps, decision-makers across the organization gain access to valuable data, deep analytics capabilities, real-time collaboration, and actionable visualizations from any device. Tidemark has offices throughout North America and Europe and is funded by Greylock Partners, Andreessen Horowitz, Redpoint Ventures, Tenaya Capital, Silicon Valley Bank and Workday. To learn more about Tidemark, please visit www.tidemark.com or follow us on Twitter (@TidemarkEPM).

Four Ways You Pay for Training

By Evan Hackel

Every company pays for training. You can either pay for it up front or you pay for it through poor results at many times the cost of doing it right. People don’t think about it this way, but maybe they should. Let me tell you a story about a company where a lack of training was costing $1.68 million a year.

There was once a chain of nine floor-covering stores that was doing $12 million in annual sales. They had an overall goal to increase profits, which were sitting at an average profit margin on products sold of 34 percent.

Knowing that they could improve their margin if they focused on training and raised pricing, they trained salespeople to use sales tools and helped customers understand the true value the company offered. They focused on solving customer problems by concentrating more on the customer’s needs and helping them find the right products. By demonstrating value and being better in assisting customers meet their needs, they increased margin and sales.

As a result, the company increased their margin from 34 percent to 48 percent—a 14 percent improvement. In that $12 million company, the result was a $1.68 million increase in gross profit dollars plus increased sales. The improvement in profit was demonstrable. The reality is that the true differentiator was the training. If they’d simply changed out the merchandising without doing the training, it would have had a much smaller impact.

Another way to look at it is that for years, a failure to train was costing that company $1.68 million a year in gross profit. The cost of training for this company was in essence $1.68 million per year, because they didn’t spend any money on training. You see, every company pays for training. You can either pay for it up front or you pay for it through poor results at many times the cost of doing it right.

Are you too paying for training without knowing it? Let’s take a close look at just how that could be happening to you.

Lost Opportunity: You Can Train Staff to Close More Sales

Let’s say that your staff should be closing 40 percent of sales, but currently they are only closing 30 percent. That means you are losing 25 percent of potential sales; if your company is doing $10 million in annual sales, you are losing $3,333,333 in sales.

With training, increasing a close rate from 30 percent to 40 percent is a reasonable expectation. It can mean training staff how to be more polite, listen better, present products more effectively—and ask for the order. It is very, very doable. And if you are not doing it, you are paying for training without even realizing it.

Which is more costly, losing $3 million in sales or investing in training?

Lost Opportunity: You Can Train to Improve Employee Retention

Losing employees is costly. According to a study by the Center for American Progress, the cost of replacing a worker who earns between $30,000 and $50,000 a year is 20 percent of annual salary, or about $10,000. (If you’re losing employees who earn more than $50,000, replacing each of them will cost you even more.)

Let’s assume that you have 250 employees and that your annual turnover rate is 30 percent. So you’re losing 75 employees a year and spending $750,000 to replace them.

(You’ll also be losing money by paying unemployment benefits, losing sales during the time their jobs are not covered, and more, but let’s not figure that in.)

What if you did a better job of training employees and cut your turnover rate by 5 percent, from 30 percent to 25 percent? That is also very doable. That 5 percent improvement will pay you back more than you expect. If you have 250 employees, you will be losing only about 60 workers a year, not 70, a saving of about $100,000 a year.

Incidentally, the link between training and retention is well documented. Well-trained employees are happier and therefore less likely to leave. And because they do their jobs better, you will have to fire and replace fewer of them.

Which is cheaper—having a high turnover rate that costs you $100,000 a year, or investing in training?

Lost Opportunity: You Can Train Salespeople to Sell Just a Little More on the Average Ticket

Let’s assume that your average customer spends $25 on each visit to one of your locations. Through training, you can increase that average ticket to $28. Your staff can learn to refer customers to other products, upsell, and apply other simple strategies.

Let’s further assume that you have 400,000 customer transactions a year. If you can train your salespeople to increase ticket size from $25 to $28, you will increase annual sales from $10 million to $11,200,000.

Which is cheaper, losing a $1,200,000 in sales or investing in training?

