Lower Brent/Cushing Premium Hasn’t Hurt Exports/Brent/Houston Relationship More Important

by Sandy Fielden, Director, Oil and Products Research, Morningstar Commodities Research

Exports Remain Buoyant

The premium of international benchmark Brent crude to its U.S. counterpart West Texas Intermediate (WTI) delivered to Cushing, Okla., has narrowed nearly 50 percent this year even as outright crude prices reached three-year highs in the third week of January before last week’s tumble. The Brent premium to WTI averaged $6.05/barrel during the last four months of 2017 (after Hurricane Harvey), coinciding with a near doubling of crude exports from an average 776 thousand barrels/day between January and August 2017 to 1,358 mb/d from September through year-end, according to the Energy Information Administration (EIA). Many believed a narrower Brent premium this year would impede exports, but in fact EIA data shows exports averaged 1,361 mb/d between Jan. 5 and Feb. 9, 2018. This note looks at why the Brent premium has narrowed and why we believe crude exports have so far remained buoyant.

Brent Premium

The narrowing Brent premium is the result of greater strength in WTI prices, reflecting falling crude inventories at Cushing and strengthening Midwest demand for feedstock. A constraint on the 590 mb/d Keystone Pipeline from Western Canada has reduced flows from that system into Cushing by 20 percent since November. The December startup of the Plains/Valero 200 mb/d Diamond Pipeline from Cushing to Memphis increased Cushing outflows. Cushing crude stocks fell over the summer in 2017 but increased again after Harvey before resuming their decline in early November; since then, they have dropped 51 percent to 33 million barrels on Feb. 9, according to the EIA. The net result of falling inventories is an increase in demand for prompt crude at Cushing, reflected in a backwardated structure to CME/Nymex WTI futures where crude prices for immediate delivery are higher than for further out months.

During the first eight months of 2017, the Brent premium averaged $2.80/barrel before Hurricane Harvey struck the Gulf Coast in late August, causing the loss of 20 percent of U.S. refining capacity and a consequent build in crude inventory that put downward pressure on WTI prices relative to Brent. The Brent premium pushed out over $6/barrel in September and averaged $6.05/barrel in the last four months of 2017. The premium peaked at $7.05/barrel on Dec. 26 and has fallen 47 percent since then to $3.76/barrel on Feb 14.

As the Brent premium to WTI widened, overall crude prices were recovering from their 2017 low point on June 21 when WTI settled at $42.53/barrel and Brent at $44.82/barrel. By the end of 2017, WTI was up 42 percent to $60.42/barrel and Brent up 49 percent to $66.87/barrel. Prices continued to increase in the new year with WTI reaching over $66/barrel and Brent more than $70/barrel by Jan. 26 before falling 10 percent as part of the market correction in February. As we detailed in our recent year-end crude review (“OPEC Boost Lifts Crude, but Has It Risen Too Far Too Soon?”), the robust overall market in the latter half of 2017 reflected the positive impact of OPEC’s production cuts and increased demand. This year’s recent spurt and subsequent decline reflect a buildup and selloff of speculative long positions in crude futures as bullish hedge funds bet on higher prices then sold off in the face of higher U.S. production expectations and inflation concerns in equity markets.

Within this overall crude price volatility, the narrowing Brent premium to WTI this year spurred market speculation that U.S. crude exports would fall in tandem. This view is predicated on the assumption that U.S. exports depend on the relationship between WTI futures prices at Cushing and Brent prices in the international market. Our analysis of crude pricing in the Gulf Coast region suggests that this is not entirely the case because the relationship between WTI prices in Houston, on the Gulf Coast, and Brent is a more significant indicator for exports.

