As we discussed a few months ago, the Permian Basin is starting to feel the impact of AI data centers creating demand for natural gas fired electricity. Chevron and Diamondback Energy are two of the larger players engaging in projects to power AI data centers. For investors, those deals barely move the needle for a shareholder.

I have been diving into proposed projects and have found one that might be of interest for the enterprising investor willing to take some risk for big upside. New Era Helium (NEHC) has emerged as a strategic player in the Permian Basin, leveraging its dual focus on helium extraction and natural gas-powered energy solutions to address the surging demands of artificial intelligence (AI) infrastructure.

New Era Helium’s partnership with Sharon AI through Texas Critical Data Centers (TCDC) represents a cornerstone of its Permian Basin strategy. The 50/50 joint venture aims to construct a 250MW net-zero data center powered by natural gas with integrated carbon capture, utilization, and storage (CCUS) technology.

The companies have focused on a 200-acre site near Penwell in Ector County, Texas, near fiber optic networks, natural gas pipelines, and CO₂ infrastructure, which was recently put under contract for acquisition. The location enables access to existing CCUS systems for enhanced oil recovery, aligning with net-zero goals.

New Era will provide natural gas under a 20-year fixed-price agreement (five-year base + three five-year options), ensuring cost stability for the data center. The project’s first phase is slated for completion in late 2026.

The companies plan on capturing anthropogenic CO₂ and utilizing tax credits under Section 45Q ($85/ton), TCDC aims to offset emissions from natural gas combustion, positioning the facility as a pioneer in sustainable AI infrastructure.

The tax credits are under some doubt due to the Trump Administration and investors should watch the news for clear signal that the credits will be available. If they are, then the upside of the project becomes much more interesting.

New Era Helium’s 137,000-acre Pecos Slope Gas Field in Southeast New Mexico is central to its helium and energy strategy. It has helium reserves of over 1.5 billion cubic feet (BCF) of proved and probable helium, with $113 million in committed sales via 10-year contracts. Instead of selling natural gas as a commodity, New Era plans to generate 70MW of behind-the-meter power for AI data centers, targeting 20 years of production at 20,000 Mcf/day.

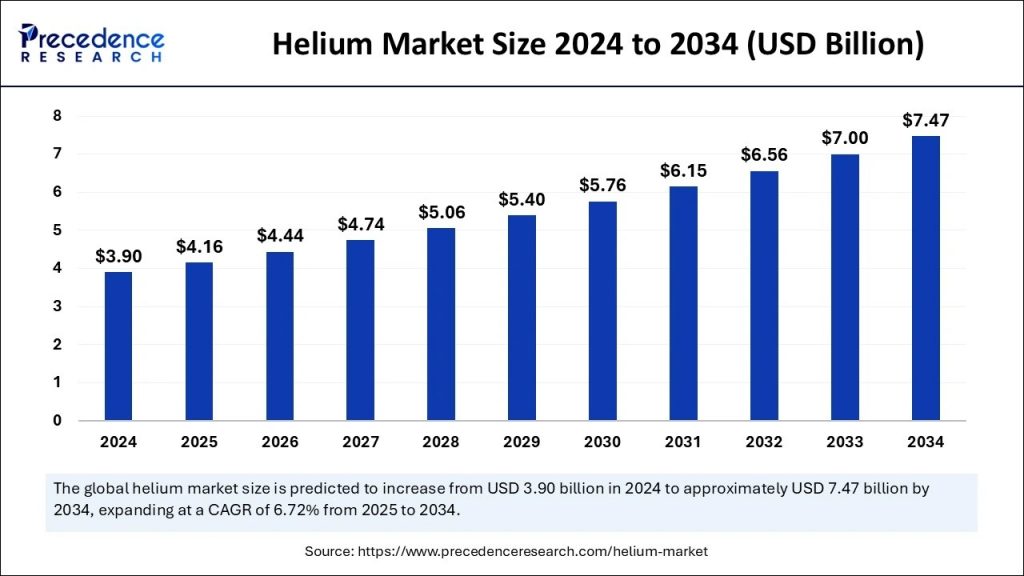

Helium is critical for semiconductor manufacturing, GPU cooling, and quantum computing—cornerstones of AI infrastructure. With the U.S. CHIPS Act incentivizing domestic semiconductor production, New Era’s helium reserves position it as a key supplier amid global shortages. The company’s integration of helium extraction with natural gas-powered data centers creates a vertically aligned model to support AI growth.

They will have a 20 MMCFE/D helium/natural gas processing plant that is on track for Q2 2025 completion, enabling monetization of helium, natural gas liquids (NGLs), and pipeline-spec gas.

Here is another potential pitfall for investors. New Era Helium faces significant financial headwinds despite its ambitious projects. Revenues are small and unstable, the company is losing money during this capex phase, cash reserves are low, and the company will need to raise more capital.

While the company has $65M remaining from a $75M equity purchase agreement this is only enough to fund bare bones buildouts. It is likely they will have to leverage 45Q tax credits, if they are still available, and future cash flows from gas/NGL sales. The joint venture with Sharon AI shares does mitigate development costs for the data center as Sharone provides upfront capital (https://tinyurl.com/4umpc3xc).

The company’s survival under this capital structure (i.e., avoiding reorganization) hinges on timely commissioning of the Pecos plant and securing additional liquidity through equity draws or asset monetization. It is critical to follow the details in real time.

Any setbacks in the Pecos plant’s Q2 2025 completion could exacerbate cash flow issues. As most readers are familiar with, energy market volatility must also be navigated. The wild card is the carbon capture viability, in my opinion.

If carbon capture can be done efficiently and the tax credits are paid, the stock could soar. If carbon capture does not become part of the revenue and margin equation, then the company is likely facing a restructuring. This a classic high risk, high reward stock. Use only risk capital and stay very informed of developments both in Washington D.C. and in the Permian Basin.

For disclaimers and deeper dives, please visit my investment letters at FundamentalTrends.com or MOSInvesting.com or my Registered Investment Advisor firm Bluemound Asset Management, LLC.

A change analyst and investment advisor, Kirk Spano is published regularly on MarketWatch, Seeking Alpha, and other platforms.