Money? It’s Baaaaaccckk. You hear things from different people with different connections. It is always nice as an analyst to try and put things into perspective. A recent Hart’s article quantified some numbers and the implications are interesting. Oil, natural gas, and midstream development have gotten hot. Quickly. In the last 10 days of October, almost $20 billion of private equity funding was raised. For the last three years, the annual average has been closer to $3 billion. That isn’t just improving, that is a step change, or two, and in 10 days. From 2010-2019, private equity raised about $21 billion every year. The year 2020 hit, with Covid, and the industry saw an 80 percent drop in sequential revenues, and private equity dried up to about $3 billion. That is either a huge aberration or it’s back. It is the well-established players who are fueling this increase. EnCap companies account for 45 percent of that raise but it really is different this time. Forty percent of the capital commitments are from new institutional relationships, which means we are losing the pariah image a bit, and funds are looking more for returns than politics. EnCap Managing Partner, Doug Swanson, also credited large family offices, which, over the last couple of years, have emerged as large providers of capital, many times in direct competition with the historical idea of private equity. The remaining 55 percent was raised by Quantum companies. So, while it seems that two companies dominated this amazing bump in capital availability, I think it is more of the next level down, and there are groups and families who actually parted with their money in the current environment. Funds spending money is nothing new. More “grassroots” willingness to invest in energy is new, or at least has been for the last several years.

Money? It’s Baaaaaccckk. You hear things from different people with different connections. It is always nice as an analyst to try and put things into perspective. A recent Hart’s article quantified some numbers and the implications are interesting. Oil, natural gas, and midstream development have gotten hot. Quickly. In the last 10 days of October, almost $20 billion of private equity funding was raised. For the last three years, the annual average has been closer to $3 billion. That isn’t just improving, that is a step change, or two, and in 10 days. From 2010-2019, private equity raised about $21 billion every year. The year 2020 hit, with Covid, and the industry saw an 80 percent drop in sequential revenues, and private equity dried up to about $3 billion. That is either a huge aberration or it’s back. It is the well-established players who are fueling this increase. EnCap companies account for 45 percent of that raise but it really is different this time. Forty percent of the capital commitments are from new institutional relationships, which means we are losing the pariah image a bit, and funds are looking more for returns than politics. EnCap Managing Partner, Doug Swanson, also credited large family offices, which, over the last couple of years, have emerged as large providers of capital, many times in direct competition with the historical idea of private equity. The remaining 55 percent was raised by Quantum companies. So, while it seems that two companies dominated this amazing bump in capital availability, I think it is more of the next level down, and there are groups and families who actually parted with their money in the current environment. Funds spending money is nothing new. More “grassroots” willingness to invest in energy is new, or at least has been for the last several years.

