The Eagle Ford’s center of gravity hasn’t shifted so much as sharpened. Production is broadly steady with modest gas-side growth, operators are leaning into longer laterals and bolt-ons rather than big rig adds, and the Corpus Christi export complex keeps widening the outlet to global markets—especially for LNG. The result is a basin that’s cash-efficient, infrastructure-advantaged, and still consolidating.

Production and activity: flat-to-up with a gas skew

The U.S. Energy Information Administration (EIA) expects Eagle Ford natural gas output to edge higher as LNG demand rises—moving from ~6.8 Bcf/d in 2024 to ~7.0 Bcf/d in 2026. Oil volumes are holding up thanks to efficiency gains rather than heavy drilling growth. That matches the national pattern this year: fewer rigs, similar production, and a premium on capital discipline. U.S. Energy Information Administration+1

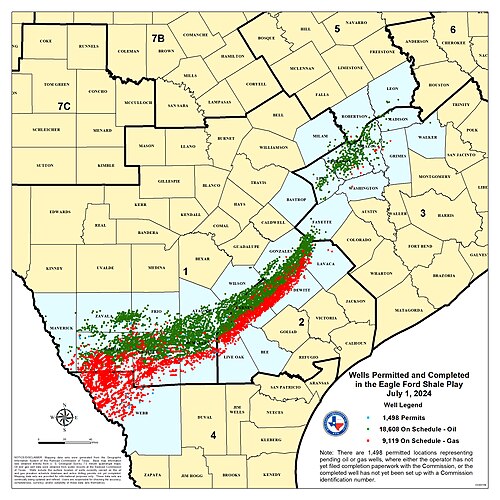

State data corroborate the stability narrative. Railroad Commission of Texas (RRC) monthly tables for 2025 show sustained oil and gas volumes across key Eagle Ford counties, even as operators fine-tune development cadence. (Note the RRC’s figures exclude condensate from “crude oil” and are subject to revisions.) Railroad Commission of Texas

Export pull: Corpus Christi keeps setting records

The Port of Corpus Christi—effectively the Eagle Ford’s “ocean-going pipe”—continues to post record throughput. In 1H 2025, port customers moved 65.2 million tons of crude (up ~3.8% year/year), while LNG volumes rose nearly 11% to 8.5 million tons. That expanding outlet underpins basin pricing and marketing flexibility, supporting steady development even in choppy commodity tapes. portofcc.com+1

LNG is the bigger story. Cheniere’s Corpus Christi Stage 3 expansion hit multiple 2025 milestones—Train 1 reached substantial completion in March, Train 2 in August, with another train slated to complete this year and the balance in 2026. Cheniere also took FID on Midscale Trains 8 & 9 in June 2025, adding >3 mtpa of capacity next door. As Stage 3 ramps, Corpus Christi’s total nominal capacity trends toward ~3.1 Bcf/d (3.9 Bcf/d peak), strengthening Gulf Coast gas demand and, by extension, the Eagle Ford gas case. Cheniere+2Cheniere Energy, Inc.+2

Corporate moves: consolidation continues

Deal-flow remains selective but consequential. ConocoPhillips closed its acquisition of Marathon Oil in late 2024, adding material Eagle Ford inventory to a Lower 48 portfolio now focused on scaled, low-cost resource. Since then, COP has been pruning non-core assets to pay down deal debt and refocus capital—selling Gulf of Mexico interests to Shell and marketing Anadarko assets—moves that reinforce a returns-first stance across the enterprise. For Eagle Ford partners and service firms, that means an emphasis on efficiency, long-laterals, and repeatable programs, not a rig stampede. Reuters+3ConocoPhillips+3ConocoPhillips+3

In the mid-cap cohort, Crescent Energy’s Eagle Ford push has been a through-line—first with a $2.1B deal for SilverBow announced in 2024 and other bolt-ons, signaling that scale and contiguity remain strategic in South Texas. Market watchers note that while mega-mergers grabbed headlines, targeted Eagle Ford consolidation is alive and well. Crescent Energy+2Mercer Capital+2

Operator playbooks: longer laterals, capital discipline

EOG—one of the basin’s bellwethers—trimmed 2025 capex by ~$200 million while still guiding to modest growth, reflecting basin-wide discipline. The company has highlighted South Texas bolt-ons that enable extended laterals and improved returns, and it continues to align gas development with LNG and Gulf Coast power demand signals. That’s emblematic of how leading Eagle Ford operators are threading the needle: prioritize inventory quality, return cash, and pace development to market pull. Reuters+2InvestorRoom+2

Power and electrification: a quiet structural shift

While the headline power-build is more visible in West Texas, the trend is relevant basin-wide: operators are electrifying pads and midstream assets to cut fuel and maintenance costs and to meet ESG targets. Texas is approving major grid investments, and private developers are adding gas-fired capacity to cover industrial load growth and intermittency—developments that, over time, improve reliability for South Texas oil and gas too. Reuters

Regulatory and ESG: flaring scrutiny and seismicity management

On flaring, pressure remains high—from investors, buyers, and NGOs—to minimize routine flares and improve gas capture. Advocacy groups have kept a spotlight on Texas flaring practices, and the RRC has tightened aspects of its procedures in recent years. Separately, RRC’s seismicity review protocols for disposal wells continue to shape water-management and SWD siting decisions across Texas, including Eagle Ford counties with sensitive faulting. Executives should expect permitting diligence—seismic surveys, pressure management plans—to remain part of the cost of doing business. Commission Shift+2Oaoa+2

What it means for 2026 planning

- Marketing & basis:Corpus Christi’s rising crude and LNG throughput supports stronger netbacks and optionality. As LNG trains ramp, watch Gulf Coast gas basis and pipeline balancing—particularly during winter LNG peaks. Port Technology International+1

- Capital allocation:Expect continued emphasis on free cash flow and inventory high-grading over raw activity growth. Consolidators with contiguous acreage—able to drill 10,000–15,000’ laterals—retain the edge. Reuters+1

- Services pricing:With rigs not racing ahead, services remain competitive; the winners will be those enabling faster cycle times, longer laterals, and lower emissions per BOE. Industry reports indicate softer rig counts in 2025 even as production holds—mirroring what you may see on the ground. World Oil

- Permitting & stakeholder risk:Keep flaring minimization and seismicity diligence front-and-center to avoid delays. Oaoa+1

Bottom line: The Eagle Ford is behaving like a mature, advantaged shale province: steady volumes, export-driven gas momentum, and value-over-volume capital programs. For business leaders, that translates into predictable development, sustained midstream utilization, and a market that rewards efficiency and integration more than brute activity. If LNG and exports keep climbing as planned through 2026, South Texas gas—and the liquids that come with it—should remain on firm footing.