by Paul Wiseman

At the dawn of the digital oilfield age, many staffers worried about being rendered obsolete by the efficiencies inherent in automation. Since the upheaval of COVID-related workplace changes, employees have left the oil patch in droves. For many oil and gas operators, making the remaining workers more efficient by employing automation and other forms of IT has become necessary for survival.

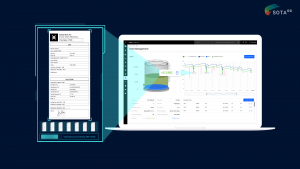

Managing artificial lift systems is one of the most important aspects of the IT age, and that’s the focus of Boomerang SCADA. Also, Houston-based SOTAOG is leveraging tank data and other factors to boost producers’ income by up to 20 percent.

But a 2022 survey by energy research firm Gartner, Inc., shows that Chief Information Officers are concerned about getting funding to do even more with IT. How well companies focus on boosting IT may have a direct influence on profitability, many believe.

Boomerang SCADA Vice President of Operations, Austin de Graaf, says the company’s artificial lift management systems do not do away with site trips—they just make them less often and more efficient. “The amount of people, especially in the Permian, is limited. So if we can assist in making the work more efficient, then they can do more work with the same amount of people.”

Boomerang goes beyond simply collecting and managing SCADA data, he said. By organizing tasks into workflows, each staff member can better plan and prioritize their day. “We can send them an automated report every day at 5 a.m. or 6 a.m. and say, ‘Out of a hundred wells, today you’re going to go see these eight or ten first,’” he explained.

Those decisions hinge on how each well has performed over the previous 24 hours. “If a well has been going down every six hours steadily, that’s one that somebody needs to go visit.” The daily report can set priorities based on wells with issues. Or, wells that are newer and more productive can be prioritized due to their greater importance to total production numbers. Reports and workflows go out from the cloud for distribution through email or text.

Priorities can be set by each producer, but de Graaf noted that he and his partners have spent years in the field themselves—working for an artificial lift company—and have created a solid set of built-in priorities. Most buyers make only small tweaks in what they’ve provided. “They all do things a little bit differently,” he observed, “so it’s really up to them to tell us what they want. We can build out anything and we can do it really quickly.”

For producers using Boomerang, their SCADA’s array of sensors has already eliminated the need to gauge tanks and manually fill Excel spreadsheets with recorded data. It’s all collected and store automatically through Boomerang’s cloud-based system for reporting and workflow scheduling.

The oilfield’s historic resistance to change is breaking down, de Graaf said, for two main reasons. One is that challenging times have required it. But mainly he sees that younger generations are used to managing bank accounts, lunch menus, and even laundry by smartphone—so adding well monitoring and control is a natural progression.

Rod pumps by the dozen dot the countryside, and de Graaf says Boomerang can save miles and hours every day by eliminating the need for daily trips to each one.

For gas lift, de Graaf stated that most producers rent the compressors they require, and that those rentals can be expensive. Therefore, in any month where the compressor is operating less than 97 percent of the time, the compressor company must pay the operator a discount. Boomerang can not only track compressor run time, it can detect and record any problem that caused a shutdown, helping the operator track any owed discount—if applicable. “Was it the operator’s fault because he wasn’t supplying the gas, or was it a mechanical issue in the compressor, so the compressor company should give them a discount?” he said.

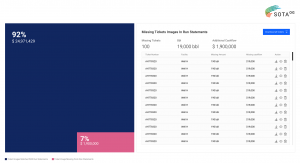

This SOATAG software displays the value realized when their system supplies the data that otherwise would have been lost due to 100 lost tickets.

ESPs produce a lot of fluid, but can be finicky. “So if we can automate intake pressure drawdown, flag issues sooner, make remote changes within a second, not 10 minutes later, and do troubleshooting remotely, that would help the ESP business.” So Boomerang tailors each program to the size of the company and the assortment of lift types.

Boomerang can use existing SCADA hardware if they add their proprietary edge computer, which de Graaf called their “boombox to the system onsite.” The device is “about the size of a deck of cards.” Once “trained” in the location’s equipment and given autonomous control, the boombox can use AI and ML to continue operating the site even if there’s a communication failure, continuing until communication is restored.

Drilling for Profits

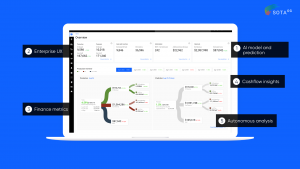

SOTAOG, headquartered in Houston, describes itself as “an intelligent enterprise software solutions provider.” Its cofounder and CEO, Sarah Tamilarasan, notes that digitally collecting and sorting well data is nothing new. The difference lies in how it can be put to work toward greater profitability. “I think the real value is in analyzing the data,” using computers to quickly run thousands of calculations and provide useful information.