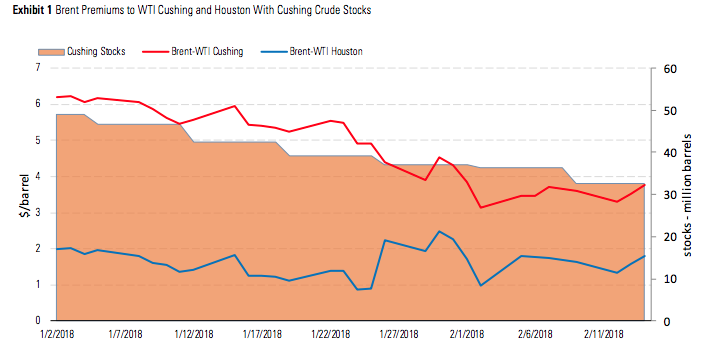

This conclusion is evidenced by the differential between prices for Brent and for WTI crude in Houston, which remained relatively steady this year even as the Brent premium to Cushing narrowed. Exhibit 1 shows the falling Brent premium to WTI (red line, left axis) and the Brent premium to Houston WTI (blue line, left axis). The Brent premium to Cushing is falling along with Cushing inventories (orange shaded area, right axis) while the Brent premium to Houston remained relatively flat at an average $1.61/barrel this year through Feb. 14.

Complex Picture

Aside from the Brent premium to Cushing or Houston WTI, continued encouragement of U.S. exports has other moving parts in what is a complex picture. As we pointed out in a note at the end of last year (“Permian Makes and the World Takes”), growing shale crude production in the Permian Basin is not needed by domestic refiners and therefore has incentive to get to the Gulf Coast and export markets. Additional shale crude growth in the Rockies and the Anadarko SCOOP and STACK plays is shipped to Cushing, where it can add to the flow of Gulf Coast exports or be consumed by Midwest refiners. Since June 2017, shale crude from North Dakota can also flow direct to the Gulf Coast (Beaumont/Nederland, Texas) on the Dakota Access Pipeline.

If the Cushing market is short crude, then WTI Cushing should price at least $1/barrel higher than Midland to encourage more barrels to move from the Permian to the Midwest (tariffs are about $0.70/barrel). The slight February average Cushing premium to Midland ($0.13/barrel) is a disincentive to move WTI to Cushing (red dashed line in Exhibit 2). The narrow Midland discount likely reflects increased Permian demand to meet new shipper commitments on the Enterprise Midland-toSealy/Houston Pipeline with initial capacity of 350 mb/d, which began operations in late 2017 and has been ramping up since.

IFS on Digital Transformation

by Magne Halvorsen, Global Industry Director for Oil and Gas at IFS

In 2018, digital investments and new business models are the key that can empower oil and gas companies to leverage their industry’s recovery, according to research at IFS.

Many oil and gas companies experienced a tough couple of years recently as oil prices plummeted to record-low levels. The recovery of the industry started in 2017, though, and now is the time to kick it into a higher gear to reap the benefits of being an early adopter of new technologies and business models. We at IFS predict that new charging models, digital investments, and compliance solutions will be the three key initiatives that companies within the sector will be pioneering to leverage the industry turn-around in 2018.

1. Industry recovery will boost digital investments by 30 percent

The good news is that the cost cutting and downsizing over the past few years is now at an end, both for the oil companies themselves and their suppliers. Global demand for oil is growing in the West and in China, with OPEC recently claiming that the country will increase its forecast by 1.35 million barrels per day (b/d) to reach 98.12m b/d. With the macro-figures telling us this increase may last for the next few decades, industry players are ramping up their activity, with many playing catch-up in the digital space.

When talking to customers and prospects in the industry, I hear the need to tap into digital technologies—including cloud, IoT, big data, advanced planning and scheduling, and automation—is key to become smarter and more efficient at extracting oil and gas. Part of this is being driven by the downsizing that has taken place over recent years – with fewer crews to man rigs and facilities, organizations need to maximize the human resources to hand. Thus, automating manual tasks becomes important.

Songa Offshore is one of those at the vanguard of this push. The company has connected IoT sensors to 600 assets on each of four oil rigs throughout the North Atlantic Basin. The IoT data is fed into the ERP system which forms the basis for reducing maintenance costs and increasing productivity by driving operational efficiencies. The main potential optimization lies in the automation of work orders—if specific data points can trigger automated work orders, this will save significant time and costs.

Other potential investments are rolling in, including beacon technology to improve safety by alerting crew members when they’re in a restricted zone. Elsewhere, advanced visualization and planning tools could help oil and gas contractors speed up the drilling license application process and maximize productivity by being able to better indicate which areas they are already cleared to drill in.

