Social collaboration, low crude oil prices, and EPA proposal flaws are just three of the topics that come up for dissection in this month’s miscellany of truncated articles. These are the full versions of the “Drilling Deeper” news items that appeared as abbreviated versions in the print edition of the June 2015 PBOG.

NOV to Stage Grand Opening in Odessa

National Oilwell Varco (NOV) will host the grand opening of the NOV Wellbore Technologies Facility at 11 a.m., July 15, at 8301 Groening Road in Odessa, Texas. The event is intended to showcase NOV technologies and to raise community awareness of NOV’s capabilities and dedication to the Permian Basin. During the grand opening, attendees will get a chance to explore the new facility, visit with NOV personnel, have lunch, and get to know the staff.

Chris Carson, district sales manager of NOV’s Wellbore Technology Division said, “The grand opening is more for our customers to come in and see the state of the art facility that we built. They’ll be able to walk around, look at the facility, walk through the facility, be able to talk to all of the NOV personnel there to really understand what we’re going to be doing over there, how our service quality works, how our safety works, how our processes work. Really just have them come in, eat lunch with us, talk to all of us, get to know us. We get to know them, and we can better grow the business and have them become more comfortable with what we’re doing, as far as the new facility is concerned.”

The fourth customized NOV facility, the new location is specifically designed to support Permian Basin operations and applications. Local customers will now have access to in-shop tools and service and will no longer need to ship tools to the NOV Robstown facility.

Measuring a total of 80,000 square feet, with a 55,000 square foot shop, the new facility combines Midland and Odessa offices, as well as engineering offices previously housed in three separate locations. Double the size of NOV’s current facility located off of I-20, it features new machinery and equipment. The NOV Wellbore Technologies Facility will streamline NOV’s communication with the Permian Basin community and will improve customer service and access.

“Our new facility is going to house all of our operations as far as the guys that take care of servicing the tools. It’s also going to house all of our sales team, our engineering team,” Carson said. “We’ve been growing as far as our regional design engineers and being able to design drill bits and parts for our tools in house, here in West Texas. We’re more than doubling the size we have, more than tripling our office space to be able to put more support, more engineering support, more sales support, more operations support here locally.”

Steve McCullough, southern area sales manager for NOV, said the company’s goal is “to build the most up-to-date service center that we have just about anywhere in the nation. There’s only a few of these supercenters, as we like to call them. There’s one in Casper, one in Oklahoma City, Rosenberg, Texas, and now in Odessa. It does provide us an opportunity to bring our level of service to a very high standard of service quality and an even more safe work environment for our employees.”

Being available to their customers is an important part of the NOV philosophy. Carson said, “I think by us building this facility out here, it shows that we’re committed to the Permian Basin and southeastern New Mexico to provide our customer with the service, the quality of tools, and the things that they need to better their drilling operations. I think it shows that we’re here for the long haul and we’re here to support our customer’s needs, not just now, but on into the future.”

And what about the downturn? Undeterred, NOV moves confidently forward. When asked if coming in during a downtime perked people up a bit, Carson stated, “I believe so. We hear every day of some of our competitors that are pulling out of West Texas because they’re trying to reduce their cost out here. We want to go to our customer and say, we’re here, we’re going to be able to service your tools here, and we have the expertise here with the people we have to service those tools for West Texas. I think we can provide a higher service quality and a higher quality product with our products coming directly from where they’re going to be run.”

Low Crude Oil Prices Provides Opportunity

According to Matthew Jurecky, GlobalData’s Head of Oil and Gas Research and Consulting, “Voluntary oil production cuts to support oil prices have been ruled out in favor of a brutal process of natural selection to correct the market. The most efficient producers will be left standing as growth slows and companies cut capital budgets and reduce headcounts. Producers are retrenching, focusing capital on maintaining production levels, repaying debt, and paying dividends. Those with financial obligations greater than cash flows from operations, and especially those that have depended on debt for growth, will become increasingly distressed. These companies will ultimately be forced to either sell assets or seek an outright buyer to avoid bankruptcy.

“The impact of low prices will be felt across the entire value chain. Profit margins for equipment manufacturers and services providers are being squeezed. Producers fighting for survival will try negotiating price cuts or opt out of contracts to prolong production and cash flows. Margins for service companies will fall and those unable to compete and operate profitably will require strategic options. Companies heavily exposed to emerging or speculative production areas counting on future growth are vulnerable, whether pipeline operators or service companies. The more prolonged the period of low oil prices, the more exposed companies will be.

“While efficient operators will survive, those with limited long-term planning will falter and become targets. Companies with uncommitted capital are presented an opportunity to expand market share and non-industry speculators have a strong entry opportunity, particularly financiers and those interested in distressed debt. Strong profits had been fueling the mergers and acquisitions market, but value awaits patient contrarians now able to buy when the market is at its lowest and confusion reigns.

