While not yet out of the woods, the oil and gas patient is doing better as 2020 gets further in the rear view mirror. Recovery signs are pointing upward—and none more so than those surrounding most types of energy demand and, therefore, energy production—and frac’ing is vital to that.

The Institute for Energy Research reported gasoline prices averaged $3.076 per gallon on June 15, 2021, the highest in six years. The U.S. Energy Information Administration June 29 report stated that distillate demand had returned to 2019 levels while gasoline was right behind, with jet fuel rising, but lagging behind the other two. Jet fuel’s 2020 collapse was greater than gasoline or distillate, leaving it more ground to make up.

Because of this upturn in demand and the resulting price rise into the $70 range, production is ramping up. The EIA reports that March oil and gas production in New Mexico hit an all-time record. Oil production averaged 1.16 million b/d and natural gas averaged 6.19 Bcf/d, 17 percent higher than the previous month. February, of course, was when Winter Storm Uri caused the shutdown of a large part of the industry for several days.

It’s no secret that there are still concerns about virus mutations and the energy transition, and that’s keeping a lid on some drilling expenditures. Yet there’s still growth in the industry, including the frac sector. James Wicklund, managing director for Stephens Inc, an energy banking firm, said this in a recent emailed newsletter:

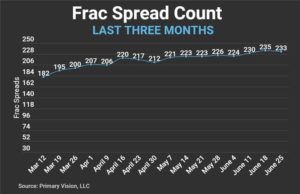

“According to Primary Vision, there are 235 active spreads and 280 marketed spreads, putting utilization at 80 percent, nearing that point where historically pricing has started to move. My fingers are crossed and I hope they all have the same discipline being seen in E&P as curtailed capex is resulting in record cash flows and even positive earnings for many. Electric frac fleets account for 6 percent of the market, 16 spreads, with no indications of new orders according to one report. Frac efficiencies are estimated at around 5 percent YTD, slower than the torrid pace of the past few years, but still headed up.”

That same week there were 470 drilling rigs, up nine from the previous week. Active frac spreads were up by five.

Wicklund says privately held independents are ahead of majors on adding rigs. “Private oil companies, including private equity backed ones, account for about half of all current drilling activity, a significantly larger share of activity than their size or production levels would warrant on a relative basis. Public companies are constrained/restrained by investors and board members. Many private companies don’t have those restrictions.”

What This Means

Matt Johnson is CEO of the aforementioned Primary Vision. The company monitors global frac’ing activity to help clients identify market trends for strategy decisions.

The company’s Frac Spread Count tracks frac’ing across the United States and in the oil basins of Alberta, Canada. They count frac spreads, defined as the collection of equipment needed for a typical frac job. That includes the array of pressure pumps, blenders, hydration units, and other equipment and people required for a job. They sort the data by operator, pumper, region, duration, and other categories.

Rig counts have risen slightly since January, as prices have pushed upward, but hesitation still rules. Producers began the year by frac’ing DUCs (drilled, uncompleted).

“Rigs have mostly been flat this year,” said Johnson. “In terms of growth we’re going to need to see more permits and more rigs, or that DUC count’s going to go down. We think that’s naturally going to happen over the course of the next few months, especially as operators have been able to manage their decline curves a lot better this year versus last year.

“What you’ll see is the frac spread count hover here in the next few months somewhere around 230-250 with the Permian Basin leading the way. And we’ll see rigs increase.”

Comparing the two numbers—the Frac Spread Count with the rig count for horizontal wells—gives a telling metric, said Johnson, which is tracked by Princeton Energy Advisors.

The frac spreads always lag behind rig counts. Princeton’s President, Steven Kopits, explains how his numbers work.

“I divide the number of horizontal oil rigs by the number of frac spreads reported by Primary Vision. This includes spreads involved in activities other than oil drilling, e.g., natural gas drilling. So we’re speaking of a rule of thumb rather than some scientific measure. However, when the spread ratio is below 62 percent, it tends to rise over time; when it is above 62 percent, it tends to fall over time.”

As of end of June, the frac spreads to horizontal rigs number was 70 percent, a number Kopits called “near historical highs.”

