Here you will find the full versions of our articles… articles that appeared in truncated form in our print edition of the magazine, in our “Drilling Deeper” department.

Table of Contents:

Groundwater Resources of the Permian Basin

Leadership, Teamwork, and the Oil and Gas Company

Brent-WTI Price Spread Narrows

Groundwater Resources of the Permian Basin

by Wade Oliver, Gerry Grisak and Daniel Lupton, on behalf of INTERA Inc.

It has often been said that land without water is largely without value. Water is not only essential to life, but fuels economic growth. This is especially true in the Permian Basin, where the limited water resources must meet the needs of landowners and growing cities, such as Midland, Texas, in addition to increasing demands by the oil and gas industry due to the proliferation of hydraulic fracturing. Though water plays a key role in their operations, the water resources of the basin are highly variable both in quantity and quality, and it is often difficult for oil and gas companies to get a clear understanding of the water resources in an area. This is especially true for groundwater, as information on well locations and characteristics, water quality, aquifer depths, and productive capacity are dispersed among various state agencies and numerous hydrologic reports. INTERA, a Texas-based water resources consulting firm, recently released a free database of the groundwater resources in Midland County designed for use by the oil and gas industry to demonstrate the type of information that is available.[1] With a clear understanding of the water resources and uses in an area, including deeper brackish formations, companies can make more informed water-use decisions and reduce or eliminate impacts to local freshwater sources where possible.

It has often been said that land without water is largely without value. Water is not only essential to life, but fuels economic growth. This is especially true in the Permian Basin, where the limited water resources must meet the needs of landowners and growing cities, such as Midland, Texas, in addition to increasing demands by the oil and gas industry due to the proliferation of hydraulic fracturing. Though water plays a key role in their operations, the water resources of the basin are highly variable both in quantity and quality, and it is often difficult for oil and gas companies to get a clear understanding of the water resources in an area. This is especially true for groundwater, as information on well locations and characteristics, water quality, aquifer depths, and productive capacity are dispersed among various state agencies and numerous hydrologic reports. INTERA, a Texas-based water resources consulting firm, recently released a free database of the groundwater resources in Midland County designed for use by the oil and gas industry to demonstrate the type of information that is available.[1] With a clear understanding of the water resources and uses in an area, including deeper brackish formations, companies can make more informed water-use decisions and reduce or eliminate impacts to local freshwater sources where possible.

Water supplies are generally categorized as surface water, such as rivers and reservoirs or groundwater. Surface water reservoirs and large-scale potable water distribution systems were constructed in West Texas in the 1950s and ‘60s in response to the drought of record from 1947 to 1957. During development of the surface reservoirs, alternative sources of water, including some largely untapped aquifers, were identified as potential water supplies for the future. In the mid-1960s, the city of Midland, in a prescient decision acknowledging the inevitability of periodic droughts, acquired the T-Bar Ranch in Winkler County for its significant groundwater resources in the Pecos Valley Aquifer. Fifty years later, the Midland County Fresh Water Supply District completed 67 miles of pipeline from the T-Bar Ranch to Midland in less than a year and began delivering water to the city in May 2013. Today, groundwater supplements provide for many municipal and fresh water supply districts. Groundwater is included in strategies to meet current and future water needs in all of the Texas and New Mexico Regional Water Planning Areas within the Permian Basin, as seen in Figure 1. It is also the primary source of water for most domestic  and livestock purposes.

and livestock purposes.

In addition to the above demands, groundwater has been used for over a century by the oil and gas industry for drilling and secondary oil recovery operations. For instance, the former Shell water system pumped as much as 600,000 barrels of water per day, starting in the 1960s, from the deep Capitan Reef Aquifer and distributed it throughout Ector and the southern part of Andrews County (Brackbill and Gaines, 1964). Though in smaller quantities, potable groundwater from near-surface aquifers, such as the Ogallala and Edwards-Trinity Plateau, has also been used for secondary recovery.

The dynamics of water needs for the oil and gas industry in Texas changed dramatically with the widespread adoption and use of horizontal drilling and hydraulic fracturing to enhance oil and gas recovery. These modern exploration and development techniques require significantly more water than conventional drilling. A typical horizontal hydraulic fracturing operation requires between one and four million gallons of water; to put that into perspective, an Olympic-size swimming pool holds approximately 660,430 gallons of water.