“Asset values have collapsed and now is the optimal time to acquire. Buyers benefit from asset values appreciating in the long term as prices rise over the years. Companies with strong long-term planning and risk controls will take center stage. The fruits of planning will be lower debt obligations and cash reserves that support companies through years of low oil prices and also provide for acquisitions, without stressing balance sheets. Looking for options will be those that have found their cash reserves depleted and those that have depended upon debt to fund operations above and beyond cash flow.

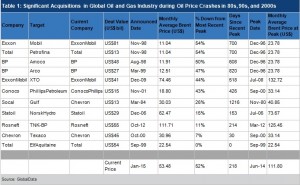

“Previous oil price crashes in the ’80s, ’90s, and 2000s all triggered significant acquisitions, redrawing the landscape and creating stronger and more efficient operators. It would be an opportunity lost should the environment not be exploited, as International Oil Companies (IOCs) are moving into the next decade with fewer greenfield opportunities and increased competition from National Oil Companies (NOCs). NOCs are more technically capable and increasingly taking control of domestic resources. This is resulting in fewer exploration opportunities for IOCs, meaning they will need strategic inorganic opportunities to replace reserves and grow production. IOCs with similar objectives, shared vendor relationships, and complementary asset portfolios would see significant operational synergies from mergers and be more efficient to compete in the post-price crash world.

“Although not without challenges, the merger of Exxon and Mobil created the largest publicly-traded oil company in the world and reached pre-merger levels of employees within five years, but with much expanded operations. Independent producers will also face pressures to consolidate or risk being considered bolt-on opportunities to larger portfolios. Those with heavy debt obligations will find the next year challenging, as the low price environment lasts longer than hedging programs covered for. Pure-play operators with the strongest positions will snap up smaller operators to gain market share. This is especially true in the U.S. shale plays, where there is heavy competition and low barriers to entry have allowed for many smaller operators.”

Lesser Prairie Chicken Plan Successful

On March 31, the Western Association of Fish and Wildlife Agencies (WAFWA) submitted to the U.S. Fish and Wildlife Service (USFWS) its first annual report detailing achievements under the Lesser Prairie Chicken (LPC) Range-wide Conservation Plan (RWP). Among other highlights, the estimated Lesser Prairie Chicken range-wide population increased by 20 percent to around 22,400 birds, industry partners committed $45.9 million in fees to pay for mitigation actions, and landowners across the range agreed to conserve nearly 40,000 acres of habitat.

“The results from the first year of RWP implementation clearly demonstrate that both industry and landowners are willing to conserve the species,” said Bill Van Pelt, WAFWA’s grassland coordinator. “Private industry’s willingness to avoid and minimize impacts to Lesser Prairie Chickens is evident, and where those impacts were unavoidable, they paid mitigation fees to offset those impacts on cooperating landowners’ properties. As a result, all industry impacts were offset with conservation agreements during this first year.”

A key RWP goal is to engage private landowners in habitat conservation, since farmers and ranchers control much of the land within the bird’s estimated 40 million acre range in the states of Texas, Oklahoma, Kansas, New Mexico, and Colorado. The annual report notes six landowner contracts were finalized during the reporting period March 1, 2014-Feb. 28, 2015. WAFWA paid out $117,357 in signup incentives to landowners for enrolling 37,767 acres of Lesser Prairie Chicken habitat and anticipates paying landowners another $5 million for conservation practices over 10 years pending annual maintenance reviews.

Another key component of the RWP is cooperation of energy companies and other industry sectors operating within the bird’s range. During the first year, 174 oil and gas, pipeline, electric, wind energy, and telecommunication companies enrolled in agreements with WAFWA to avoid, minimize, or mitigate their operations. In the process they committed $45,877,823 in enrollment and impact fees to cover off-site mitigation actions for unavoidable impacts.

Significantly, the amount of habitat impacted by industry development decreased 23 percent, primarily due to a consolidation of oil and gas developments under the RWP. About 700 project agreements were authorized to offset impacts to Lesser Prairie Chickens from various development activities. This means companies were actively selecting areas that already had prior development for new project siting or actively selecting areas of lower quality habitat, and in doing so minimized the impact of their operations on Lesser Prairie Chickens and their habitat.

“WAFWA has made tremendous strides in implementing the RWP during this first year, and is on target to accomplish their 10-year goals as outlined in the RWP and endorsed by the USFWS 18 months ago,” said Ross Melinchuk, Lesser Prairie-Chicken Initiative Council chairman. “The Endangered Species Act and accompanying 4(d) rule, together with the RWP, provide a blueprint for conservation of this species. Given time, improvements in habitat, and the return of more favorable weather conditions across the species’ range, we should see a continued increase in Lesser Prairie Chicken populations across the range in the coming years.”

