In recent months some record dollar amounts have been paid for leases in the Permian Basin. In 2018 a Santa Fe firm that places bids for anonymous investors bid more than $95,000 per acre for a tract of U.S. government land on the New Mexico side of the Basin. That number was a record high for government land in that state, the previous record being less than half that at around $40,000 per acre.

When Concho Resources paid $9.5 billion to acquire RSP Permian in March 2018, researcher Sanford C. Bernstein estimated that the price paid implied a per-acre cost of about $75,000, once you back out the value of production.

Yoann Hispa, CEO at PetroValues Inc, an online oil and gas properties marketplace that helps mineral owners get a fair price for leases, says even at those prices producers can make money depending on certain variables.

“If you look at the production of wells in plays like the Wolfcamp, where the production is very good, you can make money,” he said. “It depends on three variables.”

“The first factor is the production of the well over time,” he said. While each well is different on that measure, the production of nearby wells in the same formation can be a predictor, which could lead to high lease prices.

“Second is the cost to drill.” Wells in the Wolfcamp and other Permian locations are among the cheapest to drill. The lower those upfront costs are, the more a company can afford to spend on leasing.

The third issue is, “How many wells can you drill per drilling spacing unit” with strong production numbers. “It comes down to how much money can you make—it’s simple economics,” Hispa pointed out.

If all those variables line up strongly in the operator’s favor, “they could make a profit if the operator only drilled half of the acreage—especially if they get good production.”

Offshore leases have more risk because drilling costs in the Gulf of Mexico are much higher than costs onshore. One offshore well can cost $150 million whereas a two-mile horizontal onshore well can cost as little as $6 million.

Companies typically look at payouts over 30-40 years. That works because, unlike royalties, leases are paid for only one time. The operator has the entire life of the lease for earnings to surpass the purchase price, although most expect to make a profit within a much shorter time.

Based on those three criteria, lease prices vary from basin to basin as well as on the price of oil and gas at the time of the lease.

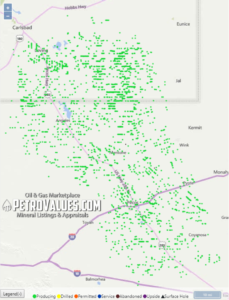

This chart from PetroValues pinpoints those wells in the Delaware Basin whose initial production, averaged over three months, is greater than 500 barrels of oil a day. This chart, then, essentially highlights the prime areas of the Delaware Basin.

Prices also vary depending on who the seller is. Hispa noted that there is a sad saying, as follows: “The price at the dinner table is greater than the price at the kitchen table.” At the kitchen table the buyer’s representative—usually the landman—is talking to the landowner/mineral owner. The landowner, not being an oil and gas professional, may ask a low price because they do not know the market.

Leases at the kitchen table are rarely protected by Pugh clauses—clauses which can be added to an oil lease to limit the rights of the lessee to hold only particular depths or amounts of the leased property. A kitchen table lease also may not protect the length of the lease or get the owner the best price. These issues are among the reasons Hispa and other founded PetroValues as an online marketplace for all parties to ascertain values.

At the dinner table (at a nice restaurant) the buyer would be talking to a producer who had previously bought the lease and had decided to sell. As an industry insider, that seller would know the acreage’s true value.

The “dinner table” sale can come about if an operator buys up a lease then changes plans for any of several reasons. Some operators buy leases specifically in order to begin development, prove the assets, then sell at a profit because they’ve verified that the asset does hold value. Or an operator may need to raise cash, they could be trading an ‘outlier’ property in exchange for one closer to the geography or geology they already have, or other reasons.

Speculation can also come into play in a resale.

“A large percentage of leases are resold,” he said. “Speculators buy leases in order to flip them, usually to large operators, which is a huge business,” he said.

Speculators know they can resell leases based on engineering and geological research. If they get into a play before its worth is common knowledge they can execute the classic “buy low, sell high” strategy.

Land owners sometimes feel that having an attorney look over the contract is a good idea—and he notes that, for the legal aspect, this can indeed be good—but attorneys may not know what constitutes a good value for the client, who are serious buyers, or how far a deal can be pushed.

The fact that lease prices can fluctuate wildly at times is based on factors such as variable geology even in a nearby wells, completion techniques, fluctuations in commodity prices and whether the minerals are owned by the landowner or a producer.

“We see fluctuations in all basins,” said Hispa. “Some have gone from zero to $30,000 per acre due to the knowledge of newly located production. Early knowledge helps buyers because, he noted, “operators are usually two years ahead of mineral owners in the knowledge of what a lease is worth.”

Knowledge lags because, unlike in real estate where sales prices are recorded at the county, Hispa said, “For lease and mineral sales, most of the time the record at the county says $10 plus consideration.”

And, like any other investment, spending big on a lease isn’t a guarantee of returns. “Sometimes it doesn’t work. The operator may have bet on bad geology and get bad wells as a result,” he said.

The old days of wildcatters gaining and losing fortunes from one well to the next have been replaced by computer models and horizontal drilling and frac’ing. Yet oil and gas is still fraught with risks and rewards and the marketplace helps determine winners and losers.

__________________________________________________________

Paul Wiseman is a freelance writer in Midland.