-

Investment in compliance solutions to increase by 20 percent

With governments around the world increasingly focused on restricting pollution, 2018 will see a continued rise in demand for ways to minimize CO2 and NOx emissions as well as to accurately document them for compliance purposes. Thus, we are likely to see a move away from diesel-powered plants to the use of alternative energy sources, such as tidal, to reduce emissions. With each rig producing as much CO2 annually as 5,000 cars, there is a heavy price to pay – financially and environmentally.

Advanced compliance and risk solutions will become an essential requirement to automate the monitoring and reporting of emissions, replacing inefficient manual processes. While remote facilities have historically been difficult to connect to the internet, satellite communications are enabling a new wave of cloud-powered systems to support these efforts.

-

20 percent of Oil and Gas companies will adopt a more service-centric business model

Another key evolution in the industry driving the push to become faster and more efficient at extraction involves a change in the way oil and gas companies pay their suppliers and contractors. The traditional “day rate”—the flat-fee rate a contractor is paid per day for operating, say, a drilling rig—is increasingly moving to a performance-based system.

Where an oil company might have agreed a contract of $300,000 per day for 100 days, they may offer more or even a bonus if that can be completed in 80 days. This creates new opportunities for those industry suppliers who can become more efficient. The IoT and big data analytics are key enablers here, with sensors able to feed back on various environmental and drilling conditions to maximize productivity. However, technology alone will not produce the desired goals unless organizations can break down traditional siloes between teams which monitor equipment, analyze weather conditions and those focused on other parts of the operation.

These trends can also be seen in terms of the gradual servitization of the industry. In fact, IFS research on the benefits of servitization for oil and gas companies has revealed that those looking to add innovative service and asset management capabilities to their offerings can reduce CO2 emissions by 10–15 percent and maintenance costs by 25–30 percent. One key area to do the latter is in the classification process. Every five years, floating rigs must be taken out of operation while essential maintenance checks and documentation take place. But with firms earning $300 to 400K per day, the three weeks this can take could lead to losses in the millions.

Advanced planning and scheduling technologies will therefore become a game-changer for both oil and gas companies and service providers, helping them better plan and document maintenance offshore without the need to take vessels to the yard as frequently. These are highly sophisticated systems, maximizing the human resources on board and incorporating key risk assessments of equipment to ensure any maintenance work is done and recorded according to a strict timetable.

What´s next?

So, what do oil and gas companies need to do to make the most of these opportunities in 2018? Fundamentally, I’d suggest that many organizations are in need of a “digital cleanse.” Many legacy tools, technologies and, most importantly, processes remain in operation that might be a barrier to innovation. Automation will not work if you are simply automating inefficient and error-prone manual processes. In fact, our recent research found that only 7 percent of global firms are successfully harnessing data-driven insight to deliver faster time-to-innovation and competitive advantage – by far the lowest of any industry studied.

Fortunately, the industry is in good shape to recover from recent years of underinvestment. Enterprises know what’s required to capitalize on the current upturn to become modern, competitive organizations. But to achieve this next level of growth, increase margins and support exciting new business models, these firms will need to invest in new digital skills as well as technologies.

Trump and Oil: After One Year

Now that we’ve passed the one-year mark since Donald Trump’s inauguration as President of the United States, the Oil Research team at Thomson Reuters takes a look at how the oil industry has performed over the last 12 months. Highlights follow below.

* President Trump’s promise “to put America first” has resulted in certain measures being taken in the US oil industry this year to fulfill pledges made during the presidential campaign.

* President Trump’s very first act after being elected was to approve the Dakota Access Pipeline (DAP) which would transport Bakken crude to the physical markets at comparatively lower costs, supporting domestic producers.

* Such policy decisions helped U.S. domestic crude oil compete with foreign imports, though they were also supported by some OPEC producers deliberately lowering shipments to combat high global crude oil inventories.

* The 2017 US Atlantic hurricane season was one of the deadliest ones experienced in US history with a total of 17 named storms and the highest number of major hurricanes—since 2005—which had disastrous effects on U.S. oil and gas markets.

* A number of countries in the Arabian Gulf closed their borders and banned Qatari flagged vessels from entering their economic zone after accusations were levied against Qatar for having links to terrorist organizations. As a result, we saw new physical flows with U.S. condensate being exported to the UAE.

* The co-ordinated move by the Gulf countries followed President Trump’s state visit to Saudi Arabia which raised questions about the US’ involvement to restrict Qatar—which has close ties with Iran and Turkey and who both share strategic interests in the ongoing conflict within Syria.

