So Much to Sort Out

The year 2017 begins with big deals and big changes, all accompanied by fresh takes on the new doings. These are the full versions of the articles shown in truncated form in the print version of our March issue.

Texas to Lead in Production Through 2018

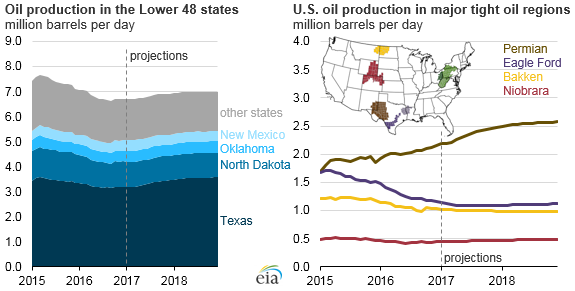

In EIA’s January Short-Term Energy Outlook, U.S. crude oil production is forecast to increase from an average of 8.9 million barrels per day (b/d) in 2016 to an average of 9.3 million b/d in 2018, primarily as a result of gains in the major U.S. tight oil-producing states: Texas, North Dakota, Oklahoma, and New Mexico. Of these states, Texas and North Dakota will continue to be the largest producers of crude oil because of the large amounts of economically recoverable resources in the Eagle Ford, Permian, and Bakken regions. Production in Texas, the largest oil-producing state, is driven by two major oil-producing regions, the Permian and the Eagle Ford. As defined in EIA’s Drilling Productivity Report, the Permian region makes up a large geographic area with producing zones each more than 1,000 feet thick and with multiple stacked plays. Because of its large geographic size, the Permian offers a lot of potential for testing and drilling, and the multiple stacked plays allow producers to continue to drill both vertical wells and hydraulically fractured horizontal wells.

Although overall U.S. oil production has been declining since mid-2015, production has continued to increase in the Permian region. In 2016, Permian production averaged 2.0 million b/d, a 5% increase from the level in 2015. EIA expects this trend to continue, with Permian production projected to average 2.3 million b/d in 2017 and 2.5 million b/d in 2018.

Compared with the Permian region, the Eagle Ford region has fewer overall drilling opportunities in core areas. The Eagle Ford region has a significantly smaller geographic area than the Permian region, and the region’s target producing zones are only about 200–300 feet thick, compared to the thousands of feet within the Permian. As with most shale and tight oil regions, the Eagle Ford region has wells with high initial production rates, but faster than average production rate declines. Because of these production rates, drilling fewer new wells has a more immediate effect on production. As low oil prices slowed the pace of drilling, production in the Eagle Ford region has declined since March 2015, with average annual production at 1.6 million b/d in 2015 and 1.3 million b/d in 2016.

Although declines in Eagle Ford production are expected to continue through the first half of 2017, EIA expects production in that region will begin increasing in the third quarter of 2017 and will continue to increase through 2018 as higher oil prices encourage more drilling activity. With the combination of the Permian’s continued growth and renewed production in the Eagle Ford, Texas is expected to continue to be the largest-producing state through 2018.

The Bakken and Three Forks formations drive crude oil production in North Dakota, which has been in decline since 2015 in response to lower prices. Unlike in Texas, producers in North Dakota have additional infrastructure constraints involved in transporting their products to market. During the winter, production costs increase as operators must deal with below-freezing temperatures and heavy snowfall. However, as in the Eagle Ford, new drilling is expected to increase, enabling overall Bakken production to stay at least flat through 2018.

More information about current drilling activity and production in key regions is available in EIA’s Drilling Productivity Report. More information about monthly production and price expectations through 2018 is available in EIA’s Short-Term Energy Outlook.

Heartland Comments on Keystone, Dakota Access

In late January, after President Donald Trump signed two executive orders intended to expedite completion of the Keystone XL and Dakota Access pipelines, the Heartland Institute issued its reaction to the proceedings. The orders encourage TransCanada to reapply for a permit to complete the Keystone XL pipeline and direct the U.S. Army Corps of Engineers to “review and approve [the Dakota Access Pipeline] in an expedited manner, to the extent permitted by law.” The following statements are from public policy experts at Heartland, a free-market think tank.

Isaac Orr, Heartland’s research fellow on Energy and Environmental Policy, observed that when President Trump signed the two executive orders, he righted two of former-president Obama’s wrongs. “Americans consume 19.6 million barrels of oil per day. Ten years ago, Americans imported half of the oil used every day. Now, thanks to frac’ing, net oil imports have fallen to only a quarter of U.S. consumption. Pipelines are needed to transport this oil. Pipelines are the safest, least-expensive way to transport oil. 99.99 percent of all the oil transported via pipeline arrives safely at its destination. Transporting North Dakota oil via pipeline is about half as costly as shipping it via rail. This pipeline is vitally important to making sure oil producers can compete with countries like Venezuela and Saudi Arabia, increasing the odds American workers will have access to high-paying jobs in the frac’ing industry.”

