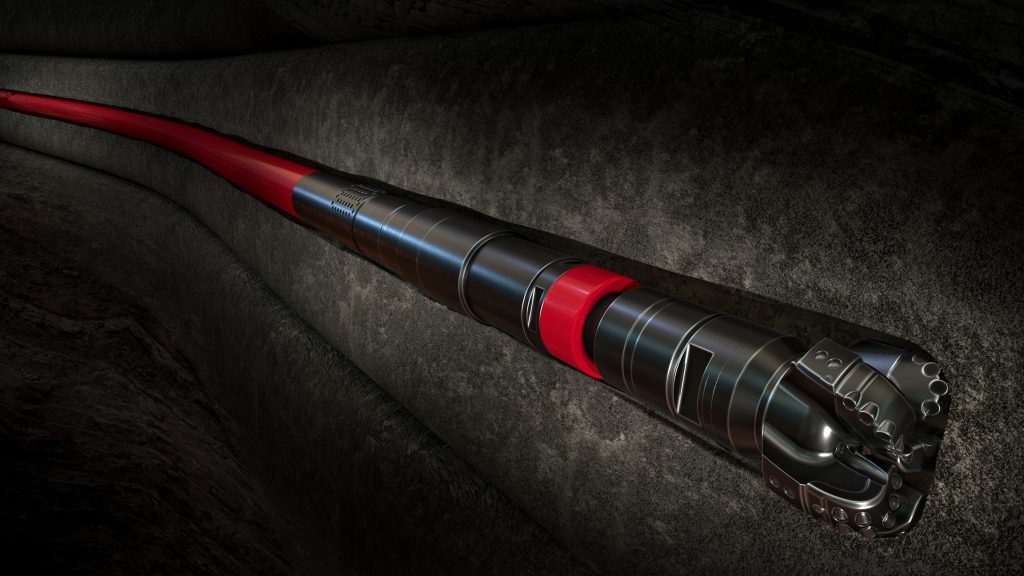

The bottomhole assembly (BHA) seen here is designed to drill multiple wellbore sections in a single run. This is Halliburton’s iCruise® X steerable system (RSS) with Halliburton’s HyperSteer directional drill bit.

“How long should a man’s legs be?” someone supposedly asked the lanky Abraham Lincoln. “Just long enough to reach the ground,” he wisely replied. In light of that, the oil patch question of, “How long should a lateral be?” could be answered similarly: “Just long enough to reach the oil.”

Specifically, long enough to reach the most pay zones with enough consistent wellbore integrity to facilitate optimal fracs and production. That’s not quite as catchy as Honest Abe’s response, but the lateral question is a bit more involved.

The last three years have seen the oil patch answer change, stretching from “about a mile,” up to first two, then three. According to Amr Mohammed Hassan, strategic business manager for Halliburton, those are shorties. In the Middle East, Halliburton has drilled more than nine miles—50,000 feet—on many occasions.

So how does an operator decide which wells to extend beyond two miles? Hassan gives the service company’s perspective on the procedure and challenges.

Halliburton’s ICruise X intelligent rotary steerable system, an award winning technology, is an automation-enabled platform designed specifically for longer well applications in harsh environments.

What drives the Decision

“In many cases longer laterals offer benefits of increased reservoir contact, enhanced production rates, and improving economics,” said Hassan, strategic business manager for Halliburton. That’s why they’re done, but many factors attend the decision-making process.

Length and shape of laterals is all about maximizing asset value, Hassan said, listing the main factors therein as reservoir characteristics, acreage constraints, and completion designs.

He explained, “There is the engineering piece, hydraulic torque, and drag; there’s a wellbore quality piece, which is critical when, later, you’re running your completions.” Drilling a three-mile lateral doesn’t accomplish much “if you cannot run completions in it.”

Surface limitations also come into play, including the rig’s horsepower, among others. Maximizing the customer’s value involves “technology investment, innovation, engineering solutions, investment in training, and competency of personnel,” Hassan said. That, plus using automation to maximize and optimize value for the customer.

Halliburton is no stranger to the challenges of U-shaped laterals, and the resultant torque and drag that is at a maximum at the end of the lateral. For that, they optimized their iCruise CX and NitroForce high torque motors to create the extra torque needed to overcome the resistance.

What Has Brought About Longer Laterals?

With the greater reservoir contact and economies of scale brought by longer laterals, one might wonder why the industry is only now doing this. It’s about the technology, Hassan said. “A few years ago maybe there was the appetite to do it, but the technology wasn’t there.”

Now with drilling automation standardizing delivery, better completion and frac design, and other technologies, that is “increasing the appetite to drill more of the long lateral wells. At the end of the day,” Hassan observed, “it’s all about maximizing asset value.”