* The United States’ increasingly hawkish policy against Russia, Iran and North Korea increased political tensions in Asia and the Middle East, which again supported oil prices.

* President Trump’s most recent action in recognizing Jerusalem as the capital of the State of Israel had a profound impact on both the Islamic and developed world, with the EU, Russia and China all voicing opposition to the decision. This final act of 2017 has raised political risk premiums to the highest levels since oil prices collapsed during the summer of 2014.

Outlook for Energy Stocks in 2018: A False Sense of Security for Oil Markets

by Joe Gemino, Equity Analyst for Morningstar

The inevitable resumption of production growth in the United States, coupled with expansion in Libya and Nigeria, will likely nudge crude stockpiles higher again in 2018.

Crude fundamentals look healthier than they’ve been for years, largely due to voluntary curtailments from OPEC and its partners. By giving up 1.8 million barrels per day (mmb/d), combined, this group has engineered a temporary supply shortage in an effort to realign global inventories with the long-term average before the cuts expire at the end of 2018.

- However, several months of stagnating shale growth, driven by a sharp increase in drilled-but-uncompleted wells and the fallout from Hurricane Harvey, have lulled oil markets into a false sense of security. The inevitable resumption of growth in the U.S., coupled with expansion in Libya and Nigeria, will likely nudge crude stockpiles higher again in 2018—whether other OPEC members comply with fully agreed production targets or not.

- Even before the OPEC cuts are lifted, supply is likely to outstrip near-term demand growth and tip the industry into oversupply in 2018, driven by rapidly growing U.S. output. Our 2018 and midcycle forecasts for West Texas Intermediate are still $48/bbl and $55/bbl, respectively.

- Despite our bearish outlook for near- and long-term oil prices, we see pockets of opportunity in the oil and gas space. Energy sector valuations look fairly valued at current levels, with an average price/fair value estimate of 0.98. Still, on a relative basis, energy is one of the cheaper sectors, with several others trading at a price/fair value above 1.05.

As many expected, OPEC announced on Nov. 30 that it will extend its crude-oil production cuts through the end of 2018. The impact of these cuts will fall short of what the cartel and its partners are hoping for, however.

Several months of stagnating shale growth, driven by a sharp increase in drilled-but-uncompleted wells and the fallout from Hurricane Harvey, have lulled oil markets into a false sense of security. The inevitable resumption of growth in the United States, coupled with expansion in Libya and Nigeria, will probably nudge crude stockpiles higher again in 2018, whether other OPEC members comply with fully agreed production targets or not.

What’s obvious by now is that current oil prices provide economics that are very attractive to the major U.S. shale producers. This has created the conditions that will allow tight oil to grow rapidly, and is a reality that even forthcoming cost inflation will not change. Unless shale producers become more disciplined or OPEC resigns itself to permanently ceding market share to U.S. producers, oil markets have major problems looming on the horizon. Neither is likely to occur.

The U.S. horizontal rig count remains well below the 2014 peak, but due to remarkable advances in efficiency and well productivity, it is already high enough to drive very strong growth for several years. The U.S. shale industry still has a long runway of Tier 1 drilling opportunities, especially in key growth basins (the Permian, for example). And there’s ample scope for further advances in productivity and efficiency, offsetting any cost reinflation from shale service providers and capping break-evens for marginal producers.

Therefore, next year’s output is likely to exceed the “call on U.S. shale.” But the industry can’t react quickly when it recognizes the danger because many of its rigs operate under fixed-length contracts with steep termination penalties. And when the rig count does decline, there will be an additional overhang related to the lag between drilling a well and bringing it online. Nothing is ever certain in the world of oil, but a crude awakening for energy investors could very well be near at hand.

Looking past 2018, we expect a midcycle price of $55/bbl WTI. This estimate is based on our cost outlook for U.S. shale production, which we expect to be the marginal source of global supply. Sustainably lower shale break-evens mean the era of low-cost oil is here to stay. Our view on lower shale costs is driven in large part by our expectations for minimal inflation in proppant and pressure pumping costs.