Christopher Essex, professor of applied mathematics at the University of Western Ontario, remarked on the safety of the pipeline. “I believe that Canada is the largest supplier of foreign oil to the United States,” Essex said. “It gets there in part via huge dirty dangerously flammable trains of oil-bearing tank cars. Pipelines are far safer, cleaner, and cheaper, but the completion of this pipeline and others has been prevented by a seemingly endless artificial Wagnerian psychodrama. It has damaged economies and lost good jobs for good people in both countries.”

“The decision to advance the pipelines is a long overdue no-brainer. Pipelines are simply safer, more economic, and present less environmental risk than does the currently used rail transport.”

Walter Starck

Policy Advisor, Environment

The Heartland Institute

media@heartland.org

312/377-4000

“By giving the green light to the Dakota Access and Keystone XL pipelines the Trump administration prioritizes jobs, the economy, consumers, mineral owners, and national security over radical environmentalists. It is a great day!

“The Clinton and Kerry State Department played politics with the Keystone XL pipeline, costing jobs in the United States and causing economic hardship for our good neighbors in Canada.

“The Obama administration has attacked our traditional energy industries for eight years. The Keystone XL pipeline, EPA’s Clean Power Plan and Waters of the United States rule, the United Nations Framework Convention on Climate Change, Bureau of Land Management rules on hydraulic fracturing, venting of natural gas … the Obama administration’s accomplishments are impressive. They have been successful in stifling the development of traditional energy and increasing the cost of heat and electricity to consumers, especially burdening the poor and elderly.

“The Dakota Access Pipeline gives access to the Gulf Coast for Bakken oil, and that is a win for energy security, mineral owners, workers, and our economy. It means jobs for the oil, steel, and construction industries. Also, it makes sweet crude more competitive in the marketplace. It also means jobs for environmental protestors, so everyone wins!

“In President Trump the radical environmentalists have finally met a man who understands cost/benefit analysis, and acts accordingly. “

Bette Grande

Research Fellow, Energy Policy

The Heartland Institute

governmentrelations@heartland.org

312/377-4000

“Pipelines are the safest way to transport oil over land. When the Keystone XL pipeline was proposed, it made economic sense to build it. Not only was it to be built with private money, it made far more economic sense than many of the so-called ‘shovel ready’ jobs in the ‘stimulus bill’ funded by taxpayers. Whether it still makes economic sense is now up to the developers, not the arbitrary political whims of Washington.

“Stopping the Dakota Access pipeline after 98% of the pipeline was laid down was an example of how the greens infected political decisions in Washington. The pipeline was to be drilled almost 100 feet below the riverbed of the Missouri, not placed on it. But, that made little difference to those stopped it.

“Let’s hope that President Trump’s decisions are a sign of better times to come.”

Kenneth Haapala

President

Science and Environmental Policy Project (SEPP)

Ken@Haapala.com

312-377-4000

“President Trump did the right thing, and with the proper urgency.

“Pipelines are cheaper, more reliable, and safer than freight trains for transporting oil, and the increase in production means our nation’s consumers and businesses will get the best prices possible. Lower energy costs also make U.S. manufacturing more competitive. That will create well-paying jobs and put people back to work.

“This is a big win for the American people, and the science shows that not a single polar bear will die because of it.”

S.T. Karnick

Director of Research

The Heartland Institute

skarnick@heartland.org

312/377-4000

The Heartland Institute is a 33-year-old national nonprofit organization headquartered in Arlington Heights, Illinois. Its mission is to discover, develop, and promote free-market solutions to social and economic problems. For more information, visit our website or call 312/377-4000.

Things Perry Shouldn’t Forget at DOE

Rick Perry needs to eliminate the many costly and counterproductive activities of the Department of Energy and return the agency to its original mission, said Dr. Merrill Matthews of the Institute for Policy Innovation, as reported by the Washington Examiner. Matthews stated that Former Gov. Rick Perry, R-Texas, will face a number of challenges when he takes over the Department of Energy, both from the bureaucracy within and environmentalists and the media outside. The agency was created in 1977 by President Carter, partly in response to Middle Eastern oil-exporting countries’ decision to use oil as a political weapon. DOE, whose proposed 2017 budget is $32.5 billion, is responsible for a number of energy-related tasks. Surprisingly, regulating the fossil fuel industries isn’t one of them. Those responsibilities primarily belong to the Environmental Protection Agency and the Department of the Interior.

One important function has been to deal with nuclear issues, including nuclear power, missile complexes and nuclear waste and cleanup.

The agency is also tasked with developing a national energy plan. That focus has changed with different presidential administrations. Under the Obama administration, the agency has been a cash cow for green energy projects, often with questionable results.

For example, in 2014 DOE ponied up a $150 million loan guarantee for Cape Wind, a wind turbine project to be located in Nantucket Sound. However, local pushback over the potential doubling of consumers’ electricity bills, even after millions of taxpayer dollars, has stalled the project.

The solar energy company Solyndra, whose failure became a national scandal, received its $535 million loan from DOE in 2009, though it originally applied for the loan in 2006 under the Bush administration.

In short, Perry needs to reign in, downsize and refocus DOE. Here are some steps he should take.

