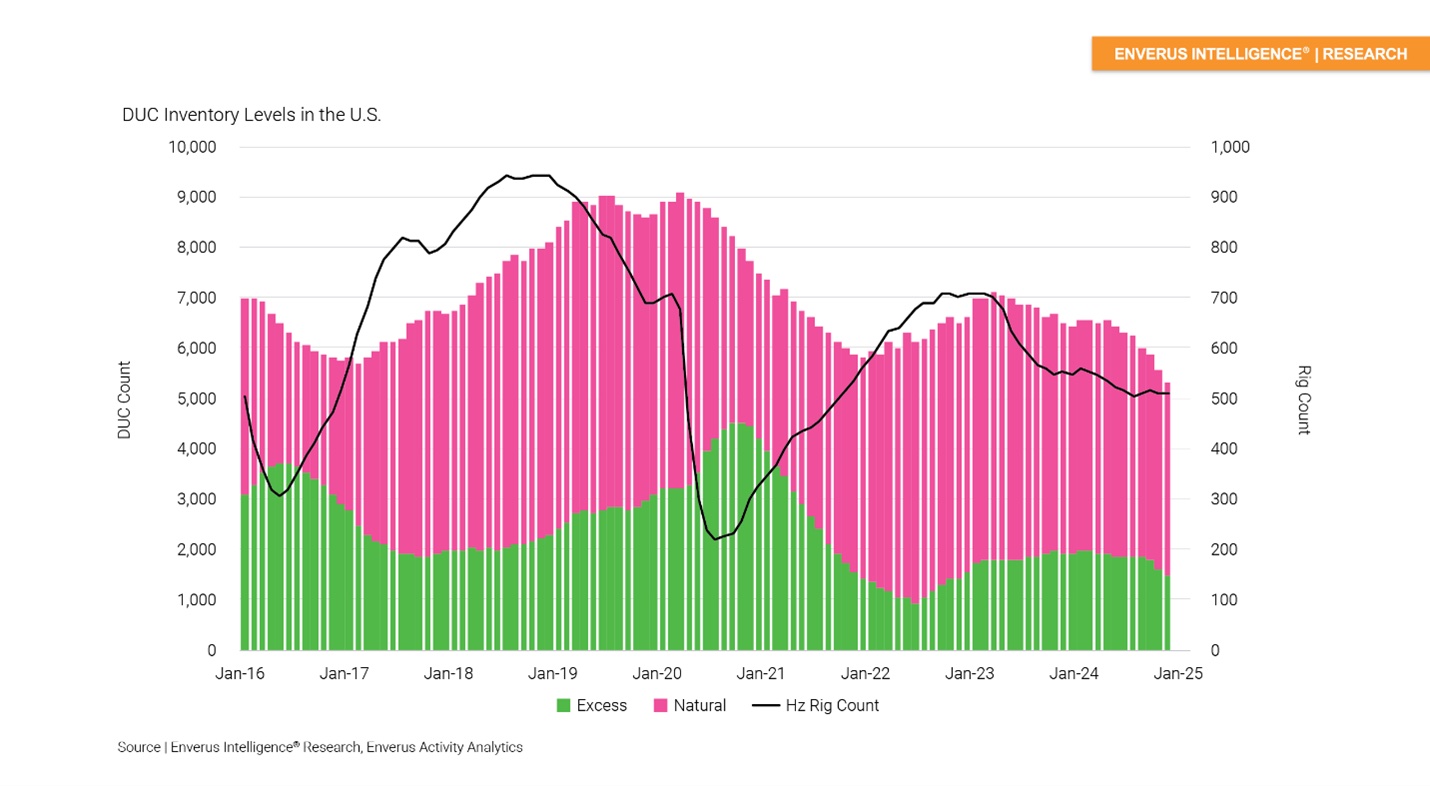

Enverus Intelligence Research (EIR), a subsidiary of Enverus, an energy-dedicated SaaS company that leverages generative AI, released on Feb. 12 a report that analyzes recent inventories of drilling uncompleted wells (DUCs) and the implications for 2025 budgets. DUCs provide operators with strategic flexibility, financial benefits, and operational efficiency, making them a crucial aspect of the industry’s dynamics. EIR’s report also examines differences between EIR’s DUC estimates and those of the Energy Information Administration (EIA).

“Operators are entering into 2025 with lower DUC inventory numbers than they entered 2024, creating potential for impacts to capital efficiency throughout the year,” said EIR principal analyst and report co-author Mark Chapman. “DUCs act as a form of inventory and when market conditions are favorable, such as higher winter gas prices, companies can quickly complete these wells to boost production and capitalize on the higher prices, providing a tailwind early in 2025.”

Key takeaways of the report include the following. (1) The number of drilled uncompleted wells (DUCs) in the last year fell faster than the drop in drilling rigs, indicated the backlog of such wells is declining. This has implications for energy companies’ 2025 forecasts on production and capital efficiency. (2) The Midland Basin depleted its inventory of excess DUCs the most over the past year, falling from two months to one. (3) A few gas producers bucked the industry trend and managed to increase total DUC inventories by more than one month since last year. (4) EIA estimates of DUCs have become increasingly misaligned with EIR’s calculations, which Enverus suspects largely reflects differences in the granularity and timeliness of data sources.