Open Season: Llano Pipeline for Produced Water

Goodnight Midstream Permian, LLC, is conducting a binding Open Season to provide an opportunity for producers to enter into long-term contractual commitments for Goodnight’s Llano Produced Water Pipeline System to be constructed in Lea County, New Mexico. The Open Season will commence on February 8, 2018 and close on March 30, 2018.

The Llano Pipeline will transport produced water from the central Delaware Basin to Goodnight’s saltwater disposal well system on the Central Basin Platform (“CBP”) in the Eunice area. Goodnight’s produced water system will utilize the depleted oil fields on the CBP as a superior geologic alternative for sustainable disposal of produced water into multiple formations.

Highlights

The Llano Pipeline will begin at its origin point in Lea County. The high-pressure pipeline will have an initial capacity of 200,000 barrels of water per day and is supported by a long-term dedication from a key producer. The Llano Pipeline is anticipated to be placed in service in the fourth quarter of 2018. Goodnight plans to construct multiple receipt points along the pipeline’s route with each receipt point having the capability to accept produced saltwater at 50 psi.

A map of the detailed route with planned receipt points for the Llano Pipeline can be found on the Goodnight Midstream website at goodnightmidstream.com/llanopipeline.

Tariffs will vary depending on the structure of dedication and the location of a producer’s receipt point. Up to 80 percent of initial capacity will be reserved for producers entering into long-term commitments during this Open Season and at least 20 percent will remain open for uncommitted producers seeking interruptible capacity.

Process

Producers who would like to receive Open Season documents must first execute a Confidentiality Agreement, a copy of which may be requested from Coley Kellogg using the contact information included below.

To the extent bids exceed the Llano Pipeline’s capacity, Goodnight reserves the right to reduce the maximum capacity available to each bidding producer according to system priority, which will assign the highest priority to producers entering into long-term minimum volume commitments.

Inquiries

Inquiries about the Open Season should be directed to Coley Kellogg at 214-347-4450 orllanopipeline@goodnightmidstream.com.

Goodnight Midstream owns and operates an extensive network of water gathering pipelines and saltwater disposal wells in the premier oil shale fields in the United States, with a leading position in the Bakken of North Dakota, a rapidly expanding footprint in the Permian Basin, and an emerging presence in the Eagleford shale and the Powder River Basin. For more information, please visit goodnightmidstream.com.

DOE to Put $30M into Unconventional

TheU.S. Department of Energy (DOE) has announced the selection of six projects to receive approximately $30 million in federal funding for cost-shared research and development in unconventional oil and natural gas recovery.

The projects, selected under the Office of Fossil Energy’s (FE’s) Advanced Technology Solutions for Unconventional Oil and Gas Development funding opportunity, will address critical gaps in our understanding of reservoir behavior and optimal well-completion strategies, next-generation subsurface diagnostic technologies, and advanced offshore technologies.

As part of the funding opportunity announcement and at the direction of Congress, DOE solicited field projects in emerging unconventional plays with less than 50,000 barrels per day of current production, such as the Tuscaloosa Marine Shale and the Huron Shale. The newly selected projects will help us master oil and gas development in these types of rising shales, along with bolster DOE efforts to strengthen America’s energy dominance, protect air and water quality, position the nation as a global leader in unconventional oil and natural gas (UOG) resource development technologies, and ensure the maximum value of the nation’s resource endowment is realized.

All six projects represent a critical component of DOE’s portfolio to advance the economic viability and environmentally sound development of domestic UOG resources and support ongoing programmatic efforts in both onshore and offshore UOG research. These efforts include (1) improving understanding of the processes involved in resource development; (2) advancing technologies and engineering practices to ensure these resources are developed efficiently with minimal environmental impact and risk; and (3) increasing the supply of U.S. oil and natural gas resources to enhance national energy dominance and security.