According to a recent study by the Texas Bureau of Economic Geology, water use in Texas for hydraulic fracturing has increased significantly over the last several years from an estimated 11.4 billion gallons in 2008 to 26.6 billion gallons in 2011 (Nicot and Scanlon, 2012). Though this is small relative to the total amount of groundwater used in the state, it can be very significant locally if potable groundwater is scarce, as is the case in many areas within the Permian Basin.

The primary aquifers in the Permian Basin are the sands and gravels of the Cenozoic Pecos Valley Alluvium and the Tertiary Ogallala aquifers; the Cretaceous Edwards-Trinity Plateau limestones and sandstones; the Santa Rosa sandstone of the Triassic Dockum Group; the Permian Rustler Formation; and the Capitan Reef Aquifer. Groundwater is also produced in the Roswell artesian basin in the lower Pecos Valley in New Mexico from the Permian San Andres limestone, Queen and Grayburg formations, as well as the overlying Quaternary Alluvium. Together these aquifers cover the majority of the Permian Basin and many areas have more than one aquifer present at a particular location. However, the depths, productive capacity and water quality of these resources varies widely. Some aquifers are as much as 5,000 feet deep and well yields range from only one to two gallons per minute in some areas to over 1,500 gallons per minute in others.

A key limiter of the use of groundwater is its quality. Groundwater quality can be broadly categorized on the basis of the total dissolved solids (TDS) content. Fresh water has a TDS below 1,000 milligrams per liter (mg/L). Brackish water is moderately saltier than fresh water and has a TDS between 1,000 and 10,000 mg/L. Water above 10,000 mg/L TDS is generally considered saline. As reference, seawater is considered saline, with a TDS of approximately 35,000 mg/L.

A key limiter of the use of groundwater is its quality. Groundwater quality can be broadly categorized on the basis of the total dissolved solids (TDS) content. Fresh water has a TDS below 1,000 milligrams per liter (mg/L). Brackish water is moderately saltier than fresh water and has a TDS between 1,000 and 10,000 mg/L. Water above 10,000 mg/L TDS is generally considered saline. As reference, seawater is considered saline, with a TDS of approximately 35,000 mg/L.

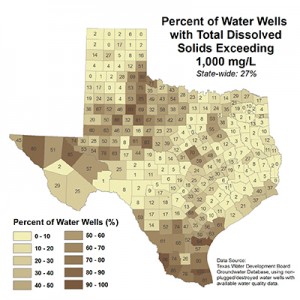

The drinking water standard in both Texas and New Mexico is a TDS concentration below 1,000 mg/L. Figure 2 illustrates the proportion of groundwater wells in Texas counties with recorded TDS values exceeding this threshold. Counties in the Permian Basin and South Texas stand out, comparably, as having a large percentage of groundwater wells producing brackish and saline water instead of fresh water. In the Permian Basin, this ranges from 28 percent of wells in Ector County to 85 percent in Reeves County. While fresh water is often most desirable, many users are forced to settle for lesser quality water because that is all that is available.

Despite the variability in the quality and water availability in the aquifers of the Permian Basin, with the right information, oil and gas companies can come to a good understanding of the water source options in their areas of interest. Companies can also learn about the characteristics of those sources, such as likely water quality and well yield, and potential nearby conflicts for the resource, including public supply water wells.

Records of well depths, yields and locations, water quality, and water levels, can be obtained from state agencies, such as the Texas Water Development Board (TWDB), Texas Commission on Environmental Quality, Texas Railroad Commission, New Mexico Office of the State Engineer and New Mexico Oil Conservation Division. Hydrogeologic studies have also been completed on many of the aquifers in the basin, which are available through some state agencies and in various technical journals. Due to more limited historical use, the characteristics of several deeper brackish aquifers in the Permian Basin are not as well established, but reliable estimates of water quality and productive capacity can be made through analysis of geologic trends and geophysical logs.