To help industry avoid and minimize impacts, a decision support tool known as the Southern Great Plains Crucial Habitat Assessment Tool (CHAT), developed through the Western Governors’ Association, was used to spatially represent focal areas and connectivity zones where conservation actions will be targeted to expand and sustain the species. In addition, a project estimator tool was incorporated into the CHAT to facilitate pre-planning for development to reduce impacts to the bird. Since February 1, 2015, the estimator tool has been receiving an average of 87,570 hits per week signaling its utility to industry.

In addition to RWP achievements, the Lesser Prairie Chicken Initiative (LPCI), a complementary program administered by USDA’s Natural Resources Conservation Service (NRCS), approved 23 projects across the species’ range in 2014 that will improve more than 180,000 acres of LPC habitat on privately-owned land through prescribed grazing and brush management. Through the LPCI program, landowners will be paid $2,935,894 for implementing conservation activities benefiting LPCs. Through LPCI and the RWP, nearly a quarter million acres have been targeted for LPC conservation in the first year of RWP implementation.

The RWP is an adaptive management framework that allows for the review and incorporation of new information as it becomes available and to make adjustments to maximize conservation benefits to LPC. The Lesser Prairie-Chicken Advisory Committee, comprised of private landowners and representatives from industry, non-governmental agencies, state and federal agencies, provided input and feedback through this framework. During the past year, in addition to identifying research needs for the species, adjustments were made to the timing of surveys, the burial of power lines, and the delineation of impact buffers through this adaptive management process.

Details about RWP plan goals and year one achievements are in the full annual report, which is available on the WAFWA website at www.wafwa.org.

U.S. E.I.A. Announces Keynote Speaker

The keynote speaker for the 2015 EIA Energy Conference has been announced. Matthew K. Rose, Executive Chairman, BNSF Railway Company, will deliver that address.

Mr. Rose joins keynote speakers Dr. Ernest Moniz, U.S. Secretary of Energy; Pedro Joaquín Coldwell, Secretary of Energy Mexico; and Harold Hamm, Chairman and CEO Continental Resources at the 2015 EIA Energy Conference, June 15-16 at the Renaissance Downtown Hotel,

Washington, D.C.

Register Now http://www.fbcinc.com/e/eia/

Other keynote speakers will be announced soon.

Flaws Revealed in EPA’s Proposal

According to a newly released environmental analysis, Ozone NAAQS Proposed Rule—Evaluation of the Science, the EPA’s recommendation to lower the current ozone standard, is unsubstantiated by the evidence provided by the agency. The extensive review, conducted by Zephyr Environmental Corporation and commissioned by the Texas Pipeline Association, revealed that the current standard of 75 parts per billion continues to be protective of public health and welfare, with an adequate margin of safety.

On November 25, 2014, EPA proposed to update the air quality standard for ground-level ozone. EPA claims that the proposed updates would better protect the public and the environment; however, the agency hasn’t identified any studies that indicate a clear causal relationship between ozone concentrations less than 88 ppb and clinically relevant adverse human health impacts.

“Zephyr’s analysis confirms that EPA’s proposed rule is unsupported,” said Thure Cannon, president of TPA. “EPA has failed to point to any persuasive body of scientific evidence supporting its proposal. Unnecessarily tightening the ozone standard would simply add to the already cumbersome bureaucracy tied to the midstream industry and other industries and would impose enormous additional costs, with no offsetting benefit.”

TPA submitted the analysis, in addition to written comments opposing the proposed rule to EPA, on March 13, 2015. After reviewing the comments submitted by TPA and other members of the public, the agency will make a final decision on the ozone standard, which is expected in October 2015.

The full analysis, Ozone NAAQS Proposed Rule—Evaluation of the Science, may be found online at www.texaspipelines.com.

Different Energy Industry Downturn

There was no crystal ball in which to see the future at the annual BoyarMiller Energy Breakfast Forum, but there was a sense of calm and clear acceptance of the current supply-induced down cycle expressed by three presenters who provided their industry insights to more than 200 interested attendees.

“This was one of our most highly anticipated breakfast forums, given the current state of the oil and gas industry,” said Chris Hanslik, chairman of BoyarMiller. “As business partners with our clients, we strive to deliver insights that impact their strategies for success. These three presenters accomplished that by providing exceptional overviews on industry trends, the regulatory and political climates, and the current down cycle.”

Presentations were delivered by James Wicklund, managing director of energy research for Credit Suisse LLC, Matthew Pilon, managing director of Simmons and Company International, and David Pursell, managing director of Tudor, Pickering, Holt and Co.

Their presentations are available on the BoyarMiller website at www.boyarmiller.com.