This high number means a correction is coming. “First, it implies that DUCs continue to be run down. This has to end shortly, because the industry typically operates with a six month inventory of DUCs. This soared to nearly four years of inventory during the pandemic, but has now returned to 30 weeks, a little above normal.

“As DUC inventories return to normal, operators will have an incentive to increase the rig count and reduce the spread ratio back that 62 percent range. This should happen during the course of the summer.”

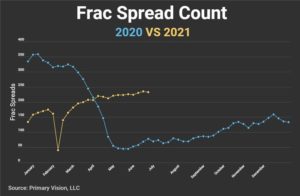

Johnson added that rig activations are lagging behind the normal expectation of that report, but that with COVID, “This is a new season.” He observed that a year ago the frac spread count collapsed to just 45—the lowest number ever since the start of the frac era.

He does have hope. “In the last 12 months we’ve come back, operators were able to get out of 2020 alive, and 2021’s expectations are managed, we just haven’t quite seen those rigs come back to 6-7-800. That’s where we’ll see material growth.”

For the rig and frac count growth that has happened so far, much has been fueled by independents, he said. There just aren’t as many independents as there used to be. “When I started doing this 10 years ago, we had almost 1,100 active operators frac at least one well per year. Just last year we had under 200. So the consolidation that’s happening in our business is so large. This year, I believe we’ll see more operators because there’s more work being done with more budget. It will be interesting to see if we see some of the smaller players come back.”

He sees two subcategories as ripe for growth: refracs and electric fracs. “We’ve always thought that this [refrac’ing] was such a big business, but it really hasn’t panned out. For every 100 wells that are frac’ed in the United States, one of them is a re-frac.”

For the second issue he notes, “I look forward to the electric spread world improving, probably in the middle 2020s. If we look at the 230 active spreads we have out there, only 15 of them are powered electrically. That’s a really small margin. We can do better, we’re going to do better, and I don’t think that will be a surprise. I think we’ll do it and we’ll be the best at it in the world.”

Boots on the Ground

One of the leaders in completions is Liberty Oilfield Services. Kevin Schey, the company’s Midland sales manager, said DUC completions were much higher in January than at midyear for his office, seconding Kopits. “Well over 50 percent back in January were DUCs, and I’d say we’re probably under 50 percent here today.” He stressed that those numbers are estimates.

He said public companies generally left more DUCs during the pandemic than privates because the privately held companies did very little drilling at all then.

Frac Technology Evolves

“The industry is always finding ways to be more efficient,” said Schey. He’s seen increases in stage length, clusters per stage, while the number of pounds per square foot has plateaued as of 2020. Recycling of produced water for frac’ing is also on the rise for cost savings and efficiency.

“The industry is always finding ways to be more efficient,” said Schey. He’s seen increases in stage length, clusters per stage, while the number of pounds per square foot has plateaued as of 2020. Recycling of produced water for frac’ing is also on the rise for cost savings and efficiency.

At the top of the list, however, may be simulfrac’ing on multiwell pads. “That’s pumping down two wells at once with maybe 1.5 frac spreads or so. That’s mainly driven by cost savings for the operator, and also efficiency.” Four, six, and eight well pads are the most likely locations for this option.

Adopting simulfrac’ing does present some changes for frac crews. “It’s not something you can just flip a switch and be doing it the next day. You just meet with that customer and get a partnership developed where they understand what you need as a service company, to make that happen and provide an extra 50 percent of horsepower.”

Next on the horizon is electric frac’ing, which Liberty is developing and hopes to have in operation sometime in the second half of 2022. To source the power they plan to use natural gas reciprocating engine generators. We also have the option of plugging into the grid if that’s available.” A combination of sources is also possible. Natural gas supplies could come from site gas, LNG, or CNG as the producer decides.

In 2020, the company saw the effects of the 45 frac spread count and was forced to make layoffs. But Schey said things picked back up shortly thereafter, they were able to purchase two companies, and that they rehired almost everyone who wanted to come back.

“We’re very good at adapting, especially since the last two downturns were so close to each other. It’s a struggle, but the struggle makes you stronger. When you lift bigger weights you get bigger muscles.”

________________________

By Paul Wiseman