Click here to listen to the Audio verison of this story!

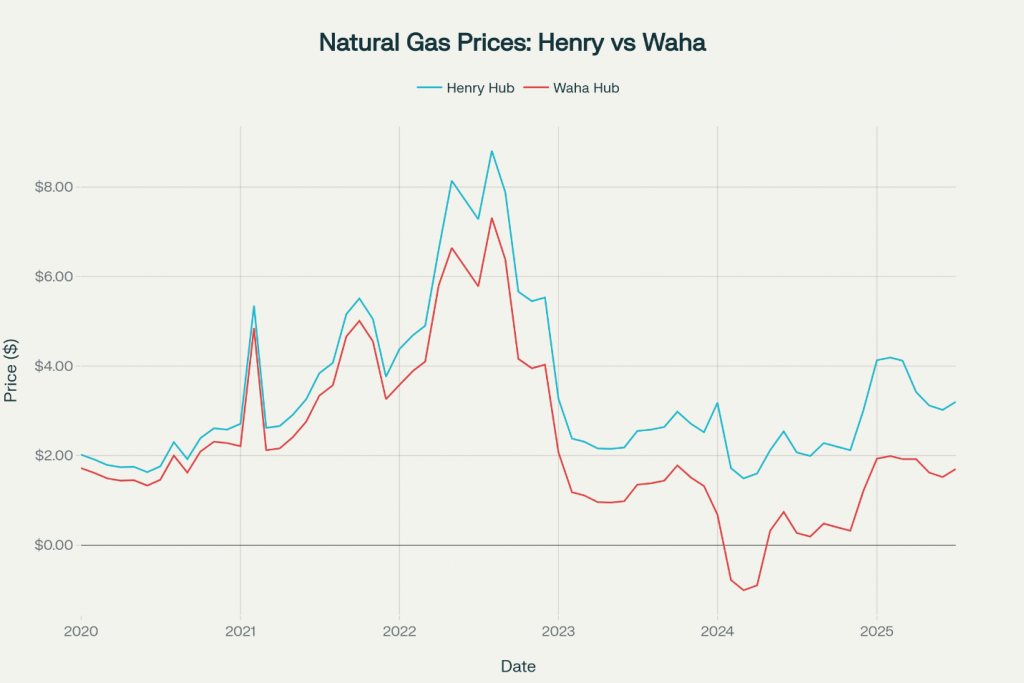

Delaware Basin natural gas prices have suffered versus gas from other regions for years. The gap between Henry Hub and Waha Hub pricing is well known, by now.

The primary factor driving Waha Hub discounts has been insufficient pipeline takeaway capacity relative to rapidly growing regional production. Natural gas production in the Permian has more than tripled from 7.8 Bcf/d in 2017 to more than 25 Bcf/d currently.

For the balance of 2025, the EIA has slightly lowered its Henry Hub price estimate by 3 percent, with Waha expected to be about the same. That is actually an improvement versus the recent widening price gaps.

In 2026 and beyond, Waha pricing is forecast to improve relative to Henry Hub and in absolute terms. Three key drivers will improve the revenues and margins for Delaware Basin natural gas producers.