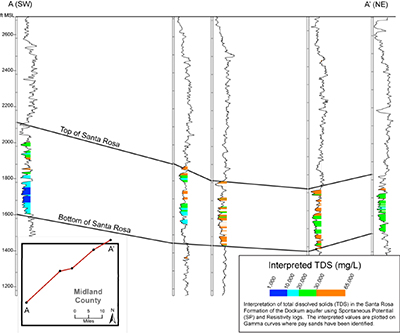

As an example, the study completed by INTERA of the groundwater resources of Midland County includes an evaluation of the water quality in the Santa Rosa formation of the Triassic Dockum Group, which is a potential source of water for hydraulic fracturing with fewer conflicts than younger, shallower formations in the county. The water quality in the Dockum sandstones is generally non-potable, though it is highly variable throughout the Permian Basin. The map in Figure 3 illustrates the range in TDS content of Dockum groundwater in the Permian Basin in Texas from TWDB reported water quality data. Most Dockum groundwater quality ranges from slightly saline to saline, with the exceptions of where the Dockum outcrops and receives recharge on the eastern extremes of the Permian Basin; and Winkler, Ward, Loving and northeastern Reeves counties, where the water quality is similar to that of the overlying Cenozoic Pecos Alluvium. Some of the reported Dockum wells in these counties are potentially open to the Cenozoic Pecos Alluvium in addition to the Dockum, and in the vicinity of the Monument Draw Trough in Winkler, Ward and Reeves Counties, there may be significant collapse structures and fracturing that provides vertical interconnectivity not seen elsewhere in the basin. Throughout most of the Permian Basin in Texas, Dockum wells typically do not yield more than about 100 gallons per minute, due to the relatively low permeability of the fine-grained Dockum sandstones and the limited available drawdown that is usually not more than a few hundred feet. The Dockum is seldom used as a municipal or domestic water supply, with the exception of a few instances on the eastern side of the basin near the outcrop area. In some areas, stock wells and domestic wells may be screened or opened to the Dockum if there is no occurrence of better quality groundwater.

Since the Dockum can be a viable potential source of water for hydraulic fracturing, and the quality of the water used for hydraulic fracturing is important, the Dockum groundwater quality was evaluated using geophysical spontaneous potential (SP) logs obtained from the TWDB and commercial sources. This water quality interpretation is based on the application of Archie’s law (Archie, 1942, 1947, 1950) which relates the electrical conductivity of a sedimentary rock to its porosity and brine saturation. The methodology used to determine the Dockum water quality consists of:

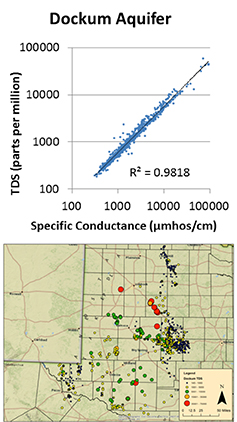

estimating the formation water resistivity (Rwe) at formation temperature using the deflection of the SP curve and the resistivity of the mud filtrate at formation temperature (see Asquith  and others, 2004); calculating the equivalent formation water resistivity at 75 degrees Fahrenheit; calculating the specific conductance at 75 degrees Fahrenheit (µmhos/cm); and developing an empirical relationship for the conversion between specific conductance at 75 degrees Fahrenheit and formation water TDS. All of this with the assumption, which is reasonable, based on the majority of Dockum water samples, that the primary cation in the formation water is sodium. The empirical relationship between specific conductance and Dockum formation water TDS shown in Figure 3 was developed using conversion coefficients ranging from 0.48 to 0.60, depending on the range of formation water resistivity, converted to specific conductance. Using this method, TDS can be reliably estimated in areas of the Dockum Aquifer that do not have existing wells or water quality analyses, as shown in Figure 4.

and others, 2004); calculating the equivalent formation water resistivity at 75 degrees Fahrenheit; calculating the specific conductance at 75 degrees Fahrenheit (µmhos/cm); and developing an empirical relationship for the conversion between specific conductance at 75 degrees Fahrenheit and formation water TDS. All of this with the assumption, which is reasonable, based on the majority of Dockum water samples, that the primary cation in the formation water is sodium. The empirical relationship between specific conductance and Dockum formation water TDS shown in Figure 3 was developed using conversion coefficients ranging from 0.48 to 0.60, depending on the range of formation water resistivity, converted to specific conductance. Using this method, TDS can be reliably estimated in areas of the Dockum Aquifer that do not have existing wells or water quality analyses, as shown in Figure 4.

The water used for oil and gas operations, including hydraulic fracturing, often does not need to meet the same water quality standards as other users, such as drinking water, irrigation or livestock. This is only an example, but it demonstrates the type of information and analyses that can be useful to oil and gas companies seeking to better understand the water source options and manage their use of the limited groundwater resources of the Permian Basin. The Midland County Groundwater Database prepared by INTERA, which includes aquifer locations and depths; well yields, locations, and water quality; brackish water quality interpreted from geophysical logs; and the locations and characteristics of disposal wells was designed for use by oil and gas companies and represents the type of information that can be assembled throughout the Permian Basin. To receive a copy of the database, contact Wade Oliver, PG at (512) 425-2058 or woliver@intera.com.