The Goal is Zero

“We have to slow U.S. oil production growth close to zero, not production, but production growth,” said James Wicklund, managing director of energy research at Credit Suisse LLC. “Oil production here increased by almost 1.6 million barrels last year alone, and we were 80 percent of global production growth over the last three years. Now we have to slow down. It isn’t the end of the world, it just feels like it,” he quipped.

Wicklund said that U.S. horizontal rig count has to drop by 30 to 35 percent and stay there for four to eight quarters to get U.S. production growth to zero. However, it is difficult to get companies to agree to slow down production growth on their own, and the price of oil governs that growth. While Wicklund said no one can predict the price of oil, he expects the price to hover around $60 for the next two years and warned the price may bottom lower than that once U.S. storage capacity is full.

“It’s not all bad,” said Wicklund. “We will become an industrial-based oil country again by 2016. Once we are at or close to zero we will start growing production from that point forward. The problem is it will be on a secular basis of 3 to 5 percent annual growth as opposed to the 8 to 10 percent annual growth experienced from 2010-2014. But it will be a good business because we know where the oil is—we don’t have to go find it.”

Wicklund said the collateral damage will be felt hard, especially in Houston, where 74,000 jobs have already been lost and more losses are predicted. About 58 percent of office space in Houston is directly or indirectly related to the energy sector.

He said the duration of this cycle may take six quarters to fix. Orders for deepwater projects are stalled and a more favorable economic level for activity could take about two or three years. In the meantime, he said it will be a “tough” environment with the industry under a lot of pressure.

“When the price of oil hits bottom, stocks of the oilfield service and E&P companies will bottom too, and we have to have a realistic expectation of when they will recover,” said Wicklund.

Matthew Pilon, managing director of Simmons & Company, said the energy industry is notoriously cyclical and while we can’t help but compare the cycles this one is quite different. He cited seven ways the current market is different from 2009, including the availability of capital being very high.

Private equity funds targeting energy raised $88 billion from 2010-2014 and these funds have become a large part of the market. “There are 500 private equity-owned energy services and equipment companies,” said Pilon. “When marketing a business, we have many more exit options available. We can target private equity firms by size, interests, or geography and generate a targeted list to match interests.”

Because there is so much capital and very large funds available, Pilon said there is less need for initial public offerings, or IPOs. “You don’t see companies getting to a point where they want to go public to raise capital, but rather they transition to the next tier of private equity firm.”

Pilon said the result is an increase in the number of larger private companies with a high interest among private equity firms in identifying operating partners and good talented managers.

As North American energy markets expanded in recent years, so did oilfield services and equipment mergers and acquisitions activity. However, Pilon said that M&A activity dropped in the last couple quarters and he speculated it will continue to slow this quarter and into Q2.

“Many potential 2014 deals were put on hold and it takes time to fill the pipeline,” said Pilon. “We had a record M&A backlog in 2014 so we think there is a lot of pent-up demand. We will begin to see deals that are more appropriate for the current market, so there is a lot of activity coming, but it will probably be slower before it gets better.”

In addition to the availability of immense capital, other ways the downturn is significantly different from 2009 is that banks are a lot healthier than they were, although cautious in their lending practices. Pilon also said the world economic situation is better than in 2009, when there was a global recession.

“But another key factor to keep in mind is the market psychology,” said Pilon. “We have the memory of a quick recovery in 2009. So potential sellers are not selling for cash—they are doing the least offensive deal if they need to raise money or restructure debt with the hope that things will get better and that is contributing to the drop in M&A activity.”

Pilon ended with a warning about the reliability of oil futures prices and noted the magnitude of the forecasting errors made by the U.S. Energy Information Administration and others.

Regulations and Debates

David Pursell of Tudor, Pickering, Holt and Co. acknowledged that there should be no new surprises from legislators in Washington D.C., but they will continue to push for increased regulation.

“We will see the idea of exporting U.S. oil gaining traction, but there is not enough understanding of the issue right now,” said Pursell. “Maybe the next administration will get more serious about it, but it means a lot of education needs to take place.”

Pursell told the group that Endangered Species Act enforcement will be a constant for the industry, as will ongoing rail regulation, although the amount of crude being shipped by rail has been declining for several years.

Also on the legislative agenda is the association of seismic activity with water injection. “There is zero chance that water injection is causing seismic activity, but the topic grabs headlines and will continue to be explored,” said Pursell.

Climate change and carbon emissions will also continue to be discussed on Capitol Hill, as well as hydraulic fracturing, in general. “In my opinion, the push against hydraulic fracturing is driven by the desire to see more growth of solar energy. There may be some regulation about produced water being held in a covered tank instead of a lined pit, but nothing is expected to be a game changer. Just know that fracturing opponents are not going away.”

Purcell predicts that the Keystone pipeline will eventually pass, citing the logic that pipelines are proven to be the safest mode of crude transportation.