Eliminate all mandates and subsidies for energy sources. According to a 2015 study by the Taxpayer Protection Alliance, the Obama administration spent an average of $39 billion a year over five years subsidizing solar and other renewable energy projects, and a chunk of that money came from DOE.

But the federal government should not be in the business of deciding private sector winners and losers. That’s what consumers and markets do. Perry should phase out DOE clean energy subsidies and hand that money back to taxpayers.

Scale back and rationalize energy research. DOE is charged with conducting energy research and development. In an effort to fulfill Obama’s dream of a clean energy economy, DOE’s 2017 budget request hoped to “double clean energy R&D funding in five years.” That’s probably not going to happen now.

There may be a role for DOE to engage in certain types of specialized energy R&D, both for fossil fuels and clean energy, but that possibility has often been used to promote political agendas. Perry needs to depoliticize DOE’s R&D and refocus its efforts on developing a realistic energy plan, one that recognizes the country will be dependent on fossil fuels for decades to come.

Expedite approval of liquefied natural gas terminals. Liquefied natural gas could become a major export, but for several years the federal government has been a roadblock rather than a catalyst.

The Federal Energy Regulatory Commission is an independent agency within DOE. Among other duties, it is charged with approving applications to build liquefied natural gas terminals that cool natural gas to -260 degrees so it can be shipped on tankers.

Under the Obama administration, the permitting process has been slow. Perry should do what he can to expedite the application approval process. Not only would the additional income from gas exports help the economy, it would provide an alternative for our allies who are dependent on countries like Russia for their natural gas.

End the Strategic Petroleum Reserve. The Strategic Petroleum Reserve was created under the DOE to stockpile crude oil in case of disruptions in U.S. oil imports. But innovative drilling techniques have increased U.S. oil production so rapidly that we will soon be a net oil exporter. That greatly expanded production has negated the need for the Strategic Petroleum Reserve. It should be phased out.

DOE has a number of important core responsibilities, but it has also engaged in numerous costly and counterproductive activities. Perry needs to eliminate those activities and return the agency to its original mission. It will be a smaller and less costly DOE but a much more effective one.

The Institute for Policy Innovation (IPI) is an independent, non profit public policy research organization based in Dallas. IPI resident scholar Dr. Merrill Matthews is available for interview by contacting Erin Humiston, (972) 874-5139, or erin@ipi.org.

Making Sense of Merger

Noble Energy’s acquisition of Clayton Williams Energy fits a pattern that fits these times, according to the analyst form of Canaccord/Genuity. (See our coverage of this deal in this month’s News Reviews department.) Sam Burwell, CFA, and an analyst for the firm, said that they view Noble’s (NBL) acquisition of Clayton Williams (CWEI) as an analog to the prevailing “public-on-private” mergers-and-acquisitions (M&A) trend. “Given that CWEI was not growing all that much, was tightly held by insiders and had only recently jettisoned its non-Permian acreage, we viewed the company as more akin to the private equity-backed companies than most other public Permian pure-players (at least from an M&A perspective). With regard to NBL, we had previously considered it a likely bidder for either Silver Hill or Brigham (or Jagged Peak) given its relatively limited Permian inventory. Ultimately, the company stayed closer to its existing leasehold by first acquiring about 7,000 acres from private operator Manti Tarka in November, followed by this deal for CWEI. From NBL’s perspective, the fact that the lion’s share of CWEI’s Delaware acreage was directly adjacent to its current block made the deal more logical than stepping further afield to grab Silver Hill or Brigham.

We don’t see clear read-throughs from NBL/CWEI unless large-caps’ desire for public mid-caps heats up; we’d point to EGN if that happens.”

As we laid out above, we view NBL’s acquisition as more in line with RSPP/Silver Hill or FANG/Brigham rather than the start of a “public-on-public” trend in M&A. The public

Permian names trade at substantially richer valuations (~$50K/acre, before takeout premia) than the privates ($20K-$40K/acre, all in), making it all the more difficult for

acquirers to pull off an accretive deal. That said, if we had to pick one company in our coverage that could be a target it would be EGN. Similarly to CWEI, it has high quality

Permian leasehold (~120K acres between the Midland and Delaware in its case), recently sold non-core assets and trades more cheaply on a per-acre basis relative to

peers (see page 2). Even with a 20% premium on the equity, EGN’s EV/acre would be ~$40K.

XOM’s addition in New Mexico further illustrates that public companies prefer to acquire private assets. This morning the oil giant announced it is acquiring ~250K acres from the Bass family

companies (BOPCO) for ~$5.6B in cash up front. Adjusting for the 18 MBoe/d of flowing production, the acreage value works out to ~$20K/acre. To our knowledge, much of the

leasehold is located in Eddy County. While there are no perfect deal comps, we would note that on a per-acre basis XOM paid more than twice what EOG dropped for Yates’

New Mexico assets back in September. This deal somewhat notwithstanding, oil majors have not been significant acquirers of onshore E&P assets for some time. Ironically,

the last large M&A deal of that type was XOM’s acquisition of XTO in 2009. We note, however, that the BOPCO transaction was again a public company buying privately held assets.

Sam Burwell, CFA, analyst, Canaccord/Genuity