“The simplest example is that tank level data comes in every ten minutes out of every tank” in their system. “Those tanks contain an oil company’s cash flow. The oil in the tank is your cash on hand.” Any signature drop in the tank level is likely due to the oil being sold into a pipeline. “Pipeline sales have a unique signature and truck sales have their own signature,” she noted.

Properly analyzing those two signatures and comparing them to current oil pricing shows a company their cash flow. That helps a company’s reconciliation for end-of-month payment.

Data analysis at this point is vital because it’s where many companies lose money every month—to the tune of 3 to 7 percent. “That’s free cash flow you can have just because you’re analyzing and you’re in charge of your data,” Tamilarason pointed out.

Majors and larger independents usually have enough resources in-house to prevent this loss through significant check-and-balance systems. She sees smaller producers, with a smaller work force, as the ones most in need of third-party help at the sales point. Many in this category tend to depend on the buyers to track the oil against daily prices and make proper payments.

With SOTAOG’s system a client producing 10,000 BOPD would generate almost 8 million real-time tank level data points for analysis, every ten minutes. Correctly analyzing cash flow involves connecting that data with lease operating expenses and with the daily changes in oil prices that correspond to the time of the sale. With all that, “Now you’re adding almost another 100 million computations on that data to estimate your cash flow and reconcile your truck tickets to every tank level drop.” Without that, many producers are reduced to “back-of-the-hand” calculations.

“This is where cutting-edge technology comes in.” When the field hand uploads the tickets, optical character reader technology reads the ticket and stores it in the database. From there the system associates each ticket’s data with the appropriate tank level drop.

This way, any data discrepancies involving a missing ticket or conflicting data can be investigated and corrected daily. The producer can then be sure they’re getting paid properly at the end of the month.

Corroborating tickets with tank levels achieves 3-7 percent savings, and broadening the analysis can bring up to 20 percent improvements in the bottom line, Tamilarasan believes.

Tracking production numbers over time can help producers determine whether each well is optimized, and if it’s reaching its full potential. For example, “You can see if your critical rate for gas lift wells is dropping, and if you’ve got to do more gas lift injection—and if you do you’ll probably get more oil.” This is one of the areas that bring the total AI gains to 20 percent, Tamilarason said.

Production optimization provides a view of a well’s decline curve compared to reserves, predicting oil flow over, for example, a five-year period. AI can incorporate operating expenses such as water disposal, electricity, and more to provide the best production plan for overall value. These kinds of calculations would take months for humans to manage, but AI can do it in real time.

Tough economic times and gains in AI’s abilities have opened more producers to AI’s possibilities. Who gets on board and how far they go with the system varies from company to company. “I think it depends on the COO (Chief Operating Officer) and how progressive they are.” She noted that JP Morgan Chase’s Global Head of Energy Strategy Christyan Malek told Bloomberg Radio last fall that shale producers now need $80-90 per barrel to make cash flow. This has pushed the efficiency button for many COOs.

“It costs you $10 million to drill a well. But if you can do more optimization of your existing production, that’s where your value is,” she said. And AI analysis can get make that happen.

CIOs Face Opportunities and Challenges

Any COOs and CIOs looking to expand IT and AI capabilities to improve their companies’ bottom line face good news and some not-so-good news, Gartner researchers found.

“The 2023 Gartner CIO and Technology Executive Survey shows an oil and gas industry confident in adopting a defined range of technologies,” says the report. Yet anecdotally, it adds, a significant number of executives are concerned about pushback in getting enough funding from their companies to do all that’s required to secure their firms’ futures.

On the positive side, recent years have seen great leaps forward regarding certain issues including security, decision making, and infrastructure cost (buying sensors, controllers, communication hardware/software). More and more companies are dealing with employee shortages and investors’ cash flow demands by digitizing many field services.

The report notes, “…companies are increasingly prioritizing applications modernization, enhanced connectivity, and a decisive shift away from legacy infrastructures and data centers.”

While that sounds good, almost two out of three CIOs surveyed were concerned that their firms’ budgets were not growing as they felt befitted this expansion of goals, even as company profits soared in 2022’s higher price environment.

CIOs were asked to rank their companies’ top digital priorities over the last two years, allowed to include more than one on their list. Those priorities included: Improving operational excellence (71 percent); increasing employee productivity (40 percent); ensuring business continuity and resilience (31 percent); and growing revenue (29 percent), among others.

Concerns abound regarding objectives that only made the bottom of the list: Increasing innovation (17%); introducing new products/services (3 percent).

The fact is that revenue growth, while one of the top priorities, only registered on 29 percent of the lists. “Innovation and new products may be pursued as secondary goals for digital investment, but new business capabilities are enabled by digital technologies,” the report said.

The future of IT in informing oil and gas decision-making depends largely on the companies themselves. Many feel that the industry needs all the tools it can employ in order to survive the volatilities of the current market.