He closed hoping that Mexican energy reform will happen because it offers much opportunity for U.S. businesses doing business there, as well as for the country of Mexico.

About BoyarMiller

BoyarMiller, a Houston-based law firm, is comprised of two practice groups: business and litigation. The business group serves multinational companies, middle-market businesses, and entrepreneurs in need of collaborative and strategic representation. The litigation group represents organizations of all sizes, from entrepreneurs to Fortune 500 companies, seeking to resolve complex business issues and employment disputes. See www.boyarmiller.com for more information.

Social Channel To Advance Women In Energy

Pink Petro announced March 10 the launch of a new online community that aims to unite, connect, develop, and grow the number of women working across the energy value chain. Powered by Jive Software, Inc. (Nasdaq: JIVE) and catalyst funded by energy giants Halliburton and Shell, this unique social collaboration channel gives women an important new resource to help advance their careers in an industry long dominated by men.

“We have created Pink Petro to elevate the much-needed voice of women in energy globally,” said Katie Mehnert, the founder of Pink Petro. Mehnert, an energy veteran with global safety leadership roles at Shell and BP, believes women bring a unique perspective to the sector. “In light of the market downturn, the time to fight for the future of our industry is now. Our for-purpose community will help women seize career opportunities and get them exactly where they should be: leading the fight to solve today’s energy challenges.”

In a recent study from Rigzone, 48 percent of employees and 53 percent of hiring managers reported that a culture created by a male-dominated environment is a contributing factor to the gender imbalance in the industry. With global energy businesses announcing steep job cuts, the industry faces a looming labor shortage when it emerges from the current downturn. In this environment, the need for talent development is particularly acute.

Powered by Jive-x, Pink Petro allows members to post questions, share advice, join groups, connect to coaches, or follow thought leaders to gain meaningful insights. The community also offers mobile applications for iOS and Android tablet and phone users. Individuals, companies, trade associations, and non-profit organizations can all join the platform by applying and investing in a membership, with individual fees starting at $50 annually.

“We take a long-term view of talent at Halliburton, and we see Pink Petro as a valuable resource that will become a key asset to our critical diversity initiatives,” said Cindy Bigner, Halliburton’s global senior director of Corporate Affairs and Diversity Initiatives. “We expect the Pink Petro community to play an important role in providing women with the tools, information, and additional resources they need to enjoy successful careers within Halliburton and throughout the energy industry.”

“Shell is a global leader in diversity in the energy industry, and we are proud of the advances that we have made in increasing opportunities for women to contribute and lead in our business,” said Fred Wipple, vice president of Diversity and Inclusion at Shell. “Pink Petro will be a valuable resource for women looking to succeed in the challenging and rewarding jobs in the energy industry, and it fits well with our social media outreach. We’re excited about what Pink Petro means to the women of energy—those who work for Shell, those who will join our company in the future, and those women entrepreneurs who own and operate businesses that supply goods and services in our industry.”

“Every industry needs passionate voices like Katie Mehnert and the members of the Pink Petro community, who recognize the power of communication and collaboration in driving important change across century-old global energy businesses,” said Elisa Steele, CEO and President, Jive Software. “It’s exciting to see disruptive new businesses thrive on our customer communities solutions. Jive is proud and committed to help empower Pink Petro’s members and the energy industry to work better together.”

Pink Petro is one of several energy, extraction, and engineering-related organizations that have launched Jive-based communities to drive innovation, productivity, career development, and safety. Organizations like Schneider Electric, BG Group, Cameron, and SunEdison are using Jive solutions to help employees, customers, and partners better connect, communicate, and collaborate.

About Pink Petro

Pink Petro is the first social channel for women in energy and their advocates. Its mission is to unite, connect, develop, and grow women worldwide by harnessing the power of social business technology. More information can be found at www.pinkpetro.com.

About Jive Software

Jive (Nasdaq: JIVE) is the leading provider of modern communication and collaboration solutions for business. Recognized as a leader by the industry’s top analyst firms in multiple categories, Jive enables employees, partners and customers to work better together. More information can be found at jivesoftware.com.

Firm Offers Solution for Idle Equipment

Low crude prices have recently idled millions of dollars of oilfield equipment across the nation. So, how do you protect a multi-million dollar piece of equipment so it is ready to go when oil prices inevitably rise and drilling activity picks up?

Instead of letting the expensive equipment corrode in the yard, Dallas-based Protective Packaging Corporation (PPC) is offering a cost-effective protection package for oil field equipment serving the Permian Basin and other national and international gas plays. The same PPC products have been used for years to protect idled U.S. military equipment, vehicles, planes, and technology from environmental factors and idleness.

“These rigs have been running for 24-hours-a-day for years and now they need to be protected from idleness,” says Steve Hanna, CEO of Protective Packaging Corporation. “Based on what we have learned from working with military contractors, our protection products can prevent equipment inactivity problems such as corrosion, clogged fuel lines, and destroyed rubber gaskets and tires, all for significantly less than it will cost to fix and replace.”