References

Brackbill, R.M. and J.C. Gaines, 1964. El Capitan Source Water System. Journal of Petroleum Technology, Dec. 1964, p 1351-1356.

Nicot, J.P. and B.R. Scanlon, 2012. Water Use for Shale-Gas Production in Texas, U.S., Environmental Science & Technology, Vol. 46, p. 3580-3586.

Archie, G.E., 1942. The electrical resistivity log as an aid in determining some reservoir characteristics. Petroleum Transactions of AIME 146: 54–62.

Archie, G.E., 1947. Electrical resistivity an aid in core-analysis interpretation. American Association of Petroleum Geologists Bulletin 31 (2): 350–366.

Archie, G.E., 1950. Introduction to petrophysics of reservoir rocks. American Association of Petroleum Geologists Bulletin 34 (5): 943–961.

Asquith, G. and D. Krygowski, 2004. Basic Well Log Analysis. AAPG Methods in Exploration Series, No. 16, 244p.

___________________________________________________________

Leadership, Teamwork, and the Oil and Gas Company

by Roger Schwarz

Is your leadership team getting the results it needs? Does your leadership team really work as a team or is it less than the sum of its parts? Does it consistently get the results it needs or is it stuck?

Is your leadership team getting the results it needs? Does your leadership team really work as a team or is it less than the sum of its parts? Does it consistently get the results it needs or is it stuck?

If your leadership team is like most of the ones I’ve worked with over the past thirty years, chances are you’re dissatisfied with the team’s performance, how it works together, or both. The team may be making poor decisions, may take too long to make decisions, may not commit to decisions the team makes, or may have such a difficult time working together that team members avoid working as a team.

If your leadership team is like most in the oil and gas industry, a significant number of its members are engineers or scientists. I’ve worked with leadership teams in oil and gas exploration, production, and distribution and found that they share a common problem. When these teams face a challenging situation and members have different views on the topic, everyone thinks they are right.

Unilateral Control: The Limiting Team Mindset

In this “I am right” mindset, which I call unilateral control, team members think they understand the situation and those who disagree don’t understand. They think they are right and those who see it differently are wrong. They believe that others are contributing to the problem, but they are not.

Our mindset drives behavior which leads to results. The unilateral control mindset turns team problem solving turns into a team debate in which the different sides try to convince each other to adopt their solutions. All the information needed for good problem solving doesn’t get on the table, team members don’t build on each others’ ideas, and the team either reaches and impasse or makes a decision without enough commitment to implement it well.

Although the unilateral control mindset is typical of almost all leadership teams facing challenging situations, the professional training that engineers and scientists receive seems to give them an extra dose of it. These professionals believe that the logical, analytical way they have been trained to think gives them a distinct edge over others – even others with the same professional training.

It is ironic. Engineers and scientists are trained to think logically and analytically: they rely on the scientific method to solve problems. When they work on technical problems, they make sure their data are valid, they test their hypotheses before declaring them true, and they carefully design their experiments and analysis to rule out other explanations for what they are observing. The irony is that when engineers and scientists form a leadership team and address problems that go beyond purely technical challenges, they discard the scientific method that makes their work so valuable. As a team they revert to considering information without determining whether it’s valid and to making inferences about the situation and other team members without testing them out.

Mutual Learning: The Transforming Team Mindset

The good news is that engineers and scientists can create smarter leadership teams by using a mindset that’s based on the scientific method: I call it mutual learning. When you and your team use a mutual learning mindset, you operate from this set of core values:

- Transparency: You share all the relevant information you have about the topic, including your reasoning, your feelings, and your strategy for how you will influence others.

- Curiosity: You are genuinely interested in learning others’ views on the topic, including their reaction to your views. You ask questions to learn what others are thinking.

- Informed choice: You want to ensure that you and others are making decisions based on good information.

- Accountability: You hold others and yourself accountable for their work and for explaining their actions.

- Compassion: You recognize others’ concerns, connect with them, and respond to them, even if you don’t agree with the actions they have taken.

Along with these core values, you and your team operate from a set of core assumptions:

- I have information; so do other people.

- Each of us sees things others don’t.

- People may disagree with me and still have pure motives.

- Differences are opportunities for learning.

- I may be contributing to the problem.

When you and your team operate from a mutual learning mindset, you use behaviors for that make your team smarter: You share all the relevant information about a problem, agree on what important words mean, understand each others’ thinking, identify all the needs that must be met to effectively solve a problem, test assumptions and inferences, and even discuss the undiscussable issues that members talk about outside team meetings but that can only really be addressed in a team setting.