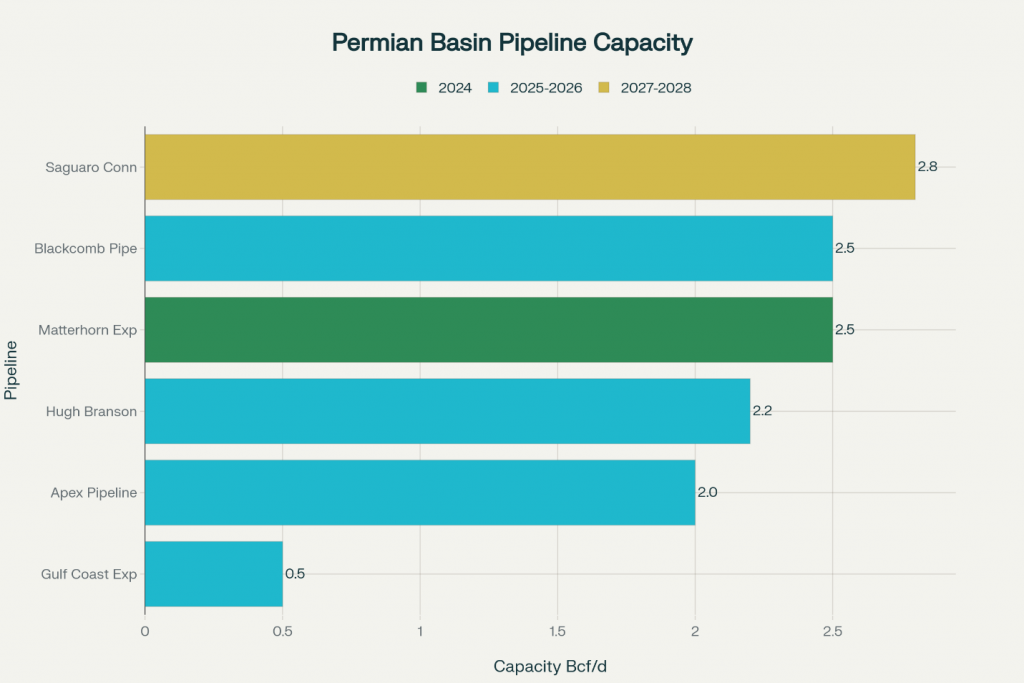

The first among these is increased takeaway with new pipeline capacity. Already, the Matterhorn Express has added 2.5 Bcf/d of takeaway capacity to the region. Coming online in 2026 will be nearly 5 Bcf/d and another nearly 3 Bcf/d in 2027-8.

Coupled with new and coming takeaway capacity, natural gas is seeing increased demand from the artificial intelligence boom and exports of LNG. Data centers consumed approximately 4.4 percent of U.S. electricity in 2023, but this figure could triple to 12 percent by 2030 as AI applications proliferate across industries. LNG demand is forecast to increase by 2 Bcf/d in the next few years.

While things will not play out quickly for traders, investors should get “buy the dips” opportunities into a more bullish cycle developing for summer 2026 and beyond. Several companies continue to make my radar as leaders in the next bullish cycle.

Permian Resources’ (PR) concentration of assets in the core Delaware Basin positions the company to benefit significantly from regional AI data center development. With approximately 450,000 net acres primarily located in Eddy and Lea Counties, New Mexico, and Reeves and Ward Counties, Texas, the company sits at the heart of the region’s natural gas production growth.

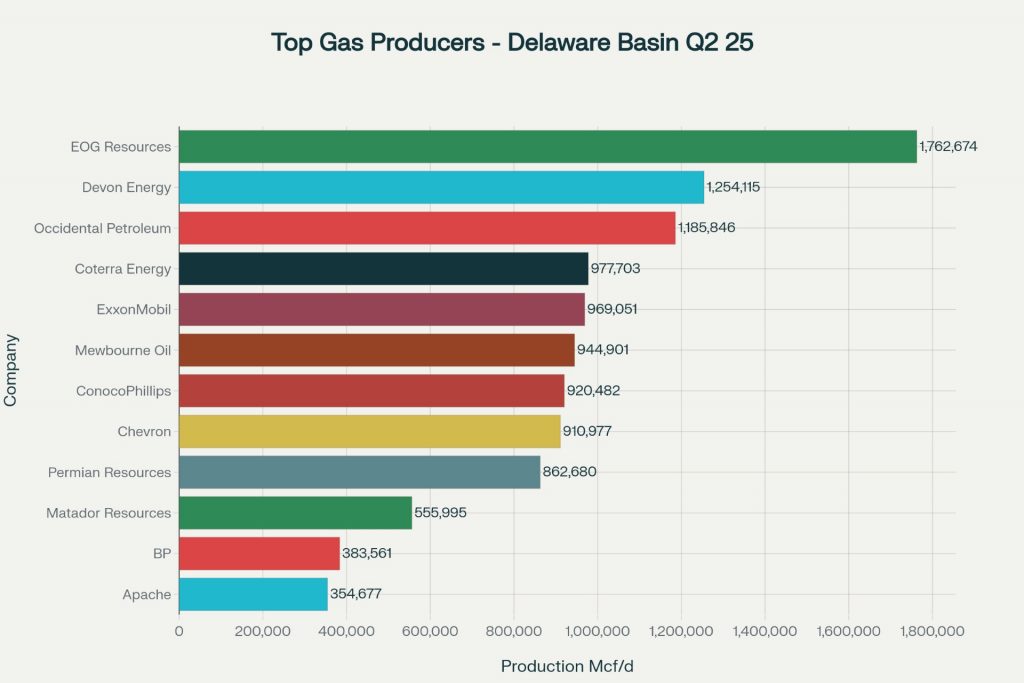

The company’s natural gas production of 664.7 MMcf/d in the second quarter of 2025 represents a significant resource. Permian Resources’ strategic asset acquisitions, including the $608 million purchase of Delaware Basin assets from APA Corporation, have further consolidated its position in the region’s highest-quality acreage.

The enhanced pipeline infrastructure allows Permian Resources to optimize its gas monetization strategies. The company has entered into multiple transportation and marketing agreements to improve all-in netbacks, directly benefiting from the improved takeaway capacity and positioning to capture premium pricing from potential data center customers.