PPC’s protection package includes volatile corrosion inhibitors (VCIs) to treat the inside of the engines and pumps to prevent rust, the biggest problem facing inactive oil field equipment. Externally, customized barrier bags and covers paired with desiccants protect equipment from damaging UV rays and everyday dirt, bugs, and animals.

Craig Harris oversees Protective Packaging Corporation’s operations in the Permian Basin from his base in Midland.

“As someone who has worked in the oil and gas industry for many years, I’ve seen downturns before. What I learned is that it is time consuming and expensive to restore equipment after it has sat idle in the yard,” he said. “Taking the time to protect motors, electronics, and pumps means that they can be up and running quickly when production resumes.”

The number of active onshore oil rigs in Texas has dropped by more than 30 percent since last year. With the size and cost to house this equipment, indoor storage is not an option. Many of the rigs may remain offline and idle for a year or more.

“In relation to the value of the equipment you are protecting, any upfront cost is a very minor investment to ensure that when you go to restart the rig you have minimal maintenance and can begin producing again immediately,” said Harris. “In taking these steps now, you avoid experiencing the long-term consequences of corrosion damage and the thousands of dollars it will cost to repair or replace down the road.”

Repairing oil field equipment that has been subject to rust, moisture, and static would result in downtime, as well as countless dollars spent on refurbishment and replacement. This comprehensive protective packaging was designed to ensure that equipment will function properly and safely with minimal maintenance required, ultimately protecting equipment owners from costly machine replacements once drilling comes back online.

Besides oil and gas industry related customers, Protective Packaging Corporation provides specialized packaging services for the military and defense industry, electronics, communication and transportation industries. Protective Packaging is a Texas-based, ISO-certified, veteran-owned small business corporation that has been in business over 35 years.

For more information, visit www.protectivepackaging.net.

IADC Labels New Rules Burdensome

A new final rule regulating hydraulic fracturing on federal and Indian lands will only result in increased costs and regulatory redundancy, ultimately impacting America’s long term energy security, according to International Association of Drilling Contractors (IADC) President and CEO Stephen Colville.

The final rule, issued by the U.S. Bureau of Land Management (BLM) in the March 26, 2015, Federal Register, includes requirements that replicate controls already in place. These existing requirements themselves enshrine the good oilfield standards that the industry has routinely practiced for many years and continuously improves. BLM estimates that the rule will impose additional annual costs of $32 million. However, other estimates place these expenses much higher.

“IADC strongly disagrees with the necessity of the BLM rule, which creates more bureaucracy at the cost of positive economic impact for states with hydraulic fracturing operations,” said Mr. Colville. “While we are focused on continuous improvement in all facets of drilling and production operations, we believe that the implementation of duplicative rules with regard to hydraulic fracturing are burdensome and pointless and therefore without merit.”

Numerous respected scientific studies have confirmed there is no harmful environmental impact from today’s hydraulic fracturing operations. These operations have been central to America becoming virtually energy self-sufficient, driving energy costs to one-half of those in Europe, and one third of China’s. Further, the combination of hydraulic fracturing with technologies developed by drilling contractors has been instrumental in employing more than half a million Americans, both directly and indirectly.

“It is noteworthy that hydraulic fracturing has been conducted safely and responsibly in the U.S. for more than 60 years and states have successfully regulated these activities for decades. It appears that BLM has published the final rule without definitive consultation with the states affected by it, and without properly weighing the economic impact against the benefits expected. IADC will never object to regulation that is necessary and beneficial. However, this new rule adds an unnecessary and duplicative layer of regulations. As an added layer of compliance, the rule creates unnecessary costs to an industry that plays a major part in this country’s economy in terms of low energy costs and high employment. It is disheartening that this rule will impact future industry growth.”

About IADC

Since 1940, the International Association of Drilling Contractors (IADC) has exclusively represented the worldwide oil and gas drilling industry. IADC’s mission is to catalyze improved performance for the drilling industry by enhancing operational integrity and championing better regulation to facilitate safer, cleaner and more efficient drilling operations worldwide. For more information, visit the IADC website at www.iadc.org.

North Dakota and Texas Oil Production Up

Oil production from key shale formations in North Dakota and Texas increased by 17,000 barrels per day (b/d), or 1 percent, in March versus February, according to Bentek Energy, an analytics and forecasting unit of Platts, a leading global provider of energy, petrochemicals, metals, and agriculture information.

In South Texas, Eagle Ford basin crude oil production averaged 1.6 million barrels in March, up 344,000 incremental barrels per day (b/d) or 28 percent from March 2014, according to Sami Yahya, Bentek energy analyst. Additionally, crude oil production in the North Dakota section of the Bakken shale formation of the Williston Basin averaged 1.2 million b/d in March, Bentek data showed. This was 215,000 b/d higher than the year ago level.

