Enverus, a leading energy SaaS and data analytics company, is releasing its summary of Q4 and full year 2020 U.S. upstream mergers and acquisitions (M&A). After an anemic start, 2020 upstream M&A accelerated dramatically in the second half of the year as a challenging economic backdrop spurred a wave of industry consolidation. Activity crested in Q4 with three multi-billion-dollar mergers centered on the oil-rich Permian Basin driving the quarter’s total value to $27 billion, the third most active quarter by value since oil prices lost their footing in late 2014.

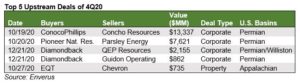

The biggest deal of the fourth quarter and 2020 was ConocoPhillips’ $13.3 billion acquisition of Concho Resources, one of the best-positioned, largest independent producers in the Permian. That deal, the biggest pure shale acquisition by any company since 2011, vaulted the Permian from a potential weak point in Conoco’s portfolio to a cornerstone of its global strategy.

On the heels of that merger, Pioneer Natural Resources announced its own maneuver to roll up Parsley Energy for $7.6 billion, giving it combined control of nearly 1 million acres across the Midland and Delaware sub-basins. Finally, Diamondback Energy nabbed publicly traded QEP and private equity-sponsored Guidon Operating for just over $3 billion in a combined effort to build out its position in the heart of the Midland Basin.

“As anticipated, additional merger activity during Q4 centered on E&Ps with high quality lands and reasonable debt loads, and the Permian Basin is the most target-rich region under those criteria. The fact that three of the leading Permian independents—Concho, Pioneer and Diamondback—each participated in a deal implies a recognition by the industry that scale is vital for companies to remain relevant going forward,” said Enverus M&A Analyst Andrew Dittmar.

Consistent with earlier deals like Chevron’s acquisition of Noble Energy for $13 billion in July 2020, and Devon Energy’s $5.6 billion merger with WPX Energy in September 2020, all the big Q4 public company corporate deals were all-equity, low-premium combinations.

“Wall Street appears supportive of E&P deals, but with very specific expectations on deal structure and the quality of the merger target,” added Dittmar. “The limiting factor for consolidation in 2021 will be the number of attractive merger partners left at the end of a very active year.”

While big corporate deals lifted M&A value in 2020, deal flow as measured by the number of announced deals fell to historic lows. There were only 140 announced deals with a reported value in 2020, the lowest annual total since at least 2006 and just about one-third of average deal flow over the last 10 years.

“There was very little appetite on either the public or private company side for buying upstream assets in 2020 as preserving cash to pay down debt or return to equity owners was prioritized,” said Dittmar. “In particular, companies were unwilling to invest substantially in buying undeveloped land, a staple of past upstream deal markets. What asset deals did get announced were largely focused on acquiring existing production and cash flow, sometimes through bankruptcy sales.”

The outlook for 2021 deal activity will depend largely on the trajectory of the COVID-19 pandemic, global economic activity, and their associated impacts on commodity prices. Assuming a continued recovery in global activity, upstream M&A is likely to normalize relative to the boom-and-bust cycle of large corporate deals or nothing during 2020. There is a substantial backlog of non-core asset divestments for companies to pursue, particularly for those that participated in 2020’s corporate merger wave and now have expanded portfolios. Likely buyers include some public companies, but with a healthy contingent of private equity capital looking to take advantage of opportunities created by the downturn. Other potential buyers include energy-focused SPACs, which have become broadly popular on Wall Street.

Corporate consolidation is likely to continue as companies look for synergies to drive down their cost structures. That is particularly true among the industry’s small and midsize participants, which are urgently in need of scale. Companies that went through a Chapter 11 restructuring in 2020 could emerge as potential merger partners now that debt loads are rightsized. However, there may be fewer very large corporate deals because so many of those were accomplished during the last year, winnowing the list of possible participants.