Permian Resources pays a base dividend, special dividends and is buying shares back. Their shareholder yield is among the tops in the industry. I rate Permian Resources a buy under $15 per share, with a back-up-the-rig price below $12.

Coterra Energy’s (CTRA) approximately 297,000 net acres in the Delaware Basin, combined with annual production averaging 262 MBoe per day from the Permian Basin, provides significant exposure to the AI-driven gas demand surge. The company’s decision to reverse planned rig reductions and maintain nine rigs in the Permian reflects management’s confidence in improved market conditions driven by enhanced infrastructure and emerging demand sources.

Coterra’s operational focus on the Wolfcamp Shale and Bone Spring formations, with 90 percent of their producing wells being operator-controlled, provides the company with flexibility to adjust development strategies to capitalize on premium gas markets. The company’s recent acquisitions of Franklin Mountain Energy and Avant Natural Resources added approximately 49,000 net acres and 290.7 producing wells, further strengthening its Delaware Basin position.

Coterra further owns assets in the Anadarko and Marcellus. I believe the Anadarko could be sold, freeing up about a billion dollars of capital. If that plays out, that could make Coterra a very lean power player in the Delaware and East Coast-focused Marcellus.

Coterra pays a substantial dividend and recently authorized a share buyback program of over $2 billion, of which it has bought back roughly a billion worth of shares already. I rate Coterra a buy under $27/share, with a back-up-the-rig price below $24.

Matador Resources’ (MTDR) unique vertical integration strategy through midstream assets provides distinctive advantages in serving data center markets. The company’s completion of over 20 miles of natural gas pipeline connections in the Delaware Basin creates enhanced optionality for both its own production and third-party volumes.

The company’s strategic focus on the northern Delaware Basin, particularly in Lea County, N.M., positions Matador to benefit from both improved regional pricing and potential direct-supply opportunities to data center operators. The company’s midstream connectivity provides flow assurance and multiple outlet options that become increasingly valuable as data centers require guaranteed supply security.

Matador’s presence in Lea County, near Permian Resources properties, opens up the possibility of strategic transactions between the two companies. At the Hart Energy conference last year in Fort Worth, legendary Matador CEO Joseph Wm. Foran discussed the idea of own-it-forever versus being an acquirer. I am not certain which way he leans, but some combination with Permian Resources’ strategic finance-minded Co-CEOs seems like it could happen.

Matador pays a solid dividend and has a stock buyback program of $400 million that it has been using strategically to “buy the dips” and reduce share count. I rate Matador a buy under $50/share, with a back-up-the-rig price below $45.

Devon Energy’s (DVN) massive Delaware Basin footprint of approximately 400,000 net acres positions the company as a major supplier of natural gas for data center applications. They are also positioned well for strategic M&A of any sort.

The company’s impressive production profile includes 764 MMcf/d of natural gas from Delaware Basin operations as of third-quarter 2024, representing substantial volumes that could serve the growing AI infrastructure market.

Devon’s operational excellence in the Delaware Basin, demonstrated through projects like the 21-well CBR 12-1 development in Loving County, showcases the company’s ability to efficiently develop multi-zone projects that maximize both oil and gas production. This operational capability becomes increasingly valuable as data center demand creates premium markets for reliable, high-volume gas supply contracts.

The company’s strategic capital allocation, with more than 50 percent of total investment directed to the Delaware Basin in 2025, ensures continued production growth that can serve emerging data center demand. Devon’s multi-zone development strategy across six different formations provides operational flexibility to optimize gas-to-oil ratios based on market conditions and customer requirements.

Devon pays a solid dividend and has a substantial buyback program of $5 billion, of which it has used about half to strategically reduce share count. I rate Devon a buy below $35/share with a back-up-the-rig price under $30/share.

In summary, I see most of the Delaware Basin stocks breaking out sometime between spring 2026 and spring 2027. Knowing with certainty is impossible, but buying at the right prices offers appreciation potential, income, and a margin of safety not found in many stocks. The back-up-the-rig prices could be hit between now and then on macro factors.

I am consistently selling cash-secured puts on these stocks as volatility in the energy sector creates opportunities to generate very strong returns on cash held in money markets. We have regularly generated annualized returns in excess of 30 percent on cash-secured put option sales.

An example is a recently expired PR $12 August put that we sold for 61¢ in late May. For holding $12 per share in cash for two months, in case we were assigned to buy the shares, we made a 5 percent return in 2 months, or roughly 30 percent annualized.

Selling cash-secured puts is a great way to maintain a margin of safety versus owning equities outright. To discuss how you can use this financial tool effectively and safely, contact me at my Registered Investment firm found at BluemoundAM.com or become a member at my investment letter found at FundamentalTrends.com.

A financial analyst and investment advisor, Kirk Spano is published regularly on MarketWatch, Seeking Alpha, and other platforms.