“Producers in both the Eagle Ford and Bakken basins are still maintaining their production levels by high-grading their acreage and pushing for better efficiencies,” explained Yahya. “The current average economic return for the two basins is 17 percent. However, the downside risk is that some producers may elect to increase their number of drilled-but-uncompleted wells in the near term—until they figure out their cash flow status—which will further flatten or bring down production levels.”

Bentek analysis shows that from March 2014 to March 2015, total U.S. crude oil production has increased by 1.3 million b/d.

“Prices of both Eagle Ford and Bakken shale oil have been on an upward trajectory since mid-March and reached a year high in early April,” said Jacqueline Puig, Platts associate editor of Americas Crude.

The Platts Eagle Ford Marker, a daily price assessment launched in October 2012 and reflecting the value of oil out of the Eagle Ford Shale formation in South Texas, is up 25 percent since mid-March, with an average price of $53.30 per barrel (/b) for the year. The marker has ranged between $46.22/b and $62.20/b since the beginning of January.

The price of oil out of the Bakken formation at Williston, North Dakota, is up 36 percent since mid-March, with an average price of $46.81/b for the year, according to the Platts Bakken assessment. It has ranged between $38.43/b and $57.45/b since the beginning of January.

How to Invest with Trustworthy CEOs

By L.J. Rittenhouse, CEO Rittenhouse Rankings

Georgia was a successful artist. She had never taken a business course in her life, nor picked investments. Her father was an experienced businessman and did this for her. When he died, Georgia inherited his portfolio of stocks and hired a manager.

Her new financial advisor, Russell, didn’t waste time and purchased three gold companies for her portfolio. With the economy heading south, he figured these investments would outperform the market. When he called to tell her what he had done, Georgia thanked him. Then she went to each company’s website to find their annual reports. After reading the letters to shareholders in each report, Georgia called Russell back. “Keep the stocks in two of the companies,” she said. “Sell the third.”

Russell was shocked and asked, “Why?” Georgia replied, “The shareholder letter by the CEO in that third company isn’t as candid or informative as the other two letters. It didn’t discuss the company’s financial results and used a lot of useless business jargon. It didn’t inspire trust.” Russell assured her that all three companies were sound, but Georgia was firm. He sold the stock.

Four months later, this company was charged with falsely reporting income. Its shares dropped to all-time lows, and Georgia was vindicated. Did she have insider knowledge? Had she carefully analyzed the financial statements? No. Georgia trusted her instinct that executive candor is a vital clue to investing with trustworthy leaders.

Perhaps you’ve read shareholder letters that failed to educate you about the business. Written in PR-speak, they hide the CEO’s true personality and leadership style. But not all letters will waste your valuable time. Georgia’s experience taught her to invest with leaders who communicate clearly. As annual reports are released in the spring, read them and look for these three leadership qualities:

1) Reveals Leadership and Avoids Business Jargon

Consider these sleep-inducing phrases taken from some 2013 financial company shareholder letters in 2014: “the outstanding capabilities of our company,” “the strategy we outlined several years ago is driving growth,” and “help make financial lives better, through the power of every connection.” This business jargon fails to inspire confidence or build trust.

In contrast, Charles Schwab CEO Walt Bettinger opens his 2013 letter with a personal reflection about writing a shareholder letter: Some time ago, a close friend and I discussed the nature of the annual letters that CEOs write to their companies’ stockholders. He and I agreed the best approach was to craft the letter as if I were speaking with a colleague who had been away from the company for the entire year and to keep it free from spin or corporate-speak.

Bettinger’s language is straightforward and candid. He imagines what it would be like if he were the reader. His active verbs and simple descriptions engage us and begin to build connection that can lead to trust.

2) Provides Context and Explains “Why”

CEOs write a lot about what is happening in their businesses, and less about why this is important. JetBlue CEO Dave Barger does both in his 2013 shareholder letter. He is a master of meaningful context that reveals underlying business strengths and weaknesses. One such strength is the company’s strategy to constantly maintain a cost advantage relative to competitors.

Context adds credibility to CEO claims such as the airline’s 14-year old mission to “bring humanity back to air travel” through the “JetBlue Experience.” What can JetBlue passengers expect from this experience? Barger cites: “free inflight entertainment, the most legroom in coach of any U.S. airline…unlimited free snacks and great customer service.” But how does the company deliver great customer service? It nurtures an ownership culture that engages and rewards employees for going the extra mile for customers. How is this working? J.D. Power recognized JetBlue in 2013 as “one of only a few companies (and the only airline)” for service excellence in all of the past nine years.