It’s easy to think that you’re using a mutual learning mindset when you’re using a unilateral control mindset. That’s because we are almost always unaware of our mindset. However, those who have different views than we do can see our unilateral control mindset clearly. If you’re not certain what mindset you’re using in high-stakes challenging situations, take this free short survey to learn immediately what mindset your team is operating from.

Developing a leadership team that is smarter than the sum of its parts requires that you and your team shift your mindset as well as your behavior. With time and discipline your team can consistently have strong performance and solid working relationships.

Roger Schwarz is an organizational psychologist, speaker, and author of Smart Leaders, Smarter Teams: How You and Your Team Get Unstuck to Get Results and The Skilled Facilitator. He is president and CEO of Roger Schwarz & Associates, a consulting firm that has helped many Fortune 500 leadership teams get better results. For more information, visit www.schwarzassociates.com or find him on Twitter @LeadSmarter.

___________________________________________________________

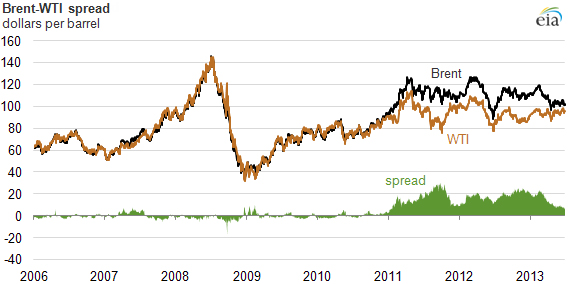

Brent-TWI Price Spread Narrows

The Brent-WTI spread, the difference between the prices of Brent and West Texas Intermediate (WTI) crude oils, has narrowed considerably over the past several months. The spread, which was more than $23 per barrel ($/bbl) in mid-February, fell to under $9/bbl in April, and has ranged between $6/bbl and $10/bbl since then.

The narrowing of the spread is supported by several factors that have:

- Lowered Brent (North Sea) prices because Brent-quality crude imports into North America have been displaced by increased U.S. light sweet crude production, reducing Brent-quality crude demand

- Raised WTI (Cushing, Oklahoma) prices because the infrastructure limitations that had lowered WTI prices are lessening

Before 2011, Brent and WTI crude oil prices tracked closely, with Brent crude oil prices typically trading at a slight discount to WTI crude oil, reflecting delivery costs to transport Brent crude oil and Brent-like crude oil into the U.S. market, where they competed with WTI crude oil. In early 2011, this longstanding relationship began to change, and since then, WTI crude oil has priced at a persistent discount to Brent crude oil. Increased U.S. light sweet crude oil production combined with limited pipeline capacity to move the crude from production fields and storage locations, including Cushing, Oklahoma, the delivery point for the Nymex light sweet crude oil contract, to refining centers put downward pressure on the price of WTI crude oil.

More recently, expansions in U.S. crude oil infrastructure have eased the downward pressure on the price of WTI. Since mid-2012, significant pipeline takeaway capacity has been added at Cushing, enabling crude oil to flow to and from the trading hub more easily. Other pipeline and rail projects have also been completed, making it possible to move barrels from production areas, such as Texas and North Dakota, to refinery centers without passing through the hub. Even U.S. East Coast refineries, which historically have relied on Brent crude oil and Brent-like crudes, can now access U.S. light sweet crude oil. U.S. crude that moves by rail is replacing Brent crude oil and Brent-like crude oil imports into the U.S. East Coast, putting downward pressure on the price of Brent crude oil and narrowing the differential versus WTI crude oil.

The future of the Brent-WTI price spread will be determined, in part, by the balance between future growth in U.S. crude production and the capacity of crude oil infrastructure to move that crude to U.S. refiners. The International Energy Agency (IEA) reported that planned maintenance in the North Sea oil fields this summer will reduce production, adding upward pressure to Brent prices and potentially widening the Brent-WTI spread. In its June 2013 Short-Term Energy Outlook, EIA forecast the Brent-WTI price spread to average $11/bbl in 2013 and decline to an average $8/bbl in 2014. For more information about the Brent-WTI spread, see the June 5, 2013, edition of This Week in Petroleum.

For more information from the EIA, visit this page:

http://www.eia.gov/todayinenergy/detail.cfm?id=11891

[1] To request a free copy of the database of Midland County Groundwater Resources, contact Wade Oliver, PG at (512) 425-2058 or woliver@intera.com.