By Rick Adams, Senior District Engineer, Energen Resources Corp., and Bill Wooden, Applied Seismic Research Corp. (ASR)

In August 2007, Energen Resources began to explore use of a new technology called “Seismic Stimulation” that improves oil production

by providing energy to allow coalescence of the immobile oil droplets into mobilized oil. At the time, the technology had shown success in Permian Basin Clearfork and Glorieta carbonates as well as in sandstone fields in other parts of the United States. Energen was especially attracted by the fact that the tools can be deployed in shut-in or temporarily abandoned wells. The tools have very little required maintenance and zero environmental impact. Only a month later, the Texas Railroad Commission (TRRC) certified Seismic Stimulation as an official Tertiary Recovery method, thereby qualifying for a 50 percent reduction in the State Severance Tax for ten years on total affected production including all future in-fill drilling. The novelty of the technology and the attraction of long-term tax credits drove the initial use of Seismic Stimulation in the company.

ASR’s service contract places no additional burdens on Energen’s time to monitor the stimulation or provide filings with the TRRC. ASR includes, as part of its service, preparation of the necessary graphs and tabular data for filing of the TRRC H-12 which is the first step in starting an EOR project. During stimulation ASR provides graphs showing the monthly progress of the stimulation. After a one year stimulation period, as required by the TRRC for tax credit qualification, ASR prepares the graphs and tablular data for the filing of the H-13. Energen employs an Austin-based consulting firm for the formal filings of the H-12 and H-13. This firm is experienced in these filings and also provides an independent second opinion on the EOR results. The TRRC requires “proof of positive response” over the course of a one year stimulation to qualify the affected area for the tax credits. All graphs constructed by ASR contain only those wells unaffected by other stimulation methods during the historical and stimulation timeframes.

The first Seismic Stimulation Tool was deployed in the Whiteface Unit (WFU), Levelland County, Texas. The Whiteface Unit is a San Andres waterflood with a stable production history against which the stimulation could be judged.

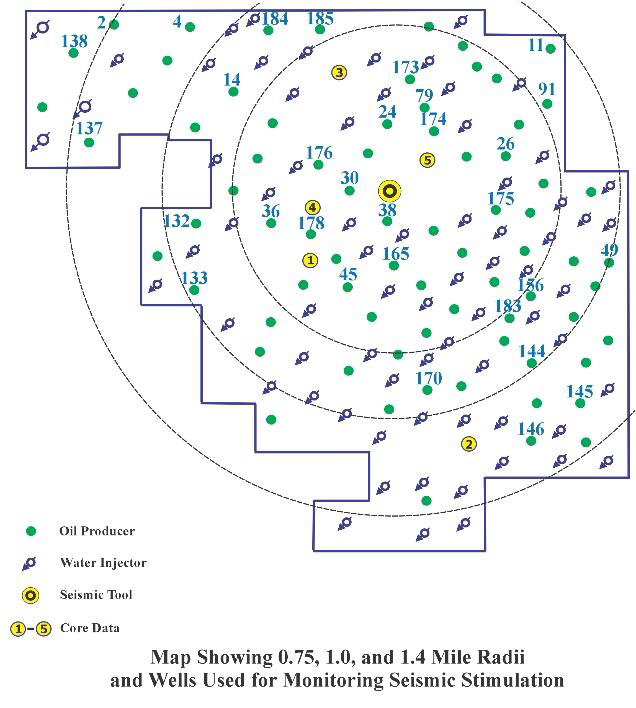

The map of WFU shown below has 0.75, 1.0 and 1.4 mile Radii displayed on it.

The reason for monitoring three stimulation radii is that the TRRC allows an operator a 0.75 mile radius “to start the EOR project” meaning that it assumes Seismic Stimulation will potentially enhance oil recovery in at least a 0.75 mile radius. ASR monitors all three radii and provides graphs of each area enclosed to show whether or not the stimulation is reaching that area. In the final H-13 submission, the most distant radii graph is submitted as evidence of the stimulation being effective to that distance. The TRRC then reviews the H-13 submission and following its approval, all production, both current and future to the farthest radii, is granted the Tertiary EOR credits. In this instance the entire unit benefits from the tax credits.