With drilling costs rising and the increased focus on investor returns, Hassan says producers are focused on drilling faster—maximizing ROP (rate of penetration) while still hitting bullseye on the target zone every time and assuring wellbore quality. “You can break a lot of drilling speed records, but not at the expense of being unable to complete the well,” he said.

Is the Third Mile Worth It? That Depends

Whether a third mile lateral pays off in per-foot production can depend at least somewhat on when the payoff is needed, said Laura Sanchez, financial data product owner for TGS Well Data Products, a leading energy data and intelligence company with offices in Houston and in Norway.

For a recent paper on the topic, Sanchez looked at 400 wells drilled in the Permian Basin since 2020. She studied company reports and ran a series of charts based on three oil price scenarios: low, medium, and high. She evaluated each well’s Internal Rate of Return (IRR) and net present value (NPV) in the process.

For this story, she spoke in terms of barrels. Her question: “If you have a 10,000 foot lateral vs a 15,000 foot extended-lateral well, are you getting more [absolute] volume? Yes, you do get higher volumes at first.”

After two years, however, things start to level out. “Around 24 months,” she said, “you do not see much difference in total production. It’s very similar to a two-mile lateral.” But due to the higher production rates early on, the long-term production is higher because “you are entering a larger portion of your reservoir [with the longer laterals].”

Because the extra length raises drilling costs significantly, the most informative question revolves around whether it pays off on a per-foot basis. Here the advantages tend to disappear.

“On a per-foot basis, your volumes are actually marginally worse compared to what you would get from a 10,000 foot lateral well,” she said.

Consequently, Sanchez pointed out that longer laterals embody greater risks of failure. The danger of losing an entire investment should make an operator evaluate their ability to tolerate that risk, possibly separating larger E&Ps from smaller ones with less capital muscle.

TGS data show that, indeed, the larger operators are at the forefront. “Some operators are staying in a comfort zone because they might be smaller, they have realized that’s a proper recipe for them, and they don’t necessarily want to be pioneers exploring [the intricacies of] the longer lateral wells,” she said. Those that are indeed moving ahead are the supermajors. The latter also typically have larger leases in which to stretch those wells.

For an operator who decides to go ahead she asks, “Are those earlier barrels a good investment?” In terms of NPV and PV10, she believes they are. In the final equation, “It’s a question of do you have the financial muscle to bear a potential negative outcome?”

Length Isn’t the Only Variable

Sanchez reports that many operators are looking at other factors in their search to maximize production. “A lot of operators are running multivalent analysis to determine what attributes are involved in drilling a successful well.” Besides the drilling and fracturing component, variables also include the type and amount of proppant, frac fluid, or different geology between first-tier and second-tier wells.

Cost Challenges

Helmerich and Payne’s West Texas Regional Director Clay Hebert offered the driller’s perspective, and how they’re seeing long laterals play out in West Texas. He reports that, over the last 12 months, 31

percent of wells H&P drilled in the Permian Basin were at least two miles. Only a small percentage of those were more than three miles, a restriction he attributes to acreage restrictions. “With all the M&A activity recently, that’s likely to change,” he said.

Deciding on lateral length and shape involves sorting through a long list of variables, in a procedure whose complexity he compares to solving a Rubik’s Cube.

Among the biggest challenges for drilling and completion are the massive increases in pumping pressure, horsepower, and equipment required for miles-long work—which also requires huge investments in machinery.

In his early days with H&P, beginning in 2012, Hebert said onsite equipment was rarely called on to produce more than 5000 psi. “Today I don’t have any rigs that aren’t upgraded to 7500 psi,” he observed. This is requiring new types of capital investment in higher power pumps, and higher torque top drives. The future is pointing to rig upgrades that we don’t currently have in U.S. land onshore drilling.”

Along with equipment, investment in supplies is strained with longer laterals. “It requires upgraded setbacks; you need to set back more pipe if you’re drilling deeper and further, or even just further,” he pointed out, adding, “We’re seeing more and more of that offshore drillship-type scope creep coming into the U.S. land onshore, like we’ve never seen before.

“On the other hand,” Hebert said, “these bigger, lumbering giants must remain agile and able to pirouette quickly in order to meet today’s frantic drilling schedules. It’s almost a permission-to-play requirement that your rig remains mobile, and able to move in three days or less.”

Longing for Oil

For the question regarding how long should a well’s laterals be, it’s not about reaching the oil—it’s about reaching more oil for less cost. As technology enables longer and longer fracs and completions, the current growth spurt may continue for the foreseeable future.

Paul Wiseman is a freelance energy writer. His email is fittoprint414@gmail.com.