Freedom from OPEC has been high on the American agenda for 23 years now. The Permian Basin is at the heart of the mission to secure American energy security.

As an investor, I look for unique value propositions. The Permian, as the last significantly growing U.S. oil basin, is overlooked and underappreciated by most investors. That yields some great investment opportunities.

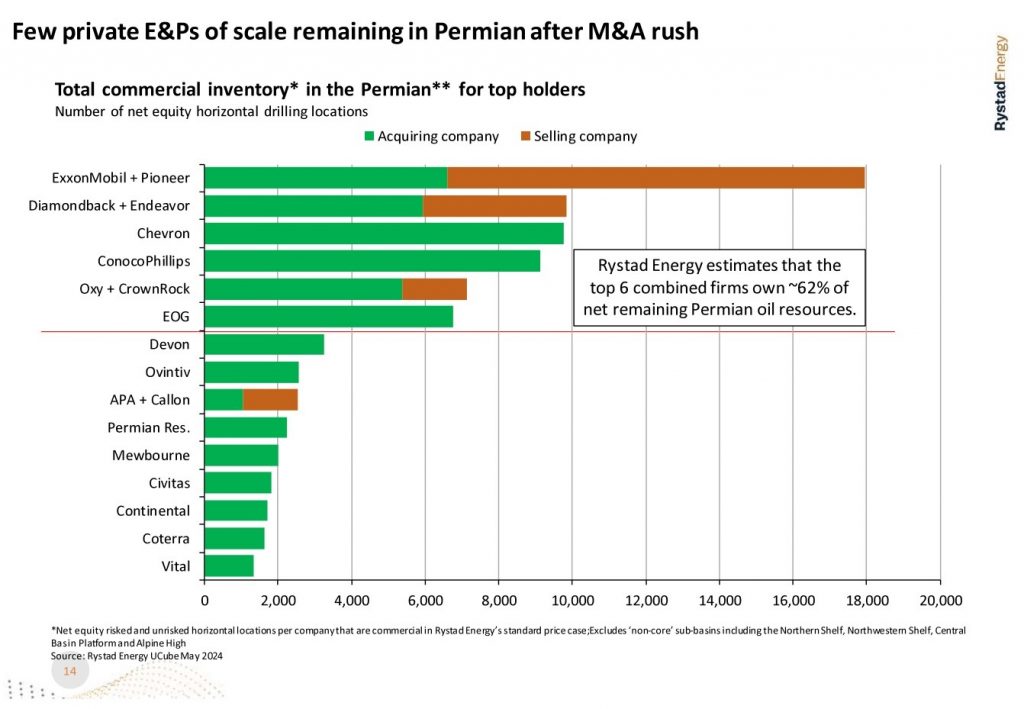

To best use longer laterals, cube, and other technology, companies are rationalizing their asset bases and expanding acreage where strategic. I expect many more asset swaps and sales, as well as several more mergers, in the next few years. The strategic positioning should yield strong results for shareholders in companies that practice financial prudence.

Diamondback Energy (FANG) is in a great position to maximize the value of their holdings. Focused on the Midland, where they will certainly add some pieces, their assets in the Delaware are a valuable card for them. At the Hart Energy SuperDug conference in Fort Worth, President and CFO Kaes VAn’t Hof discussed the potential to either sell or expand their Delaware holdings. Either way, Diamondback should come out a winner.

Permian Resources (PR) is focused on the Delaware and would seem to be a natural fit with Diamondback to acquire some of their assets or, if both managements are ready, to explore the prospect of a merged company.

Coterra’s (CTRA) Delaware assets could be in play as well. If they sell their Delaware assets, they could focus on being a natural gas pure play in the Marcellus.

Exxon (XOM) would seem to be blocked by the DOJ from making another major acquisition; however, they will be active in acreage sales, purchases, and swaps.

The next four largest Permian producers, Chevron (CVX), Conoco (COP), Occidental (OXY), and EOG all seemingly have the ability to pick up a smaller player in a deal.

Devon Energy (DVN), with assets in the Williston, Eagle Ford, Anadarko, and Powder River, seems to be in play. While every management wants to grow a bigger company and run more assets, Devon, as a dabbler in private equity, seems more likely to me to be acquired or parted off at this point. If that is Devon’s route, then their cash potential to shareholders would be large.

Apache (APA) with the acquisition of Callon is interesting. They have a lot of moving parts and it seems to me, from a private equity style mindset, that management would be prudent to sell some assets. We’ll see what management decides, but Apache could be a big winner with the right moves.

Ovintiv (OVV), formerly Encana, also jumps out at me. They could strategically sell Midland assets to focus on their other less exploited plays, the Montney in particular. Or sell other assets to focus on the Midland. Some rationalization of assets seems certain to improve efficiencies.

While the Justice Department has played hardball on recent mergers to avoid an oligopoly, it is important they understand the strategic necessity of the mergers.

An “all of the above” energy strategy makes sense for America within the reality that oil demand will not fall this decade and possibly not even next decade. AOTA requires American oil and gas producers to be able to maximize their acreages’ potential.

The effectiveness of strategic positioning will be key to lengthening the time that the Permian can maintain high production levels that ensure freedom from OPEC.

As an investor, I am looking to see which companies put together the best rock and the best economics, while exercising financial prudence. We’ll see how things rationalize from here, but I am very optimistic about the outcomes as a shareholder.

My firm and I own stock in Permian Resources, Occidental Petroleum, Coterra, and Diamondback Energy. For disclaimers and deeper dives, please visit my investment letters at FundamentalTrends.com or MOSInvesting.com or my Registered Investment Advisor firm Bluemound Asset Management, LLC.

A change analyst and investment advisor, Kirk Spano is published regularly on MarketWatch, Seeking Alpha, and other platforms.