Descriptions of each selected project follow:

- Hexagonal Boron Nitride Reinforced Multifunctional Well Cement for Extreme Conditions—C-Crete Technologies LLC (Stafford, TX) will provide a systems approach for developing the next generation of well cement. This cement will prevent offshore spills and leakages at extreme high-temperature, high-pressure, and corrosive conditions. A proof-of-concept hexagonal boron-nitride/cement composite will be developed and tuned to offer optimum slurry formulation and rheological properties, and the best hybrid nanostructure. By preventing offshore spills and leakages at extreme conditions, this project will increase cost-efficiency and production, mitigate risk over the productive life of the wells, and improve environmental and worker safety. DOE Funding: $1,500,000; Non-DOE Funding: $375,000; Total Value: $1,875,000

- Hydraulic Fracture Test Site II (HFTS2) – Delaware Basin—TheInstitute of Gas Technology (Des Moines, IL) will carry out multiple experiments to evaluate well completion, design optimization, and environmental impact quantification. The Institute will conduct these experiments using a hydraulic fracture test site experimental well in the Delaware Basin portion of the Permian Basin of Western Texas—specifically targeting the Wolfcamp formation. Anadarko Production Company and Shell Exploration and Production Company have both agreed to host the test site on their acreage. DOE Funding: $7,974,000; Non-DOE Funding: $12,590,000; Total Value: $20,564,000

- Eagle Ford Shale Laboratory: A Field Study of the Stimulated Reservoir Volume, Detailed Fracture Characteristics, and EOR Potential – Texas A&M Engineering Experiment Station(College Station, TX) will improve the effectiveness of shale oil production by providing new scientific knowledge and monitoring technology. This technology will be for initial stimulation/production as well as enhanced recovery via refracturing and enhanced oil recovery methods. This research will enable operators of thousands of existing fractured horizontal wells to better select refracturing candidates and design refracture treatments. Researchers will also gain knowledge about created fracture geometry when the two new production wells are monitored with high-resolution distributed sensing technologies during fracturing. DOE Funding: $8,000,000; Non-DOE Funding: $2,000,000; Total Value: $10,000,000

- In-Situ Applied Coatings for Mitigating Gas Hydrate Deposition in Deepwater Operations—The Trustees of the Colorado School of Mines (Golden, CO) will develop and validate robust pipeline coatings to prevent deposits of hydrates in undersea oil pipelines. These coatings, for field and commercial deployment, are critical in offshore leak and spill prevention. The coating system can be applied in situto treat existing flowlines. This technology will aid in flow assurance by decreasing the need for hydrate treatments and by avoiding plugging and subsequent safety and environmental consequences of the flowline. It will be a major, fundamental breakthrough in hydrate science and engineering, and is critical to deepwater field operations. DOE Funding: $1,498,000; Non-DOE Funding: $374,000; Total Value: $1,872,000

- Tuscaloosa Marine Shale Laboratory (TMSL) – University of Louisiana at Lafayette (Lafayette, LA) will address knowledge gaps regarding the Tuscaloosa Marine Shale (TMS), enabling more cost-efficient and environmentally sound recovery from this unconventional liquid-rich shale play. The TMS has been estimated to contain 7 billion barrels of recoverable light, sweet crude oil, while its current total average production is only about 3,000 barrels of oil per day. Development of the TMS in eastern Louisiana and southwestern Mississippi could significantly impact local communities economically. However, over the past several decades, operators have been unsuccessful in the TMS play, in part due to its clay-rich nature which makes it sensitive to water. Improved understanding of the TMS, along with public scientific assessment of new approaches for developing the play, will expand and accelerate industry efforts to cultivate this resource with minimal environmental impact. DOE Funding: $3,680,000; Non-DOE Funding: $5,977,000; Total Value: $9,657,000

- Field Laboratory for Emerging Stacked Unconventional Plays (ESUP) in Central Appalachia – Virginia Polytechnic Institute and State University(Blacksburg, VA) will investigate and characterize the resource potential for multi-play production of emerging unconventional reservoirs in the Nora Gas Field of southwest Virginia. There the project will evaluate and quantify the benefits of novel completion strategies for lateral wells in the unconventional Lower Huron Shale. A major research objective of the project is to characterize the geology and potential deep pay zones of Cambrian-age formations in Central Appalachia. A second major research objective is to evaluate and quantify the potential benefits of novel well-completion strategies in the emerging (and technologically accessible) Lower Huron Shale. This research will improve understanding of the geology and resource potential of the Cambrian Rogersville Shale and produce research-driven and industry-proven best practices to prudently develop these resources. DOE Funding: $7,999,000; Non-DOE Funding: $3,146,000; Total Value: $11,145,000

To learn more about DOE’s programs within the Office of Fossil Energy, visit their website. More information about the National Energy Technology Laboratory is available on the NETL website.