3) Sets an Example by Reporting Successes and Failures

Berkshire Hathaway CEO Warren Buffett believes that a trustworthy CEO communicates candidly with investors—in just the way he would expect if their positions were reversed. In his 2013 shareholder letter, Buffett described Berkshire’s wide-ranging businesses from candy to machine tools and railroads to windmills. He admitted that while some businesses have enduring advantages and report growing profits, others “have very poor returns.”

Buffett took responsibility for these disappointing results. He wrote: “I simply was wrong in my evaluation of the economic dynamics of the company or the industry in which it operated.” In this and in past letters, he shares the lessons learned from these mistakes and how these helped him to find companies with sound economics. Like other successful executives and entrepreneurs, Buffett continues to perfect the skills of “failing wisely.”

Why does straight talk matter?

As Georgia learned, words are the building blocks of trust. But not just any words. Only those that shine light into dark place—a definition of candor. Companies that lack candor will weaken trust and eventually stumble or fall apart.

To invest with trustworthy leaders, look for executive communications in which the CEO: 1) carefully uses words that grow revenues and trust; 2) explains the “what” and “why” of company actions; and 3) candidly sets an example by reporting on successes and failures.

About the Author:

L. J. Rittenhouse is CEO of Rittenhouse Rankings Inc., a corporate communications company that analyzes gaps in corporate candor to improve performance. A financial relations advisor and motivational speaker, L.J. has been featured on CNN and in The Wall Street Journal. Warren Buffett recommended her bestseller, Investing Between the Lines. For more information, please visit www.RittenhouseRankings.com.

Energy Leaders Highlight Continental Approach, Environment

April 22, 2015, the Honourable Greg Rickford, Canada’s Minister of Natural Resources, was joined by Dr. Ernest Moniz, United States Secretary of Energy, and Pedro Joaquin Coldwell, Mexico Secretary of Energy, for a panel discussion during CERAWeek 2015 in Houston, Texas. This occasion represented the second trilateral meeting of the three North American energy leaders. Last December, during their meeting in Washington, D.C., the ministers signed a Memorandum of Understanding formalizing trilateral cooperation for greater cooperation and integration with a long-term goal of attaining North American energy security.

The leaders highlighted the need to maximize North America’s competitive advantage and to enhance sharing of best practices in developing unconventional oil and gas, and also the importance of building safe, modern infrastructure to meet the rising demand for energy in North America and around the world.

During his introductory remarks, Minister Rickford emphasized Canada’s economic fundamentals and the Harper Government’s actions in creating one of the world’s most favourable investment climates by lowering taxes and opening new markets through free trade agreements.

Canada’s overall tax rate on new business investment is the lowest in the G7. The Harper Government’s low-tax plan has contributed to Canada’s position as the second-fastest growing clean energy market in the G20.

Minister Rickford also discussed Canada’s contribution to global energy security through innovation and efficiency in the oil sands. He noted that Canada has the ability to deploy its energy expertise, technology, and products in partner countries to advance responsible resource development and use.

The Minister reinforced the benefits of the proposed Keystone XL pipeline, which the U.S. State Department has acknowledged is environmentally sound and will create jobs and replace insecure—and same or higher-emitting—sources of crude from countries such as Venezuela with a secure, reliable supply from Canada, North Dakota, and Montana.

Quick Facts: Recent Milestones in North American Energy Cooperation

Canada and the United States enjoy the largest energy relationship in the world—worth more than $140 billion annually in energy trade.

The U.S. Department of Energy announced that it will help advance carbon capture and storage (CCS) technology at Shell Canada’s Quest CCS project in Alberta.

Minister Rickford helped inaugurate two new oil pipelines that are expected to double access for Canadian crude to the U.S. Gulf Coast.

Minister Rickford and Secretary Moniz signed an agreement improving collaboration in civilian nuclear energy research and development.

Canada, the United States, and Mexico signed a Memorandum of Understanding enhancing our continental priority of North American energy cooperation in three specific areas.

Presidential permit issued for the U.S. portion of a cross-border hydro line that could meet 10 percent of New York’s electricity demand.

Canada and the United States signed a Memorandum of Understanding to enhance energy collaboration in 11 areas.

Canadian and U.S. geological services participate in a joint mission to Kyiv evaluating Ukraine’s accessibility to, and quality of, oil and gas geological data.

Canada and the United States have already harmonized environmental standards ranging from vehicle emissions to home energy efficiency.

Quotes

“North America is a secure, responsible and reliable producer and supplier of energy. We have deeply integrated economies, abundant reserves, shared critical energy infrastructure, and common values that underpin strong collaboration. We are enhancing our continental energy collaboration in a way that supports North American energy security, jobs and environmental performance. The North American energy sector is undergoing a profound transformation that for the first time puts our energy independence within reach.”

The Honourable Greg Rickford

Canada’s Minister of Natural Resources