Lost Opportunity: You Can Train to Improve Customer Retention

If your company does that same $10 million in annual sales and your customer retention rate drops five percentage points, which means you have lost $500,000 in sales. Yet the right kind of training in areas likes sales and customer service has been shown to retain many more customers. Again, it is “doable.” And the result can be a big improvement in profitability.

Which is cheaper, losing $500,000 worth of customers a year or training?

Let’s Review

You pay for training, one way or another. Every company pays for training. You can either pay for it up front or you pay for it through poor results at many times the cost of doing it right.

Your company results are affected by the quality of the training your company provides. Investing in training upfront is going to provide you a 10x or greater return on your dollar.

Additionally, training is the safest investment you can make. If you spend more money in advertising, it may or may not be effective in bringing customers to your business. Training is about improving results with the customers you already have coming to your business.

Question: every business is different, how much is poor training costing you? How could investing in training upfront improve your profits?

ABOUT THE AUTHOR:

Evan Hackel is the CEO of Tortal Training, an executive coach, speaker and author of Ingaging Leadership: A New Approach to Leading that Builds Excellence and Organizational Success. Tortal Training specializes in developing interactive eLearning solutions to make effective training easier by specializing in engagement. As CEO, Evan promotes the Ingagement philosophy, which has helped countless organizations create a culture of partnership and common purpose to drive success. For more information on Evan Hackel please visit www.Tortal.net.

Economy at the Point of No Return?

If they had known better, they would have done better. –Maya Angelou

“All of the decisions that we make in life, good and bad, are influenced by our past. There are reasons for our actions,” says author Quentin Brent. “When we don’t judge people by their actions alone, and strive to understand the reasons behind them, then we can understand them.”

Brent’s new financial thriller, The Reason: It’s About More Than Just Money (October 26, 2015), is reality fiction inspired by the 2008 Great Recession. Brent examines how and why the market fell apart. It is a work of fiction… except for the parts that are not… the parts that unfold Brent’s views about our financial futures.

Illicit profits were all part of Zane Donaldson’s work at a financial firm, but suddenly the stakes change when his family is violently abducted. Following a trail that was never meant to be uncovered, Zane realizes that with Quantitative Easing, the Federal Reserve is doing something no criminal has ever accomplished—and the catastrophic economic implications are worth killing over.

Together with a computer hacker and a seemingly helpful special ops warrior, Zane must decide between exposing the truth and preserving the financial strength of the world. However, only Zane knows the real truth and why it can’t be revealed. The Federal Reserve isn’t just about money. While it also involves domination and control, it all comes back to one thing: The Reason.

Brent brings his background in banking and personal amateur fighting experience to this fast-paced, financial thriller. He worked for fifteen years in the banking industry. The first 10 years he worked with debt workouts and spent the last five as bank president. During his fighting years, Brent believes the experience helped him as a person by creating discipline, confidence and belief that with perseverance and God’s help, mountains can be moved. The fight scenes in The Reason are based on fights Brent experienced himself.

Gripping, thought-provoking and eerily accurate, The Reason:

- Explains the nuances and dangers of Quantitative Easing

- Portrays the reality of mixed martial arts fighting and why, sometimes, violence is the answer

- Examines why our past holds the answer to the present and future

- Reveals the dangers associated with the Federal Reserve’s lack of supervision and oversight

- Shows what the average citizen can do to help make the economy strong again

Quentin Brent graduated from the University of Minnesota with a Bachelor’s in Economics and worked in the banking industry for 15 years–the first ten working on debt workouts, and the last five as bank president. He also has 20 years experience working as CFO and part owner of a $300 million temporary staffing company. During his thirties, Brent began amateur mixed martial arts fighting and fought in a variety of different venues. He lives with his wife in Minneapolis, Minn.

Seven IM Questions for Digital Age

By Barbara Hemphill

Many companies continue to experience cutbacks in workforce, but not in workload. For the remaining employees, accessing valuable company information becomes increasingly complex, whether it’s a password, an email from a vendor documenting price agreements, or crucial information about a client contract. The computer has allowed us to generate information as never before, thus increasing our ability to create a mess. Poor information management creates inefficiency. Inefficiency costs money, causes unnecessary stress, precipitates poor customer service, and directly costs untold thousands of dollars.

