Current natural gas prices, including record high global prices, and renewed concerns for energy security are making projects that capture and commercialize vented, fugitive, and flared methane increasingly economic, with the potential to lower emissions and unlock substantial new supplies of gas, a new analysis by S&P Global Commodity Insights finds.

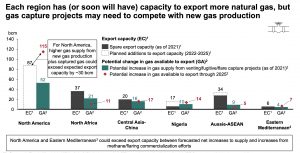

The analysis examined 6 key regions—North America, North Africa, Central Asia-China, Nigeria, Aussie-ASEAN, and Eastern Mediterranean—and found that the elevated price outlook for natural gas makes it economic to capture and commercialize more than 70 percent of the lost methane and flared gas from those areas, equivalent to 80 bcm of new supply.

Notably, the analysis finds that it could be possible to add 40 bcm of new supply—more than the total annual demand of France—to global markets within just 2-3 years. Capturing and commercializing this gas would simultaneously reduce GHG emissions by more than 750 Mt CO2e*, an amount approximately the size of Germany’s total annual emissions.

“With natural gas prices at historic levels and energy security returning as a global priority, efforts to capture and commercialize methane are increasingly economic and present a win-win proposition,” said Amb. Carlos Pascual, senior vice president, global energy and international affairs, S&P Global Commodity Insights. “Accelerating efforts to bring these projects forward can provide much-needed supply to the global market while supporting energy security and climate imperatives in the energy transition.”

The spike in global gas prices—which began in Fall 2021 and then amplified by the conflict in Ukraine—have particularly enhanced the near-term economics for methane capture projects in regions that have access to the global gas market, the analysis finds.

For a methane capture project deployed next year, 10-year revenues are now expected to be 140-240 percent higher than they otherwise would have been prior to the price spike. Even as natural gas prices stabilize in the longer term, forecasted revenues remain elevated compared to pre-war price forecasts (56 percent-93 percent higher for a project deployed in 2026 and 31 percent-38 percent higher for a project deployed in 2030).

“The elevated price outlook for natural gas has created a substantial economic opportunity to capture flared gas and methane emissions, especially in the near term,” said Eleonor Kramarz, vice president, energy transition consulting, S&P Global Commodity Insights. “While these opportunities will remain economic over the longer-term, the strongest incentives are for acting sooner rather than later when it comes to bringing new projects online.”

Advancing methane and flare capture and commercialization projects benefit from well-established technologies that already exist at scale, meaning that there are few technological barriers to deployment, the analysis notes. Still, other impediments need to be overcome.

The analysis identifies key barriers for each of the six target regions across four major categories—export capacity, capital availability, commercial and financing environment, and security risk—and lays out pathways that would enable projects to move forward.

“While the paths forward will be different in each region, there is a consistent need for clear project implementation roles, stronger collaboration between private and public organizations, and improved capital availability,” Kramarz said. “Bringing together key constituencies will be essential to address barriers and deliver new sources of supply that can strengthen energy security while reducing emissions.”