Amidst an atmosphere of positivism and enthusiasm, the 18th Annual Executive Oil Conference gave evidence that the Permian Basin, with its technologies and leadership, is poised to enter what could be its greatest chapter.

Amidst an atmosphere of positivism and enthusiasm, the 18th Annual Executive Oil Conference gave evidence that the Permian Basin, with its technologies and leadership, is poised to enter what could be its greatest chapter.

The all-day sessions, which included a number of speakers as well as two panel discussions by industry experts, convened April 3 at the Midland Center.

Billed as “an annual conference for those who buy, sell and manage oil and gas assets,” the event surpassed its billing, delivering some of the most penetrating analysis available on a marketplace that is in swift transition.

Speakers included Susan Ginsberg, vice president of crude oil and natural gas regulatory affairs for the Independent Petroleum Association of America (IPAA); U.S. Representative Joe Barton; Jerry Schuyler, president and COO of Laredo Petroleum, Inc.; Scott Sheffield, Chairman and CEO, Pioneer Natural Resources Company; and Ward Polzin, CFA, Managing Director of Investment Bank and Head of A&D, Tudor, Pickering, Holt and Co.

Ginsberg addressed her remarks to legislative and regulatory matters. Striking the position that President Obama, to insulate himself from high gasoline prices and his own failing energy policy, Obama is hammering on the oil and natural gas industry, Ginsberg remarked: “We can place our bets on the fuel of the past, or we can place our bets on American know-how and American ingenuity and American workers. . . that’s the choice we face.”

The speaker observed that the “reality,” under Obama, is that oil and natural gas production on federal lands is down 40 percent, while federal agencies have increased delays and restrictions to onshore and offshore federal lands. But the “rhetoric” from the White House has been that President Obama claims credit for increases in oil and natural gas production.

Ginsberg spoke of the pressures from Washington on the oil and gas industry, ranging from the discussion of ending oil and gas subsidies—discussion that is voiced regularly on major news outlets—to regulatory overreach by Washington that threatens to cripple the growth of the industry. As for the subsidy talk, Ginsberg said there weren’t actually subsidies that exist for the oil and gas industries that are structured like the subsidies for the farming and green energy industries. What is in place and what the administration wants to remove are allowable write offs for intangible drilling costs and other production costs. She said the removal of these write offs could affect up to 20 percent of a small producer’s profits that are reinvested in more exploration.

And as for the regulatory overreach by Washington, Ginsberg cited the Endangered species act, the financial reform legislation, and how the latter affects small oil and gas producers.

Lastly she touched on jobs, and praised the oil and gas industry for its contributions in this vein.

Barton delivered what was deemed “An Insider’s View from the Oldest Legislative House Committee (Energy and Commerce).” The event’s program stated that “as the House’s leading expert on energy policy, Barton has led the House charge to pass comprehensive national energy policy legislation.” The congressman shared his insights on the development of policies that affect the industry.

Another morning session was given over to “Stories of successful strategies and structures from those in the trenches,” featuring Joe Wright (senior vice president and chief operating officer at Concho Resources), Ron Gasser (engineering manager at Clayton Williams Energy), and Pete Hagist (vice president of operations at Whiting Petroleum Corporation).

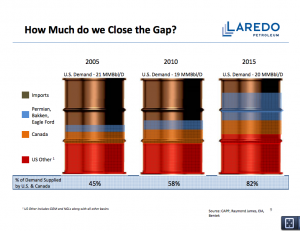

Then Schuyler spoke on “The Importance of Permian Oil Production Nationally.” (See accompanying chart [Impact of Permian Production On Imports By 2015] for some of his salient points.)

Asking the question, “Is U.S. Energy Independence Achievable by 2020?” Schuyler averred that, hypothetically, yes, it is. Some contributing factors in that vision could include the following: the Permian Basin itself, the Bakken and Eagle Ford shale plays as well as other shale plays, the GOM Deepwater project, Canadian production, diesel fleet conversion to compressed natural gas, and natural gas vehicles themselves as a potential added factor.

Asking the question, “Is U.S. Energy Independence Achievable by 2020?” Schuyler averred that, hypothetically, yes, it is. Some contributing factors in that vision could include the following: the Permian Basin itself, the Bakken and Eagle Ford shale plays as well as other shale plays, the GOM Deepwater project, Canadian production, diesel fleet conversion to compressed natural gas, and natural gas vehicles themselves as a potential added factor.

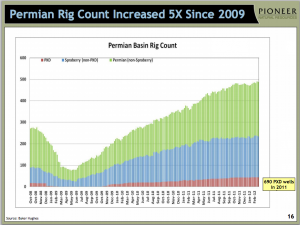

As the afternoon began, Sheffield spoke on “Pioneering the Permian.” (See accompanying charts [Permian Rig Count Increased 5 Times Since 2009] and [Numbers of Rigs in Permian Basin up 5 Times Since 2009] for some of his salient points). See also our “Rent or Buy” article in this issue for some of Sheffield’s remarks from this event.

Polzin, representing the investments world, tackled the topic of “Permian Deal Market: Right Place, Right Time.”

Why is the Permian Deal Market the right place at the right time? As Polzin noted, ten-year oil production is up 153 percent. Oil prices will remain strong, liquids pricing is “strong enough,” and oil deals are increasing. Moreover, horizontal applications, vertical applications (accessing new pay zones), and multiple targets are all contributing to the promising future.

A morning panel discussion included Matthew Thompson, Ron Gasser, Pete Hagist, and Joe Wright, while the afternoon version, which was handled by Kyle Bass, Wil Van Loh, and moderator Steve Toon, assessed today’s investment environment.

The preceding day, April 2, was given over to a golf scrambled played at Green Tree.