Michael Dell says that by 2020 the world will generate 35 times as much data annually as in 2010. Unfortunately, many companies never learned to manage paper, and most are not doing any better with electronic documents. Particularly frightening is the idea that if you have 1,000 pieces of paper, you can hire someone to sort through them looking for specific words, and eventually they will find them. If you have 1000 electronic documents stored in a variety of places from employees desktops (not backed up!) to external drives, they may never be found—and when they are, the company may no longer have the capability of reading the data!

It’s not a matter of IF, but WHEN the information management meltdown will take place, unless you address the issue now. The following are seven essential questions to address about the information in your business.

What Information Do We Need To Keep?

Start with your company’s mission and goals. What business are you in? What information do you need to reach those goals? And, of course, what information do regulators require? You can jokingly state that the word “archives” should be spelled “our-chives” since so many companies keep information that actually belongs to other organizations.

In What Form?

Most information today is already in digital form. In many organizations, that information can be stored in more than one program. Consistency is the key.

Only a small portion of the information that exists on paper today is worth converting to a digital format. As the quantity of information received and generated by business increases, electronic storage options become essential. It is simply not cost effective to use paper for long-term storage of business information.

For How Long?

Employees are scared to throw anything away, because the boss may ask for it, and many bosses won’t take the time to make a plan for records retention. When they do, the decision often breaks down in the implementation. The advantages of electronic storage can become disadvantages, as companies painfully learn when called to account for e-mail messages sent years previously. Regardless of the reasons, the results are the same: overstuffed filing cabinets and hard drives.

Many companies hold file clean-out days, and but often fail miserably. Why? Because management has failed to create the methodology, mechanics, and maintenance to enable and empower its employees to make the decisions required to eliminate unnecessary information.

Who Is Responsible for Filing It?

One client was spending thousands of dollars annually on file storage. When they looked into the situation, they identified that one big source of the problem was that multiple members of the team were filing the same information for the same project. The problem was quickly resolved by identifying a specific member of each team to be responsible for filing the appropriate information.

Every large company has an information systems person. While some large companies have a person in charge of records retention, they are often brought into the picture only after the files are full or the information is no longer used on a regular basis. Small businesses often ignore the issue entirely. Why not put someone in charge of making and implementing decisions about current information? It is essential to create a system so if a person leaves suddenly; the company is not left in jeopardy.

Who Needs Access To It?

A major challenge in information management relates to the liability created if/when unauthorized people access private data. An advantage of an electronic filing system is the ability to determine who has access to what documents. It is unnerving to walk into offices and see paper and electronic documents accessible to people who have no reason to access them!

How Can We Find it?

The three components to an effective filing system are:

1) File methodology – what documents are to be filed

2) File mechanics – how documents are filed

3) File maintenance – when documents are eliminated

If any of the components are weak, your filing system will be an ongoing frustration instead of the resource it can and should be.

How Is It Backed Up?

A client lost 30 years of research because of a miscommunication with the IT department. A survey by Adobe of 5000+ professionals found that 43 percent have lost important electronic documents, and 70 percent of those losses were caused by a computer or hard drive failure. Having a backup plan that is checked on a consistent basis is an important part of an information management system.

Clutter is postponed decisions. Countless companies are faced with the problem of hundreds, even thousands, of boxes of “archives” in storage rooms or off-site locations. Unfortunately, when management realizes the cost and the risk involved, and finally decides to do something, the people who created the paper are long gone, and current employees have little energy or motivation for making decisions about something that doesn’t affect their ability to leave work on time.

While there is no quick fix for years of postponed decisions, avoiding the problem in the future is easy. Today’s mail is tomorrow’s pile; so to get results, ignore the mistakes of the past. Create a system today to enable employees to make good decisions about the information they receive.

Barbara Hemphill is the Founder of Productive Environment Institute, in Raleigh, N.C., and author of Less Clutter More Life. As one of the country’s leading organizational experts she has helped many corporations, such as Staples, Hallmark and 3M increase their productivity and efficiency. For information about her speaking services, visit www.BarbaraHemphill.com.

Most information today is already in digital form. In many organizations, that information can be stored in more than one program. Consistency is the key.

Only a small portion of the information that exists on paper today is worth converting to a digital format. As the quantity of information received and generated by business increases, electronic storage options become essential. It is simply not cost effective to use paper for long-term storage of business information.