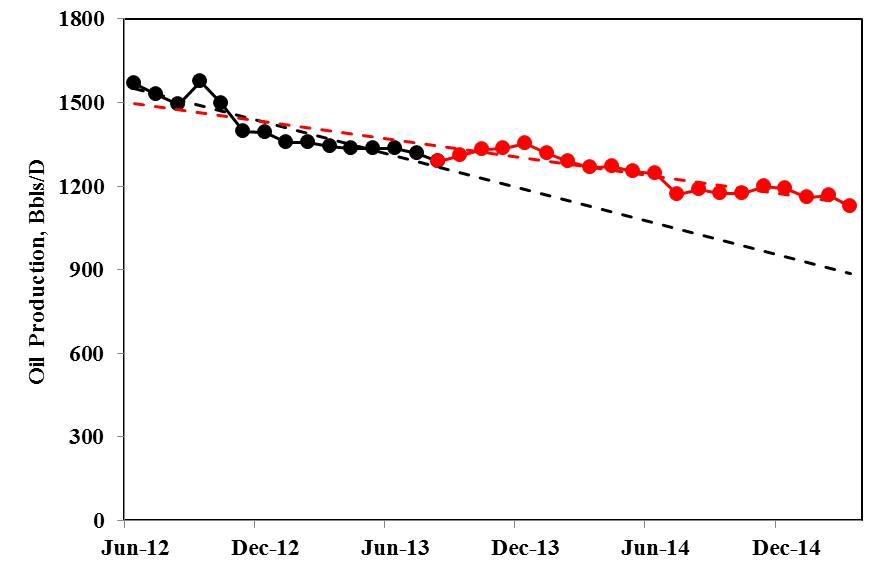

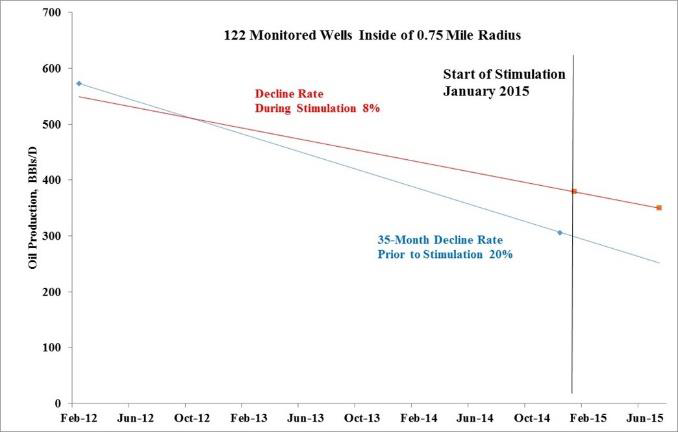

The graph to date of the results is shown below:

To date, the Whiteface Unit has recovered an estimated 92,000 additional barrels of oil and generated tax savings in excess of $1 million dollars.

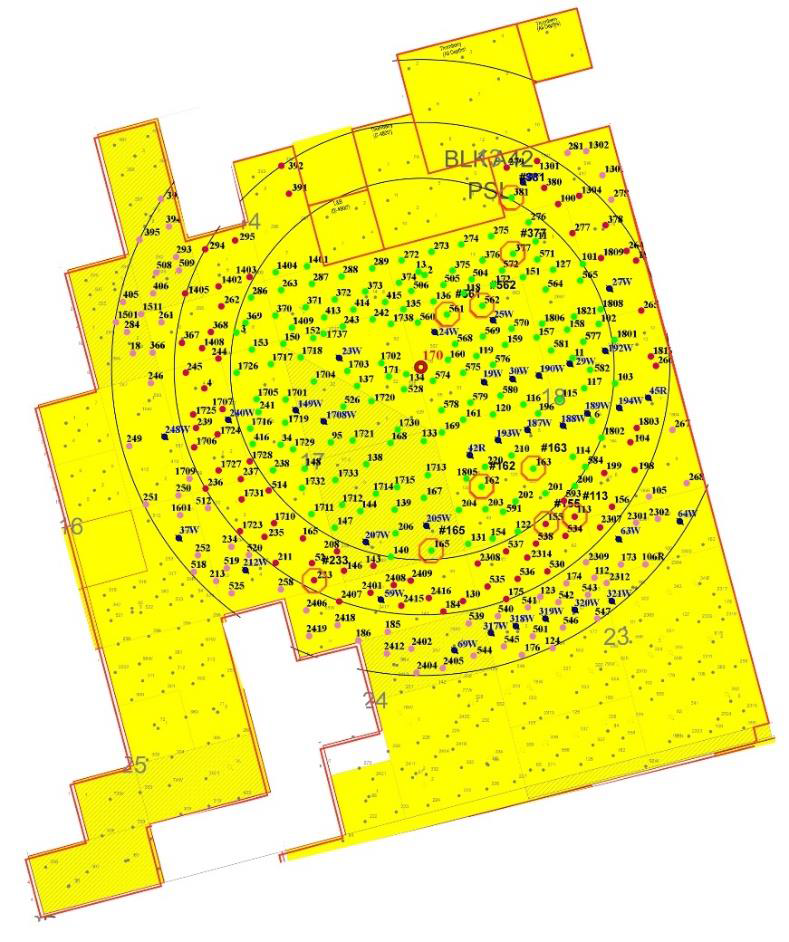

The successful implementation of Seismic Stimulation at the Whiteface Unit encouraged Energen to utilize it in the North Robertson Unit (NRU), a Clearfork waterflood in Gaines County, Texas. A map of the NRU illustrating the 0.75 and 1.0 mile radii is shown below:

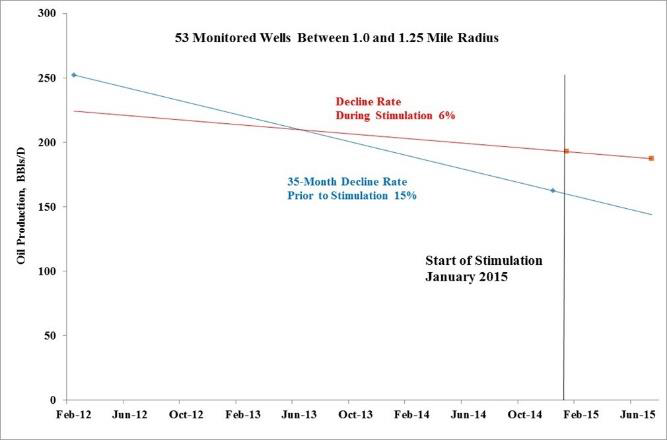

A graph of all 182 wells within the 1.25 mile radius is shown below:

As of March 2015, the stimulation has enhanced oil recovery by approximately 94,000 barrels of oil. At present NRU is under existing tax credits for the waterflood and on their expiry the Seismic Stimulation tax credits will begin to apply.

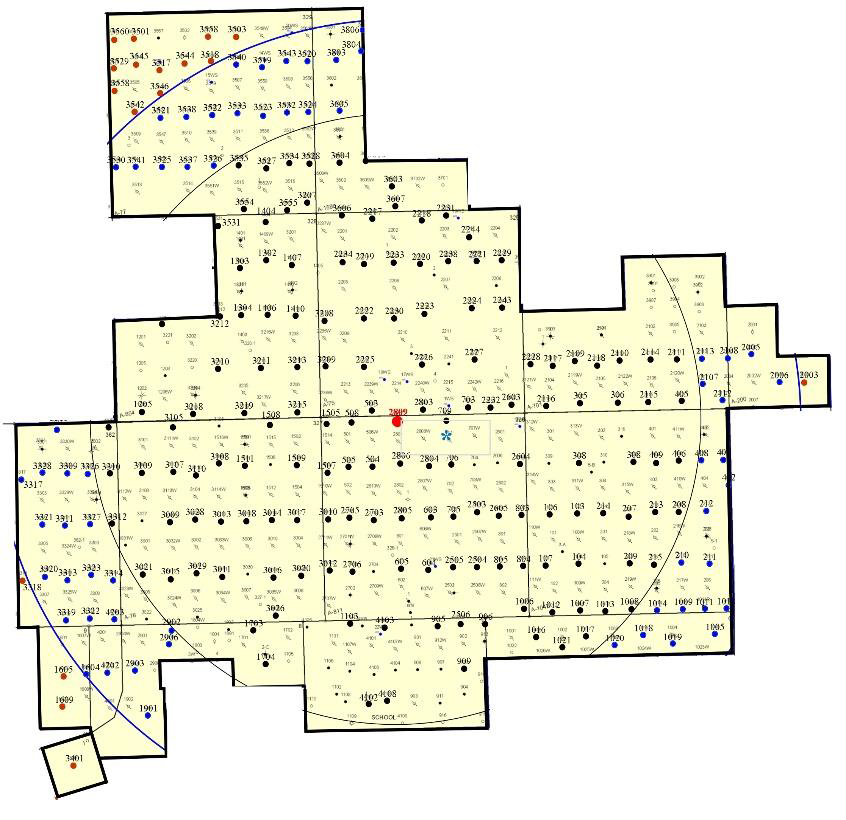

A map of the most recent installation, the West Fuhrman Mascho Unit (WFMU), a San Andres waterflood in Andrews County, illustrating the 0.75, 1.0 and 1.25 mile radii, is shown below:

WFMU is typical of many units in the U.S. with less than ideal well testing data. In such fields, ASR has to analyze each well’s test data. For each well, a least-squares best fit line is calculated through the historical and stimulation data. All wells’ best fit lines are then combined to construct a composite best-fit line representing the historical trend and similarly a composite best-fit line for the stimulation.

Fortunately, ASR has done this before for other clients and was successful in making the case to the TRRC. That client’s project was approved for Tertiary EOR credits. At present the composite graphs for the WFMU display good stimulation results as shown below.

Based on results after one year of stimulation, WFMU will qualify for the Tertiary tax credits. The TRRC requires at least one year of “proof of positive response” to file for the tax credits. Presently, WFMU results (the H-13) are being filed with the TRRC. It is important to note the tax credits start at the point of departure of the stimulation from the historical trend. In the case of WFMU these credits will start with the first month of stimulation and are retroactive to that point.

It is of interest to note the costs of implementing such a project. Typically, Energen budgets $200,000 as start-up expense including the tool, well prep, tubing, rods, and the pumping unit. ASR charges $45,000 for the tool and $6,000 per month lease. The value of the tax credits far exceed the cost of implementation once the tax credits are granted.

Energen is planning on starting a fourth project, in its North Westbrook Unit in 2016, budget contraints permitting. This is a large field and will require three Seismic Stimulation tools to cover. In it, ASR and Energen are expecting similar results qualifying the project for the Severance Tax credits.