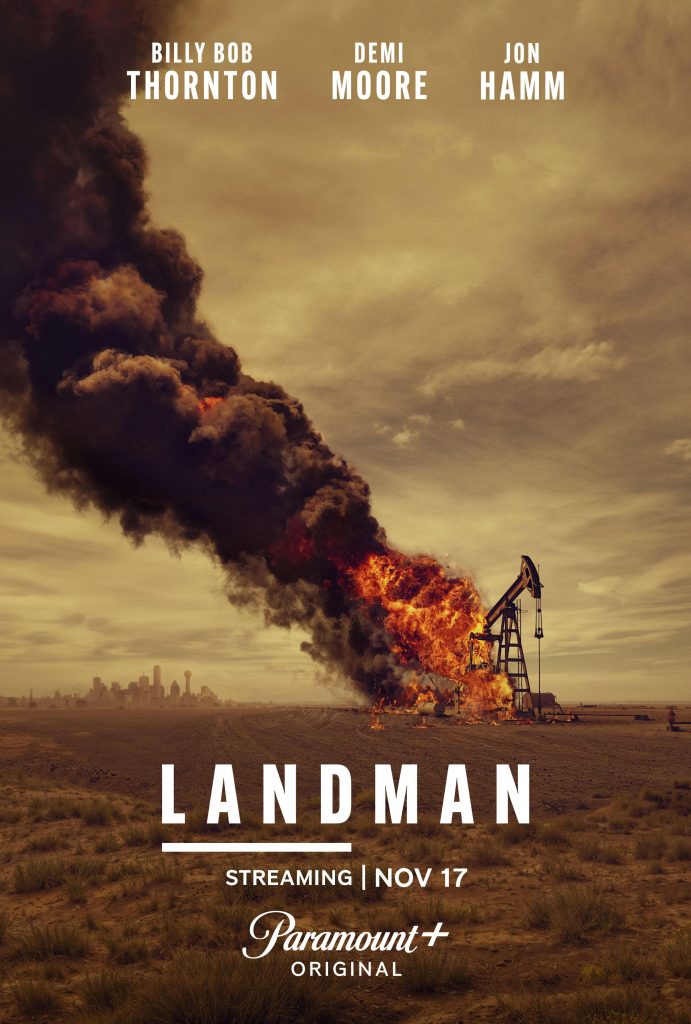

Landman!! We are still cool. Remember John Wayne in the movie Hellfighters? Giant? Dallas? And now the AAPL gets its own show! Well done, guys. Billy Bob, Demi Moore, Jon Hamm. An august crowd. Here’s a line from the show’s promo: “Deep in the heart of West Texas, roughnecks and wildcat billionaires try to get rich quick in the oil business as oil rigs begin to dominate the state. Crisis executive Tommy Norris tries to bring his company to the top during a fueling boom.” And before you scoff, remember that the writer and creator of this show bought the 6666 Ranch here in Texas for $320 million.

Snippets.

- No one in the oil and gas industry can be a climate denier. Midland was once at the bottom of an ocean.

- The U.S. has a 25 percent tariff on imported light trucks, which applies to pickup trucks, vans, and SUVs. It has been in place since 1964.

- Remember how unions were created to protect workers from exploitative corporations? Yet millions of government employees are unionized—so who exactly are they being protected from?

- Imagine where natural gas prices would be today if we had built all those Northeast pipelines.

Hear Hear! “The Wright Stuff. President-elect Trump has nominated industry veteran Chris Wright of Liberty Energy as his Energy Secretary, which we view as a strong pick.” —Capital One. We agree.

Impressive. A 21-well pad. Imagine. 21 wells targeting six different zones, all drilled from the same pad. Talk about consolidated logistics! Devon operated this pad in Loving County while bringing on a total of 55 new wells in the 3rd quarter. “The 30-day rates from this 21-well package averaged 3,300 Boe/d per well, and estimated recoveries exceed 2 million barrels per well,” according to the COO, Clay Gaspar. Four-mile laterals, 21-well pads. Do you think the technology has peaked yet? I certainly don’t.

Move Over, China. Chinese oil demand has disappointed everyone, especially those in the oil and gas industry. But we might have a new best friend. India is now poised to become the biggest driver of oil consumption growth. Increased car ownership, and not in EVs, a young and fast-growing population and more people who should be able to afford “more.”

—Jim

Subscribe to Jim Wicklund’s full e-newsletter, “Things I Learned This Week at…,” distributed weekly via email, by signing up for free at this webpage: https://www.pphb.com/newsletters. Jim is Managing Director / Client Relations and Business Development for investment banking firm PPHB. Leveraging deep industry knowledge and experience, Houston-based PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt, and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.

Subscribe to Jim Wicklund’s full e-newsletter, “Things I Learned This Week at…,” distributed weekly via email, by signing up for free at this webpage: https://www.pphb.com/newsletters. Jim is Managing Director / Client Relations and Business Development for investment banking firm PPHB. Leveraging deep industry knowledge and experience, Houston-based PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt, and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.